Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 25, 2024

New Era of Protectionism: PMI® Trade Trends to Watch

The re-election of Donald Trump as US President brings the prospect of a renewed wave of global trade protectionism, the impact of which can be tracked in real time by a variety of economic indicators.

The President-elect has proposed universal tariffs of 10-20% on US imports, as well as 60% tariffs on goods from mainland China, all of which are much larger than during the previous tariff wave from the 2017-2020 presidency which resulted in the US-China trade conflict of 2018/19.

These tariffs, and any reciprocal measures from other countries, could significantly alter the global trade landscape and lead to serious implications for demand, inventories, inflation, interest rates and exchange rates.

Leading economic indicators will be vital to understand how businesses and economies, are being impacted by protectionist policies. To that end, here are some of the best PMI survey-based indicators to watch with a proven track record of helping monitor the impact of trade conflicts in real time.

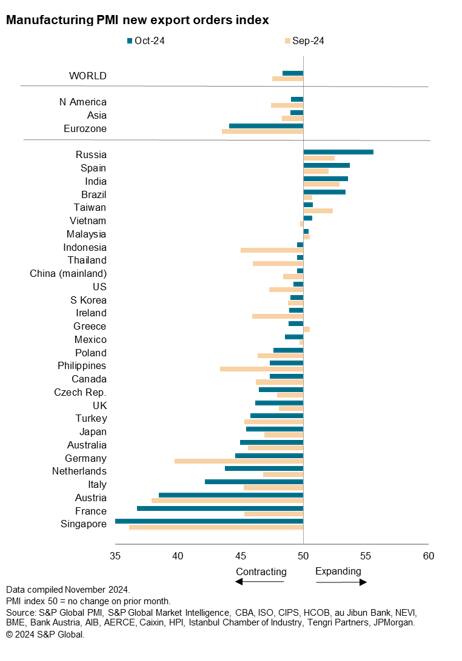

Monitoring global trade volumes: PMI New Export Orders Index

The PMI New Export Orders Index tracks export orders for goods and services on a monthly basis. Our global measure from the manufacturing sector has consistently proven to be a strong leading indicator of worldwide trade volumes. Additionally, it is also the timeliest measure of global trade available, released much faster than other global benchmarks.

Following successive tariff announcements from the US in 2018, the Global PMI New Export Orders Index fell below the 50.0 neutral threshold in September 2018 and worsened into 2019, bringing an early signal of the adverse impact that tariffs were having on cross-border trade. National PMI data showed that, while the trade downturn was initially led by mainland China, other major economies including the US and the eurozone also fell into decline as reciprocal measures were announced and export weakness permeated through the global economy.

Why watch: If export demand worsens, national and global GDP will likely suffer, particularly for countries more reliant on manufacturing and trade. The short-term impact of lower global export volumes will also likely cause job losses, higher prices and potentially disrupt supply chains.

How each economy is being affected by trade disruptions can be assessed through the ranking of economies by their respective PMI new export orders index. Our manufacturing export orders data covers almost 30 countries worldwide and regional aggregates are also available.

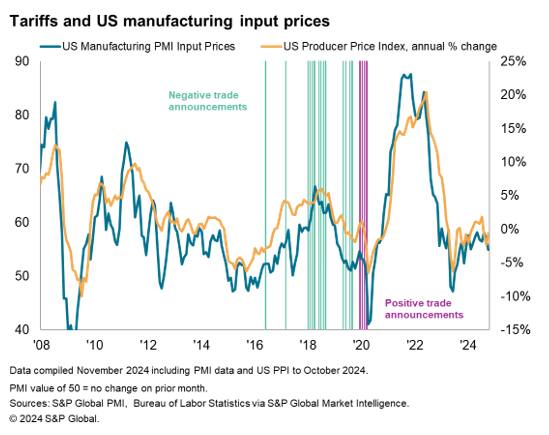

Inflation: PMI Input Prices & Output Charges Indices

The PMI Input Prices Index tracks business costs at private sector companies. In 2018, manufacturers increasingly noted tariffs as a driver of higher input costs, not just in the US but globally too. Higher expenses pushed producer price inflation to a multi-year high, adding price pressures to US businesses and connected foreign markets. As contributors to the PMI surveys are asked to provide reasons for their responses, we can track with precision when tariffs are causing firms' costs or selling prices to rise, as we saw between 2018 and 2019.

