Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 16, 2020

Is BB the place to be?

Over the past few months, the market has paid keen attention to credit positioning within high yield, particularly to BB-rated debt versus all else. Following is a quick look at rating band performance over the past ten- and one-year periods using the iBoxx $ Liquid High Yield Index (IBOXHY), as well as an intro to CDX.NA.HY.BB.33, which began trading in November 2019.

Let's check the record

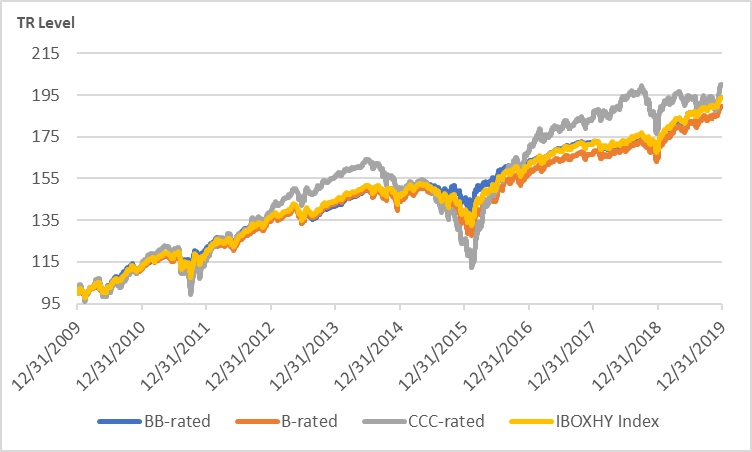

Over the past 10 years from year end 2019, investors were similarly compensated by B and BB-rated debt, with BB-rated debt delivering a 23bp annual return pickup versus B-rated debt. CCC-rated debt had the greatest total returns, returning an annual 34bp above BB-rated bonds (Figure 1).

Figure1: 10 Year IBOXHY Total Returns by Rating

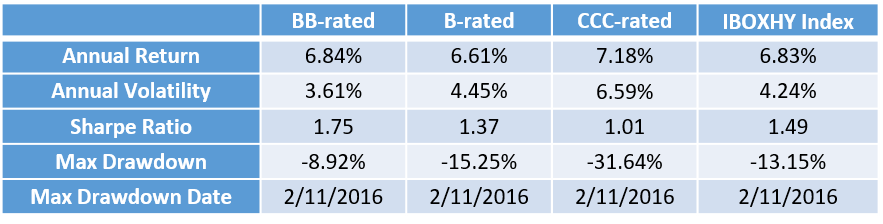

However, on a risk-adjusted basis, HY investors who clung to BB-rated debt outperformed other rating bands and the overall IBOXHY Index, with a Sharpe ratio 0.26 greater than the index (Table 1).

Table1: IBOXHY Ten Year Performance by Rating (as of December 31, 2019)

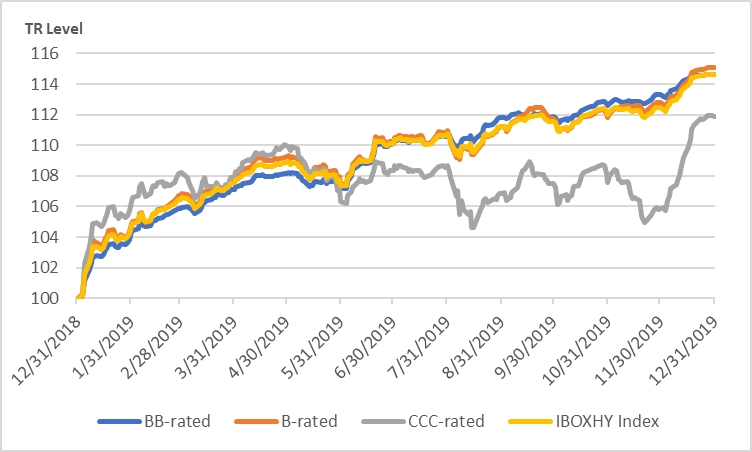

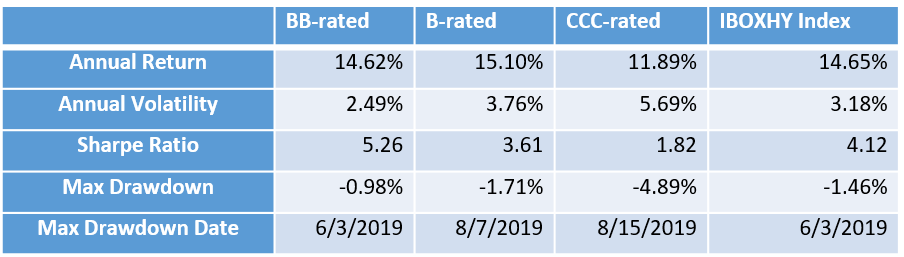

Looking over the past year, B-rated debt led the index in 2019, outperforming BB-rated and CCC-rated debt by 48bp and 321bps, respectively, on a total return basis (Figure 2).

