Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 13, 2022

Paris-Aligned EUR High Yield Corporate Index: First Quarter Review

Europe's first high-yield Paris-aligned climate ETF launched earlier this year, underpinned by the iBoxx MSCI EUR High Yield Paris Aligned Capped index. The index is part of an array of solutions that channel investment toward issuers that emit fewer greenhouse gases and are on a path towards decarbonization whilst also adhering to minimum ESG standards, in line with the EU's minimum standards for Paris-Aligned Benchmarks (PABs).

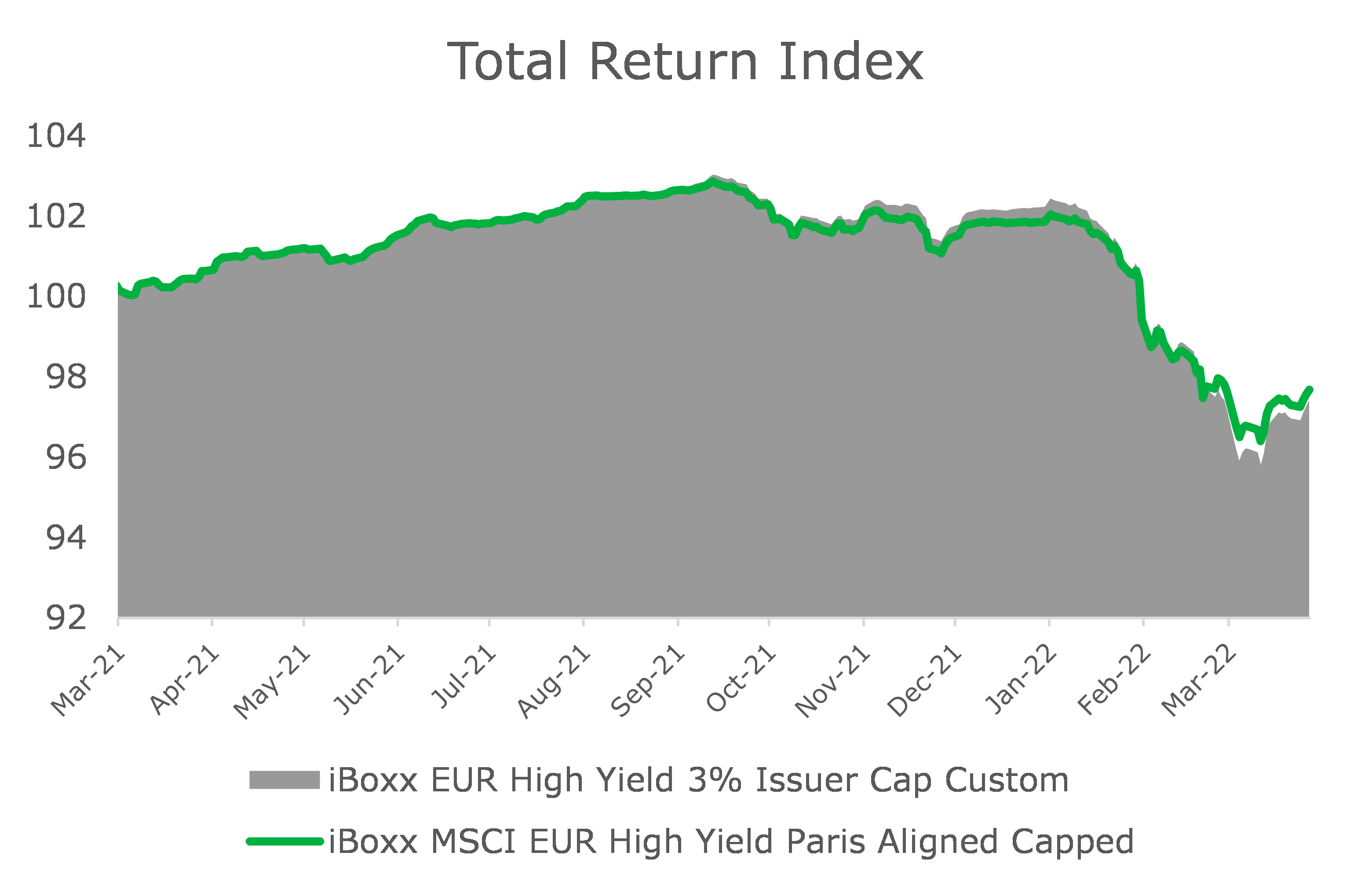

Since its inception, the index has closely mimicked its parent, posting slightly lower returns in exchange for exposure to a significantly lower greenhouse gas (GHG) emissions profile. However, since the start of the war in Ukraine, the ESG overlay that resulted in the exclusion of certain Russian bonds drove a temporary outperformance.

