Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 09, 2024

Manufacturing downturn spreads from Europe to America, but UK bucks the malaise

A global factory downturn is showing signs of spreading from Europe to America. While Asia is the stand-out regional performer, even here there are large pockets of weakness - notably mainland China and Japan. Besides India and Thailand, the UK is notable in bucking the broader downturn, albeit suffering from supply chain delays amid trade constraints, which could pose an inflation risk.

Global malaise spreads

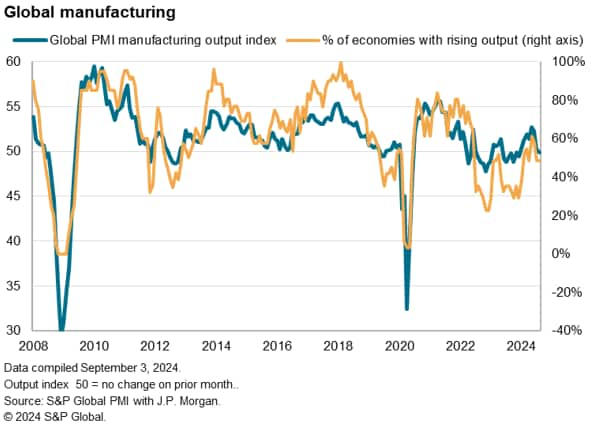

Having staged its strongest recovery for two years earlier in 2024, the global manufacturing economy slipped back into decline in August. The Global Manufacturing PMI, sponsored by J.P.Morgan and compiled by S&P Global Market Intelligence, signalled a fall in worldwide factory output in August for the first time since December.

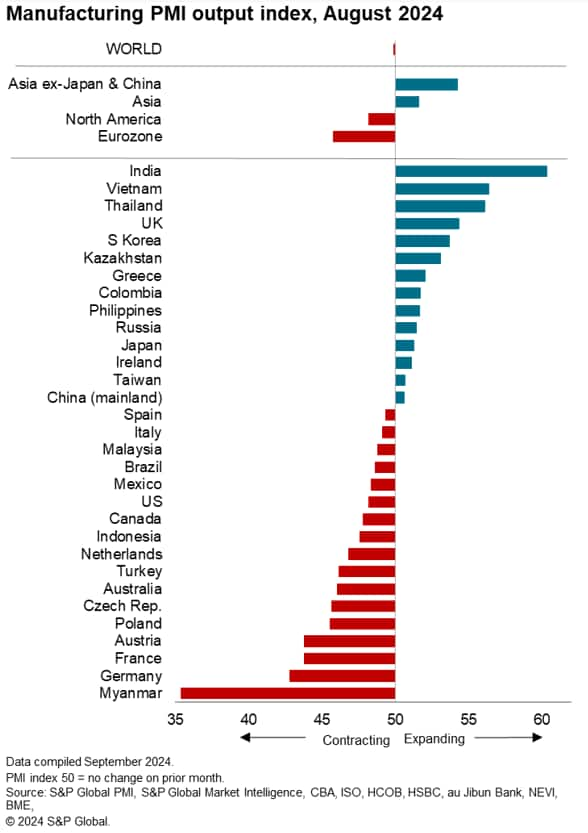

So far in the third quarter, falling output has been recorded in 17 of the 31 economies for which S&P Global compiles manufacturing PMI surveys.

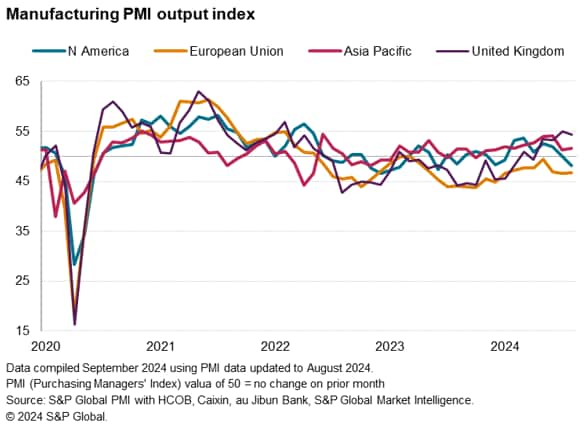

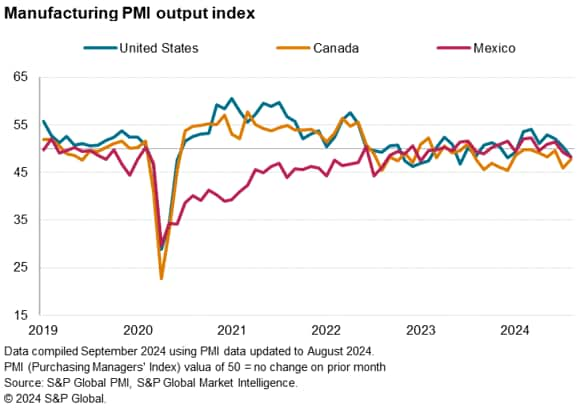

Worryingly, August has seen the downturn spread from Europe to America, and notably North America. For the first time since January, lower manufacturing output was again Canada and Mexico, and as well as in the US, causing overall North American manufacturing output to fall for the first time since January.

This renewed fall in North American output follows on the heels of sharp falls in European production. Measured across the European Union, factory output fell sharply in August, dropping for a seventeenth successive month. The European downturn was led by Germany, but steep falls in factory output were also reported in France, and Austria, as well as in Central and Eastern European economies such as Poland and the Czech Republic. More modest declines were also seen in Italy and Spain.

