Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 14, 2019

Metals Users PMI points to falling world growth and lower prices in 2019

- Broad-based deterioration in operating conditions for first time in nearly three years…

- …suggesting global growth is likely to slow in 2019

- …and metal prices may decline

Global metal-using industries are suffering their steepest downturn since early-2016, according to December survey data. The end of 2018 saw a contraction in output across all monitored groups of metal users, as new orders declined amid worsening trade conditions. As an indicator of worldwide output, this points to a bleak outlook for the first half of 2019.

The IHS Markit Global Metal Users PMITM is a composite indicator giving an accurate overview of operating conditions at manufacturers identified as heavy users of aluminium, copper or steel.

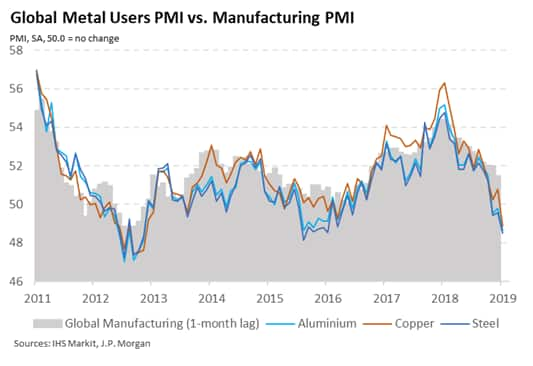

As many metal users are producers of primary manufacturing goods, these indices can give a solid forward-looking indicator of wider manufacturing output trends in the short term, and following this, an indicator of worldwide growth in the medium term.

To illustrate the leading indicator properties of the data, the Copper Users PMI has a correlation of 0.91 with the JPMorgan Global Manufacturing PMITM when leading by one month, while aluminium and steel have correlations of 0.83 and 0.80 respectively.

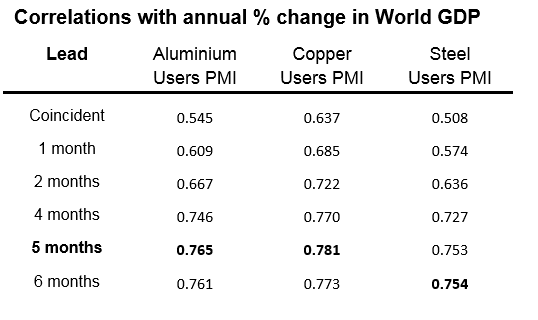

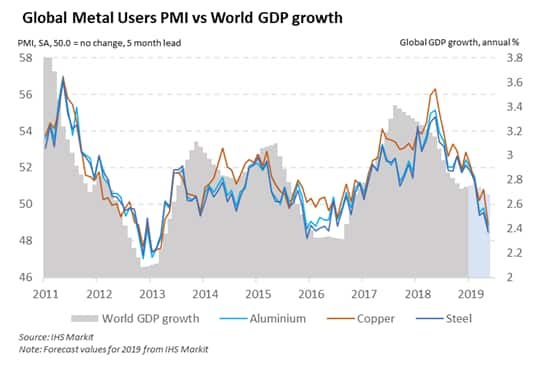

Furthermore, all three Metals Users PMIs have correlations of 0.75-0.78 when compared with annual worldwide GDP growth with a lead of five months. As such, these indices give a strong indication of global business performance over the following two quarters.

Poor conditions point to slowdown in 2019

All three Metals Users PMIs posted readings below 50.0 in December, indicating the first instance of such a broad deterioration in business conditions since February 2016. Notably, copper users signalled the sharpest deterioration for over six years while the steel and aluminium users PMIs sank to the lowest for at least three years.

Moreover, the latest data highlight a trend of worsening performance over 2018. All three metal PMIs fell by 6-7 points during the year, which was similar to the declines seen in 2011. Using correlation analysis, the recent weakening indicates falling global GDP growth in the first and second quarters of 2019, thus strengthening IHS Markit's forecast of slowing growth this year.

Falling goods trade has been a key factor impacting global economic growth in recent months. Overall, metal users reported deteriorating export orders for the last seven months of 2018, with the latest data marking the most accelerated decline in over three years. As a result, the final quarter of 2018 saw metal users reduce their output on average.

Over-stocking points to falling prices

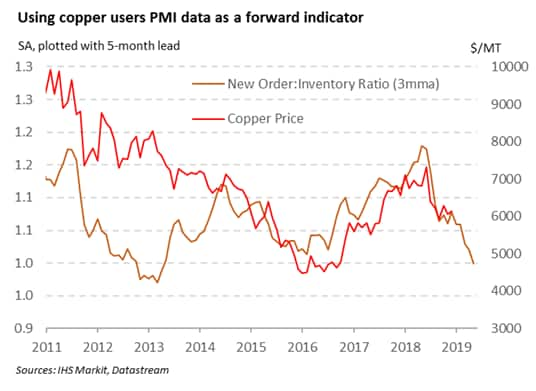

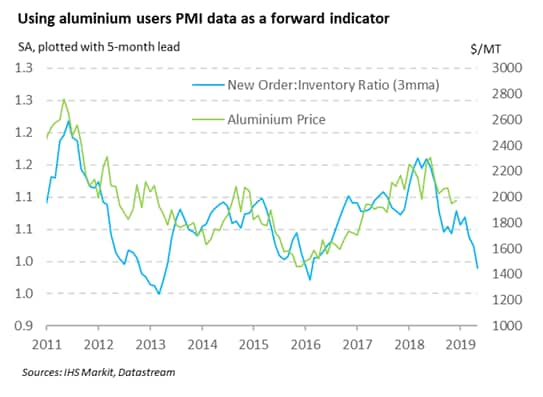

In addition, the metals users PMI forward-looking new orders to inventory ratio has a strong track record of predicting changes in metals prices. Aluminium and copper serve as key examples, giving correlations of 0.65 and 0.69 respectively against year-on-year changes in prices, when leading by five months.

Sharp dips in the ratios for both aluminium and copper users worldwide recently indicate an increase in overstocking at firms. The copper users new order: inventory ratio fell to its lowest in 41 months during December, suggesting that the fall in orders was generally unexpected and not fully matched by decreases in output and stocks of finished goods. This is likely to exert downward pressure on prices over the coming months as firms look to sell from stock and bring inventories more in line with demand.

PMI data provide key guide to metals demand trends

Using data from our established survey panels across Asia, Europe and the US, IHS Markit produce data tracking trends at copper, aluminium and steel intensive goods producers. Data cover indexes for output, new orders, new export orders, input purchasing, stock holdings, prices, vendor delivery times and employment.

For further information on commodities PMI data, please contact economics@ihsmarkit.com

David Owen, Economist, IHS Markit

Tel: +44 2070 646 237

david.owen@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmetals-users-pmi-points-to-falling-world-growth-and-lower-prices-in-2019.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmetals-users-pmi-points-to-falling-world-growth-and-lower-prices-in-2019.html&text=Metals+Users+PMI+points+to+falling+world+growth+and+lower+prices+in+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmetals-users-pmi-points-to-falling-world-growth-and-lower-prices-in-2019.html","enabled":true},{"name":"email","url":"?subject=Metals Users PMI points to falling world growth and lower prices in 2019 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmetals-users-pmi-points-to-falling-world-growth-and-lower-prices-in-2019.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Metals+Users+PMI+points+to+falling+world+growth+and+lower+prices+in+2019+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmetals-users-pmi-points-to-falling-world-growth-and-lower-prices-in-2019.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}