Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 28, 2022

Mainland Chinese key dry bulk commodities fundamental demand is projected to stable in 2022

With the continuing COVID-19 pandemic and the 2022 Winter Olympics dampening the economy development, mainland China's GDP growth in the fourth quarter 2021 was 4%, which is lower than the 4.9% growth recorded in the previous quarter and 6.5% lower than the growth recorded in the corresponding period a year earlier. The National Bureau of Statistics said mainland China's GDP grew 8.1% in 2021, partly owing to the low base growth of only 2.2% in 2020. IHS Markit forecasts mainland China's GDP growth for 2022 will be 5.4%. Economic policy will change in 2022 to encourage growth in reaction to the slowdown. Mainland China's economy is faces challenges from COVID-19 outbreaks that are weighing on consumption and the property market downturn. Mainland China needs more stimulus in 2022 to sustain its economic recovery. Earlier this week, IHS Markit observed the government announcing monetary stimulus and a decrease in the Loan Prime Rate to help the struggling property industry.

As economic growth is highly correlated with dry bulk freight rate, and with the government aiming for a stable GDP growth in 2022, the dry bulk industry can be expected to gain momentum and improve towards the end of this quarter.

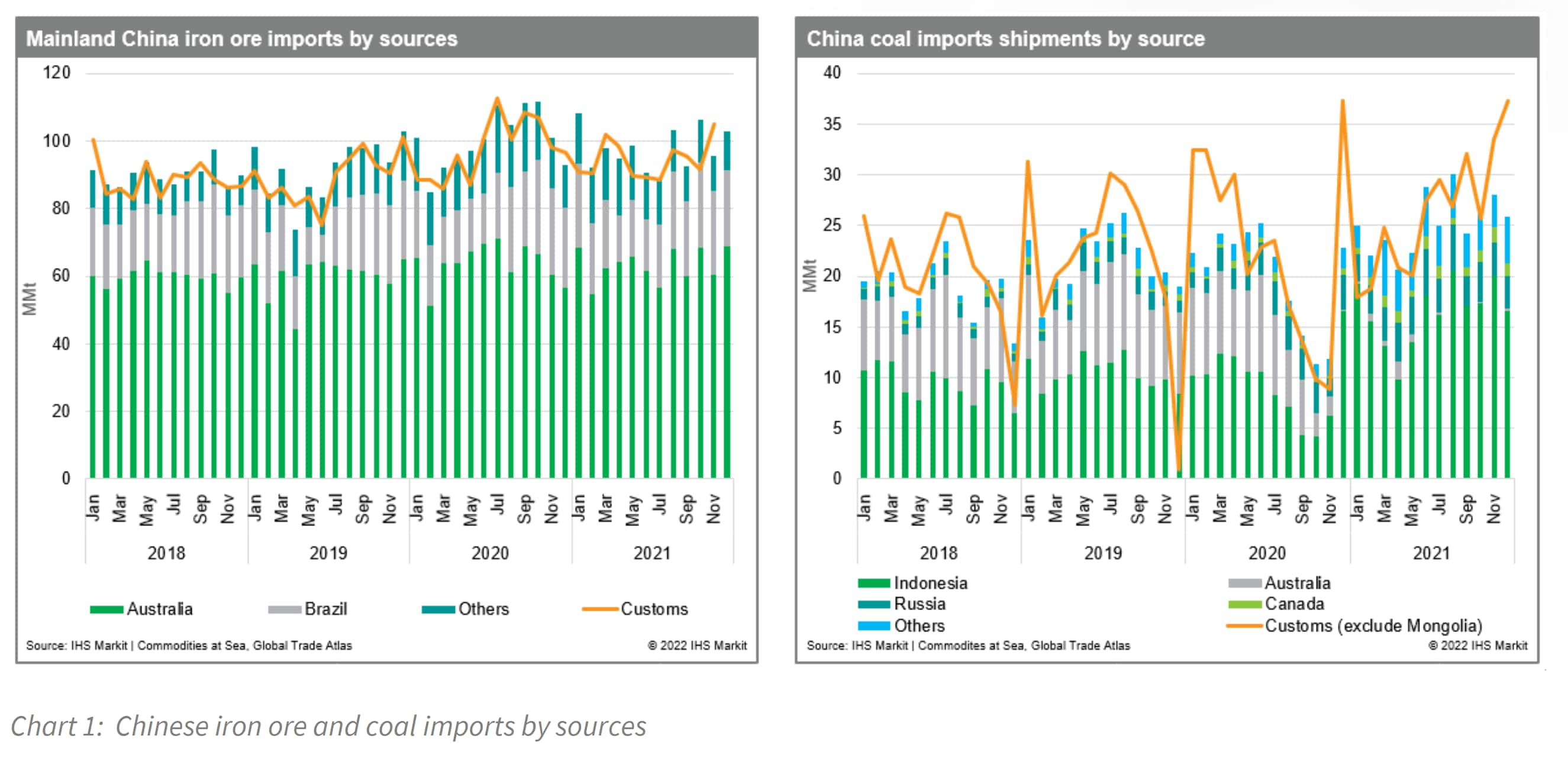

Mainland China's steel output has been reduced to realize the government's 'blue sky' goal for the Winter Olympics that are set to open in February 2022; Chinese steel production hub Tangshan has issued orange alerts several times in the winter to combat heavy pollution. Steel mills were forced to curb output until further notice. Dropping steel output weakened demand for raw material — iron ore. According to IHS Markit's Commodities at Sea data, total iron ore shipment arrivals to mainland China in 2021 were down 2.8% year on year (y/y) from the record high levels in 2020 although Chinese iron ore imports marginally increased 3% month on month (m/m) in December 2021 with winter restocking demand.