Why watch: The US Manufacturing Input Prices Index will be key to monitor how much of any tariff-related impacts are being taken on by US importers because of the PMI's unique ability to track price changes and the underlying cause through respondents' anecdotal data.

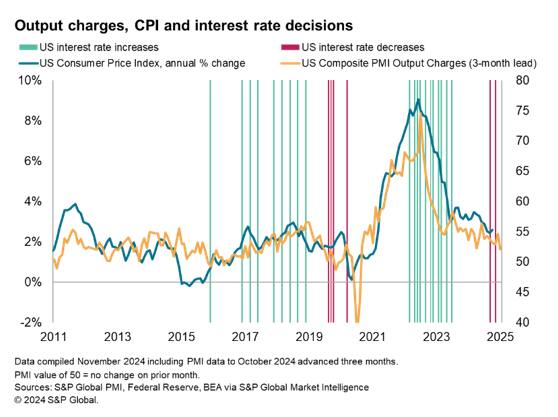

Following input prices, the US PMI Composite Output Charges Index will also be important to watch going forward. This index tracks average selling prices for goods and services and is a strong indicator of consumer price inflation across many major markets, often with a lead of several months.

Why watch: There are already suggestions that US Federal Reserve monetary policy could become more hawkish if tariff policies are implemented, as any rises in US businesses' import costs may be swiftly passed on to consumers. The US Composite PMI Output Charges Index, which leads US CPI, will give a vital steer on the path of inflation and interest rate decisions, including in countries where monetary policy either tracks or is greatly influenced by the US Federal Reserve.

What company executives are saying: PMI Comment Trackers

A unique aspect of the PMIs is that, alongside the quantitative information they provide, surveyed companies are invited to give additional qualitative information in the form of reasons for why the various business metrics changed each month. This helps users understand the cause of changes in business conditions and economic trends.

Through the PMI Comment Trackers, groups of words or phrases are combined to track specific themes, such as supply shortages, shipping delays, recession risk or wage pressures. It is therefore possible to gauge how factors, even those which aren't easily measurable like tariffs, are impacting key business health barometers like output, purchasing, prices, employment and sentiment. Indices are presented as a multiple of the long-run average, where a value of 1.0 means the frequency of mentions by survey respondents of a specific word or theme is at "typical" levels.

Why watch: In an environment of increased protectionist policies, tariffs and international trade disputes, the PMI Comment Trackers will demonstrate how exactly companies are being affected and how they are responding. During 2017 to 2019, we saw a notable pick-up in safety stockpiling behaviour among our panel members, with firms raising their purchasing activity and inventories due to fears of higher prices and tighter supply. For example, in January 2018, just as the US-mainland China trade conflict began to escalate, reports of higher input stock volumes due to concerns about price or supply were nearly three-times greater than normal.

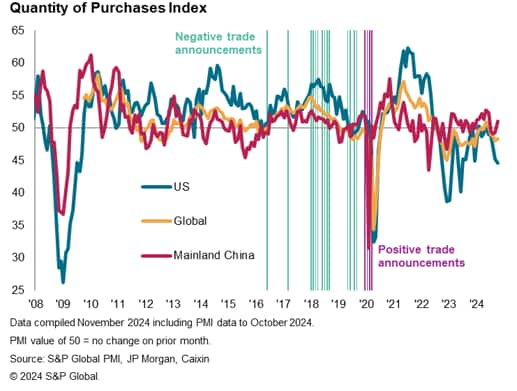

Tracking the inventory cycle: PMI Quantity of Purchases and Stocks of Purchases Indices

Through the PMI survey data, users can monitor the inventory cycle. This is principally done through the Quantity of Purchases Index and the Stocks of Purchases Index, which are obtained from respondents to our Manufacturing PMI surveys.

The PMI Quantity of Purchases Index records changes in the amount of inputs bought by factories compared to the previous month. This will include items such as intermediate goods, commodities and any other raw materials needed for factory production. Many of these purchases will be sourced from international vendors, and therefore could be subjected to tariffs.

