Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 21, 2024

Inflation slows further as economic growth wanes: our key takeaways from the Eurozone flash PMI

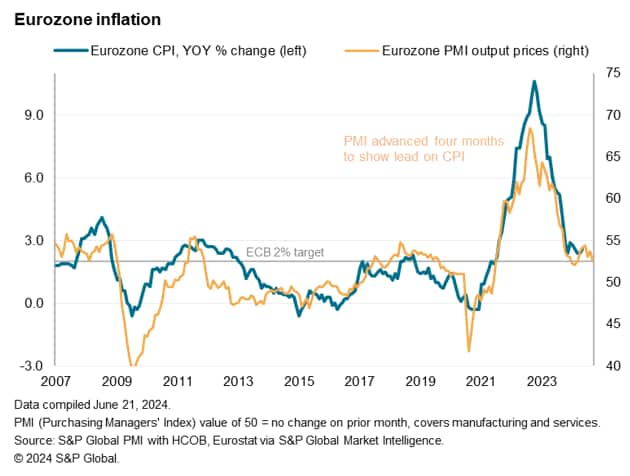

The 'flash' PMI® survey data for June provide an early snapshot of economic conditions in the euro area after the European Central Bank cut interest rates for the first time in five years. The survey showed a surprise cooling in the pace of economic growth, defying consensus expectations of a further acceleration in growth. Manufacturing in particular took a turn for the worse, deteriorating at a steepening rate. At the same time, however, price pressures cooled further, down to levels which historical comparisons suggest are compatible with the ECB's inflation target.

Here are our top-five takeaways from the June flash PMI data:

1. Economic growth slips in June

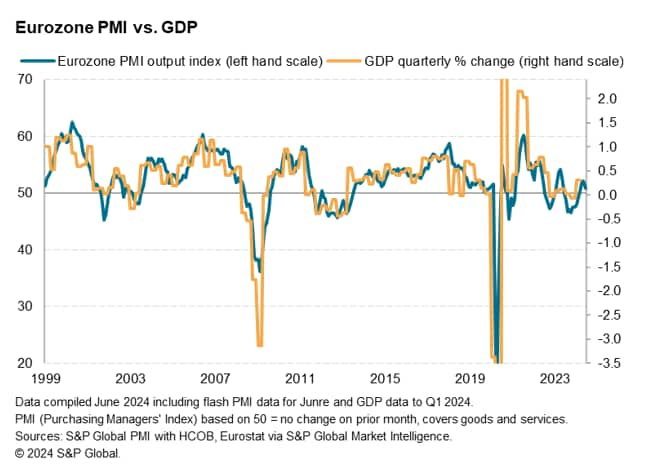

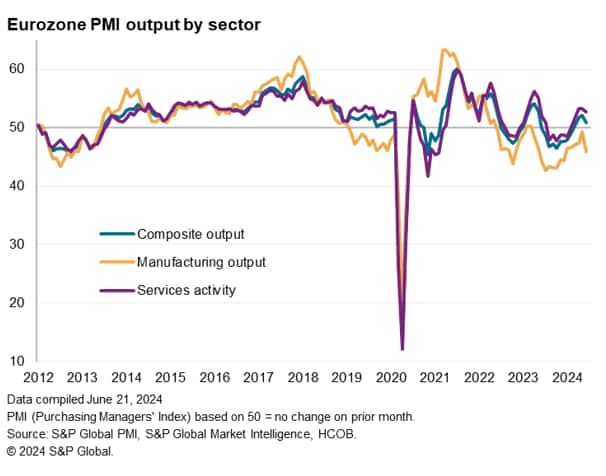

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, fell from 52.2 in May to 50.8 in June. Economists had been expecting a rise to 52.5.

Although signalling a fourth successive monthly increase in output, following a nine-month spell of decline, the latest reading is the weakest for three months and indicative of eurozone GDP growing at a sluggish quarterly rate of just over 0.1% (according to a simple OLS regression model based on prior PMI and GDP data alone). For the second quarter as a whole, the PMI average of 51.6 points to a GDP rise of 0.2%.