After bottoming out in mid-November 2021, iron ore prices were back above $130 per metric ton (62% CFR Qingdao), hoping for the mainland Chinese government's stimulus package for the property sector amid ongoing concerns about supply disruptions in Australia and Brazil. Minor adjustment on iron ore prices is within expectation when traders become more cautious considering the approaching Chinese New Year and Winter Olympics. However, economic growth will be essential for mainland China in 2022 as the National People's Congress (NPC) and the Chinese People's Political Consultative Conference (CPPCC) will be held this year. Thus in the medium-term point of view for the entire 2022, IHS Markit believes mainland China's iron ore imports will be supported at least until the third quarter of 2022.

With limited Australian coal and heavy rain disrupting Indonesian production in 2021, mainland China faced its worst energy crisis in the second half of 2021. Electricity shortages posed a threat to both people's livelihoods and manufacturing. The mainland Chinese government encouraged miners to ramp up production to secure adequate energy supplies, especially during the winter heating season. Mainland Chinese domestic coal output reached a new high of 385 million metric tons (MMt) in December 2021, putting downward pressure on coal imports, which fell 8% m/m in December 2021.

Meanwhile, the largest coal importer is also the largest coal producer. The game has shifted from seaborne trading to whether domestic supply will be sufficient to meet the demand. Fundamental demand for coal is projected to be slow until after the Chinese New Year. With economic growth recorded at 4% in the fourth quarter 2021, coal consumption is expected to warm up in line with the sped-up stimulus measures. We believe that steel output controls will be eventually relaxed after the Winter Olympics to accommodate the economic expansion, and coal consumption would rise in tandem. With the Indonesian government's announcement on coal ban in January— fearing domestic supply shortage—it is likely that a lower volume of coal will enter mainland China this month. Chinese appetite for seaborne coal will be determined by domestic coal production in the current month, and the recovery of energy-intensive sectors. IHS Markit's coal, metals and mining group expect Chinese coal imports volume will remain stable for the rest of the year and much of early year weakness caught up as year progress with stronger domestic demand outlook.

