Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 22, 2021

Monthly Global Trade Monitor - February 2021

Global recovery expected in 2021 with particularly strong growth impulse in Q2; PMI NExO readouts, however, bring mixed signals for the first time since May 2020.

Main Observations

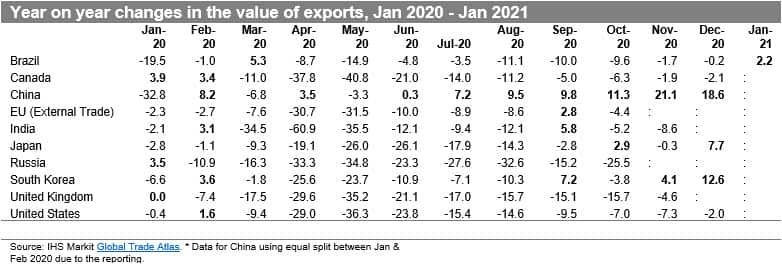

- All top ten economies, apart from China (+4.0), suffered a contraction in exports in 2020 which varied from -5.4% for South Korea, -6.9% for Brazil, -9.1% in Japan, -12.5% in Canada & -12.9% in the case of the U.S.; on the other hand, imports contracted in all the states

- Chinese exports are consistently growing yoy for seven months in a row (for imports four months in a row); the trends in exports for the top ten are optimistic with a clear recovery already in Q4 2020 for South Korea and Japan

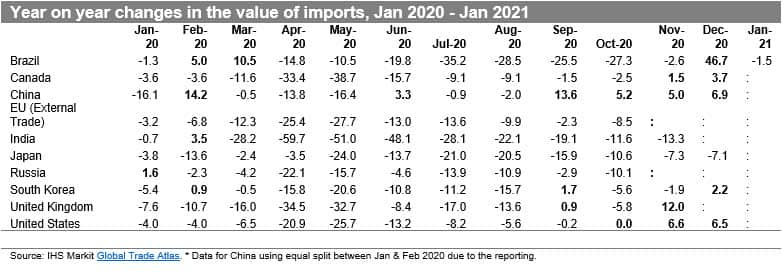

- Imports for most of the top ten economies were struck harder than exports in 2020; on a positive note we see a continuing recovery in imports in China, the U.S., and Canada and generally, in December 2020, this points to increasing market optimism and recovery in consumption demand

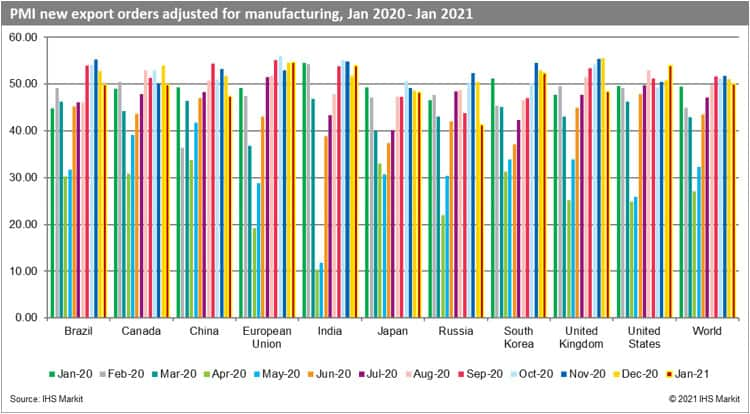

- The adjusted manufacturing PMI new exports orders (PMI NExO) readouts for January 2021 are above the benchmark value of 50.0 points for global manufacturing (50.09) and for four top ten economies: EU (54.64), the U.S. (53.95), India (53.91) & South Korea (52.38). The lowest PMI values are reported for Russia (41.26) and China (47.42)

- The observed trends in the PMI NExO are becoming blurred, in contrast to the preceding two quarters of 2020 which were pointing to a rise in market optimism from May 2020 onwards in all the top ten states; now the situation is becoming more complex and heterogenous

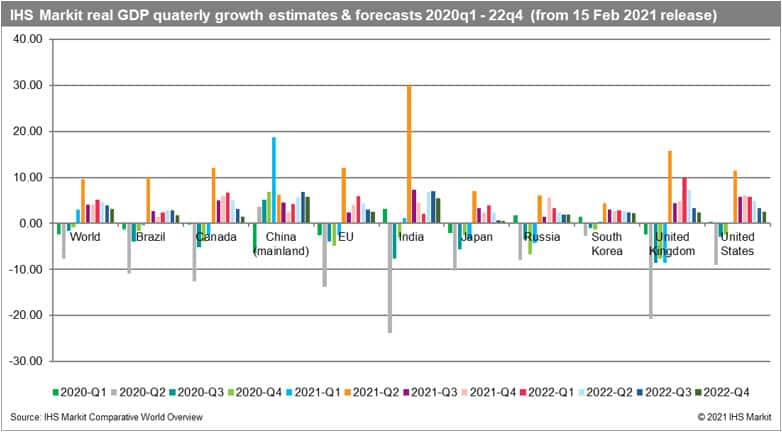

- IHS Markit real GDP forecasts for 2021 are optimistically pointing to a global recovery already in Q1 and a strong boost in growth for both advanced and emerging states in Q2 2021

