Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Feb 25, 2021

Indian auto sector - A long road to recovery

The slowdown - Where it all started

The Indian automotive industry accounts for over 7% of the country's GDP and 22% of its manufacturing GDP. The auto sector is also one of the biggest recipients of foreign direct investment (FDI) as it received USD24.2 billion between April 2000 and March 2020. The signs of a slowdown first began to emerge back in 2018, rationalising the dip in sales by attributing it to a weak festive season demand. Additionally, to curb pollution, the Supreme Court of India ruled that automakers have to upgrade from Bharat Stage-IV (BS-IV) engines to BS-VI engines, forcing many companies to heavily invest in and change production processes to accommodate the new change by April 2020. This led to a huge unsold inventory of old models, thus burdening and stressing the production facilities. And then, the final blow - COVID-19. With a nationwide lockdown in place, automakers were forced to fully shut down production facilities during April and May. According to the president of Society of Indian Automobile Manufacturers (SIAM), the industry lost around INR23 billion every day because of plant closures.

Increased demand, government spending, and new policy will fuel the sector's recovery

India's top automakers' profit and revenue grew by double digits during the December quarter in a sharp turnaround from the June quarter, when the nationwide lockdown hit sales and factory operations.

Maruti Suzuki India Ltd. (INE585B01010) posted a 24% year-over-year (y/y) rise in net profit for the December quarter on the back of a 13% y/y growth in revenue. Mahindra & Mahindra Ltd.'s (INE101A01026) profits also surged 252% y/y, while revenue grew 11.29% quarter on quarter (q/q). Tata Motors Ltd. (INE155A01022) reported a 35% y/y increase in revenue for its India business, while losses narrowed by 38% y/y thanks to higher sales of passenger and commercial vehicles and pent-up demand owing to the strict lockdown in April and May.

In the case of two-wheelers, Hero MotoCorp Ltd. (INE158A01026) posted a 23% y/y increase in profit while revenues jumped 39.7% y/y. Bajaj Auto Ltd. (INE917I01010) also exceeded expectations by posting a 23.4% rise in profit as a result of a 16.6% increase in revenue.

Researchers and analysts foresee increased demand in urban/rural areas driven by faster rural recovery, increased government spending, and the introduction of the vehicle scrappage policy as potential key factors driving sector turnaround in the future. Scrapping older vehicles will create demand for new vehicles and a proposed green tax on vehicles will add pressure on fleet owners to replace their old trucks. Companies such as Mahindra & Mahindra Ltd. and Maruti Suzuki India Ltd. have already invested in facilities to recycle vehicles.

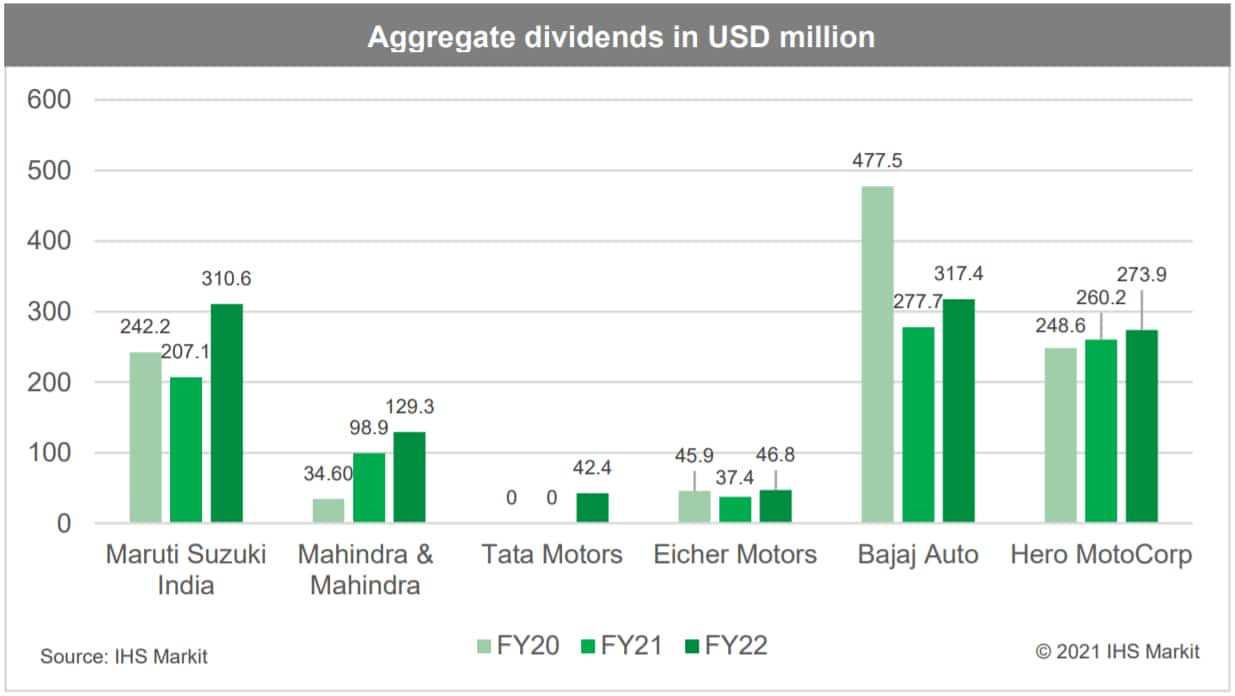

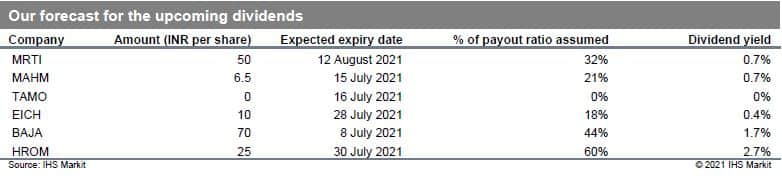

What's ahead in 2021?

To access the report, please contact dividendsupport@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-auto-sector-a-long-road-to-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-auto-sector-a-long-road-to-recovery.html&text=Indian+auto+sector+-+A+long+road+to+recovery+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-auto-sector-a-long-road-to-recovery.html","enabled":true},{"name":"email","url":"?subject=Indian auto sector - A long road to recovery | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-auto-sector-a-long-road-to-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indian+auto+sector+-+A+long+road+to+recovery+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-auto-sector-a-long-road-to-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}