Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 05, 2021

Dizzying lumber trade volatility creates alternating winners and losers out of supply chain stakeholders

While many industries and commodities took a severe downturn due to COVID-19, there were some that outperformed their historical norms. Lumber and wood related commodities certainly fall into the latter category. Within the United States, wholesale and retail lumber prices have soared since COVID-19 emerged in 2020 increasing concerns of inflation for the U.S. economy as supply has become a major concern both in terms of raw supply as well as ancillary areas like labor shortages, transportation congestion, equipment shortages and so on. (1)(2) While these prices have dropped recently from their highs, they remain elevated over historical norms with expectations to remain so for the near term. (3) Below, we will explore the macro trends and micro trends within this group as well as where IHS Markit's economists see the market for the remainder of 2021 as well as future years.

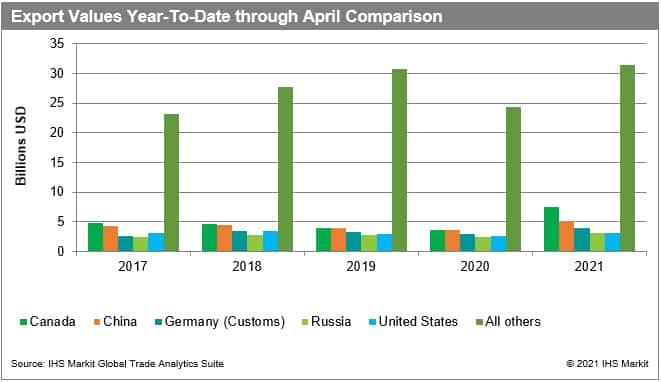

The five largest exporting countries of wood commodities under harmonized chapter 44 account for over 40% of the global international trade market when comparing January 2021 through April 2021 against the same time frame for prior years. When looking at year-to-date comparisons, most notable is that Canada has doubled from $3.6 billion through April 2020 to $7.5 billion through April 2021.

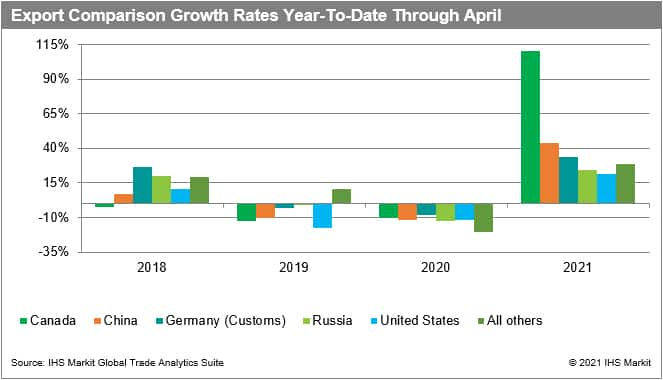

A comparison against the same time frame for prior years also shows how significant the growth has been in 2021 during which Canada shows exponential growth.

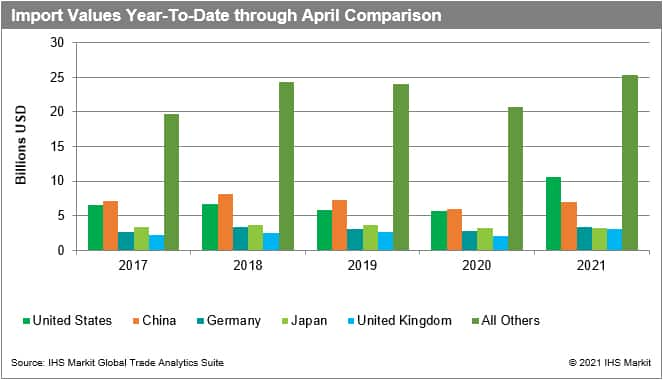

Switching to import countries of interest, mainland China has been the largest importing market in years past. However, for January 2021 to April 2021, the United States has so far overtaken mainland China as the largest importer with 20% of total imports globally.