Asian [partial] resilience

The weakness seen in Europe and North America left Asia as the strongest performing manufacturing region in August, though even here fortunes were mixed. The stand-out performer was once again India by a wide margin, followed by Vietnam and Thailand. In contrast, only modest growth was recorded in Japan and mainland China remained close to stagnation. The latter has seen growth falter so far in the third quarter compared to the robust gains recorded in the second quarter, hinting that China too is struggling amid the spreading manufacturing malaise.

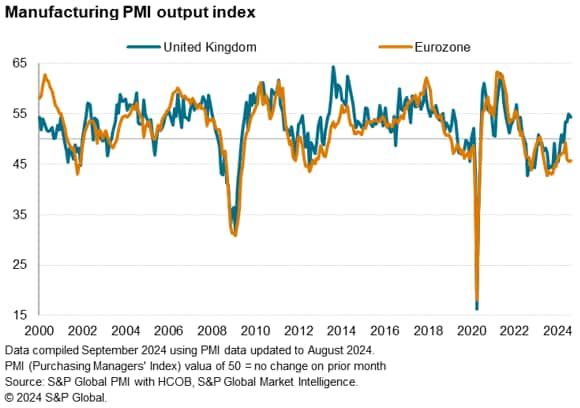

UK bucks slowdown

One final thought is on the UK, which has notably bucked the European downturn, and has reported some of the strongest output gains for over two years in recent months. Only India, Vietnam and Thailand reported faster factory output growth than the UK in August. The only other European economies reporting any manufacturing growth in August were Greece and Ireland.

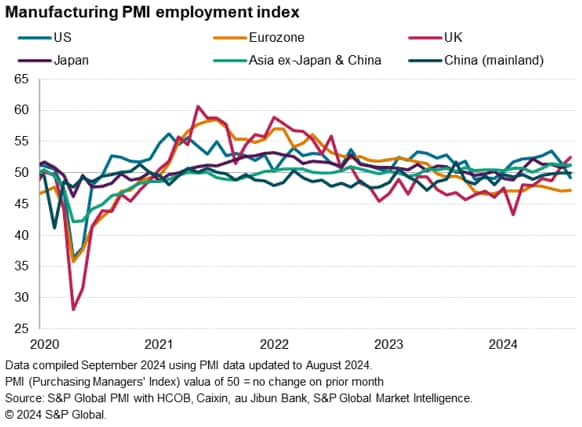

Other encouraging news from the UK is that factories are taking on staff in increasing numbers, meaning the UK is also bucking a broader global manufacturing employment downturn. While global manufacturing headcounts fell in August for the first time since February, UK jobs were added at the sharpest rate for over two years.

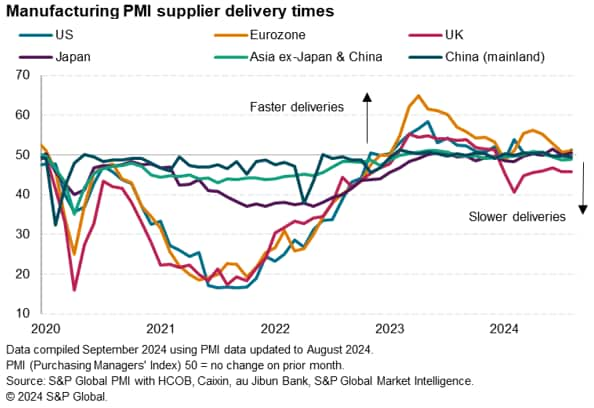

This outperformance in part reflects domestic demand benefiting from import constraints, often linked to Brexit and which are also harming UK supply chains via a lengthening of supplier lead times. These UK supply delays contrast with largely benign supply situations in other economies.

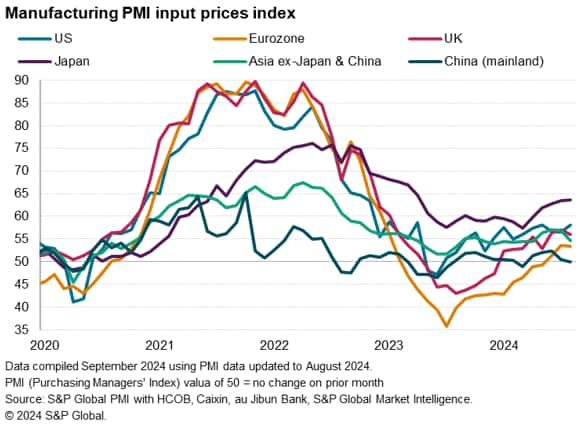

It therefore will be interesting to see if this UK performance can persist amid the tighter supply situation, and how the latter may affect prices in the coming months. UK manufacturing input prices have been rising faster than comparable prices in the eurozone so far this year, potentially adding to UK inflationary pressures, though some alleviation of the upward trend was witnessed in August.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-downturn-spreads-from-europe-to-america-but-uk-bucks-the-malaise-sept2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-downturn-spreads-from-europe-to-america-but-uk-bucks-the-malaise-sept2024.html&text=Manufacturing+downturn+spreads+from+Europe+to+America%2c+but+UK+bucks+the+malaise+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-downturn-spreads-from-europe-to-america-but-uk-bucks-the-malaise-sept2024.html","enabled":true},{"name":"email","url":"?subject=Manufacturing downturn spreads from Europe to America, but UK bucks the malaise | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-downturn-spreads-from-europe-to-america-but-uk-bucks-the-malaise-sept2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+downturn+spreads+from+Europe+to+America%2c+but+UK+bucks+the+malaise+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-downturn-spreads-from-europe-to-america-but-uk-bucks-the-malaise-sept2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}