Changes in Trade of the Top 10 Economies

- With the new trade data updated regularly in our Global Trade Atlas as reported by the states, we have the first estimates of the total contraction in trade in 2020 for some of the top ten economies

- Chinese exports have increased in 2020 by 4% yoy - the contraction was present only in Q1 (-13.4% yoy) followed by a steady recovery - +0.1% in Q2, +8.8% in Q3, and +17.1% in Q4

- All other top ten economies suffered a contraction in exports in 2020 which varied from -5.4% for South Korea, -6.9% for Brazil, -9.1% in Japan, -12.5% in Canada & -12.9% in the case of the U.S.

- It is worth noting that exports were growing in value yoy in Q4 of 2020 for both Japan (+3.5%) and South Korea (+4.2%); overall East & Southeast Asia seems to be the origin of the global recovery

- It is clear that globally (apart from China), Q2 was the worst quarter on record; the COVID-19 pandemic proved to be the worst black swan in a century with significantly more adverse impact on global trade than the impact of other recent pandemic and the financial crisis of 2008-9

- All economies have already reported the data for October; the readouts vary from -25.5% in the case of Russia and -15.7% yoy in the UK to -4.4% in the case of EU external exports and -3.8% for South Korea, only two economies reported yoy increase in the value of exports, namely China (+11.3%) and Japan (+2.9%)

- In November 2020, Chinese exports were above by 21.1% yoy and in South Korea by 4.1%, the growth rate was negative in the case of all other reporters and ranged from -0.3% for Japan to -8.6% for India

- In December 2020, three countries showed a significant yoy increase in the value of exports, are China (+18.6%), South Korea (+12.6) & Japan (+7.7%); the U.S. (-2.0%) and Canada (-2.1%) reported a decline with the value for Brazil close to 2019 figure (only -0.2%)

- Only one top ten economy has already reported the value of exports in January 2021, it's Brazil with a growth of +2.2% yoy

- In most of the top ten economies the contraction in imports in 2020 (apart from the U.S. and Canada), was deeper than the contraction in exports; all the economies that have already reported the full data for 2020, suffered a decline in 2020 ranging from -0.4% yoy for China, -6.4% in the U.S., -7.1% in South Korea, -10.4% in Brazil, -10.7% in Canada to -11.9% in Japan

- All top ten economies reported contraction in imports in Q1 and Q2 of 2020 with the second quarter once again the worst on record; in Q3 imports were growing only in the case of China (one quarter later than in exports); in Q4 2020 imports were above of 2019 level in a much larger number of states: China (+5.7%), the U.S. (+4.3%), Brazil (+1.9%) and Canada (+0.8%)

- The readouts for October 2020 showed an increase in the value of imports only in the case of China (+5.2%). The value of U.S. imports was equal to their 2019 values for the first month of the year (with a clear upward trend from May 2020 onwards). The worst situation was reported for Brazil - 27.3% yoy, also India, Russia & Japan recorded a contraction of more than -10.0% yoy

- The data for November is now available for most of the top ten group; the data shows a yoy increase in Canada (+1.5%), China (+5.0%), the U.S. (+6.6%), and the UK (+12.0%); all the other show a contraction ranging from -1.9% for South Korea to -13.3% yoy for India

- December is usually a better month for imports in advanced states fueled by the holiday season and new year celebrations. All the countries that have reported data for December 2020 show a significant increase in the value of imports yoy ranging from +2.2% in Canada to a massive increase of +46.7% in Brazil

- It is worth noticing that recovery in imports seems to be consistent and continuing in several key countries, these are in particular China (Four months of recovery in a row), the U.S. (third month in a row), and Canada (Two months in a row); it could be indicative of growing consumer confidence and increasing internal demand pointing to a recovery

- With incoming data on progress with mass vaccination programs in particular in key advanced states, the likelihood of stricter lockdowns decreases and that could have a positive impact on overall market optimism unless the third wave of COVID-19 pandemic escalates out of control

- Brazil reported a -1.5% decline yoy in the value of imports in January 2021

Prospects for the Forthcoming Months

- The reaction in trade in 2020 was consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it. The situation in 2021 is likely to be similar with the development dependent on the success of mass vaccination programs and the severity of the third wave. The overall impact of COVID-19 on global trade and the global economy will depend on the duration, severity, and spatial distribution of the pandemic and associated severity of containment efforts taken by individual states.

