Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 01, 2019

Nicaragua options shrink to address economic and political woes

- Nicaragua's worsening economic and political outlook is being driven by President Ortega's violent crackdown on anti-government demonstrations resulting in a loss of investor confidence and international condemnation over the administration's alleged human rights violations.

- Recent measures proposed by President Ortega to tackle the economic downturn are unlikely to be enough to cover government budget shortfalls and stabilize the operating environment. Given increasing liquidity strains faced by commercial banks, banking sector intervention risks will remain high during 2019.

- The emergence of an effective opposition leadership to provide a viable political alternative would probably raise government change risks but the current opposition power-vacuum leads IHS Markit to forecast that the Ortega administration will continue to govern Nicaragua through 2019.

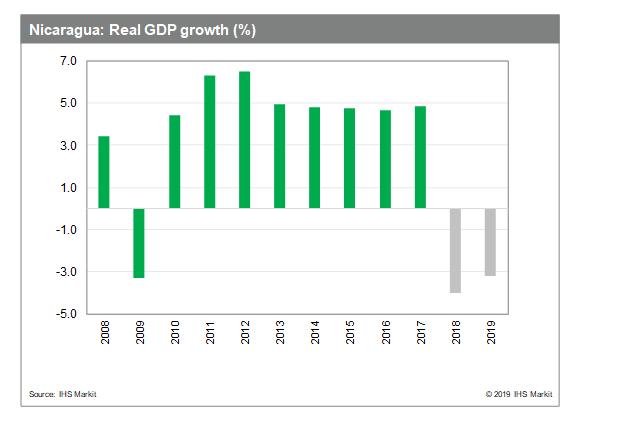

Nicaragua is currently experiencing its worst economic and political upheaval of the last twenty years. Although President Daniel Ortega has successfully managed to stop anti-government protests which started in April 2018, government actions during the protest crackdown has drawn international condemnation and triggered reprisal actions from the United States, threatening Nicaragua's economic outlook. The country entered recession in October 2018 and as of February 2019, IHS Markit projects that Nicaragua's real GDP will contract at around 3.2% in 2019 from an estimated -4% in 2018. Despite economic weakness, Ortega's control of government institutions and the anti-government protesters' lack of leadership means that the incumbent President increasingly is likely to remain in power until the next presidential elections in 2021.

President Ortega's administration has steady consolidated power in the hands of the executive since his return to power in 2007. Confidence in that power led the government to abandon established consultation processes with private business associations and unilaterally impose policies to address fiscal weaknesses including spiraling deficits at the Nicaraguan Institute of Social Security (Instituto Nicaraguense de Seguridad Social: INSS). These measures generated large-scale popular protests, leading to the death of at least 322 individuals and over 700 alleged anti-government activists imprisoned on anti-terrorism charges. Marches, blockades (tranques), and coordinated strike actions resulted in substantial supply chain disruptions and the loss of almost 160,000 formal jobs in 2018. By October 2018, the extended disruptions had driven Nicaragua's economy into recession. In Q3 2018, GDP shrank 4.8% versus the same period in 2017, driven by a fall in consumption and investment. Foreign direct investment (FDI) also has been impacted severely, with a 26% decrease during Q3 2018 alone. Inevitably, the economic contraction has pressured public finances, and we estimate the fiscal deficit to have risen to 3.2% of GDP in 2018 from 1.4% of GDP in 2017 in response to the recession and the resulting lower tax revenues.

Nicaragua's banking sector has experienced rapid deposit withdrawals since April 2018, with total deposits contracting by almost 26% between March and December 2018. Since May 2018, the central bank has adopted short-term liquidity management tools in order to preserve sector liquidity However, given increasing liquidity strains faced by commercial banks, we assess that further intervention is likely during 2019.

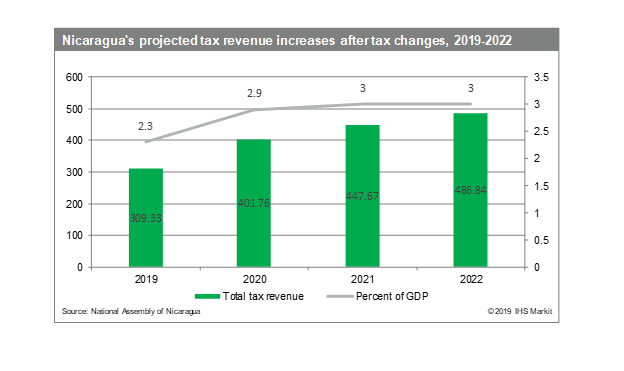

Further hindering Nicaragua's rebound capacity has been the

response of the United States. In December 2018, US President

Donald Trump signed the Nicaragua Human Rights and Anticorruption

Act of 2018 (NICA Act), paving the way for the US to oppose the

provision or extension of any new loan or financial or technical

assistance to the government of Nicaragua by multilateral entities.

The US also has imposed sanctions against Albanisa, Nicaragua's

(49%) joint venture with Venezuela's PDVSA (51%). In response,

Nicaragua's government has introduced a tax package and INSS social

security contribution structural reforms similar to those that

originally triggered the protests in April 2018. Faced with continuing economic deterioration, Ortega announced on

16 February 2019 that he was reopening a national dialogue with

opposition groups headed by business leaders in a first step to

resolve Nicaragua's political dispute. Talks are more likely to

result in concrete measures to improve Nicaragua's operating

environment if President Daniel Ortega's administration implements

a drawdown of militarized policing strategies or ends the ban on

organized public gatherings. We assess talks are unlikely to result

in government concessions sufficient to produce significant

economic recovery in 2019.

Faced with continuing economic deterioration, Ortega announced on

16 February 2019 that he was reopening a national dialogue with

opposition groups headed by business leaders in a first step to

resolve Nicaragua's political dispute. Talks are more likely to

result in concrete measures to improve Nicaragua's operating

environment if President Daniel Ortega's administration implements

a drawdown of militarized policing strategies or ends the ban on

organized public gatherings. We assess talks are unlikely to result

in government concessions sufficient to produce significant

economic recovery in 2019.

As such, IHS Markit expects deteriorating economic conditions. We estimate a GDP contraction of 4% in 2018, and our latest formal forecast projected a drop of 3.2% in 2019 driven by sharp downturns in private consumption, investment, exports, and tourism. The current 2019 GDP forecast has been adjusted for implementation of the NICA Act. Nicaragua will have limited scope to borrow, which will constrain investment in 2019.

Despite our adverse forecasts for Nicaragua's economy and banking sector liquidity risks, IHS Markit assesses that the incumbent administration is likely to retain power in 2019 and, supported by a small rebound in his popularity, continue to implement his agenda.

This post was co-authored by Cristina Arbelaez, Kari Pries, and Natasha Marade from our economic forecast and analysis team

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnicaragua-options-shrink-to-address-economic-and-political-woe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnicaragua-options-shrink-to-address-economic-and-political-woe.html&text=Nicaragua+options+shrink+to+address+economic+and+political+woes++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnicaragua-options-shrink-to-address-economic-and-political-woe.html","enabled":true},{"name":"email","url":"?subject=Nicaragua options shrink to address economic and political woes | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnicaragua-options-shrink-to-address-economic-and-political-woe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nicaragua+options+shrink+to+address+economic+and+political+woes++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnicaragua-options-shrink-to-address-economic-and-political-woe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}