Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 05, 2021

Municipals 2021 Q3 Update

Municipal new issuance has remained stable over the course of Q3 as state and local governments address financing needs during the summer season which historically witnesses lighter calendar volume(s).

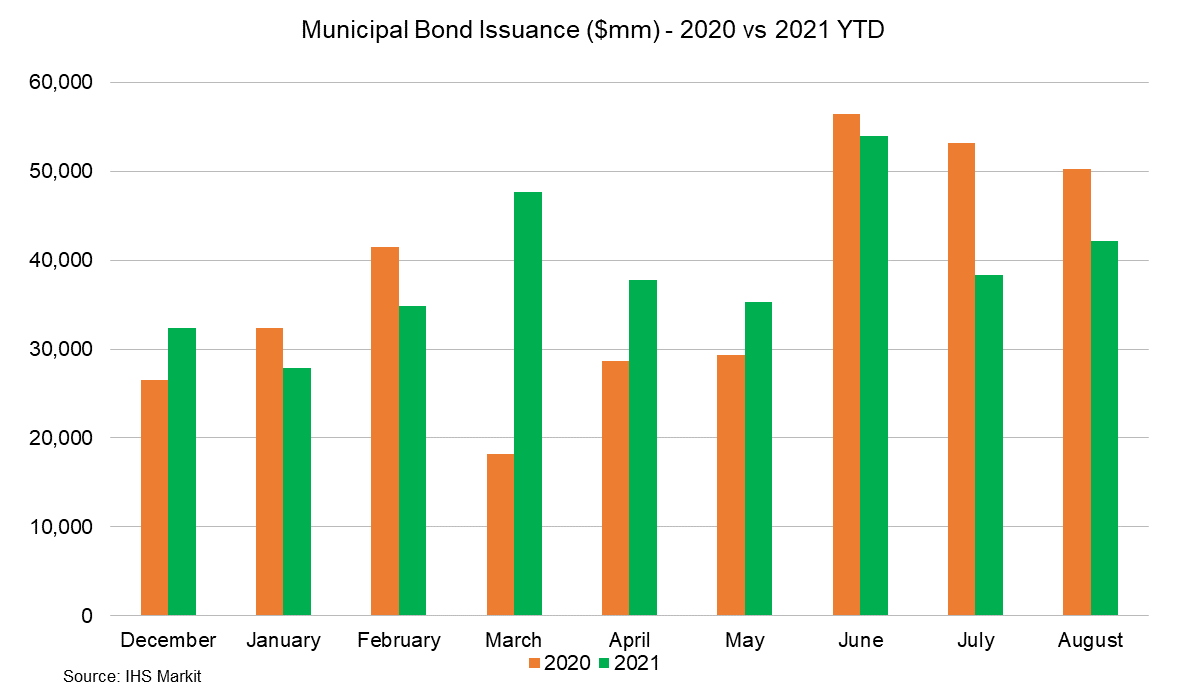

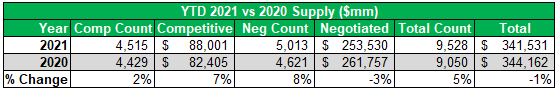

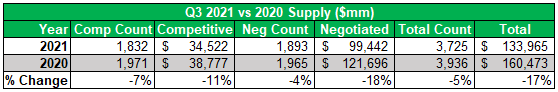

While YoY performance has been trailing closely behind 2020 (-1%), it is important to highlight the flood of issuance registered last summer, when state and local governments eagerly returned to market, after the height of the pandemic, significantly inflating 2020 Q3 levels.

Despite trailing performance relative to Q3 of 2020, June and August registered a hefty $50Bn+ and $40Bn+ respectively, falling at the top-end of monthly performance relative to historical levels.

As of 09/20/2021 new issue activity has peaked at $342Bn, falling closely behind 2020's record performance, with participants calling the potential for this year's volume to fall in line or above last year's levels based on the current trajectory.

Market participants continue to monitor updates flowing from Washington as the national infrastructure package comes to fruition, pending further funding dedicated to boost new money issuance, resulting in greater primary activity.