The index provides investors exposure to the high yield corporate debt market while screening out companies for specific ESG business involvement activities and controversies, incorporating a weight tilt towards issuers with higher ESG ratings and ESG ratings momentum, and at the same time targeting progressively lower emission levels.

The overview of the past months' data, which includes simulated back test results, shows an insight into this strategy's performance to date below.

Paris-Aligned Benchmarks Overview

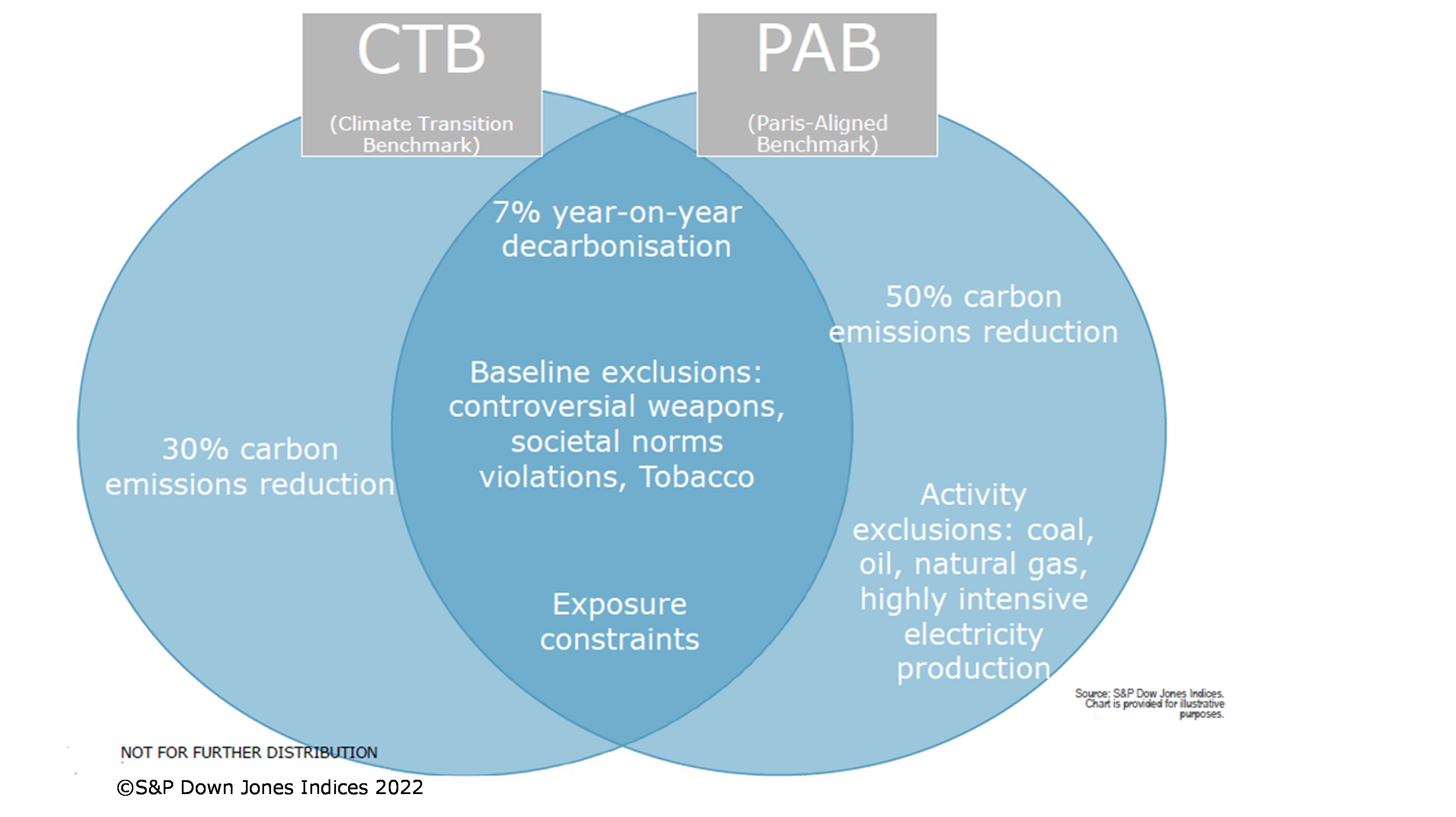

Paris-Aligned Benchmarks and Climate Transition Benchmarks are the two categories of climate benchmarks introduced by the European Union (EU) in 2019.

