Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 21, 2024

News of further solid economic growth from US flash PMI tainted by rise in price pressures

Further expansions of both manufacturing and service sector output in March helped close off another quarter of likely robust GDP growth for the US economy.

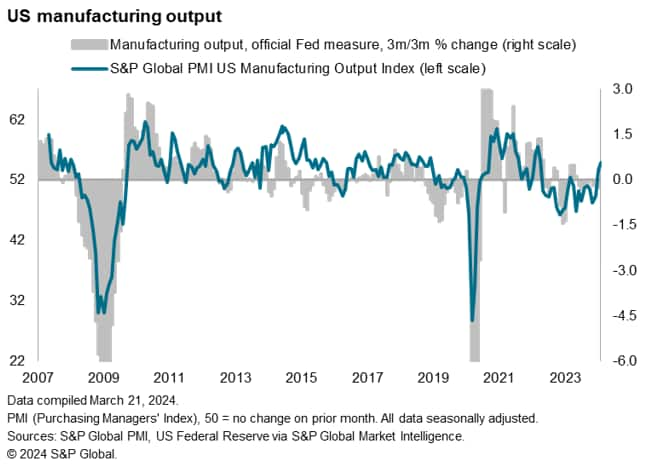

The brightest news came from the manufacturing sector, where production is now growing at the fastest rate since May 2022. Production gains are linked to improving demand for goods both at home and abroad, driving a further upturn in business confidence in the outlook.

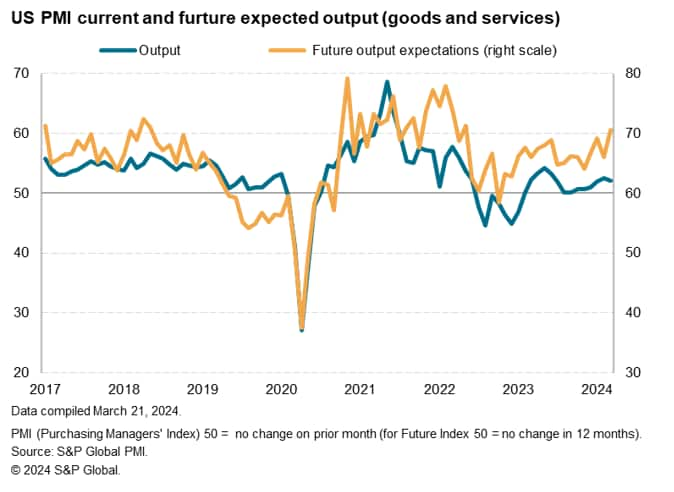

Service providers meanwhile reported a slower pace of expansion than factories, with the rate of increase also moderating slightly compared to February, linked in part to ongoing cost of living pressures. However, service providers have also become increasingly optimistic about the outlook, with confidence striking a 22-month high in March to suggest the broad-based economic expansion seen at the end of the first quarter will persist into the summer.

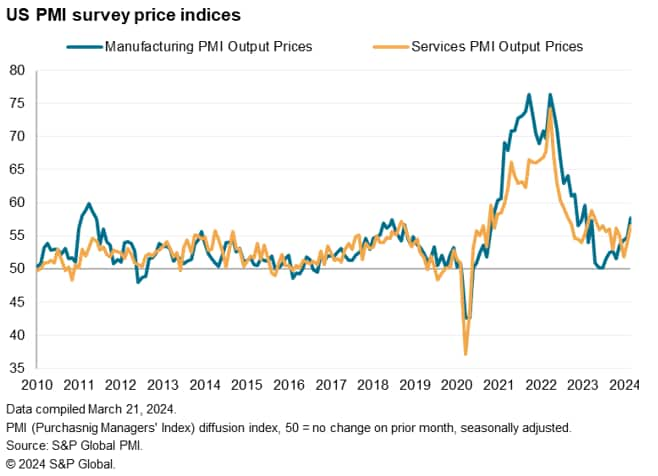

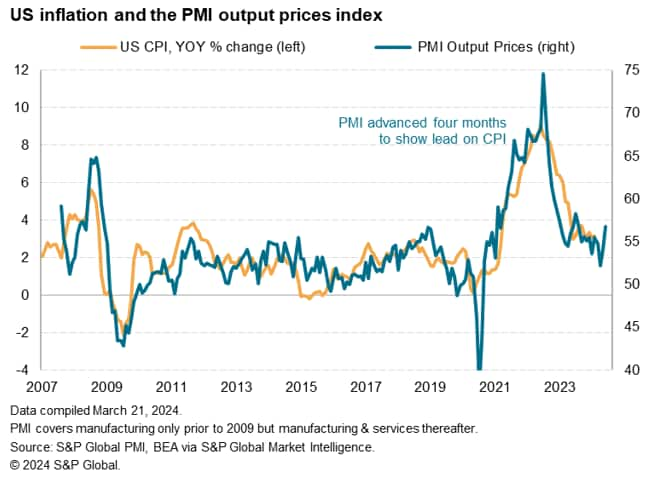

However, a steepening rise in costs, combined with strengthened pricing power amid the recent upturn in demand, meant inflationary pressures gathered pace again in March. Costs have increased on the back of further wage growth and rising fuel prices, pushing overall selling price inflation for goods and services up to its highest for nearly a year. The steep jump in prices from the recent low seen in January hints at unwelcome upward pressure on consumer prices in the coming months.

