Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 05, 2020

Operating under the radar - The complexity behind unpicking sanctions evasions

Introduction

As regulators continue to clamp down within the sanctions space, it's becoming apparent how historically some players would try to circumvent traditional screening methods in order to continue operating under the radar… or under AIS in this case. The release of the May advisory by OFAC surrounding "Guidance to address illicit shipping and sanctions evasion practises" perfectly encapsulates methods such as AIS tampering and falsified vessel information/documentation, and the necessity for having robust systems in place to carry out in-depth investigations on vessels and their owners.

Through the long years in which IHS Markit has been issuing and maintaining the IMO registry for vessels and companies, our data specialists have had to develop an increasing level of awareness to identify suspected false applications. The IMO number is very much like a vehicle identification number (VIN) or your own thumb print, unique and unchangeable for the duration of its lifespan. As such, vessels that are - or have historically been - 'tagged' as having breached sanctions or recorded undertaking suspicious activity may be inclined to try and apply for a new IMO number under false pretence to effectively receive a new identity.

The Application:

Such an account was recently captured by one of our specialists, whereby a potentially false application was submitted. The application was deemed "suspicious" due to inconsistencies in the provided information, including discrepancies between flag, call sign/maritime mobile service identity (MMSI), the company name, and the class details. The application was also submitted on a Sunday; why is this significant? Sunday might be a non-working day in many parts of the world, but in other parts, this is the equivalent to a Monday.

The flag of register provided was claimed to be the "Northern Mariana Islands", a US commonwealth in the Pacific Ocean, but the call sign given on the form started with "V7", which is allocated to the Marshall Islands. The Maritime Mobile Service Identity [MMSI] number started with 536, which doesn't fit with the range for the US Northern Mariana Islands when checked on the International Telecommunication Union [ITU]. The classification society given was DNV GL, and that it was supposedly classed between 2009 and 2014 (cannot be found on their register), with a built date of 2013.

But it doesn't stop there, as an IMO registration form requires an abundance of additional data points before submitting, such as the Gross Tonnage (158,921), the length (333) the breadth (60), the number of main engines (2) and more - these technical descriptions aren't atypical for a Very Large Crude Carrier (VLCC), but the fact that this vessel has been in existence for several years and suddenly registers for an IMO number is very unusual, particularly when you refer back to the IMO registration scheme.

The Review

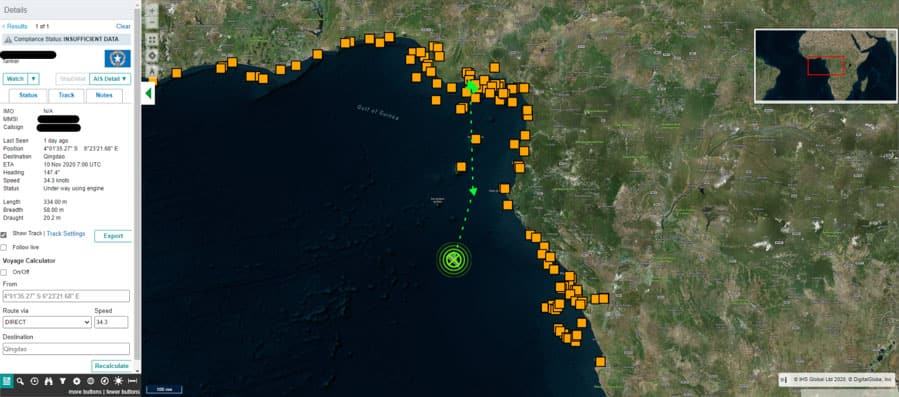

Our market-leading ship vetting tool, the Maritime Intelligence Risk Suite (MIRS) was used to conduct several checks to see if the MMSI and vessel name have existed historically. According to MIRS Ship database, there is no current ship, nor has there been one historically, named as such, nor is there any record of the MMSI pertaining to a registered vessel. If one however looked on the AIS tracking tool, to see if any ship is transmitting as that name or MMSI, they would have found at the time, a solitary ship in the Gulf of Guinea matching in name, flag, Call Sign and MMSI, as well as having similar width, length.

Looking at the vessels track over the last 365 days reveals that it was only first seen on the 17th of September at 09:46:03 UTC within the Gulf of Guinea (24 days before the IMO application came through), where at the time it was in close proximity to, and possibly calling at the Bonny Inshore/Offshore terminals within Nigeria (which happened to be its destination at the time), only to then sail south down the western coast of Africa with a destination of Qingdao, China, and a draught of 20.2 meters.

Figure 1: Vessel of interest as seen historically on AIS

Source: IHS Markit Maritime Intelligence Risk Suite

The Investigation

When inconsistencies such as this arise, it becomes difficult to discern the truth from fiction, particularly in instances like these where the build of the vessel appears sound, but no trace of it can be found under the IMO registry… which begs the question, could this in fact be a vessel already in existence under the IMO, trying to gain a new identity?

If one was to look at the MIRS database for tankers with a length of >300, breadth of >60, a DWT of >290,000, GT of >150000, the system outputs 104 Vessels to have been built to such a standard. Of the 104 vessels, 15% of these have a Severe Compliance status, indicating that there is a high risk associated with these vessels (37% have a warning, and 48% are OK). Regardless of however which way you filter and segment this fleet, no singular vessel comes forth covering all provided technical specifications. If however we remove all of the vessels which have been seen in the last 30 days from when this vessel appeared on AIS, this leaves us with 11 vessels (using 30 days as it takes 30 days to travel from Middle East Gulf to Gulf of Guinea at 10kts; most of these vessels were last seen in the Gulf/South East Asia).

Overall summary of 11 vessels:

- 10/11 are Iranian Flagged

- 5/11 match the year of build

- 2/11 match the builder

- 10/11 have sanctioned owners

- 10/11 are OFAC sanctioned

- 2/11 match the country of build

- 6/11 match the given length

- 11/11 match the given breadth

This is of course speculation, and by no means conclusive; but vessels in such a position would revel in having a new IMO number that would allow them to sail unhindered under a new identity.

IHS Markit has a 250-year heritage as the industry's authoritative source of shipping information. We manage the largest maritime ships database in the world, evolved from The Lloyd's Register of Ships, which has been continuously published since 1764. In addition, the firm is an industry leader in validating maritime data and setting standards for vessel descriptions. The IMO, for example, has nominated IHS Markit - Maritime & Trade as the sole authority for managing its unique ship identifiers. We have since been referenced by several regulators, including the OFAC May Advisory, UN Security Council August Report.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foperating-under-the-radar-the-complexity-behind-sanctions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foperating-under-the-radar-the-complexity-behind-sanctions.html&text=Operating+under+the+radar+-+The+complexity+behind+unpicking+sanctions+evasions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foperating-under-the-radar-the-complexity-behind-sanctions.html","enabled":true},{"name":"email","url":"?subject=Operating under the radar - The complexity behind unpicking sanctions evasions | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foperating-under-the-radar-the-complexity-behind-sanctions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Operating+under+the+radar+-+The+complexity+behind+unpicking+sanctions+evasions+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2foperating-under-the-radar-the-complexity-behind-sanctions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}