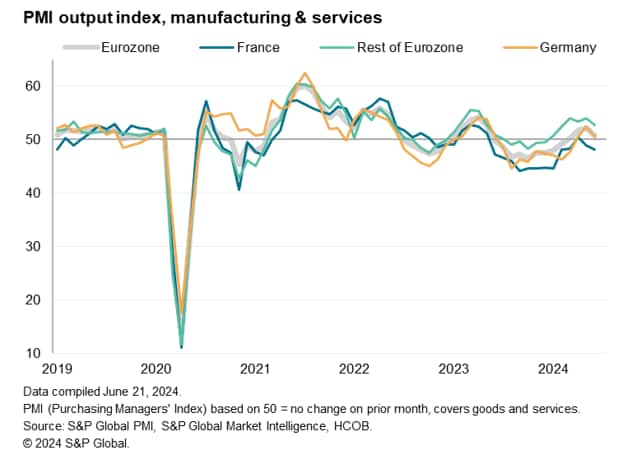

The deteriorating eurozone growth trend was led by France, which saw output fall for a second consecutive month and at the fastest rate for five months. Companies reported that the deterioration was in part linked to heightened uncertainty and paused spending following the announcement of the snap parliamentary elections. The flash composite PMI reading for France is indicative of stalled GDP in June, and a mere 0.1% expansion for the second quarter as a whole.

However, growth also slowed sharply in Germany from the 12-month high seen in May, albeit still registering growth for a third consecutive month after nine months of decline. The June flash composite PMI reading none the less indicates no GDP growth during the month and rounds of a quarter which, as in France, points to the economy growing at a meagre 0.1% quarterly pace.

Outside of France and Germany, however, the picture was brighter. Collectively, the rest of the eurozone reported output growth for a sixth successive month in June, the rate of growth losing momentum to sit at a four-month low yet remaining above the long-run average.

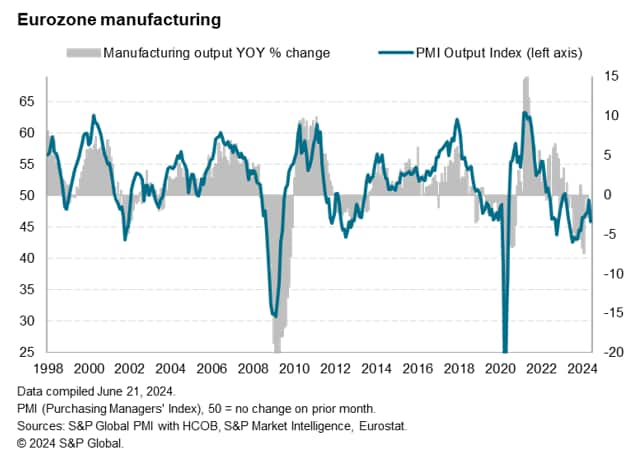

2. Manufacturing output slumps

By sector, the worsening situation across the eurozone in June was fueled by a sharp drop in manufacturing output. Having come close to stabilising in May, factory output dropped at its steepest rate for six months, extending the sector's decline into its fifteenth successive month. Production fell at increased rates in both France and Germany, hitting five- and three-month highs respectively, and showed a renewed decline in the rest of the region, dropping at the sharpest rate since December.

Fueling the manufacturing downturn was a steepening in the rate of loss of new orders, which fell for a twenty-sixth consecutive month in June - bucking the easing trend seen in prior months - in response to worsening demand indications in France, Germany and the rest of the eurozone.

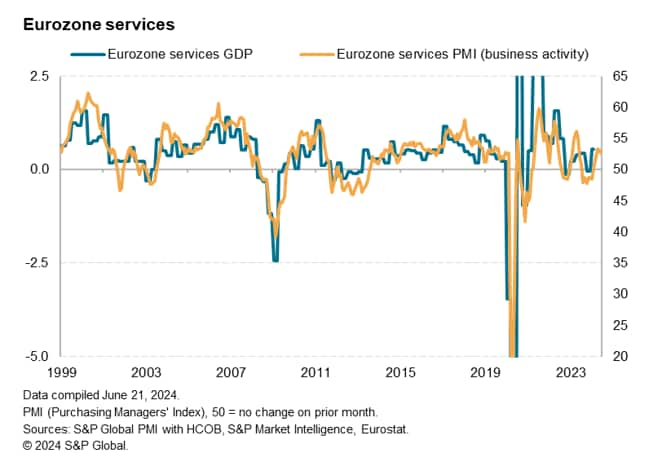

3. Service sector expansion provides offset to factory malaise

The service sector meanwhile sustained its expansion into a fifth straight month, though the rate of growth cooled to the lowest since March. The slowing was principally a reflection of lower business activity in France, often linked to political uncertainty (albeit drawing on a modest decline also seen in May). While rates of growth also lost some momentum in both Germany and the rest of the eurozone as a whole, these expansions remained encouragingly solid by recent standards of the survey.

