Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 19, 2023

Nigerian business activity recovers as cash crisis eases

The easing of the cash crisis in Nigeria has alleviated pressure on firms in recent months and helped the private sector mount a recovery from the severe disruption seen in the first quarter of the year.

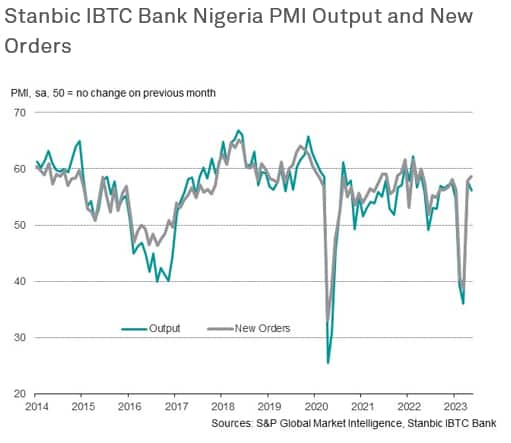

Back in March, we highlighted the impact that cash shortages were having on businesses in Nigeria as customers were unable to access the money needed to pay for goods and services. The disruption caused severe declines in business activity and new orders for two successive months, but an extension to the deadline for using old bank notes has aided a revival of business activity, according to the Stanbic IBTC Bank Nigeria PMI data, compiled by S&P Global Market Intelligence.

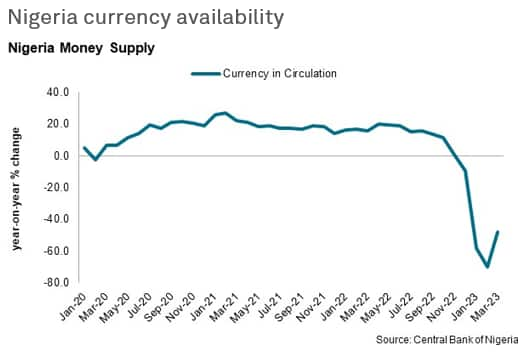

Renewed expansion in business activity

Data from the Central Bank of Nigeria shows that the amount of currency in circulation hit a nadir in February, having fallen 70% year-on-year at that point. Since then, however, a relaxation of the rules around the use of old bank notes to allow people to use them through to the end of 2023 has seen the situation improve. The amount of currency in circulation rose sharply in March, albeit remaining well below normal levels. Subsequent official data releases will likely show further improvements to the currency circulation numbers in April and May, judging by the improved PMI data for those months and the reports from companies of more normal conditions.

The PMI showed that business activity returned to growth in April as customers were better able to pay for goods and services. The rebound in output was sustained into May as new order growth hit a 13-month high.

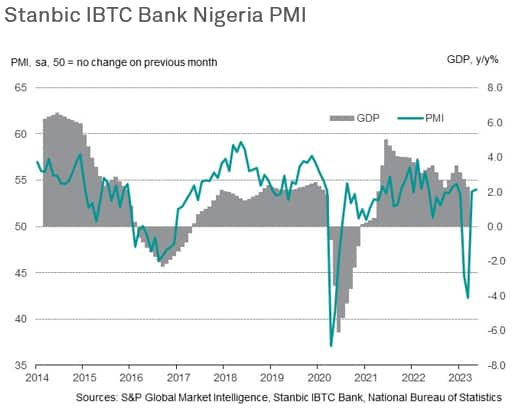

GDP growth to revive after poor first quarter

Consistent with the issues highlighted by the PMI data, GDP figures for the opening quarter of the year showed a slowdown in growth to 2.3% year-on-year, with the National Bureau of Statistics attributing the slowdown to the "adverse effects of the cash crunch experienced during the quarter". Prospects appear brighter for the second quarter, however, given the rebound in the PMI numbers seen during the quarter so far.

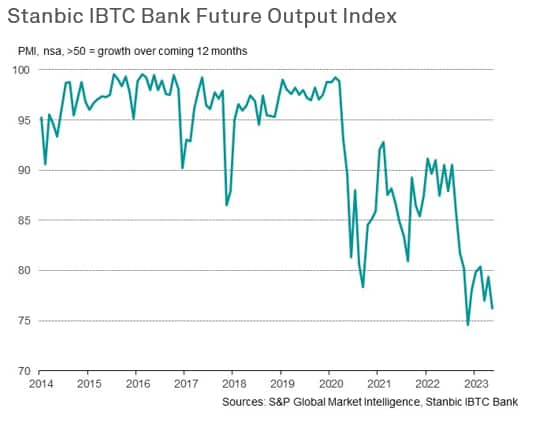

Employment recovery muted amid subdued outlook

While output and new orders have rebounded following the disruption caused by the cash crisis, the same can't be said for employment. Staffing levels fell for three successive months up to April before rising only marginally in May. Subdued hiring trends are coinciding with a relatively muted business outlook. Predictions for business activity in a year's time have fallen to levels that are among the lowest since the survey began in January 2014.

Although the cash crisis has eased, other headwinds remain for firms and consumers, including marked inflationary pressures, rising interest rates and the planned abolition of fuel subsidies (which would add further pressure to prices), restraining business confidence.

S&P Global Market Intelligence forecasts GDP to rise 2.9% in 2023, down from 3.1% in 2022.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 016

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigerian-business-activity-recovers-as-cash-crisis-eases-jun23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigerian-business-activity-recovers-as-cash-crisis-eases-jun23.html&text=Nigerian+business+activity+recovers+as+cash+crisis+eases+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigerian-business-activity-recovers-as-cash-crisis-eases-jun23.html","enabled":true},{"name":"email","url":"?subject=Nigerian business activity recovers as cash crisis eases | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigerian-business-activity-recovers-as-cash-crisis-eases-jun23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nigerian+business+activity+recovers+as+cash+crisis+eases+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigerian-business-activity-recovers-as-cash-crisis-eases-jun23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}