Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 07, 2024

PMI signals slowest global expansion since January and optimism hits near two-year low

The global expansion of business activity slowed in September, according to the latest PMI survey data from S&P Global Market Intelligence. Although a sustained robust expansion of services activity was reported, manufacturing output declined to signal a wide divergence between the performance of these two major economic sectors.

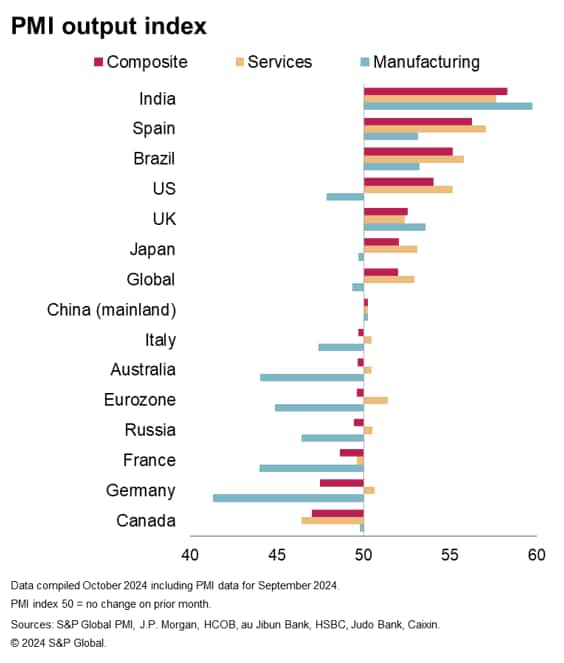

Marked divergences were also evident among the major economies, with the US and India sustaining their dominance of the developed and emerging markets respectively, but the Eurozone, Canada, Russia and mainland China showed signs of contracting or stalling.

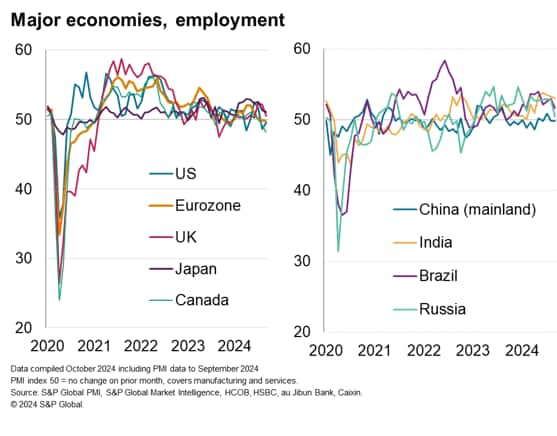

However, even in the US and India cracks in the recent solid economic performances were seen in September. The US not only saw a worrying divergence of sector output trends but also reporting a further cooling of the labour market, as employment fell for a second month running. Employment also fell in the eurozone and Canada, and stagnated in mainland China, with payroll growth rates cooling in all other major economies.

Weaker job market trends reflected lower inflows of new business, but were also often tied to growing concerns about the economic outlook, in turn commonly reflecting heightened geopolitical uncertainty. Future output expectations fell sharply worldwide in September, down to their lowest in nearly two years, hinting that the global slowdown has further to run.

Global economic growth shifts down a gear

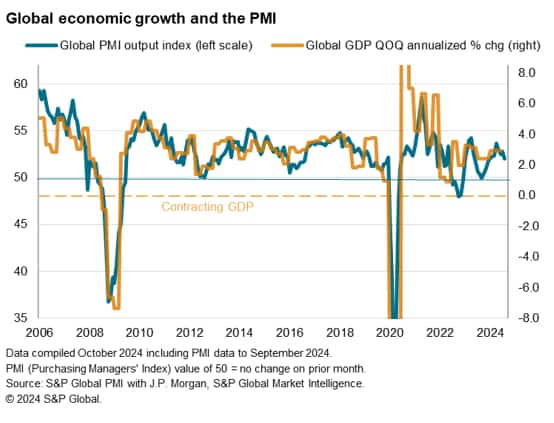

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded for an eleventh consecutive month in September, albeit with the rate of expansion slowing. The headline J.P. Morgan PMI, covering manufacturing and services in over 40 economies, fell from 52.8 in August to 52.0 in September, its lowest since January.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.5%. That follows the most recent GDP data having registered a 2.9% expansion in the second quarter, and compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic. The current growth rate signalled by the PMI is therefore one of just below trend.