- The cumulative number of confirmed cases of COVID-19 globally reached 107.8 million and 2.4 million deaths in February 2021 (Weekly Operational Update on COVID-19 from 13 February 2021)

- The cumulative number of cases is the highest in the U.S. (26.6 million), India (10.8 million), Brazil (9.5 million) followed by Russia (4.0 million), the UK (3.9 million), France (3.3 million), Spain (2.9 million), Italy (2.6 million), Turkey (2.5 million), Germany (2.3 million), Columbia (2.1 million), Argentina (2.0 million), Mexico (1.9 million), Poland (1.6 million), South Africa & Iran (1.5 million each), Peru & Ukraine (1.2 million each), Indonesia (1.1 million), Czech Republic & Netherlands (1.0 million each). Therefore, 21 countries so far have registered more than one million cases of COVID-19. The worst affected regions from the global perspective are still the Americas, Europe, and South-East Asia

- The adjusted manufacturing PMI new exports orders for manufacturing (PMI NExO) readouts for January 2021 are above the benchmark value of 50.0 points for global manufacturing (50.09) and for four top ten economies: European Union (54.64), United States (53.95), India (53.91) & South Korea (52.38). The lowest PMI values are reported for Russia (41.26) and China (47.42)

- The PMI for the U.S. shows a positive trend in the third month in a row and the EU for the second month in a row. On the other hand, PMI is falling for Japan (Third month in a row), Brazil, China, Russia, South Korea, and the world as a whole (Second month in a row)

- In comparison to December 2020, the highest increases can be identified for India (+2.13) and the U.S. (3.24) which could reflect the optimism related to the handling of power to the new Biden-Harris administration, the largest falls, in turn, can be seen in Russia (-9.17) and the UK (-7.20); the results for the UK can reflect the disappointment with the final UK-EU Trade Agreement and the first real consequences of Brexit on the external borders

- The observed trends in the PMI NExO are becoming blurred, in contrast to the preceding two quarters of 2020 which were pointing to a rise in market optimism from May 2020 onwards, now the situation is becoming more complex and heterogenous

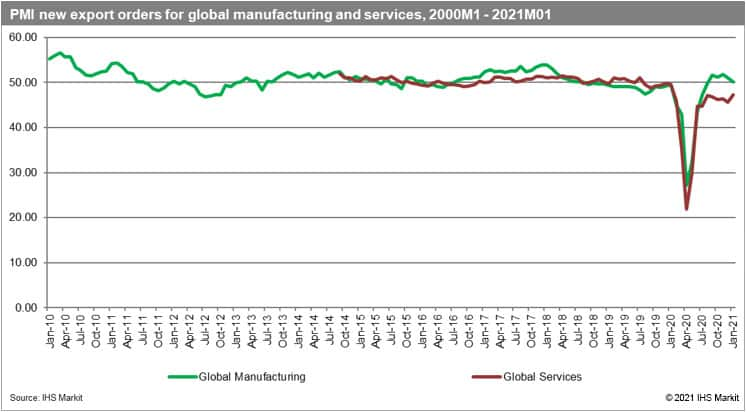

- Both PMI NExO for global manufacturing and global services showed a rapid COVID-19 crisis and quick recovery, however, the readouts for services are permanently below the 50.0 benchmark; in recent months the situation in services started to improve, however, it deteriorated somehow for the global manufacturing sector

- The most recent real GDP growth forecasts from IHS Markit were published on 15 February 2021. The forecast includes the baseline scenario of the impact of COVID-19 on the global economy and individual states

- We now estimate the contraction of global GDP by 3.7% in 2020 varying between -4.8% for advanced, -1.9% for emerging, and -6.4% for developing economies

- We predict global recovery in 2021 with year-on-year real GDP growth rates predicted to reach 5.0% (4.2% in 2022) thus adjusted upwards in comparison to the January release. The growth rates are predicted to vary between 4.3% (3.7 in 2022), 5.9% (4.9%) for emerging, and 5.3% (4.5%) for developing states

- From a quarterly perspective, both Q3 (-1.7%) and Q4 (-0.9%) proved to bring a continuing global recession in 2020. We predict a global recovery already in the Q1 of 2021 (3.0%) driven mostly by emerging states with a stronger boost only in Q2 of 2021 (9.1%)

- Recovery in China has already started in Q2 of 2020 following the COVID-19 related contraction in the first quarter. Apart from China, only two other economies out of the top ten group are predicted to grow in the first quarter of 2021, these are India (+1.2%) and South Korea (+0.4%). The major recovery in all the states has been predicted constantly for the second quarter of 2021

This column is based on data from IHS Markit Maritime & Trade GTA & GTA Forecasting

The full version of this article is available on the Connect platform for IHS Markit clients with a subscription to GTA and GTA Forecasting.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-global-trade-monitor-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-global-trade-monitor-february-2021.html&text=Monthly+Global+Trade+Monitor+-+February+2021++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-global-trade-monitor-february-2021.html","enabled":true},{"name":"email","url":"?subject=Monthly Global Trade Monitor - February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-global-trade-monitor-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+Global+Trade+Monitor+-+February+2021++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-global-trade-monitor-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}