Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 15, 2018

PMI data eyed for clues of potential second quarter Eurozone GDP rebound

- Eurozone GDP adds to signs of economic slowdown

- Survey data will provide first clues of Q2 health

- Sector PMI data suggest bad weather and timing of Easter may have subdued economic growth in March and April respectively

New GDP estimates add further confirmation to the slowing of the Eurozone economy in early 2018. The burning question, especially for policymakers, is whether the first quarter represents the start of a slowing trend, or whether it will prove to have been a temporary slowdown.

The survey data will act as a key guide to growth momentum going forward, with detailed sector data providing especially important clues as to the behaviour of businesses and consumers.

First quarter slowdown

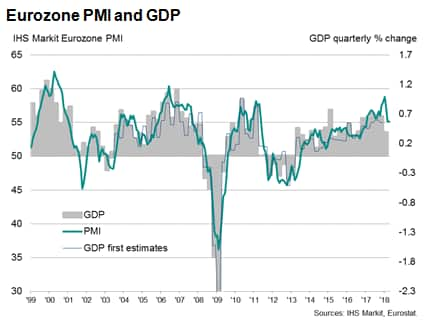

Data from Eurostat indicated that Eurozone GDP grew 0.4% in the first quarter of 2018, a relative disappointment compared to prior readings, which had shown the economy growing at a 0.7% rate throughout the second half of 2017.

Encouragingly, the official growth rate for the first quarter was below the signal from IHS Markit's Eurozone PMI, for which the first quarter average continued to run at a level broadly consistent with approximately 0.5-0.6% GDP growth.

The survey data therefore suggest that there is some scope for the official data to be revised higher in later estimates, as has generally been the case in recent years. The average upward revision over the past year has been 0.14%, bringing the official data exactly into line with the PMI's signal for growth over 2017.

In the absence of revisions, there's also a possibility of the first quarter GDP undershoot relative to the PMI meaning the official data could rebound in the second quarter, assuming of course that the economy remains in good health. The PMI data will therefore most likely be the first indicator of whether the Eurozone's expansion peaked at the turn of the year.

Second quarter clues

The April PMI reading provides mixed news on the outlook for the second quarter. Although still well below peaks seen earlier in the year, at 55.1 the index remains broadly consistent with GDP growth of 0.5-0.6%, providing cause for optimism that the official data could rebound after noise at the start of the year.

The flash May PMI reading will add significantly greater information as to second quarter growth, as Download full report

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-eyed-for-clues-of-potential-second-quarter-gdp-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-eyed-for-clues-of-potential-second-quarter-gdp-rebound.html&text=PMI+data+eyed+for+clues+of+potential+second+quarter+Eurozone+GDP+rebound+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-eyed-for-clues-of-potential-second-quarter-gdp-rebound.html","enabled":true},{"name":"email","url":"?subject=PMI data eyed for clues of potential second quarter Eurozone GDP rebound | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-eyed-for-clues-of-potential-second-quarter-gdp-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+eyed+for+clues+of+potential+second+quarter+Eurozone+GDP+rebound+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-data-eyed-for-clues-of-potential-second-quarter-gdp-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}