Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Mar 31, 2020

India abolishes dividend distribution tax

- Post April 1st, 2020, dividends will be taxable in the hands of investors based on their individual tax brackets.

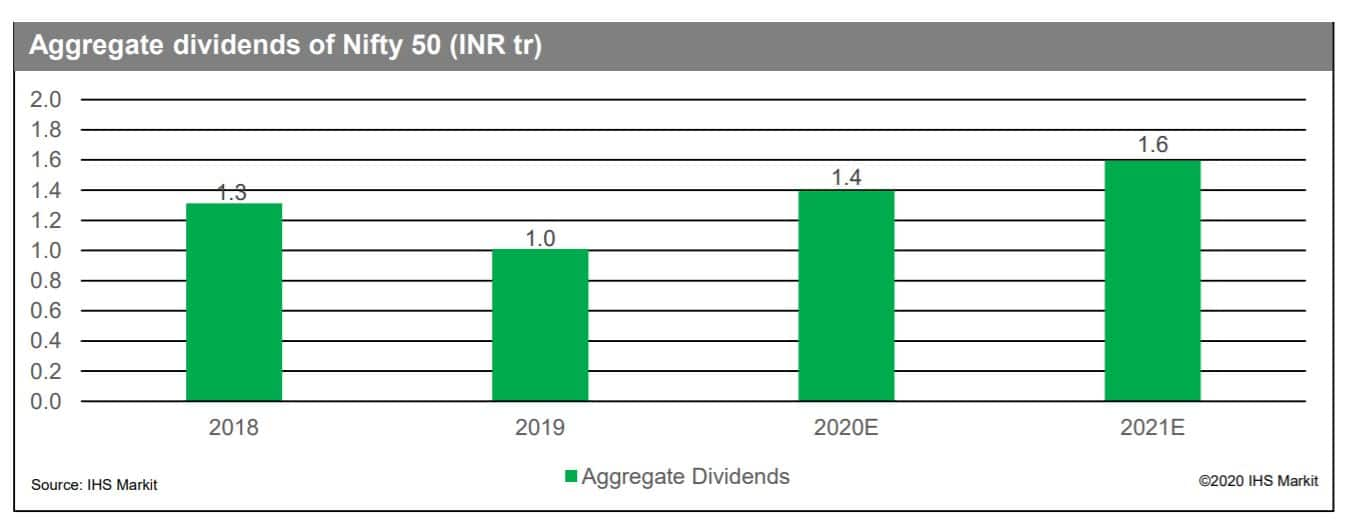

- We highlight the expected impact of the revocation of dividend distribution tax on the dividend payout of certain components of NIFTY50.

- Promoter* driven companies such as Wipro, Bajaj Finance Ltd, Sun Pharmaceutical Industries Ltd are most likely to take a hit as opposed to state-owned companies like Indian Oil Corporation, Coal India and Power Grid Corporation.

*Promoters are the primary founders of a company and are involved in the activities which comply with the necessary formalities.

Dividend distribution tax (DDT) was a tax levied by the Indian government on a dividend paying company's distributable income. A respite was given to the receiving shareholders as the taxes were previously levied in the hands of the company. However, the government has shifted the tax burden from companies to the shareholders or unitholders receiving the dividend.

Abolishment a boon for some and bane for others

There's been a mixed response to the removal of DDT as some considered the abolishment as a much-awaited move while others have been left despondent towards the new regime. For instance, the abolishment is positive news for investors with income up to INR 10lacs as they will no longer be required to pay a flat DDT rate and instead will be taxed according to their lower tax brackets. Non-residents structured as corporates who invest in Indian securities and are classified as foreign portfolio investors (FPIs) will also enjoy the new regime as they can now pay taxes at rates lower than the DDT rate and avail tax credits in their home country, as specified in tax treaties.

However, not all will benefit from the rolling back of DDT as investors with income exceeding INR 10lacs a year will be taxed at a rate that would be much higher than a flat DDT rate. This affects high net worth investors with income exceeding INR 5Cr as they will now be required to pay as much as 42% of their dividend receipts as tax which will take a big bite out of their dividend income. We believe the hit is more evident to the promoters of Indian companies who are likely to fall within the eye-watering tax bracket whilst holding shares in individual capacity.

To access the report, please contact dividendsupport@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findia-abolishes-dividend-distribution-tax.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findia-abolishes-dividend-distribution-tax.html&text=+India+abolishes+dividend+distribution+tax+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findia-abolishes-dividend-distribution-tax.html","enabled":true},{"name":"email","url":"?subject= India abolishes dividend distribution tax | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findia-abolishes-dividend-distribution-tax.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=+India+abolishes+dividend+distribution+tax+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findia-abolishes-dividend-distribution-tax.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}