Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 12, 2024

Monetary policy FAQs: Bank of Japan

Learn more about our data and insights

The Bank of Japan has made a historic step toward the normalization of its monetary policy. We explore why the bank took this step, what its next moves could be, and how this could impact Japan's economy.

Q: What made the Bank of Japan decide to change its policy?

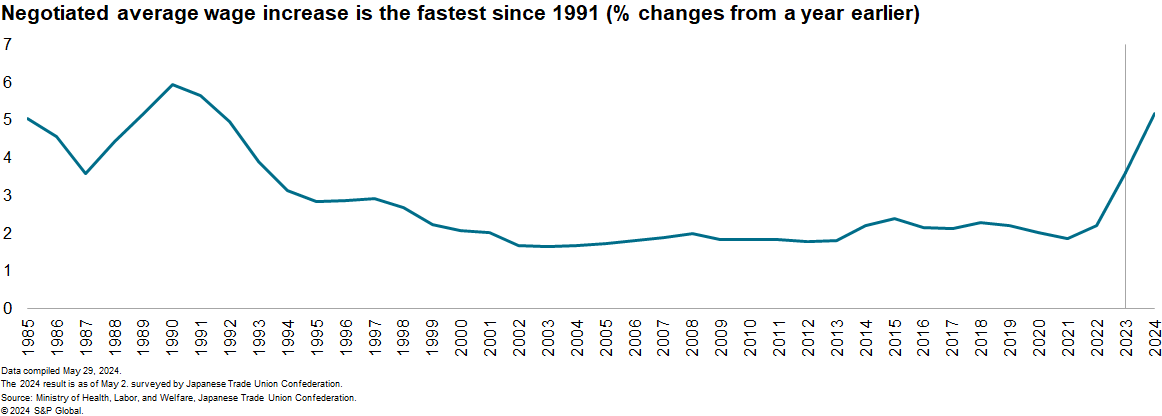

Solid results for wage negotiations were the major trigger for the Bank of Japan's March decision. The bank believes that sustainable inflation should be driven by consumer demand associated with sufficient wage increases. The results of annual wage negotiations for 2023 highlighted a remarkable average increase of 3.6%, the highest level since 1993. Still, growth of nominal monthly average cash earnings was rather modest, up 1.2% year over year in 2023. That trend reflected factors including lower wage increases at small enterprises compared with large enterprises; growth in the number of part-timers outpacing growth in the number of full-timers; and non-scheduled hours worked declining. Real monthly average cash earnings have been declining consistently since April 2022, suppressing private consumption despite the recovery in demand for services after the easing of COVID containment measures.

Q: When will the Bank of Japan's next policy rate hike come?

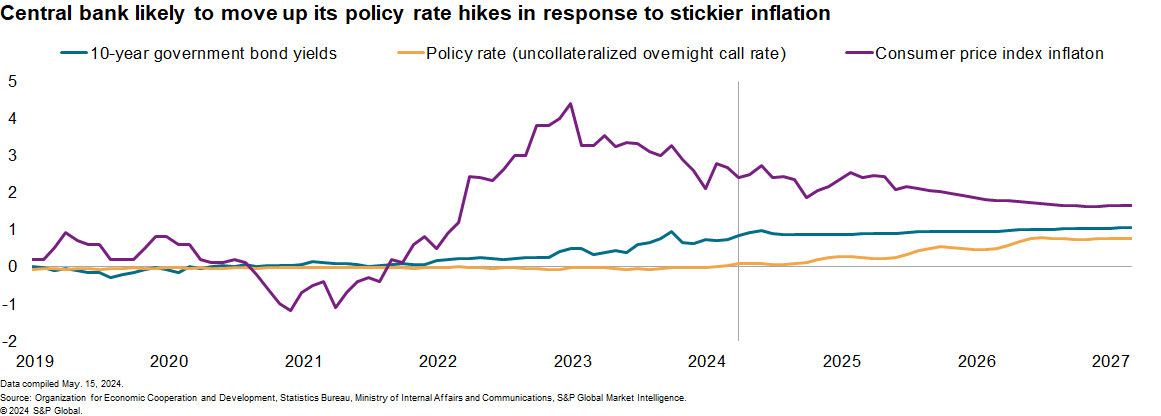

We expect that the bank's monetary policy hikes will be slow and steady. The next policy rate hike — to 0.25% — is likely to come in October 2024. Rapid policy rate hikes are unlikely because Japan's growth and inflation outlooks are modest, even if the Bank of Japan plans to hold buffers to ease its monetary policy in case the economy decelerates and inflation weakens.

