Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 01, 2024

Modest economic hit from Red Sea disruption obscures larger shipping changes

Three months after Houthi rebels began rocking global trade by attacking commercial ships in the Red Sea, the extent to which the disruptions have affected the container shipping industry and world economy in general seems relatively modest.

But even as the industry seemingly adjusts to the new status quo of routing ships around southern Africa rather than through the Suez Canal, leaving a small inflationary manufacturing blip in its wake, there are significant — yet less apparent — changes afoot. The settling of container spot rates pushed higher by the diversions and the limited economic impact on core inflation, however, belie shifts to the overcapacity challenge and regional trade flows and reveal cold, geopolitical realities for shipping.

On the surface, the headline economic data readings show marginal changes to global production and consumer disinflation due to Red Sea-driven delays in goods and inputs. Lead times for deliveries from suppliers to manufacturers in January slipped for the first time in a year, as reflected by global PMI data from S&P Global. Yet the change was miniscule — 48.9, compared with a baseline of 50. And while manufacturers such as Tesla had to temporarily close plants for two weeks, the disruption wasn't enough to push up global PMI input and output prices.

Nor has S&P, parent company of the Journal of

Commerce, changed its timeline for consumer price

disinflation, noting in a Feb. 28 analysis that studies suggest it

would take sustained 100% container rate increases to push up

consumer prices by 0.7%. Global container spot rates reached such

highs in January and February, with rates as measured by Platts

spiking 200%, but those rates haven't been sustainable amid the

seasonal dip in spot prices during Lunar New Year

celebrations.

For comparison, when US consumers drove record imports and US port

congestion sapped functional vessel capacity during the pandemic,

container rates rocketed more than 900% between 2019 and the late

2021 peak, as measured by Platts. In contrast, most carriers this

year have enough capacity to adjust to the longer transits prompted

by the vessel diversions. Fears of European port congestion due to

Asia transits thrown off by the longer routings have failed to

materialize, largely due to carriers speeding up sailings and

managing port calls accordingly with most carriers having enough

capacity to tap.

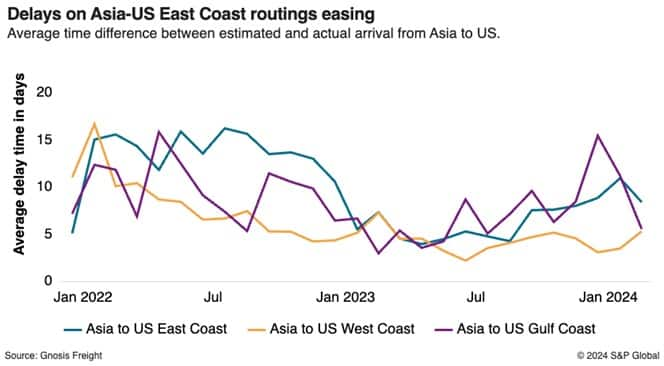

Global ocean reliability, nonetheless, crashed to 51.6% in January, a major downgrade from historical comparisons of reliability in the 70% to 80% range, according to Sea-Intelligence Maritime Analysis. Still, there are some signs that reliability is improving, with the average days of delays for Asia routings to the US East and Gulf coasts falling to date in February from January, according to routings tracked by Gnosis Freight. The average time ships were off schedule for US East Coast services through February fell from 11 to 8.5 days.

Buying tonnage time

The larger legacy of the Red Sea diversions may be less the economic shock and more that it gives container lines time to better manage the deployment of new vessels while ramping up the rate of recycling the aging global fleet. While 818 ships, equating to 6.99 million TEUs of capacity, are on order, the industry can shift away from overcapacity by revving up idling, which stands at 0.8% of the global fleet compared with 6.2% four years ago, according to maritime analyst Alphaliner.

The global fleet is severely aging, with the first of the then appropriately titled very large container ships — vessels with TEU capacities of 7,500 to 9,999 TEU — reaching their shelf life of 20 years. Those now-inefficient vessels, built for an era of larger engines and faster hulls, have scrapyards in their future, according to Alphaliner. The share of the total container fleet now two decades and older comes in at 12.2%.

Some 16% more tonnage is needed on both trade lanes to make up for the deployment of additional vessels on routings from Asia to Europe and to account for the longer transits to the US East Coast. That's requiring more than 4% of global tonnage alone, giving carriers more cushion to cascade the deployment of newer, larger vessels amid muted global demand.

Far less of those mega-ships on east-west services are calling key Middle Eastern ports, however, due to diversions away from the Red Sea. That's forcing Saudi, and, to a less extent, Egyptian importers to rely on feeder networks and even overland truck routing through Saudi Arabia to avoid elevated ocean rates from Dubai to the west coast of Saudi Arabia. Before major container lines routed east-west services away from the Red Sea, it cost about $450 per FEU, but now nears $2,000 per FEU, a Dubai-based forwarder told the Journal of Commerce on the condition of anonymity.

Middle East shippers, along with their European and North America counterparts, see few signs of hope for a near-term restoration of security through the Red Sea. Geopolitical analysts widely warn that Houthi rebels will be motivated to interrupt commercial shipping even after the conclusion of the Israel-Hamas war.

Analysts have noted, in comparison, the united approach to dealing with Somali pirates in the early 2000s; there's been less unity in responding to Red Sea threats. Notably, China has chosen not to send its own navy to protect ships departing its harbors, revealing the limitations of multilateral responses to disruptions in which container shipping finds itself swept up in more volatile times geopolitically.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-economic-hit-from-red-sea-disruption-obscures-larger-sh.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-economic-hit-from-red-sea-disruption-obscures-larger-sh.html&text=Modest+economic+hit+from+Red+Sea+disruption+obscures+larger+shipping+changes+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-economic-hit-from-red-sea-disruption-obscures-larger-sh.html","enabled":true},{"name":"email","url":"?subject=Modest economic hit from Red Sea disruption obscures larger shipping changes | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-economic-hit-from-red-sea-disruption-obscures-larger-sh.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Modest+economic+hit+from+Red+Sea+disruption+obscures+larger+shipping+changes+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmodest-economic-hit-from-red-sea-disruption-obscures-larger-sh.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}