They both have the same ambition, to further global efforts to decarbonize economies. However, their ESG requirements and required decarbonization trajectories differ slightly. The below chart highlights these key differences:

The exact requirements for both are specified by Article 7 & Article 11 of the Regulations of the EU Transition benchmarks.

iBoxx Strategy Overview

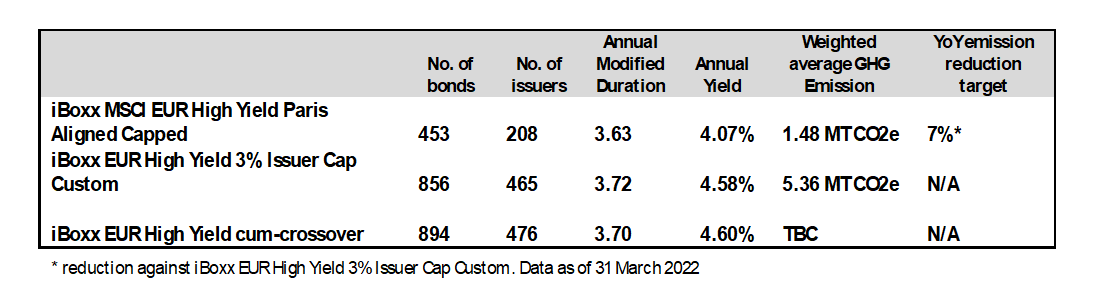

The iBoxx MSCI EUR High Yield Paris Aligned Capped Index takes the iBoxx EUR High Yield 3% Issuer Cap Custom Index as its base, an index with largely similar to iBoxx EUR High Yield Corporates universe. From that base index, there are two key layers of further filtering.

The first step is applying ESG screening on the issuer level. This universe of issuers bonds is then weighted for positive ESG ratings and momentum scores. Thereafter, maximum limits on index emission levels are determined considering the relevant regulations. This process is performed monthly using optimization to ensure the decarbonization trajectory is in line, or exceeding the EU's PAB requirements. Index GHG emissions must be 50% lower than its base (parent benchmark), and importantly index GHG emissions must reduce by at least 7% on average per annum.