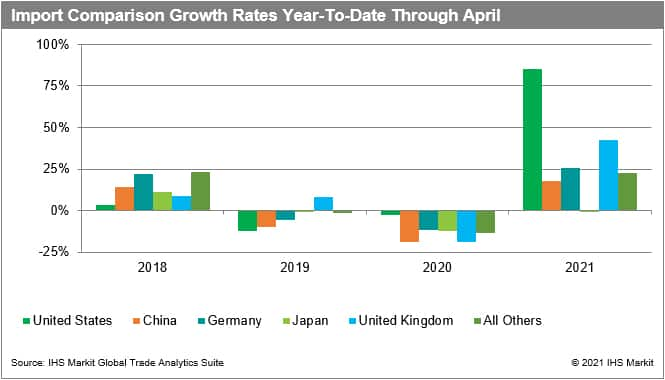

The growth rate for the United States for 2021 over 2020 exceeds 85%. Even comparing against older years of 2017, 2018, and 2019 within the same months, the growth rate is tremendous.

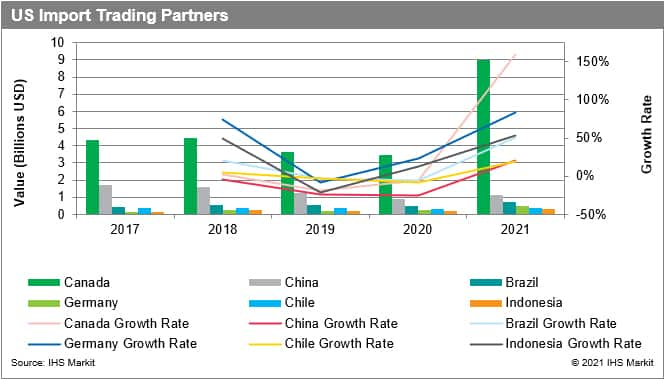

Who is the U.S. sourcing from? Not surprisingly, Canada is the primary source as previously noted, followed by mainland China, Brazil, Germany, Chile, and Indonesia. The latter group's combined market of 21% pales in comparison to Canada's market share of 63%. Within this latter group, we see extremely strong growth in January 2021 - April 2021 against the same period in 2020 as well as prior periods. Notably, imports from Germany increased 83% while Brazil and Indonesia both increased over 50% for the same comparison period. The Canadian growth rate was significantly higher still, increasing to 160% during that same time.

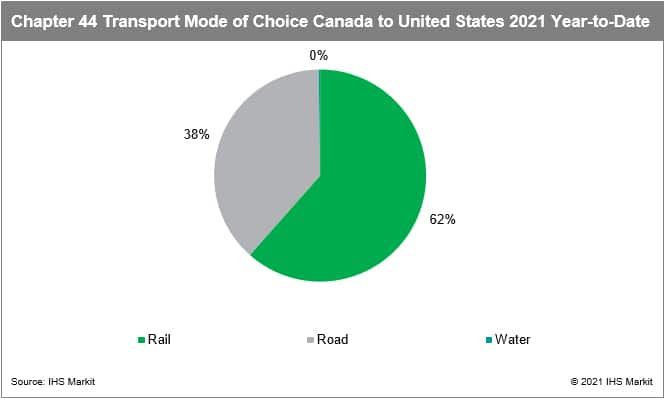

The preferred mode of transport from Canada to the United States is rail at 62% followed by road at 38%. Maritime as a mode of transports makes up less than 1% of the total. Geographical proximity, logistics flexibility, and lower costs make road and rail the primary options.

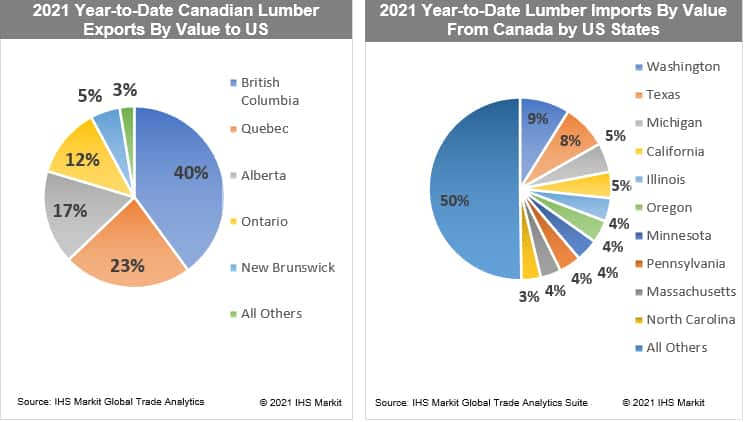

Further U.S. Canada trade analysis reveals most of the wood imports by value, moving from the provinces of British Columbia and Quebec. On the U.S. receipt side, 10 states, by value, account for 50% of the imports with the west coast states of Washington, California, and Oregon comprising 18%.

