Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Oct 28, 2021

MSCI Taiwan Index- A case study on the COVID-19-induced ex-dividend date disruption

Key implications

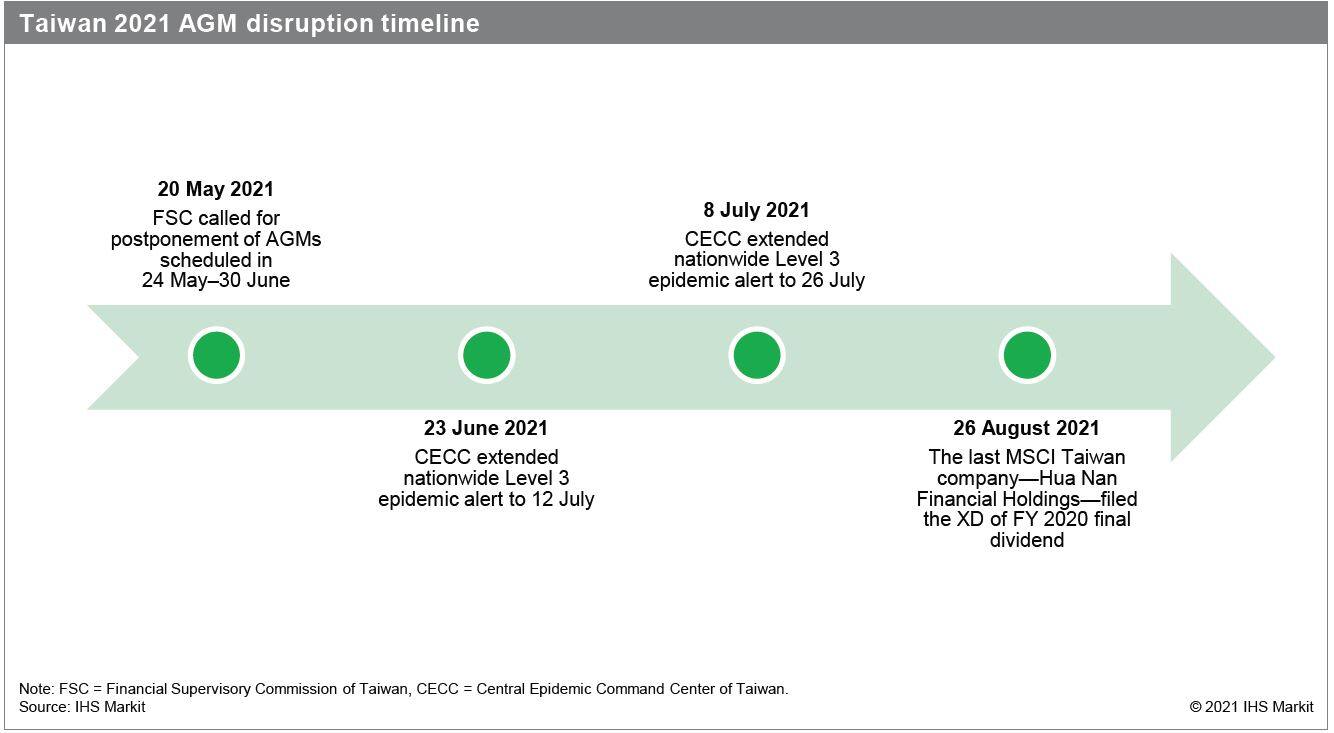

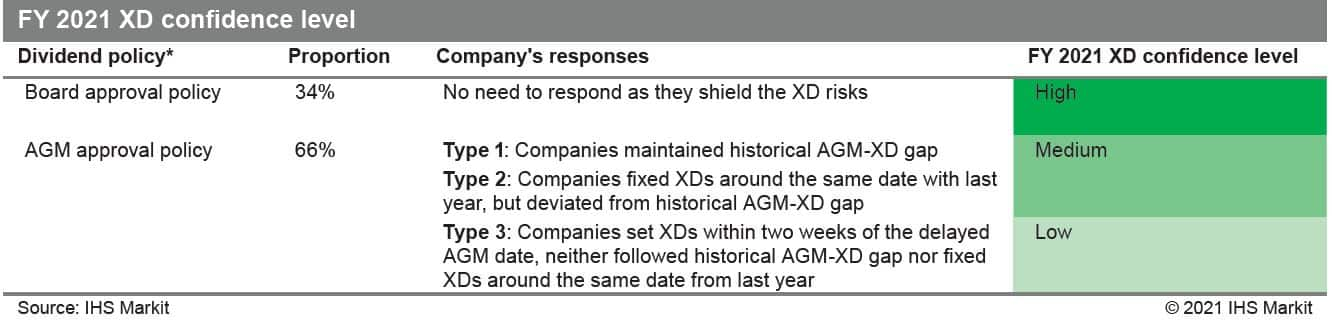

- Taiwan's COVID-19-induced annual general meeting (AGM) shift this year has impacted nearly all (except one case) the AGMs, but not all the ex-dividend dates (XDs, around 66%). The dividend approval policy (AGM or board approval) adopted by each company played a decisive part in XD shift.

- There was a clearly defined legal boundary that presented an option for companies paying cash dividends only (87%) to shield XD risk during this year's crisis, but only 34% of companies amended the change in the articles of incorporation ahead of time.

- The XD pattern of companies with board approval policy were therefore not impacted by the crisis and we forecast their FY 2021 XDs with a high confidence rank, with just a few exceptions.

- Companies with an AGM approval policy, however, managed the crisis through varying strategies under the same goal of giving as much clarity on XDs as possible. Companies that maintained a historical AGM-XD gap or fixed XDs close to the same date with last year are believed to follow the pattern before the crisis for FY 2021's XDs with a medium confidence rank. Companies that flexibly fixed their XDs within one to two weeks after the new AGM (earlier than the AGM-XD gap) this year are estimated to follow the FY 2019's XDs pattern as well, but with a low confidence rank.

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsci-taiwan-index-case-study-covid-19-induced-ex-dividen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsci-taiwan-index-case-study-covid-19-induced-ex-dividen.html&text=MSCI+Taiwan+Index-+A+case+study+on+the+COVID-19-induced+ex-dividend+date+disruption+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsci-taiwan-index-case-study-covid-19-induced-ex-dividen.html","enabled":true},{"name":"email","url":"?subject=MSCI Taiwan Index- A case study on the COVID-19-induced ex-dividend date disruption | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsci-taiwan-index-case-study-covid-19-induced-ex-dividen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=MSCI+Taiwan+Index-+A+case+study+on+the+COVID-19-induced+ex-dividend+date+disruption+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsci-taiwan-index-case-study-covid-19-induced-ex-dividen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}