Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 20, 2019

Iron Ore: September imports to remain elevated while prices face downside risk

Chinese iron ore imports are unlikely to show any signs of easing in the near-term with imports likely to stay elevated despite economic malaise persisting as signalled by continued weakness in industrial production. Strong imports could see benchmark iron ore prices facing renewed price pressures amid Chinese inventory being replenished with every passing week.

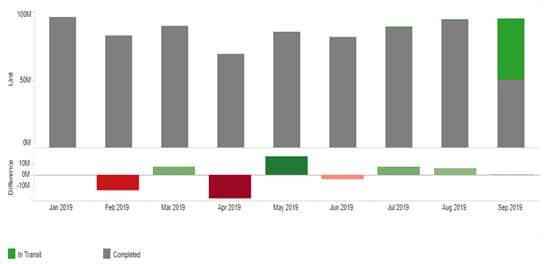

IHS Markit Commodities at Sea iron ore trade flow intelligence suggests September imports will come in above 90 mt for the third consecutive month and could even surpass a 19-month high registered in August.

China Monthly Iron Ore Imports to Stay Elevated

Source: IHS Markit Commodities at Sea

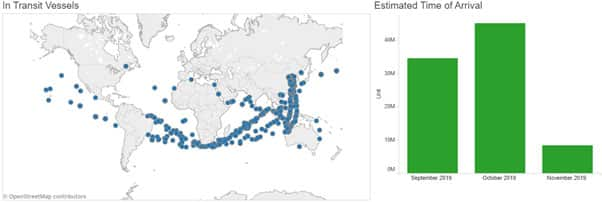

We have identified close to 600 vessels in-transit carrying 100 mt of iron ore volumes to Chinese ports amid ongoing recovery in shipments from key suppliers Australia and Brazil. Iron ore export volume recovery in Brazil is running slightly ahead of market expectations with shipments increasing both in Northern and Southern systems. We believe Brazilian iron ore major Vale will continue to ramp up exports in a bid to make up for volume loss from the January Brumadinho dam disaster. Similarly, having recovered from port maintenance, Australian exports will likely maintain a steady uptrend over the next few months. According to IHS Markit Commodities at Sea, around 44 mt of Brazilian and 41 mt of Australian iron ore is in-transit to China.

Iron Ore Heading to China Shows No Signs of Easing

Source: IHS Markit Commodities at Sea

Despite ongoing slowdown in the industrial economy, inventory restocking cycle is likely to support medium term Chinese iron ore import demand and we expect Chinese iron ore demand to stay resilient in the months ahead.

With macroeconomic indicators further deteriorating from both the supply and demand side in August, IHS Markit Economics expects aggressive fiscal stimulus and targeted credit expansion. Beijing's infrastructure stimulus push could also lend support to moderating crude-steel production aiding import demand, in our view.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-september-imports-to-remain-elevated.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-september-imports-to-remain-elevated.html&text=Iron+Ore%3a+September+imports+to+remain+elevated+while+prices+face+downside+risk++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-september-imports-to-remain-elevated.html","enabled":true},{"name":"email","url":"?subject=Iron Ore: September imports to remain elevated while prices face downside risk | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-september-imports-to-remain-elevated.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Iron+Ore%3a+September+imports+to+remain+elevated+while+prices+face+downside+risk++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2firon-ore-september-imports-to-remain-elevated.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}