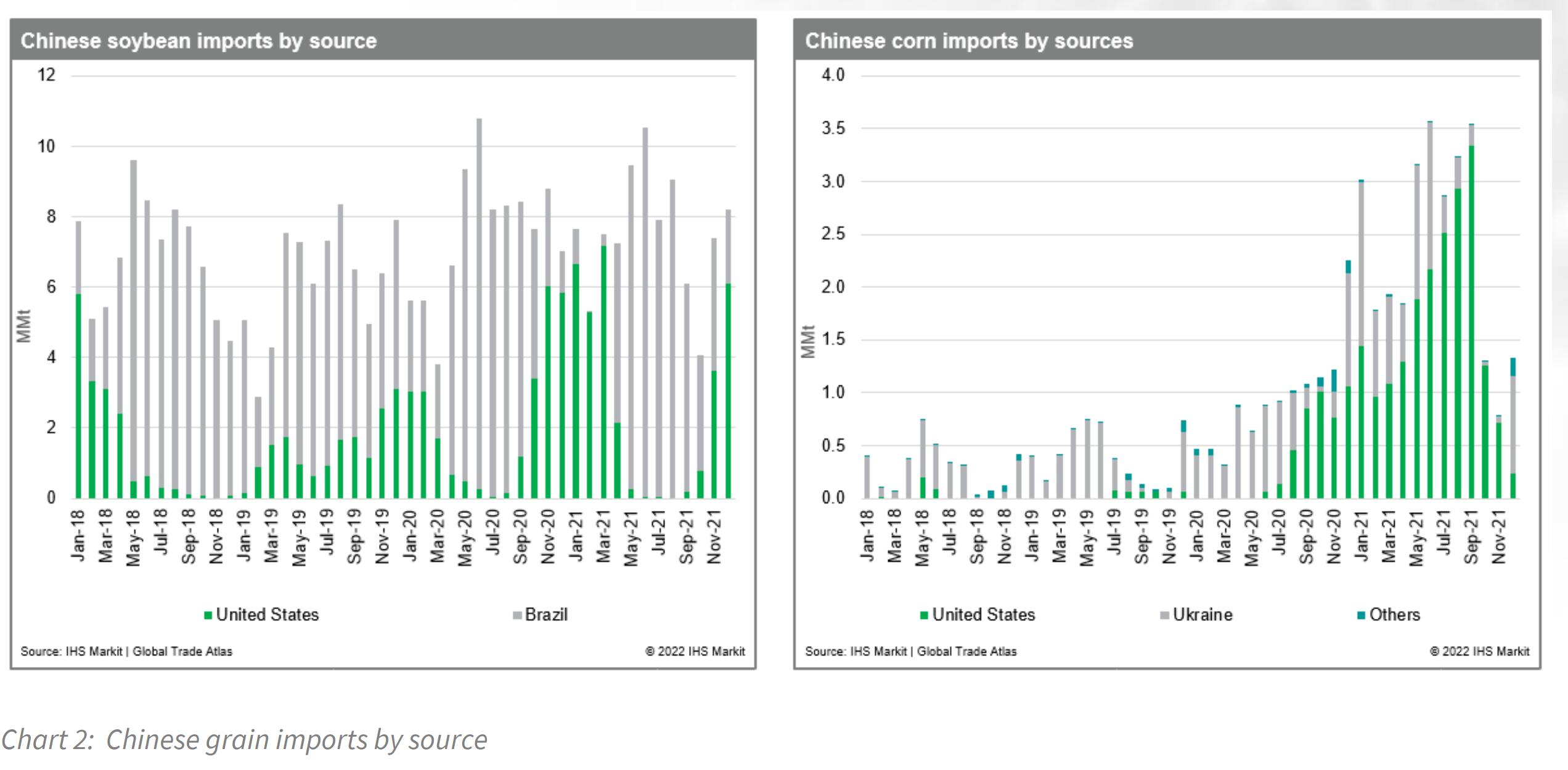

Mainland China accounts for over 60% of global soybean imports. The African swine fever outbreak in mainland China in 2018 has caused millions of pigs to be culled, significantly threatening pig production in mainland China. Chinese soybean imports fell 8% y/y to 88 MMt at that time. However, mainland China's soybean imports started to recover from the African swine fever in 2019. Unless swine are slaughtered in mass again, mainland China will require a larger soybean production to support its swine herds. According to customs data, mainland Chinese soybean imports from the U.S. jumped by 25% in 2021 with the trade agreement of agricultural purchases. Brazil soybean exports to mainland China were down 10% to 58 MMt in 2021. Mainland Chinese soybean import is forecast at 101 MMt in 2021/22, nearly 1% increase from the previous year.

Mainland China's fundamental demand in general is projected stable in 2022, although seasonal downturn in shipments was unavoidable over this period and there is the additional challenge of the Winter Olympics in mainland China which will put downward pressure on dry bulk freight rates in the short term. The near-term looks still bleak until larger open tonnage list and unfixed Atlantic ballasters cleared. However, mainland China's stable demand is expected to continue supporting dry bulk shipping moving into the next quarter. More upside risks are there over Q2-Q3 2022 with limited fleet supply and ongoing pandemic related inefficiency in port operation, and stronger container-general bulker market's spill over impact into geared bulkers. Downside risk remains towards end of 2022 as transition from COVID-19 pandemic to endemic is likely shifting consumer spending back towards the pre-pandemic trends, from purchases of goods to purchases of services.

Blog Author: Liz Gao, Senior Research Analyst, Liz.Gao@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinese-key-dry-bulk-commodities-fundamental-demand-i.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinese-key-dry-bulk-commodities-fundamental-demand-i.html&text=Mainland+Chinese+key+dry+bulk+commodities+fundamental+demand+is+projected+to+stable+in+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinese-key-dry-bulk-commodities-fundamental-demand-i.html","enabled":true},{"name":"email","url":"?subject=Mainland Chinese key dry bulk commodities fundamental demand is projected to stable in 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinese-key-dry-bulk-commodities-fundamental-demand-i.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mainland+Chinese+key+dry+bulk+commodities+fundamental+demand+is+projected+to+stable+in+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-chinese-key-dry-bulk-commodities-fundamental-demand-i.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}