Figure2: 2019 IBOX Total Returns by Rating

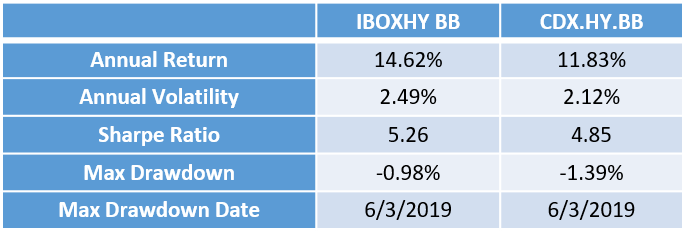

Though the same trend seen over the long term held, with BB-rated debt far exceeding B-rated debt when risk was considered. BB-rated debt's 2019 Sharpe ratio of 5.26 was 1.65 and 1.14 above B-rated debt and the overall index, respectively (Table 2).

Table2: IBOXHY One Year Performance by Rating (as of December 31, 2019)

Where are we now?

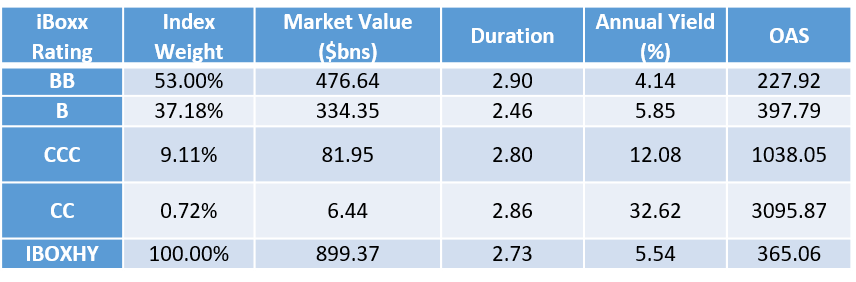

As of December 31st, 2019, BB and B-rated debt comprise roughly 90% of the IBOXHY index by market value, with BB-rated debt accounting for slightly more than half of the index. BB-rated debt's 2.90 duration is 0.44 years greater than B-rated bonds, which lends itself as an option to achieve additional duration exposure within HY without reaching down into the CCC & below-rated territory (Table 3).

Table3: IBOXHY Characteristics by Rating Band (as of December 31, 2019)

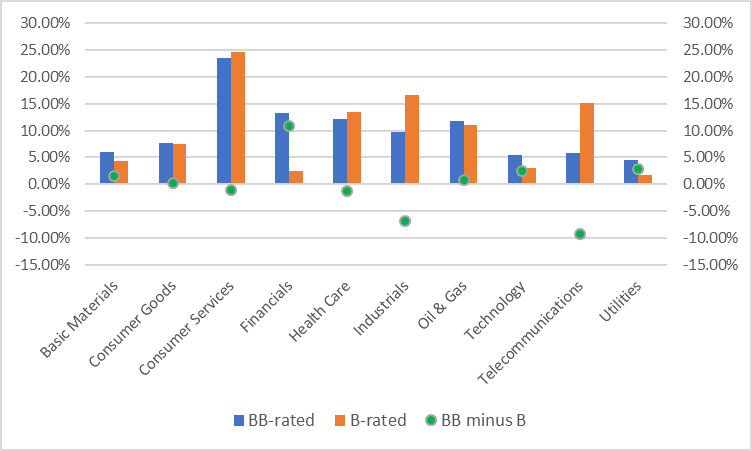

There are also meaningful sector exposure differences between BB and B-rated debt in IBOXHY. BB's 13.25% exposure to Financials is 10.82% greater than that of B-rated debt. On the underweight side, BB's 5.78% and 9.74% exposures to Telecommunications and Industrials are 9.32% and 6.85% less than B-rated bonds (Figure ).

