Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2024

Manufacturing weakness spills through to labour market

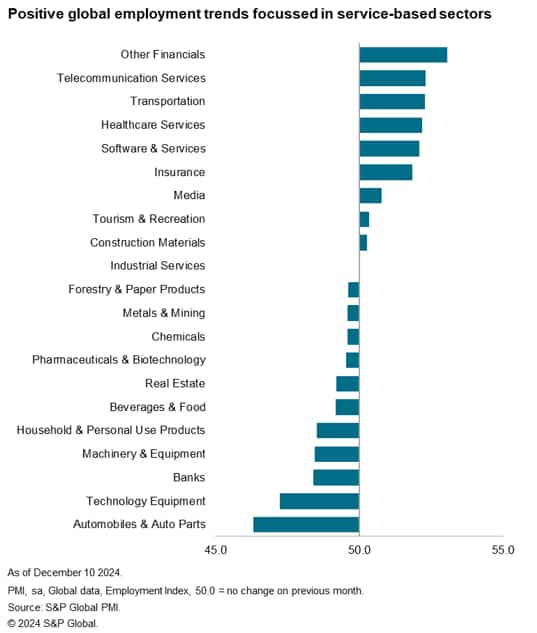

The divergence in fortunes between the global manufacturing and services sectors through large swathes of 2024 has continued to impact hiring decisions, as goods-producing segments cut employment again in November. With the exception of Construction Materials, all manufacturing-based sectors globally monitored by the S&P Global Sector PMI saw a drop in workforce numbers midway through the final quarter.

That said, the spillover of manufacturing weakness to more subdued growth in the service sector was also reflected in employment. Although nine segments, encompassing both manufacturing and services sectors, recorded an expansion in headcounts, rates of job creation were modest in many cases.

Services sectors prop up labour market growth

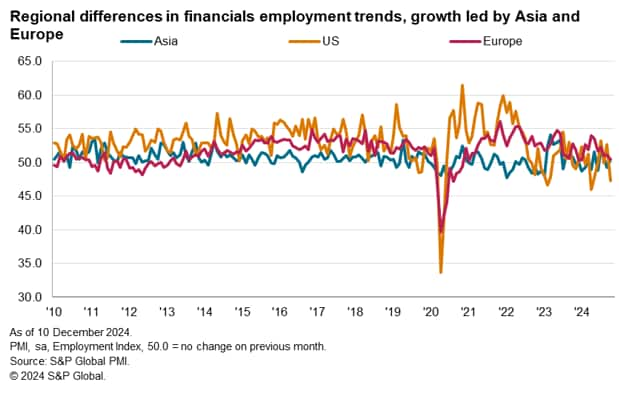

Although the financials category has largely continued to show strength and expansion in employment (Insurance and Other Financials saw solid rises in staffing numbers in November), other top performers such as Software & Services and Telecommunications Services saw a reacceleration in hiring activity at the global level. In fact, of the nine sectors for which job creation was recorded, six recorded a quicker rise in employment in November.

Moreover, of these nine sectors, only Construction Materials was manufacturing-based. Despite ranking as the third-worst performer in November, with further falls in output and new orders, the sector saw a fractional uptick in workforce numbers. Business confidence among Construction Materials businesses was also strong, easing only slightly from October's three-month high.

Cost and demand pressures weigh on manufacturing employment

On the manufacturing side, job shedding largely continued at the global level, as weak client demand and further downturns in output weighed on business confidence. Spare capacity and broad-based increases in costs were evident, with all 21 monitored sectors recording higher input prices.

At the regional level, European data saw a much more distinct divergence between the manufacturing and service sectors in November. However, much like was echoed at the broader global level, service sector employment growth was only slight in many cases.

Nonetheless, many of those in Europe who registered growth in employment saw the expansion quicken in November. Meanwhile, Software & Services, Healthcare Services and Other Financials noted the steepest rates of job creation, with the sharpest cuts to workforce numbers still being made in the Automobiles & Auto Parts segment (as has been the case since September).

Similarly, in Asia, only nine sectors recorded a rise in employment during November. This is the lowest number of segments registering an increase in staffing numbers since April, with the majority being services-based. In line with a faster and a renewed upturn in business activity, respectively, the sharpest growth in workforce numbers was seen among Software & Services and Healthcare Services firms.

Sian Jones, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 017

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-weakness-spills-through-to-labour-market-Dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-weakness-spills-through-to-labour-market-Dec24.html&text=Manufacturing+weakness+spills+through+to+labour+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-weakness-spills-through-to-labour-market-Dec24.html","enabled":true},{"name":"email","url":"?subject=Manufacturing weakness spills through to labour market | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-weakness-spills-through-to-labour-market-Dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Manufacturing+weakness+spills+through+to+labour+market+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-weakness-spills-through-to-labour-market-Dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}