Strategy Tilt versus Benchmark

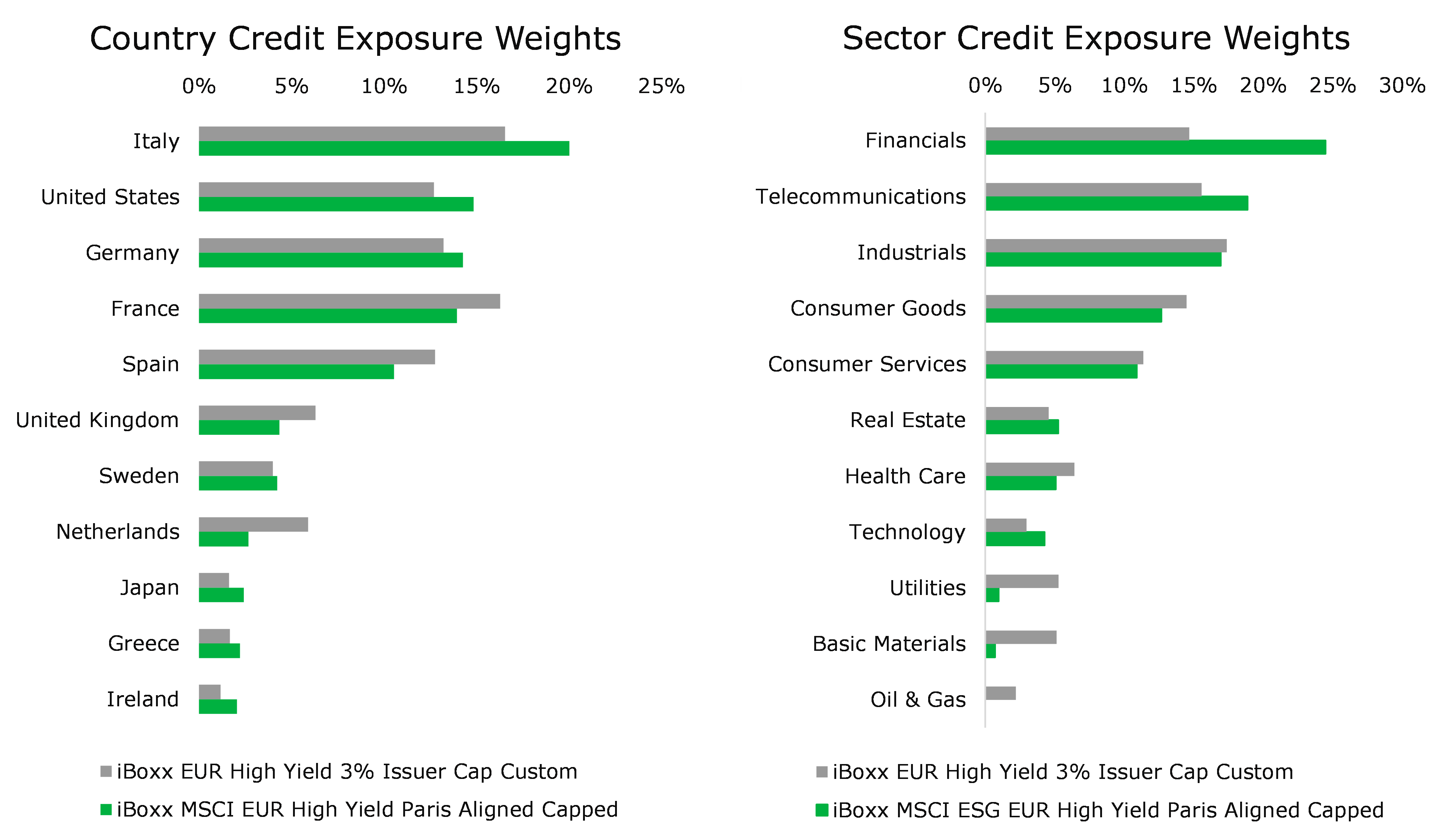

An overview of the index's profile tilt due to screening and weighting for ESG factors shows some common trends in fixed income indices when applying these factors. While the country risk does not change significantly in the two universes, the sector exposure sees a significant shift. The tilt increases exposure to Financials, Technology and Telecommunications, but reduces exposure to Basic Materials, Utilities and eliminates holdings of Oil & Gas.