Q: How far will the Bank of Japan raise its policy rate?

The Bank of Japan's latest forecasts suggested that it expects Japan's underlying inflation to reach the level that is generally consistent with its 2% inflation target in the second half of its projected period, which is the third quarter of 2025 to the first quarter of 2027. This reflects its projection that the output gap will improve, and long-term inflation expectations will rise in line with further strengthening for a virtuous cycle between wages and prices. Bank Governor Kazuo Ueda expects the policy rate to rise to the neutral rate of interest by the end of its forecast period.

It is difficult to identify the level of the neutral rate of interest for Japan, given that the central bank has kept its policy rate at nearly zero or negative for over 25 years, except for a move up to 0.5% between February 2007 and September 2008. The neutral rate of interest is derived from the equilibrium real interest rate, the so-called natural rate of interest, which will neither stimulate nor contain economic activity and at which production will continue to increase at the pace of potential growth in the environment of full employment and stable inflation. The neutral rate of interest is often described as the natural rate of interest plus inflation. Ueda mentioned that there is currently a broad range for the estimated natural rate of interest rate depending on the models used.

We expect the Bank of Japan's policy rate hikes following an increase to 0.25% in October 2024 to comprise one follow-on rate hike per year in 2025 and 2026 to 0.75%, considering the downtrend of potential growth.

Q: How will the policy rate hikes affect the economy?

Future rate hikes, if they are slow to arrive and few in number, are unlikely to weaken economic activity significantly. Once the bank can restore the function of its policy rate instrument, it could encourage firms to pursue more efficient use of capital and encourage the movement of labor to more productive firms through the exit of less productive firms.

Even so, there is a risk that higher interest rates will lead to an increase in bankruptcies and a worsening of economic activity due to a higher-than-expected interest rate burden among firms with low earnings and productivity. Higher rates for mortgage loans could delay a recovery in residential investment, which is being affected by high material costs and a rise in land prices. Private consumption could weaken because of higher mortgage loan payments unless wages increase sufficiently.

Given this, the Bank of Japan will continue to search for the neutral rate of interest and its future course of action will depend on the economic and financial environment. According to the Bank of Japan's analysis, the adverse impacts of higher market interest rates on overall banking profits, the household sector and corporate finance will be limited. Banks have also been reducing their bond holdings to improve their resilience to rises in interest rates. However, higher interest rates pose risks regarding uncertainties over changes in yield curves, the interest rate passthrough for loans and deposits (which are affected by the supply and demand balance), the competitive environment in loans and deposit markets, and relationships with customers.

The impact on individual households largely depends on their own asset-liability balances and types of housing loans. Overall corporate finance has relatively strong resilience thanks to improved sales and large cash reserves. However, interest rate hikes could become a trigger for bankruptcies for companies with low interest coverage ratios facing difficulties to improve profits and labor shortages.

Q: When will the Bank of Japan start tapering?

Under quantitative and qualitative easing, the Bank of Japan aggressively expanded its purchase of Japanese government bonds. The bank held 53.8% of outstanding Japanese government bonds as of December 2023, up from 11.5% in March 2013, just before the bank started quantitative and qualitative easing. The bank has said it is desirable to decrease the amount of Japanese government bonds purchased at some point and also to reduce the balance of Japanese government bond holdings as they mature.

The Bank of Japan could begin reducing purchases of Japanese government bonds gradually in response to market conditions. Still, it is unlikely to start meaningful reductions of the purchases until the policy rate comes close to the neutral level, which will probably be in late 2026, or unless demand for Japanese government bonds by market participants increases to a level that would convince the bank that it would not need to fight off speculative surges. The bank's continued purchase of substantial amounts of Japanese government bonds has reduced the liquidity of those bonds and lowered the number of bond market participants. The bank does not plan to use tapering as an active instrument to raise bond yields, as the short-term interest rate is its main policy instrument.

The Bank of Japan's reduction of Japanese government bond purchases could be gradual to avoid causing instability in the financial market.

Hear our global economist reveal our economic predictions for 2024

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faqs-bank-of-japan-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faqs-bank-of-japan-.html&text=Monetary+policy+FAQs%3a+Bank+of+Japan++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faqs-bank-of-japan-.html","enabled":true},{"name":"email","url":"?subject=Monetary policy FAQs: Bank of Japan | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faqs-bank-of-japan-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monetary+policy+FAQs%3a+Bank+of+Japan++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonetary-policy-faqs-bank-of-japan-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}