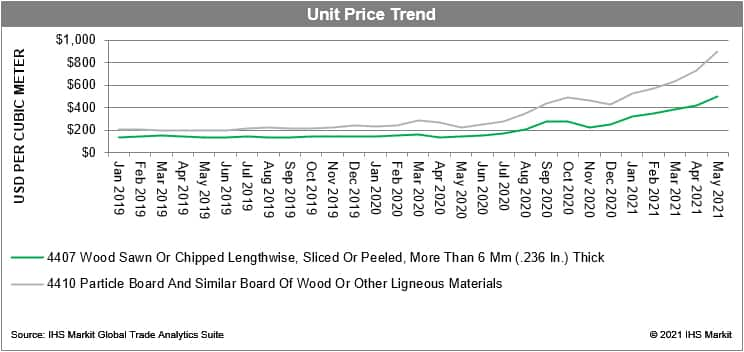

It is not just total volumes and values exhibiting high rates of volatility, but unit prices are fluctuating as well. Dating back to January 2019, two of the largest HS4 commodity categories shows relatively consistent unit values until August 2020 when the turn markedly upward with continued steady increases as 2021 progress. This trend benefits producers who are earning more for their exports per unit shipped but alienates importers and end consumers as they struggle to find supply at reasonable cost levels.

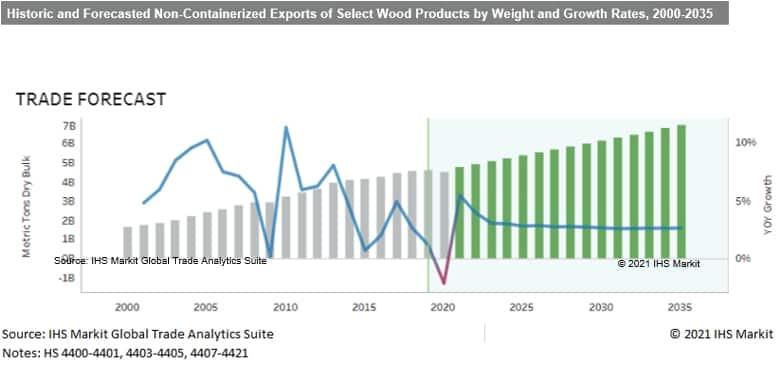

Where does the market go from here? IHS Markit GTAS Forecasting economists currently project a nearly 6% global growth in wood commodities by metric tons for full year 2021 with steady, low single-digit growth in the years thereafter through the forecast frontier of 2035. Similar annual forecasts are available for 270 commodities, 16 key indicators, and 248 countries, updated quarterly.

In summary, the trends seen within the data point discussed above indicate producers will continue to benefit from increased demand and higher price points for the foreseeable future, while stakeholders on the import side like home builders, furniture producers, hardware stores, and others may struggle to compete for available supplies at elevated prices.

(2) https://www.joc.com/special-topics/driver-shortage

(3) https://news.yahoo.com/not-just-housing-shortages-lumber-153737408.html

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flumber-trade-volatility-creates-alternating-supply-chain-output.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flumber-trade-volatility-creates-alternating-supply-chain-output.html&text=Dizzying+lumber+trade+volatility+creates+alternating+winners+and+losers+out+of+supply+chain+stakeholders+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flumber-trade-volatility-creates-alternating-supply-chain-output.html","enabled":true},{"name":"email","url":"?subject=Dizzying lumber trade volatility creates alternating winners and losers out of supply chain stakeholders | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flumber-trade-volatility-creates-alternating-supply-chain-output.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dizzying+lumber+trade+volatility+creates+alternating+winners+and+losers+out+of+supply+chain+stakeholders+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flumber-trade-volatility-creates-alternating-supply-chain-output.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}