Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 18, 2019

Japanese manufacturing's steep downturn extends into April

- Nikkei Flash Japan Manufacturing PMI remains in contraction territory with further declines reported in production and order books

- Export decline leads downturn

- GDP expected to grow by just 0.7% in 2019, slowing further to 0.5% in 2020

Japan's manufacturing economy remained stuck in a downturn at the start of the second quarter as the global trade slowdown continued to take its toll on the country's exporters. The ongoing decline in manufacturing activity raises questions over the prospects of the economy amid global growth risks and a planned sales tax hike scheduled for later in the year.

Export-led manufacturing downturn

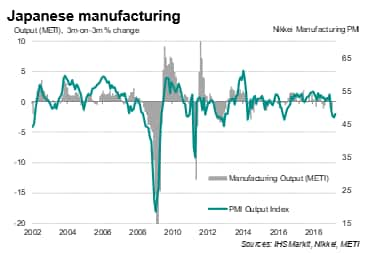

According to flash estimates, the Nikkei Manufacturing PMI for April rose to 49.5 from 49.2 in March. With 50.0 being the no-change level between growth and decline, April's flash PMI reading signalled an ongoing deterioration of manufacturing conditions during the month, albeit with a weaker rate of contraction evident.

The headline PMI is a composite indicator derived from various survey sub-indices. The Output index signalled a fourth consecutive monthly fall in manufacturing production, while the new orders index pointed to another reduction of new business inflows. While the rates of contraction in both indices were slower than in March, the downturns remained steep. Firms cut back on input purchasing and scaled down stock holdings in line with reduced order book growth.

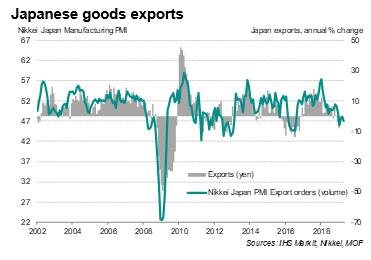

The driving force behind the manufacturing downturn was a persistent deterioration in export orders, which fell for a fifth consecutive month in April, dropping at second-steepest rate for over two-and-a-half years.

Particular stress was seen in key Japanese industries, such as electronics and autos. Japan has the world's third largest industries in electronics as well as autos. The country is also the fourth largest export market for semiconductor manufacturing equipment. But these sectors have seen demand drop sharply in recent months.

The global electronics PMI, compiled by IHS Markit, had signalled a further decrease in new order intakes in March, while detailed sector PMI showed an ongoing downturn in global auto production, with new orders falling for the sixth month running during March.

Softer growth

The PMI has acted as a reliable gauge of the health of the Japanese economy and such a weak reading added to gloomy prospects for economic growth in 2019.

IHS Markit's outlook for Japan's GDP growth is 0.7% in 2019, followed by a slowdown to 0.5% in 2020, primarily reflecting global uncertainty in trade conditions.

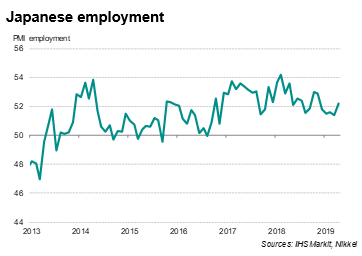

The flash manufacturing PMI continued to raise a red flag at the start of the second quarter, however two PMI sub-indices provide hopes that the weakness may find a floor. First, factory headcounts continued to grow, rising at the fastest pace in five months during April. Second, business confidence picked up to a four-month high. This could have reflected rising optimism that the US and China are nearing a trade deal, which would greatly soothe global trade risks.

For more information about the PMI surveys and the Nikkei PMI for Japan, please contact economics@ihsmarkit.com

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-manufacturings-steep-downturn-extends-into-april.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-manufacturings-steep-downturn-extends-into-april.html&text=Japanese+manufacturing%27s+steep+downturn+extends+into+April+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-manufacturings-steep-downturn-extends-into-april.html","enabled":true},{"name":"email","url":"?subject=Japanese manufacturing's steep downturn extends into April | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-manufacturings-steep-downturn-extends-into-april.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+manufacturing%27s+steep+downturn+extends+into+April+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapanese-manufacturings-steep-downturn-extends-into-april.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}