Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 02, 2018

Weekly Pricing Pulse: A pause in the MPI while the specter of geopolitical risk remains

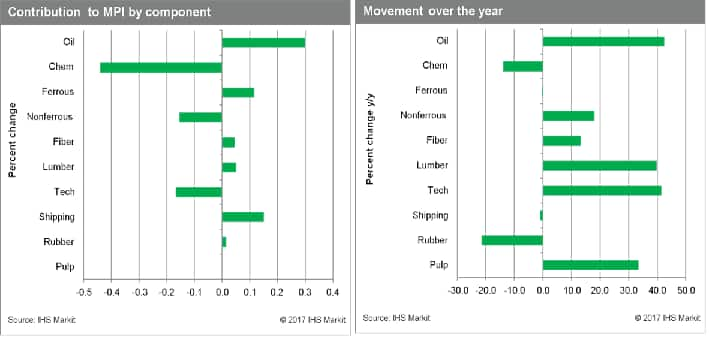

Our Materials Price Index (MPI) was essentially flat last week, dropping 0.1%. This relative stability in the top-line index masked what was in fact a turbulent week in commodity markets. Three sub-components of the MPI fell, one was unchanged, while six rose. Chemicals and nonferrous metals were the drivers behind the decline, falling 2.1% and 2.0%, respectively.

Bearish sentiment continues to drag on ethylene prices, which fell 13.8% last week. As operation issues plague the value chain, derivative demand continues to be weaker than market expectations. Nevertheless, polyethylene operating rates are starting to ramp up, which will increase pricing pressures on ethylene going forward. Meanwhile, US sanctions on Russian aluminium producers continued to roil nonferrous markets last week. Aluminium prices fell after the Treasury Department extended a grace period allowing RUSAL customers to wind down contracts. Nickel markets also reacted to the easing of the US position, tamping down concerns that sanctions may be ahead for the big Russian nickel producer Norilsk.

Data releases were mostly positive last week, albeit with some pointing to signs of peaking growth. In the United States, strong manufacturing drove a solid US PMI Composite Flash report. The PMI Composite Flash report was less exciting in the Eurozone, where it stayed roughly flat at 55.2 for April. In China, the CFLP Manufacturing PMI decelerated slightly to 51.4. The global economy remains healthy, but several risks are developing to the expansion; among those are geopolitical developments that have contributed to commodity market volatility over the past few weeks. These risks were not enough to push up the commodity complex last week but they remain nonetheless. The question ahead will be whether these risks translate into changes in fundamentals that then produce sustained price gains.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpause-mpi-specter-geopolitical-risk-remains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpause-mpi-specter-geopolitical-risk-remains.html&text=Weekly+Pricing+Pulse%3a+A+pause+in+the+MPI+while+the+specter+of+geopolitical+risk+remains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpause-mpi-specter-geopolitical-risk-remains.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: A pause in the MPI while the specter of geopolitical risk remains | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpause-mpi-specter-geopolitical-risk-remains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+A+pause+in+the+MPI+while+the+specter+of+geopolitical+risk+remains+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpause-mpi-specter-geopolitical-risk-remains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}