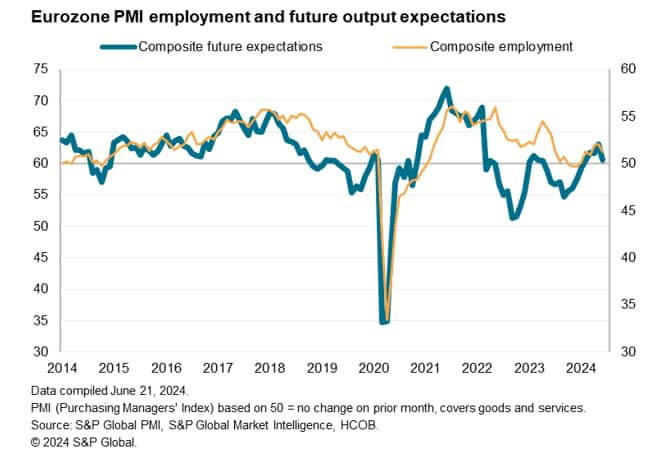

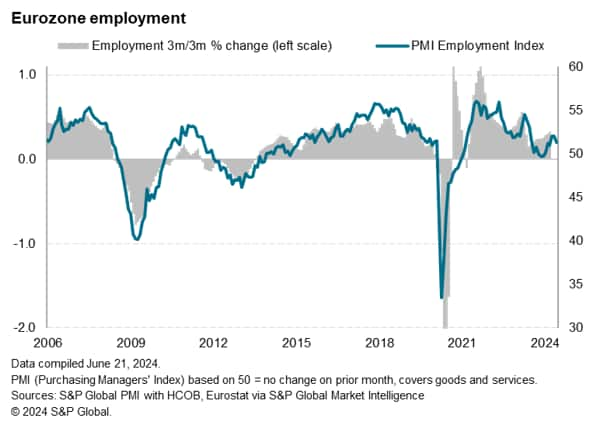

4. Uncertainty hits hiring

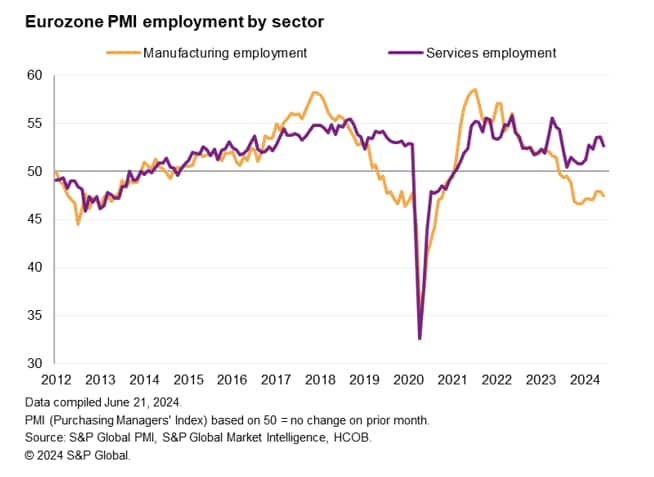

Employment increased across the eurozone for a sixth month in a row in June after two months of marginal declines at the end of last year, but the latest rise was the smallest recorded for three months. Employment fell marginally in Germany, dropping for the first time in three months in response to manufacturing layoffs, and payroll growth hit three- and four-month lows in France and the rest of the eurozone respectively, again led by manufacturing job culls.

Hiring was hit as companies became less optimistic about prospects in the year ahead. Future output expectations fell across the eurozone in June to their lowest since February.

