Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 21, 2025

Monthly PMI Bulletin: January 2025

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

Faster growth, higher inflation, and a dip in confidence

The global economic expansion further accelerated at the end of 2024, albeit with variations by region and sectors observed once again. Inflationary pressures meanwhile intensified amid stubborn services price pressures, while confidence waned among businesses.

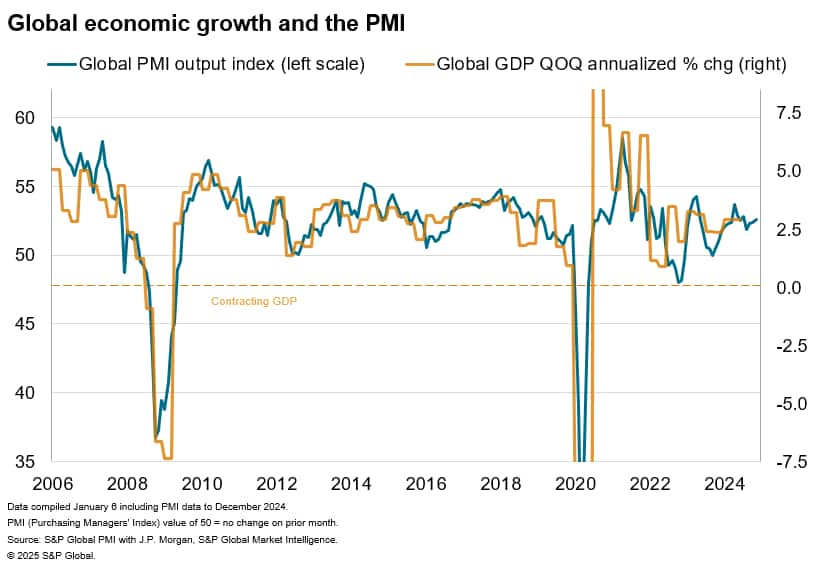

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - registered 52.6 in December, up from 52.4 in November. The latest reading was the highest in four months and signalled a pace of growth consistent with the global economy growing at an annualized rate of 2.8%.

That said, the latest expansion remained uneven, with growth limited to the service sector while manufacturing output contracted for the first time in three months. Although marginal, the latest downturn in the goods producing sector reflected a lack of demand for goods, particularly export demand, amid concerns over the impact of potential US tariffs on global trade. A renewed downturn in export demand for emerging markets further painted a picture of the fading boost from front-loading of purchases ahead of potential tariffs earlier.

By region, developed market growth accelerated in December, driven mainly by improvements in the US. Although marginal output gains were also reported in Japan, UK and Australia, other major developed economies reported largely stalled growth. Across emerging markets, growth remained broad-based but decelerated from November. India remained the leader among the BRIC economies, while the rest witnessed output growth cooling into the end of year, with mainland China notably reporting only modest growth and the weakest output expansion for three months.

Finally, global selling price inflation rose to the highest since September amidst rising services charges, which added to uncertainty regarding the monetary policy outlook. This was accompanied by reduced business optimism in December with rising concerns over growth in 2025 given US government policy changes. As such, we will be watching the upcoming flash PMI releases on January 24th for insights into business conditions at the start of 2025.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2025.html&text=Monthly+PMI+Bulletin%3a+January+2025+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2025.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: January 2025 | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+January+2025+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-january-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}