Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

May 11, 2023

S&P Global Investment Manager Index (IMI) reveals risk appetite at survey low in May

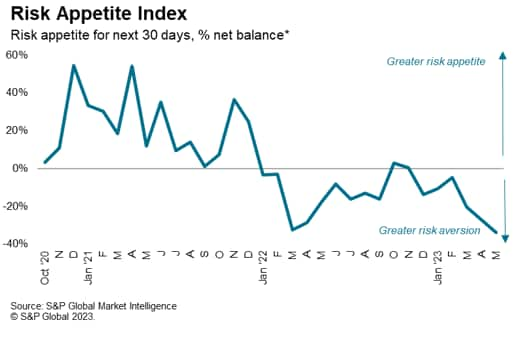

Latest S&P Global Investment Manager Index data revealed that risk sentiment rests at a survey record low in May. Near-term expected returns also sit at its lowest since result collection began in October 2020. Pressure on US equities is expected to further stem from political, monetary and broader US macroeconomic issues. according to the monthly poll of investment managers.

Consequently, a relatively defensive stance had been adopted in terms of sector preferences. That said, some bright spots were observed including a bullish turn for the tech sector midway into the second quarter.

Sell in May and go away?

The latest S&P Global Investment Manager Index (IMI) survey - based on data collected from a panel comprising approximately 300 participants employed by firms that collectively represent approximately $3,500bn assets under management - revealed that risk appetite worsened in May to the lowest since October 2020, which was when data collection first began. At -34%, down from -27% in March, this has surpassed the previous low recorded in March 2022.

Risk aversion was especially pronounced among North American domiciled investors according to detailed data, reflecting heightened jitters among various US investors in their home market.

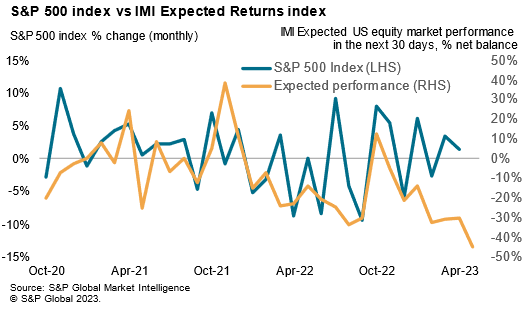

Concurrently, the IMI's Expected Returns Index also showed expectations of negative returns in the month ahead for a seventh consecutive month in May. Furthermore, the extent to which prices are expected to fall in the US market slumped to the most intense since at least October 2020.

When compared to the broad US S&P 500 index, the latest indications from the survey suggest that money managers are broadly less confident about the market as compared to how the broad index appears to be performing. The trend in which the Expected Returns Index further hints at the possibility that the current S&P 500 index's consolidation may conclude with a breakout to the downside should various concerns materialise as triggers for a sell-off.

Debt-ceiling concerns reigns top for US equity investors

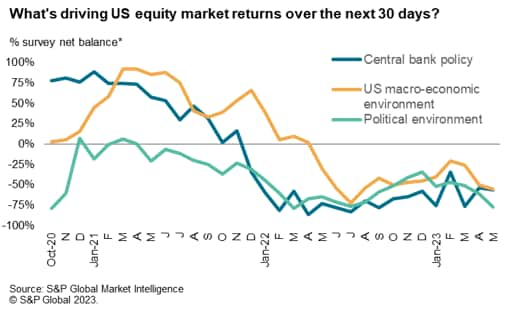

Assessing what is expected to drive near-term returns with insights gained from the IMI survey, we find that all factors bar shareholder returns are expected to weigh on the US equity market midway into the second quarter. The most aggravating factor that could lead to negative returns was the political environment according to the survey. This was accompanied by mentions of US debt-ceiling worries at the start of May and may remain a lingering concern for investors in the near-term absent any positive resolution.

Following closely behind the political environment were factors including central bank policy and the US macroeconomic environment as recession fears lingers. Notably, concerns over US central bank policy has further intensified in May despite a perceived dovish May Federal Open Market Committee (FOMC) meeting. To a large extent, this outlined that implications from the Fed's policy remain highly relevant, if not more so, even if interest rates may be near or at its peak in the short to medium term.

Defensive preferences

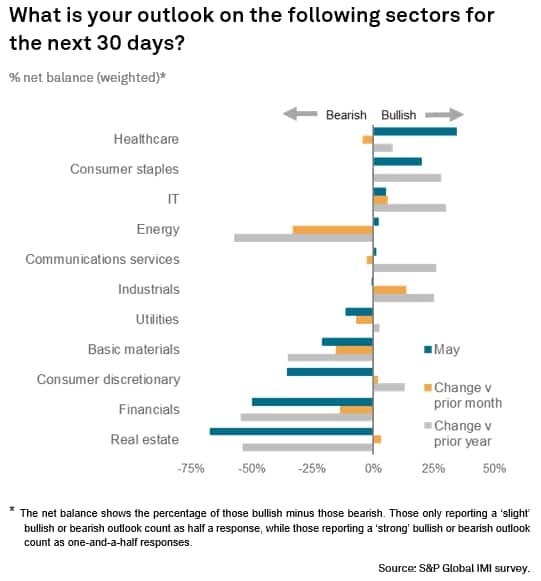

As a consequence of the ongoing overt risk averse stance, money managers appear to hold a defensive tilt in their sector preference in May. Healthcare and consumer staples led the group of sectors surveyed, the former taking the top position for a second consecutive month. That said, the S&P 500 Health Care (Sector) index can clearly be seen in consolidation mode, with the bullish sentiment yet to take it higher compared to recent peaks.

At the other end of the preferences ranking, real estate and financials sank to the bottom. Financials notably saw its position among the sectors ranked declining for a fourth consecutive month to the second lowest in the group. Recent banking sector woes have continued to affect the sector's appeal among investors.

Finally, it is worth highlighting that the IT/tech sector rose into net-bullish territory for the first time since September 2022. This bodes well for the uptrend we have noticed across various tech indices including the S&P 500 Information Technology (Sector) Index.

The June S&P Global Investment Manager Index will be released on June 13, 2023.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestment-manager-index-reveals-risk-appetite-at-survey-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestment-manager-index-reveals-risk-appetite-at-survey-low.html&text=S%26P+Global+Investment+Manager+Index+(IMI)+reveals+risk+appetite+at+survey+low+in+May+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestment-manager-index-reveals-risk-appetite-at-survey-low.html","enabled":true},{"name":"email","url":"?subject=S&P Global Investment Manager Index (IMI) reveals risk appetite at survey low in May | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestment-manager-index-reveals-risk-appetite-at-survey-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+Investment+Manager+Index+(IMI)+reveals+risk+appetite+at+survey+low+in+May+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finvestment-manager-index-reveals-risk-appetite-at-survey-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}