Why watch: Procurement strategies may change considerably in response to tariffs, as companies front-load their purchases to secure critical materials and intermediate goods before they become more costly. We saw the US Quantity of Purchases Index surge to a three-and-a-half year high in 2018 after the US-China trade conflict escalated. A considerable uplift in purchasing volumes could stretch supply chains and drive prices higher as item availability is constrained by a surge in demand. Given the globalised nature of supply chains, localised disruptions ripple outwards and can have a worldwide impact on factory input availability and prices.

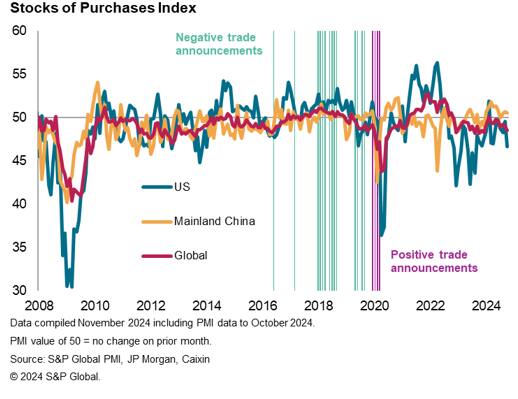

The PMI Stocks of Purchases Index measures changes in manufacturers' pre-production inventory levels each month. Typically, holdings of inputs decline during a downturn as companies retrench and adjust to the weaker economic environment. Conversely, when demand conditions are improving, businesses will often choose to cover the cost of holding surplus materials so they can ensure the fulfilment of future orders. These two points are at the cornerstone of the "inventory cycle", which plays a big role in global business conditions at any point in time.

However, other factors can interfere with the inventory cycle, such as government policy changes. Brexit is an example of this, as UK companies stockpiled goods and materials from the EU before new trade laws came into force. The anticipation of sudden supply chain disruptions and price changes can also affect company decisions on how much inventory to hold.

Why watch: The imposition and fear of tariffs on goods entering the US and other countries could lead businesses to stockpile materials. There was evidence of this in the immediate aftermath of the 2016 Presidential Election, as well as throughout 2017 and 2018, when the US Manufacturing PMI Stocks of Purchases Index trended significantly above its historic average and was well inside expansion territory. This showed a clear behavioural change to how US companies approached procurement strategies, although this would have carried cost implications for businesses, potentially denting profitability.

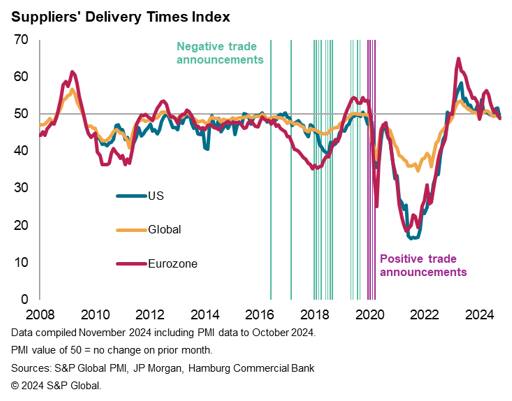

Supply chain impact: PMI Suppliers Delivery Times Index

The PMI Suppliers' Delivery Times Index captures the extent of supply chain delays in an economy, which in turn acts as a useful barometer of capacity constraints and pipeline price pressures. Additionally, the index can help users gauge whether the current global supply chain environment is indicative of a buyers' or sellers' market, which is crucial for procurement managers when negotiating with vendors, as well as economists and investors when forecasting economic variables such as production capacity or inflation.

As indicated by our PMI Comments Trackers, safety stockpiling behaviour led to a considerable uptick in purchasing activity in 2018. While this did drive strong growth across manufacturing industries, it led to longer supplier delivery times, especially in the US and the eurozone, restricting global material supply and pushing price pressures up. The imposition of tariffs, and fear of protectionist policies ramping up in their severity, can detrimentally affect supply chain capacity as businesses front-load purchases, panic-buy and build safety buffers into their inventories. This puts suppliers under pressure, further exacerbating the issues described previously as firms worry about item availability becoming even scarcer, and hoard more aggressively.

Why watch: The Suppliers Delivery Times Index will be the first measure to indicate how vendor performance is coping during a trade conflict. A somewhat stable year for global supply chains in 2024 (relative to the COVID-19 period) has helped to bring down price pressures worldwide and stabilised inventories. Although the pandemic accelerated business efforts to build more resilience into their supply chains, protectionism could place further pressure on firms to source local vendors. Regardless, disruption in the short-term is likely, bringing with it longer delivery schedules and increased costs.