Solid growth sustained into March

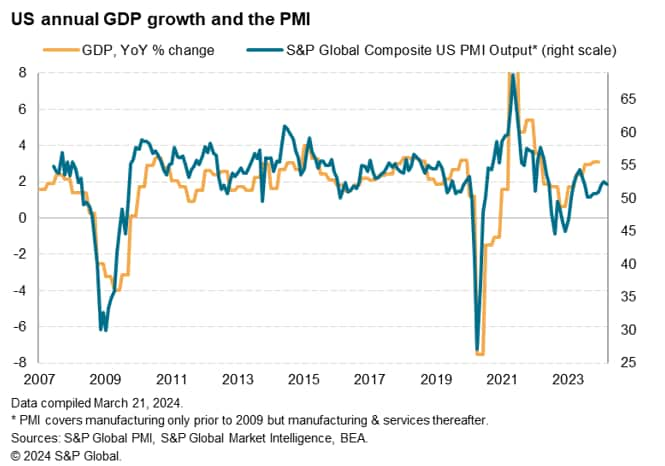

The headline S&P Global Flash US PMI Composite Output Index posted 52.2 in March, down slightly from the reading of 52.5 in February but still signaling a solid monthly improvement in business activity at US companies. Output has now risen in each of the past 14 months. Moreover, the average rise indicated in the first quarter is the strongest seen since the second quarter of last year, broadly consistent with the economy growing at a 2% annual rate (and a 2% annualized quarterly rate).

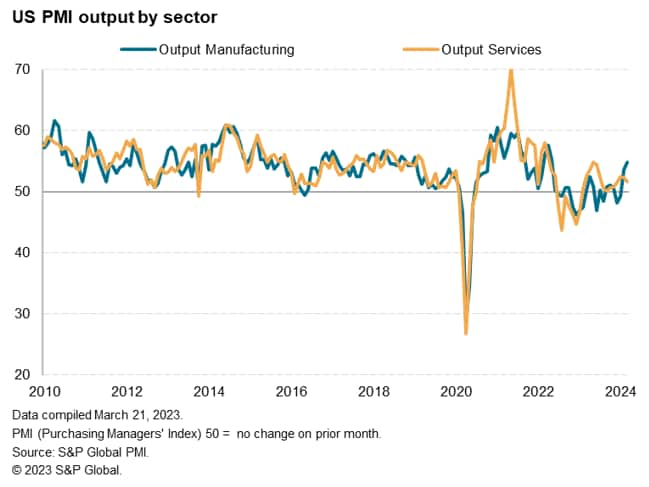

The overall slowdown in the pace of output growth reflected a slight loss of momentum in the service sector, where activity rose at the weakest pace in three months. Anecdotal evidence suggested that price pressures had restricted new orders growth in the service sector. As a result, the rate of new business growth in the service sector also softened.

However, there were also some signs of demand switching back from services to goods. The March flash PMI saw a marked acceleration of manufacturing output growth, with the rate of increase rising to the fastest since May 2022 amid a strong rise in new orders for goods.

Business confidence meanwhile jumped to a near two-year high at the end of the first quarter. While both sectors posted improvements in optimism since February, the jump in confidence was more marked in the service sector than in manufacturing. This broad-based improvement in confidence bodes well for the economic upturn to be sustained at least into the second quarter.

Inflation rates lift higher

The good news on growth is tainted, however, by signs of inflationary pressures picking up again in March. The overall rate of input cost inflation quickened to a six-month high amid faster increases across both goods and services. Service providers indicated that higher operating expenses generally reflected increasing wages, while rising oil and gasoline costs were often mentioned by manufacturers.

In turn, companies in the US raised their own selling prices at a faster pace. The resulting rate of inflation was the sharpest in just under a year, and importantly elevated by pre-pandemic standards. Rates of selling price inflation accelerated sharply across both manufacturing and services, quickening to 13- and eight-month highs respectively as companies passed through higher input costs to their customers.

Access the full press release here.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnews-of-further-solid-economic-growth-from-us-flash-pmi-tainted-by-rise-in-price-pressures-Mar24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnews-of-further-solid-economic-growth-from-us-flash-pmi-tainted-by-rise-in-price-pressures-Mar24.html&text=News+of+further+solid+economic+growth+from+US+flash+PMI+tainted+by+rise+in+price+pressures+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnews-of-further-solid-economic-growth-from-us-flash-pmi-tainted-by-rise-in-price-pressures-Mar24.html","enabled":true},{"name":"email","url":"?subject=News of further solid economic growth from US flash PMI tainted by rise in price pressures | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnews-of-further-solid-economic-growth-from-us-flash-pmi-tainted-by-rise-in-price-pressures-Mar24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=News+of+further+solid+economic+growth+from+US+flash+PMI+tainted+by+rise+in+price+pressures+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnews-of-further-solid-economic-growth-from-us-flash-pmi-tainted-by-rise-in-price-pressures-Mar24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}