Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 06, 2019

Mid-cycle adjustment to factor returns

Research Signals - July 2019

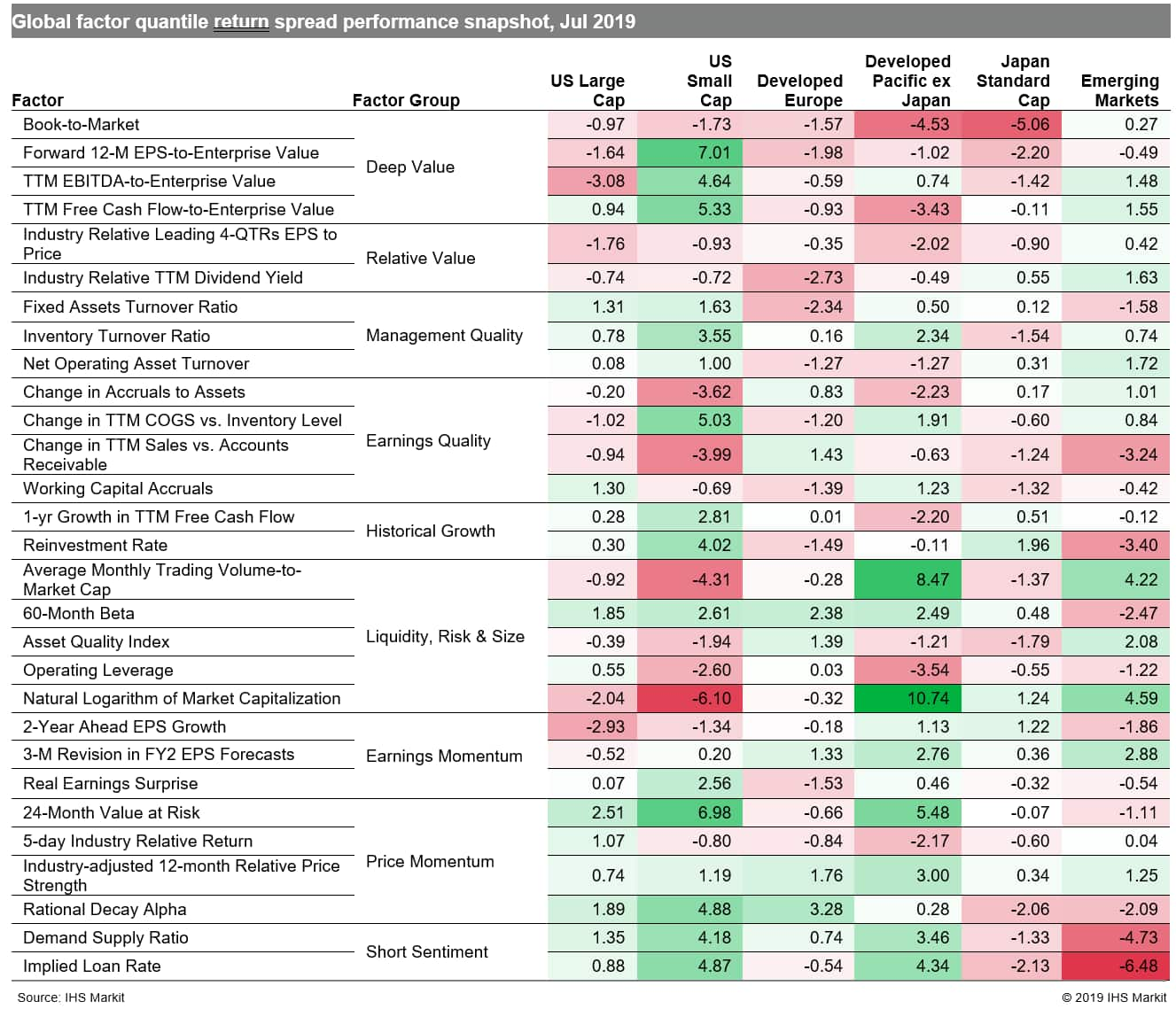

Adding to increasing concerns surrounding the year-long US-China trade dispute and its effect on the global economy, investors' hopes diminished that the Federal Reserve's first rate cut in a decade was the start of an easing cycle. However, for the month, the momentum that pushed US stocks to all-time highs, prior to the post-Fed press conference reversal, helped support Price Momentum factors, contributing to yet another cycle between investor style preferences (Table 1). In the meantime, the J.P.Morgan Global Manufacturing PMI signaled a third consecutive month of downturn in the global manufacturing sector as international trade volumes continued to contract, setting global markets up for another cycle of volatility.

- US: Large caps cycled between momentum and value factors once again, with strong spreads associated with Rational Decay Alpha, while TTM EBITDA-to-Enterprise Value lagged

- Developed Europe: Strong results were posted by Rational Decay Alpha, whereas Industry Relative TTM Dividend Yield and Inventory Turnover Ratio sat at the opposite extreme

- Developed Pacific: Small cap stocks, captured by Natural Logarithm of Market Capitalization, were highly rewarded in markets outside Japan

- Emerging markets: A broad representation of factors outperformed, including 3-M Revision in FY2 EPS Forecasts, Natural Logarithm of Market Capitalization and Asset Quality Index

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmid-cycle-adjustment-to-factor-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmid-cycle-adjustment-to-factor-returns.html&text=Mid-cycle+adjustment+to+factor+returns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmid-cycle-adjustment-to-factor-returns.html","enabled":true},{"name":"email","url":"?subject=Mid-cycle adjustment to factor returns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmid-cycle-adjustment-to-factor-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mid-cycle+adjustment+to+factor+returns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmid-cycle-adjustment-to-factor-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}