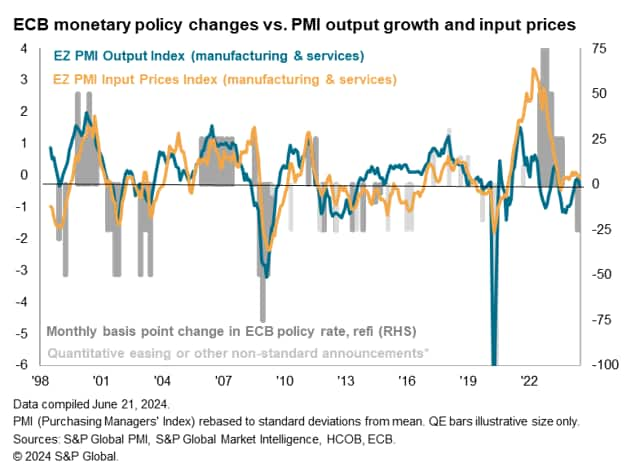

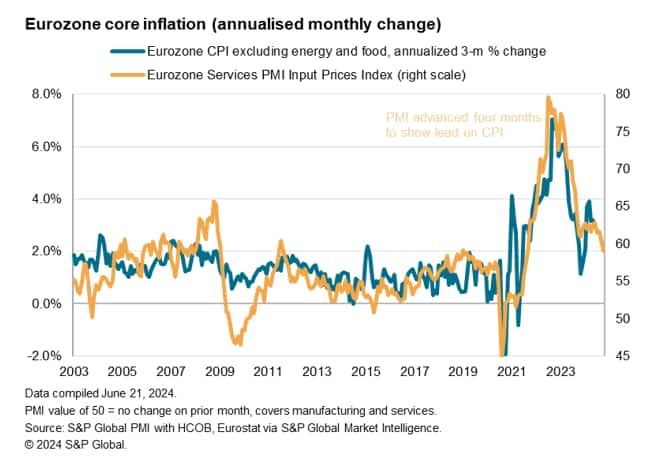

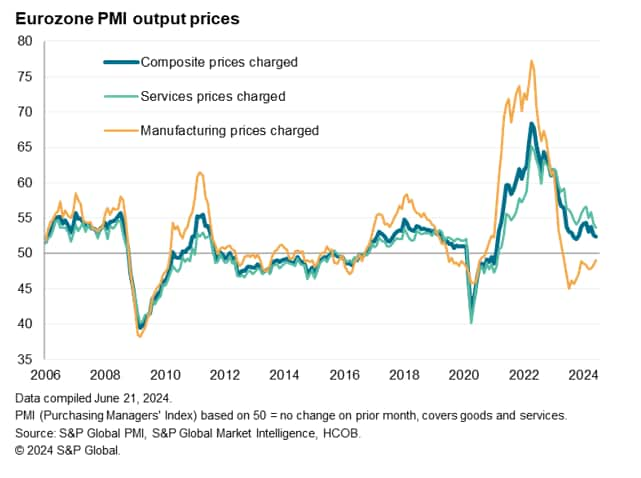

5. Prices rise at slower rate

Average prices charged for goods and services across the eurozone rose at the slowest rate for eight months in June, the rate of increase running at one of the weakest seen since inflation took off in early 2021. The decline takes the index back down to levels that are broadly consistent with the ECB's 2% inflation target, according to historical comparisons.

Of particular note, input costs in the service sector - which are heavily influenced by wage growth -rose at the slowest rate since April 2021, to thereby signal a cooling of core inflation (likewise down to target).

However, while lower input costs in the service sector fed through the weakest rise in selling prices for services recorded by the survey since May 2021, June saw some further moderation of the disinflationary trend in manufacturing. Factory input costs rose in June for the first time in 16 months, resulting in the smallest decline in manufacturing selling prices seen for just over a year - a development which could put some renewed upward pressure on inflation in the coming months if sustained.

Within the eurozone, especially weak price growth was recorded in France, where average charges for goods and services barely rose in June, registering the smallest increase since prices began rising in March 2021. French services prices in particular increased only marginally. While price growth ticked higher in Germany, the rise remained among the lowest seen over the past three years and only marginally above the pre-pandemic ten-year average. Inflation in the rest of the eurozone as a whole meanwhile slowed to a six-month low.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-slows-further-as-economic-growth-wanes-our-key-takeaways-from-the-eurozone-flash-pmi-Jun24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-slows-further-as-economic-growth-wanes-our-key-takeaways-from-the-eurozone-flash-pmi-Jun24.html&text=Inflation+slows+further+as+economic+growth+wanes%3a+our+key+takeaways+from+the+Eurozone+flash+PMI+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-slows-further-as-economic-growth-wanes-our-key-takeaways-from-the-eurozone-flash-pmi-Jun24.html","enabled":true},{"name":"email","url":"?subject=Inflation slows further as economic growth wanes: our key takeaways from the Eurozone flash PMI | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-slows-further-as-economic-growth-wanes-our-key-takeaways-from-the-eurozone-flash-pmi-Jun24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Inflation+slows+further+as+economic+growth+wanes%3a+our+key+takeaways+from+the+Eurozone+flash+PMI+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflation-slows-further-as-economic-growth-wanes-our-key-takeaways-from-the-eurozone-flash-pmi-Jun24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}