Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 12, 2019

Official data corroborate survey signals of UK labour market cooling

- ONS data show jobs being cut at steepest rate since 2015

- Vacancies show largest annual decline in a decade

- Wage growth weakens

- Surveys signal cooling persisted into October

News of the economy contracting for a second successive month in September has been swiftly followed by a warning of how the growing economic malaise is feeding through to the labour market.

Job losses at four-year high

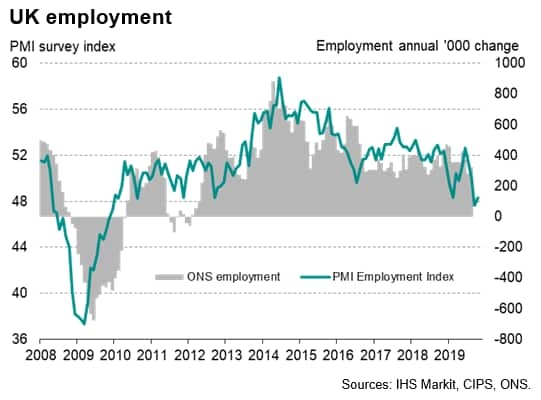

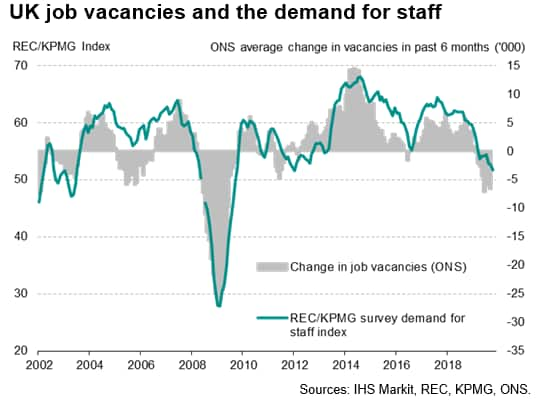

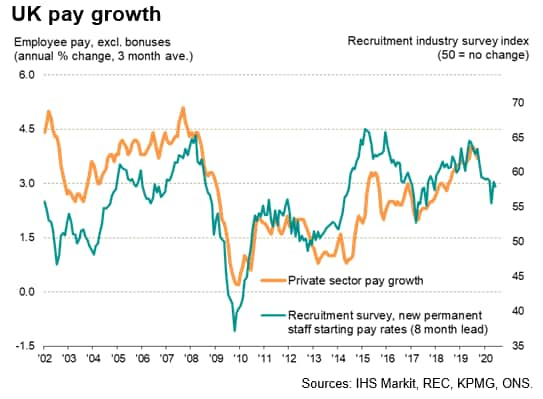

Official data from the Office for National Statistics showed employers cutting headcounts at the fastest rate for four years in the third quarter. The number of people in employment fell by 58,000 in the three months to September, the biggest reduction since 2015. Vacancies meanwhile dropped by 53,000 compared to a year earlier, representing the biggest annual fall in demand for staff since 2009. Annual wage growth also slowed, down from 3.7% in the three months to August to 3.6% in the three months to September, its slowest rate since May.

Malaise to extend into October

The official data are now falling into line with earlier warning signs of a weakening labour market from the surveys, which suggest that the deteriorating picture for jobs and wage growth has persisted into October. Recruitment agencies reported that the demand for permanent staff at employers had grown at the joint-slowest rate for a decade in October as uncertainty and worries about the outlook reduced firms' appetite to take on extra employees. The number of people placed in permanent jobs meanwhile fell for an eighth straight month, dropping in October at one of the steepest rates since the global financial crisis. Wage growth remained elevated, however, due to ongoing shortages of suitable staff, although the rate of wage inflation was reported to have been running well below that seen this time last year.

A similar weakening jobs trend was seen in the PMI surveys, where employment was reported to have fallen for a second month running in October, with the past two months having seen the largest back-to-back drop in employee numbers since 2009. The fall in employment has coincided with the surveys indicating how the economy is going through its toughest patch since 2009, with the impact of slower global economic growth being exacerbated by Brexit uncertainty, with paralysis ahead of an upcoming general election now adding to the woes.

Policy moving towards rate cuts

While the unemployment rate fell back to 3.8%, its lowest for over four decades, it's the gloomier hiring trend and signs of slower wage growth that will likely be of most concern to policymakers, especially as this could feed through to weaker consumer spending. Consumers have been a key prop for the economy in recent months, sustaining spending even when business uncertainty has paralysed corporate spending and investment. Two policymakers have already voted for a cut in interest rates, and any further weakness in the data will likely add to more calls for renewed stimulus to help the economy work through this soft patch.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fofficial-data-corroborate-survey-signals-of-uk-labour-market-cooling-nov19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fofficial-data-corroborate-survey-signals-of-uk-labour-market-cooling-nov19.html&text=Official+data+corroborate+survey+signals+of+UK+labour+market+cooling+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fofficial-data-corroborate-survey-signals-of-uk-labour-market-cooling-nov19.html","enabled":true},{"name":"email","url":"?subject=Official data corroborate survey signals of UK labour market cooling | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fofficial-data-corroborate-survey-signals-of-uk-labour-market-cooling-nov19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+data+corroborate+survey+signals+of+UK+labour+market+cooling+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fofficial-data-corroborate-survey-signals-of-uk-labour-market-cooling-nov19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}