Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 20, 2021

Not all value stocks are valued the same

Research Signals - December 2021

At the conclusion of the two-day policy meeting ending 15 December, the Federal Open Market Committee (FOMC), as widely expected, stated that it will accelerate the taper of its bond purchases and anticipates raising the federals funds rate target around mid-2022. Throughout 2021, the value/growth cycle has reacted to the trend in yields as equity and bond markets priced in developing inflation and economic growth expectations. As value stocks stage a comeback in this anticipated increasing rate environment, we take a closer look at the traditional value sectors and find nuances between cyclical and defensive value stocks.

- Cyclical Energy and Financials sectors have outstripped the market and further outpaced defensive Healthcare, Consumer Staples and Utilities sectors to date in 2021

- During the recent expansion in corporations' stock buyback programs since early 2020, the steadier pace of share repurchases by cyclical value sectors has provided a tailwind heading into 2021

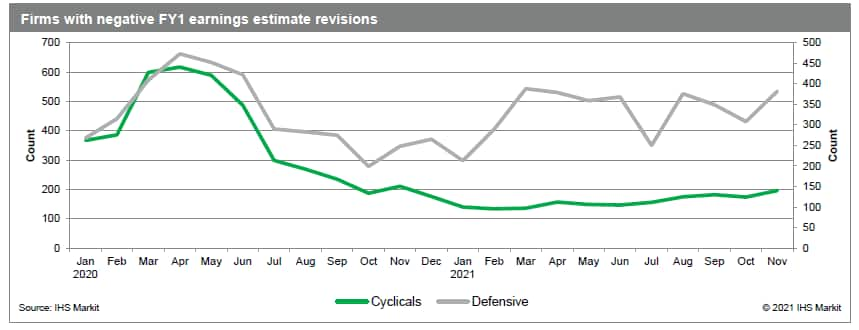

- Defensive value sectors have seen a higher drag from negative revisions and greater uncertainty in current fiscal year earnings estimates

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnot-all-value-stocks-are-valued-the-same.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnot-all-value-stocks-are-valued-the-same.html&text=Not+all+value+stocks+are+valued+the+same+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnot-all-value-stocks-are-valued-the-same.html","enabled":true},{"name":"email","url":"?subject=Not all value stocks are valued the same | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnot-all-value-stocks-are-valued-the-same.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Not+all+value+stocks+are+valued+the+same+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnot-all-value-stocks-are-valued-the-same.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}