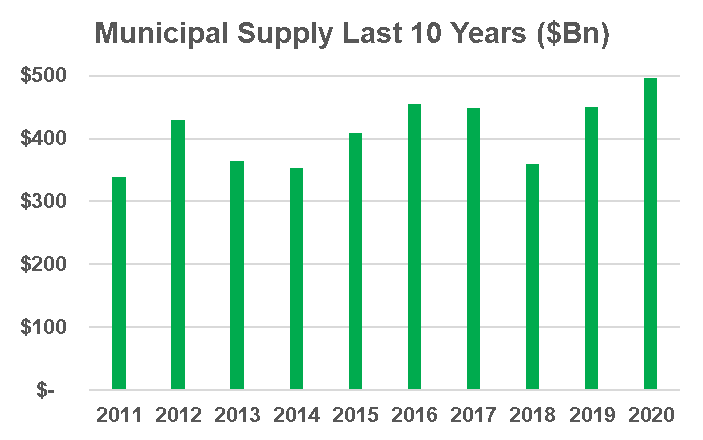

Primary volume activity continues to achieve higher levels with healthy increases YoY since 2018, affirming greater financing activity in the municipal capital markets.

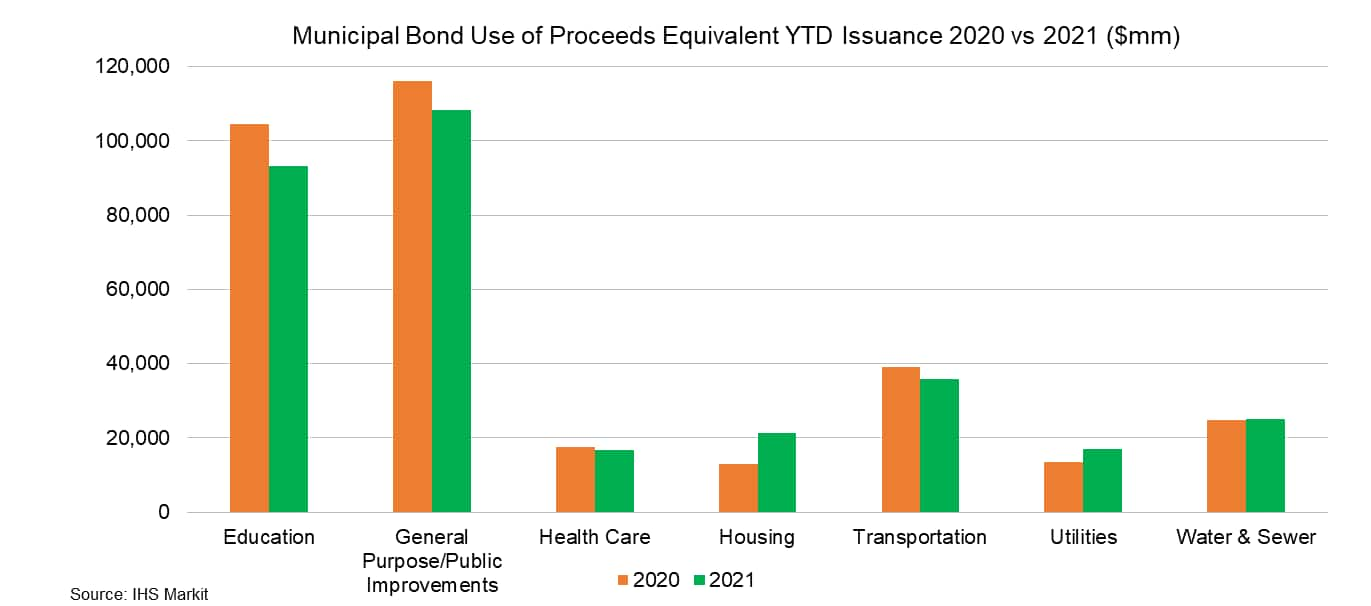

General purpose and public improvement bonds continue to account for the greatest ($) par size issued over the course of the past year, reaching $108Bn priced, marking a +10% increase YTD compared to 2019 levels.

ESG issuance continues to climb as green bond focused investors seek to put cash to work across various green, social and sustainable bond offerings with $28Bn issued over 2021, spanning 179 deals with the $1.2Bn California Community Choice Financing Authority (green bonds) marking the largest ESG deal of 2021.

The State of California priced the largest deal of 2021, supplying $2.1Bn of general obligation bonds with institutional demand front and center after the 2037 maturity was bumped 5bps, falling +30bps off the interpolated MAC curve.

Market activity is forecasted to heat up heading into the fall season (Q4) as state and local governments finalize financing activities prior to year-end, placing the market on track to break the 10 year average of $410Bn.

Please see our product page below

https://ihsmarkit.com/products/municipal-issuance.html

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipals-2021-q3-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipals-2021-q3-update.html&text=Municipals+2021+Q3+Update+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipals-2021-q3-update.html","enabled":true},{"name":"email","url":"?subject=Municipals 2021 Q3 Update | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipals-2021-q3-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Municipals+2021+Q3+Update+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmunicipals-2021-q3-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}