Figure3: IBOXHY BB vs B Sector Exposure

CDX High Yield BB Index

A new way to gain exposure to BB-rated credits is with the CDX High Yield BB Index. Dealers started making markets on the index in early November of 2019, with six market makers observed sending out runs. The CDX.HY.BB index is a sub-index of CDX High Yield that selects only the BB-rated entities. Like its parent index, the underlying components in CDX.HY.BB are credit default swaps, in contrast to the cash bonds that underlie the IBOXHY Index. Currently, there are 39 equally-weighted entities within the CDX HY BB Index, while there are 178 market value-weighted BB-rated issuers within IBOXHY.

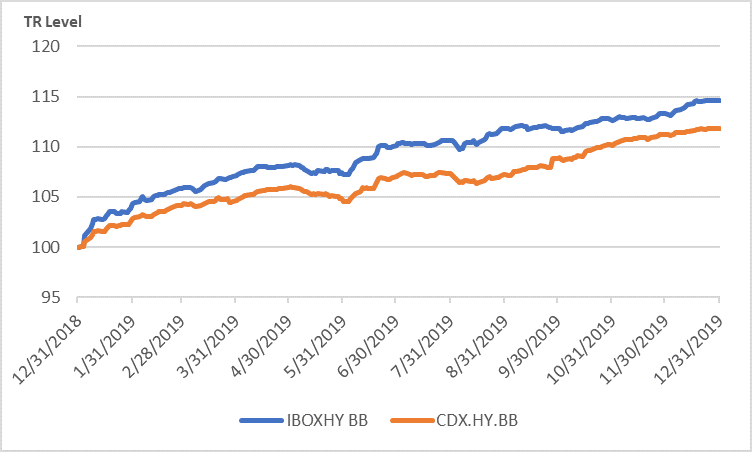

Comparing the 2019 total return of the iBoxx USD Liquid High Yield BB Index to CDX.HY.BB, IBOXHY BB outperformed by 2.79% (Figure 4).

Figure4: IBOXX BB vs CDX.HY.BB Total Returns

IBOXHY BB also outperformed on a risk-adjusted basis, its Sharpe ratio 0.41 greater than CDX.HY.BB. To note, since CDX.HY.BB is based on credit default swaps, the index provides credit exposure, while the cash bonds in the IBOXHY BB index include credit and interest rate risk (Table 4).

Table4: IBOXHY BB vs CDX.HY.BB One Year Performance (as of December 31, 2019)

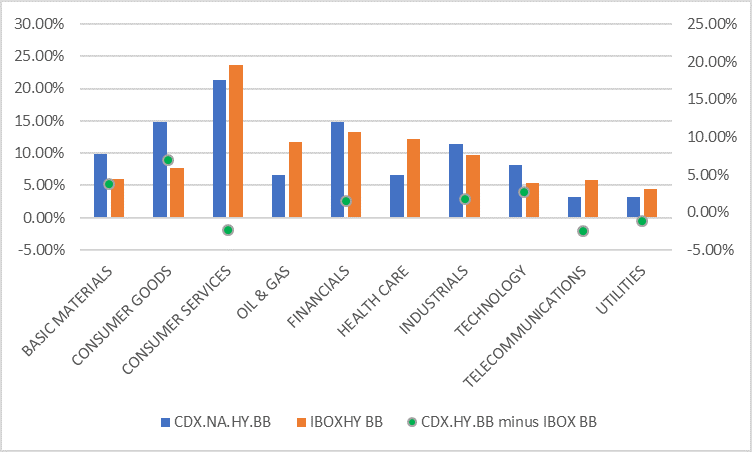

The sector exposure between IBOXHY BB and CDX.HY.BB is closer than was observed between BB and B-rated entities in the cash market. The largest CDX.HY.BB overweight differences versus IBOXHY BB are for Consumer Goods (+7.0%) and Basic Materials (+3.18%). The greatest underweighted sectors of CDX.HY.BB to IBOXHY BB are Health Care (-5.58%) and Oil & Gas (-5.24%). All other sector differences are within a 3% bound (Figure 5).

Figure5: CDX.HY.BB vs IBOXHY BB Sector Exposure

CDX.HY.BB offers the ability to go long or short BB credits on an unfunded or funded basis. Whatever your stance on the question "is BB the place to be," CDX.HY.BB is a tool you can use to answer.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fis-bb-the-place-to-be.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fis-bb-the-place-to-be.html&text=Is+BB+the+place+to+be%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fis-bb-the-place-to-be.html","enabled":true},{"name":"email","url":"?subject=Is BB the place to be? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fis-bb-the-place-to-be.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Is+BB+the+place+to+be%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fis-bb-the-place-to-be.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}