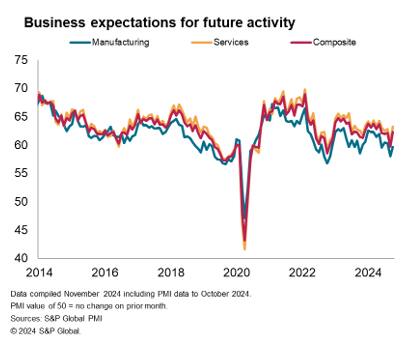

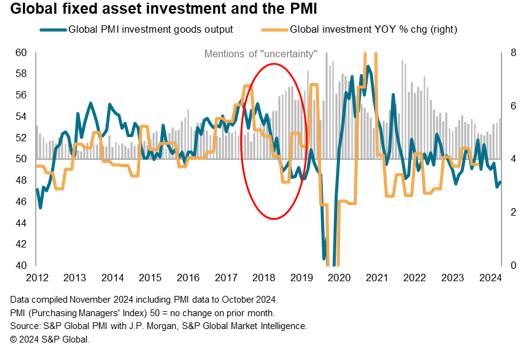

Policy uncertainty and business sentiment: PMI Future Output Index

As well as current business conditions, US tariffs are also likely to impact global business expectations. This is tracked through the PMI Future Output Index, which assesses firms' expectations of business activity in 12 months' time. Economic sentiment often has implications for business spending, capital investment, and global financial markets. protectionist policies can induce wider political and economic uncertainty, which can in turn adversely affect global economic growth. During the 2018 trade conflicts, PMI respondent mentions of "uncertainty" - as tracked through our PMI Comment Tracker - spiked higher, and we saw businesses rein in investment spending as a consequence. The longer-term impact of less capital expenditure includes weaker productivity and lower growth.

Why watch: Although some tariff policies have been proposed by President-elect Trump, firms are likely to remain nervous about if, how and when they are implemented, creating additional uncertainty and a reluctance to spend and invest.

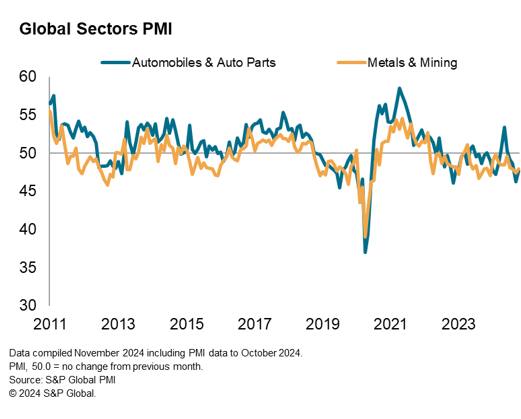

Tariff impact by industry: Sector PMIs

The Sector PMI database tracks 21 individual industries, providing detailed insights into how different sectors are performing in an environment of trade disputes and tariffs as the impact will differ across markets. Additionally, our new Industry Sector PMIs can give extra insight into how sectors are performing at the country level. The sub-indices analysed include new export orders, suppliers' delivery times, input prices and output charges, are available at these detailed sector levels too.

Why watch: As well as blanket tariffs on US imports, President-elect Trump has suggested imposing additional tariffs on specific goods and sectors. Previously this has included a range of items such as steel, aluminium, solar panels and other consumer goods. During the election campaign, he suggested implementing extra tariffs on new vehicles. The Automobiles & Auto Parts sector could therefore be uniquely impacted, particularly in major US trade partners such as Germany and Mexico.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-era-of-protectionism-pmi-trade-trends-to-watch.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-era-of-protectionism-pmi-trade-trends-to-watch.html&text=New+Era+of+Protectionism%3a+PMI%c2%ae+Trade+Trends+to+Watch+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-era-of-protectionism-pmi-trade-trends-to-watch.html","enabled":true},{"name":"email","url":"?subject=New Era of Protectionism: PMI® Trade Trends to Watch | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-era-of-protectionism-pmi-trade-trends-to-watch.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+Era+of+Protectionism%3a+PMI%c2%ae+Trade+Trends+to+Watch+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnew-era-of-protectionism-pmi-trade-trends-to-watch.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}