Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 24, 2019

Pakistan and IMF agree on USD6-billion loan after seven months of negotiations

- Following protracted negotiations, Pakistan and the International Monetary Fund (IMF) finalized a 39-month Extended Fund Facility deal worth around USD6 billion.

- Besides providing much-needed external financing, the program is essential to drive difficult structural reforms to stabilize deficits and reverse growing external debt.

- Relying on coalition partners for a parliamentary majority, the Pakistan Tehreek-e-Insaf (PTI) government of Imran Khan will face strong political opposition in implementing the IMF program conditions, implying a high risk of program slippages and loan disbursement delays.

While still to be formally approved by the IMF's management and board, this will be the Fund's 13th bailout program to Pakistan since 1988. The loan was initially requested by Pakistan in October 2018 but was delayed several times due to disagreements over the program conditions. The need for another program came after Pakistan's external and public finances deteriorated sharply in response to the government's aggressive development strategy that envisioned massive amounts of infrastructure investment financed by external loans within the China-Pakistan Economic Corridor (CPEC) framework.

Initial signs of economic stabilization are under way, but are insufficient

Since the change of government in August 2018, Pakistan's authorities have implemented several measures aimed at stabilizing the economy and secured some bridge financing from the Saudi Arabia, the United Arab Emirates and China. Among the key steps implemented so far have been the currency devaluation and the steep monetary policy tightening by the State Bank of Pakistan (SBP), as well as the reduction in government developing spending and initiated fuel price rationalization. The sharp depreciation of the Pakistani rupee (around 34% since late 2017) has helped to reduce the merchandise-trade deficit by 24% in the first quarter of 2019. The current-account deficit has also narrowed to USD8.8 billion in July-February FY 2019 from USD11.4 billion a year ago.

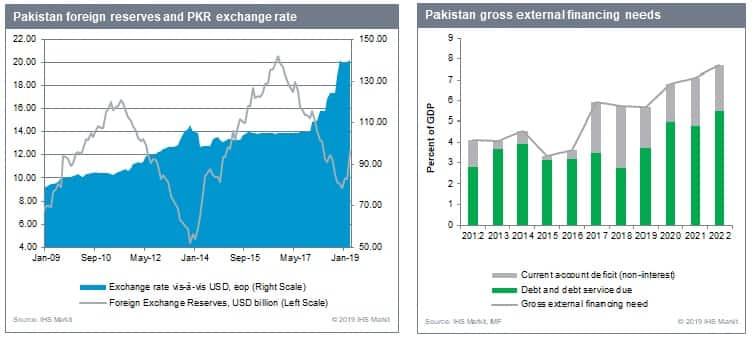

However, currency depreciation has fueled inflation, which accelerated to 8.4% in the first four months of 2019, compared with 5.1% in 2018. Sharp monetary policy depreciation to control inflation is taking a heavy toll on the real economic activity, with large-scale manufacturing output shrinking 8.8% year on year (y/y) in the three months to February 2019. Despite these adjustments, foreign-exchange reserves have not stabilized and are still hovering just under the two months of import cover, below the three-month threshold considered to be "safe". As of 3 May, the net foreign reserves of the SBP stood at USD8.98 billion, down from USD11.6 billion in March 2018 and over USD18 billion in FY 2016. Fiscal consolidation has been also slower than intended. Despite the government's reduced fiscal deficit target for the FY2019, the fiscal deficit for the first half of the fiscal year was at 2.7% of GDP, up from 2.3% during the first half of FY 2018.

Program conditions and outlook

Although detailed program performance targets have not been made public yet, the IMF named a few key areas of the program. As anticipated, the program will focus on reducing Pakistan's fiscal deficit and public debt, which would require a taxation overhaul and a reform of the energy sector and state-owned enterprises. The forthcoming budget for FY 2020 should give the first indication of the program's scale and ambition with respect to the fiscal reform. The program statement indicates a target of 0.6% of GDP for the primary fiscal deficit, which excludes debt interest service. It stood at 2% of GDP in FY 2018.

In addition, the IMF is likely to demand a market-determined exchange rate regime and greater independence of the central bank. This suggests further currency depreciation, with IHS Markit projecting the rupee to weaken by an additional 17% vis-à-vis the US dollar in 2019.

The agreed loan is slightly below Pakistan's initial request of USD8 billion, and on its own, may not be sufficient to cover all of Pakistan's upcoming external obligations. However, its main significance is in unlocking other multilateral and bilateral external financing, restoring investors' confidence, and putting the economy back on a more sustainable path to prevent further debt accumulation.

At the same time, the IMF conditions will increase both protest and government instability risks in the one-year outlook. Already, measures to stabilize the economy undertaken by the Pakistan Tehreek-e-Insaf government have raised living costs, triggering criticism from opposition parties, businesses and the general public. The PTI relies on coalition partners for a parliamentary majority, making it vulnerable to a sharp increase in living costs. Political appetite to implement IMF conditions will therefore probably be lower than the last IMF program, which was administered by a majority government, increasing the risks of program slippages and loan disbursement delays.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpakistan-and-imf-agree-on-usd6billion-loan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpakistan-and-imf-agree-on-usd6billion-loan.html&text=Pakistan+and+IMF+agree+on+USD6-billion+loan+after+seven+months+of+negotiations+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpakistan-and-imf-agree-on-usd6billion-loan.html","enabled":true},{"name":"email","url":"?subject=Pakistan and IMF agree on USD6-billion loan after seven months of negotiations | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpakistan-and-imf-agree-on-usd6billion-loan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pakistan+and+IMF+agree+on+USD6-billion+loan+after+seven+months+of+negotiations+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpakistan-and-imf-agree-on-usd6billion-loan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}