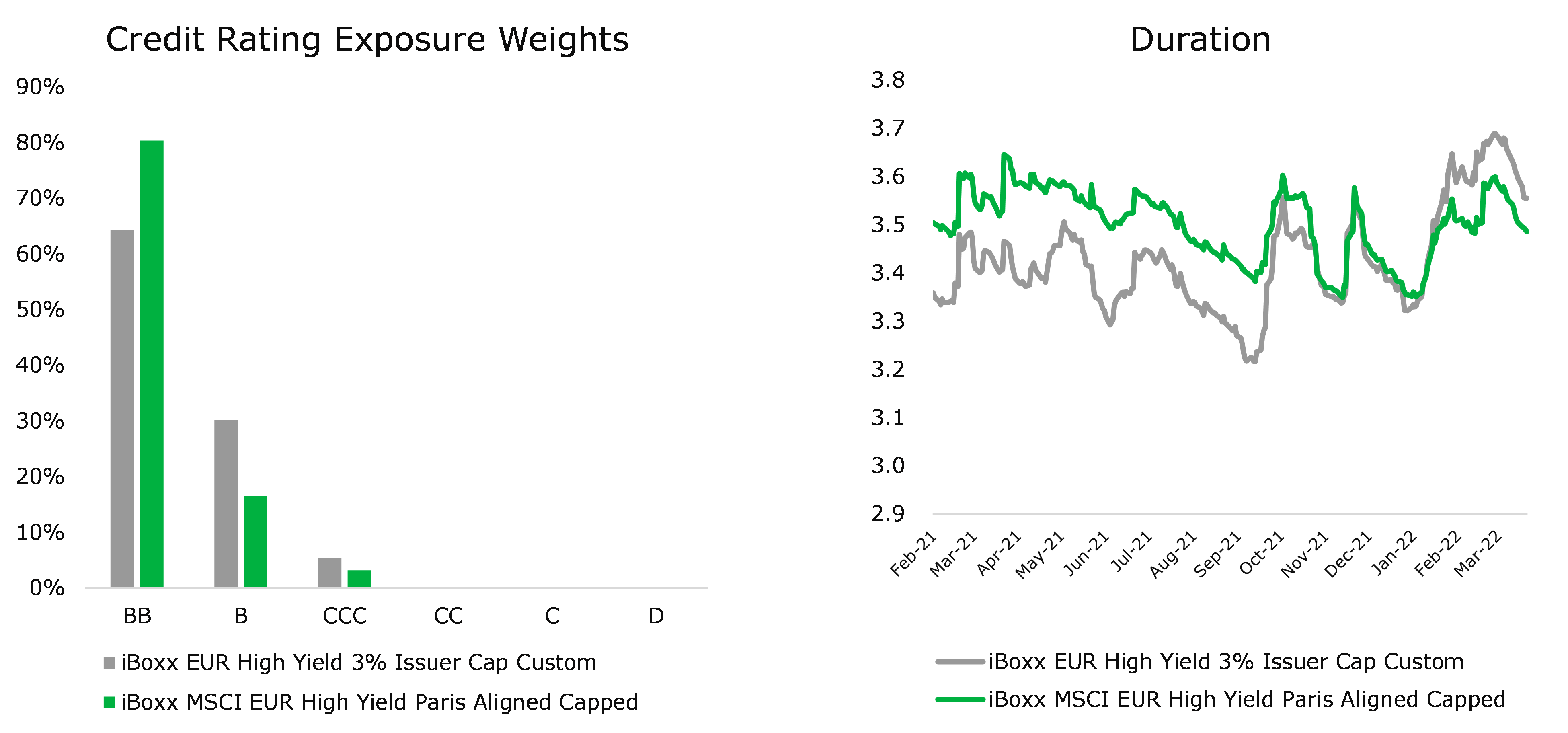

The comparison of credit rating and duration can explain the performance since January 2021 up until late February. The Paris-aligned index has a similar duration with just slightly more tilt to higher quality credit - the higher allocation of BB versus single Bs - and hence a slightly lower yield than the parent index.

Since the start of war in Ukraine, the Paris-aligned index has posted slightly stronger returns than the parent index. A closer look at the bottom performers for both indices shows that higher returns on the Paris benchmark are primarily due to Russian exclusions in March and lower performance of Russian bonds in February. They include bonds issued by Credit Bank of Moscow and ABH Financial which were dropped in the Paris-aligned index on the ESG screening process, as they had no ESG data coverage, additionally bonds issued by the Gazprom, were excluded due to the ESG sector screening requirements to filter out oil & gas issuers.

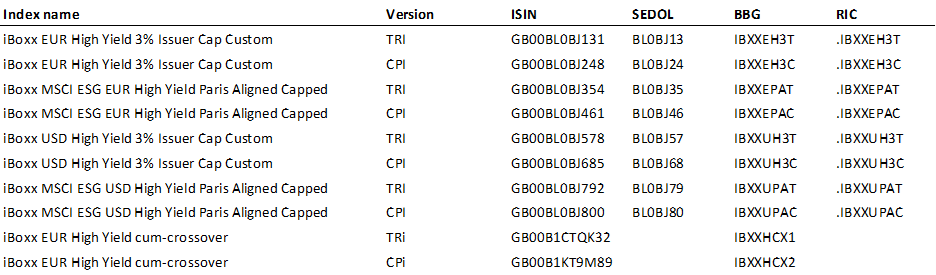

Key Identifiers

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fparisaligned-eur-high-yield-corporate-index-first-quarter-revi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fparisaligned-eur-high-yield-corporate-index-first-quarter-revi.html&text=Paris-Aligned+EUR+High+Yield+Corporate+Index%3a+First+Quarter+Review+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fparisaligned-eur-high-yield-corporate-index-first-quarter-revi.html","enabled":true},{"name":"email","url":"?subject=Paris-Aligned EUR High Yield Corporate Index: First Quarter Review | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fparisaligned-eur-high-yield-corporate-index-first-quarter-revi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Paris-Aligned+EUR+High+Yield+Corporate+Index%3a+First+Quarter+Review+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fparisaligned-eur-high-yield-corporate-index-first-quarter-revi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}