Sectoral bifurcation

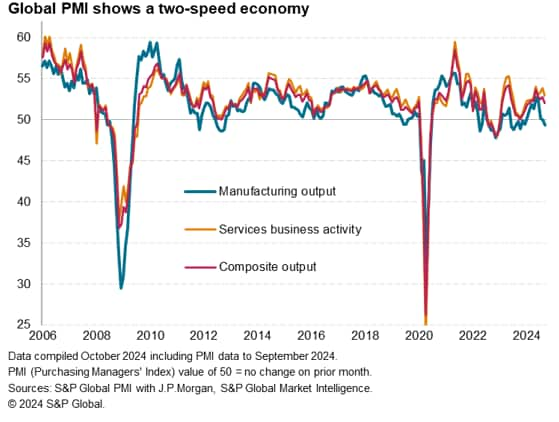

The global slowdown was led by a contraction of manufacturing output following stalled production in August, marking the first downturn in the goods-producing sector since December and representing a considerable contrast to the strong factory growth seen in the sector during the second quarter. Service sector growth, on the other hand, remained robust - albeit losing a little momentum - continuing to register one of the strongest expansions seen over the past year.

The resulting divergence between the two sectors is unusual by historical standards, especially if periods such as the economy's reopening from COVID-19 restrictions are excluded. However, past experience suggests that the service sector tends to also weaken after the manufacturing PMI output data soften, hinting that a broader slowdown may be anticipated.

US sustains its lead in the developed markets

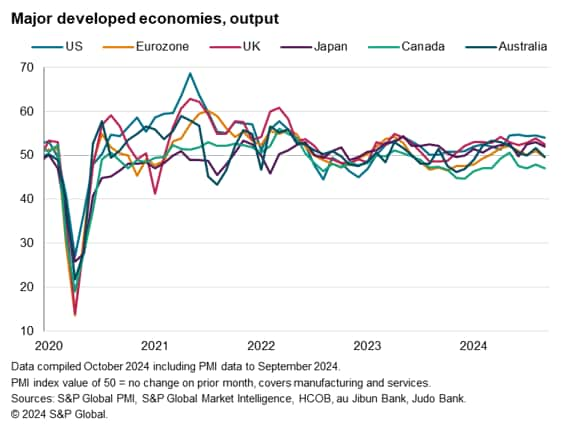

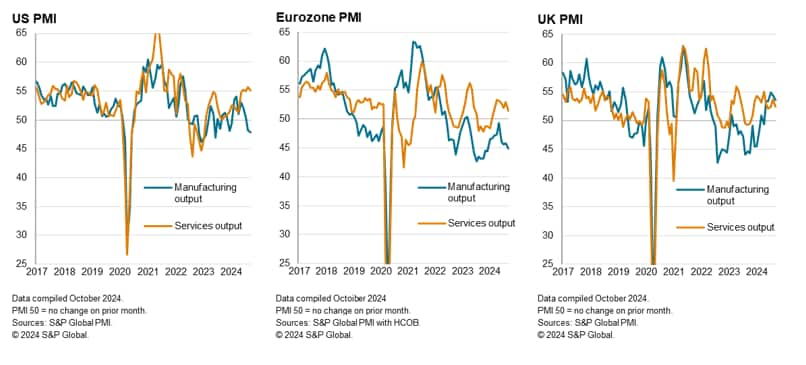

Among the major developed economies, the US notched up the strongest expansion for a fifth straight month, the rate of growth only losing very modest momentum compared to the robust average seen over the prior four months. Growth also continued to be reported in the UK and Japan, though in both cases the rate of increase waned to three-month lows.

Both the eurozone and Australia meanwhile slipped into contraction, joining Canada as drags on the global economy. Canada's downturn deepened slightly to remain the strongest of the major developed economies, as has been the case throughout the past 11 months.

Sector growth disparities were common among the major developed economies. A solid services expansion in the US was countered by a drop in manufacturing output, which fell at the fastest rate for 15 months. Japan likewise relied on its service sector to sustain its upturn, as manufacturing output fell slightly. Eurozone manufacturing output also fell at a sharp and increased rate, though here the service sector lost momentum to report the weakest expansion for seven months. A similar split of falling manufacturing output and worryingly sluggish services growth was seen in Australia.

Falling manufacturing output was by no means common across all developed economies, however, with a solid factory output gain in the UK accompanied by sustained services growth to present the most balanced picture of growth seen in the major economies. In contrast, Canada not only saw a marginal drop in factory output, but also saw a steepening service sector decline.

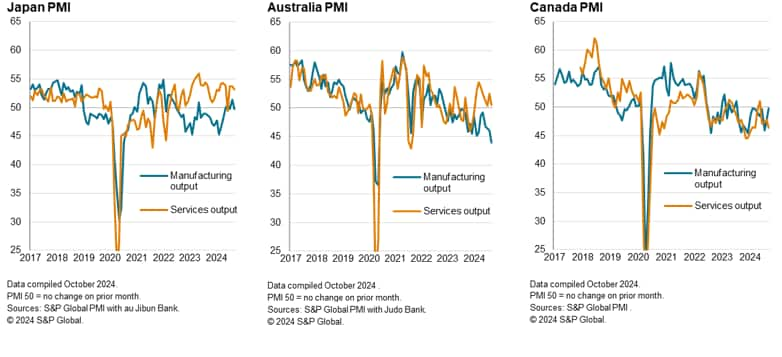

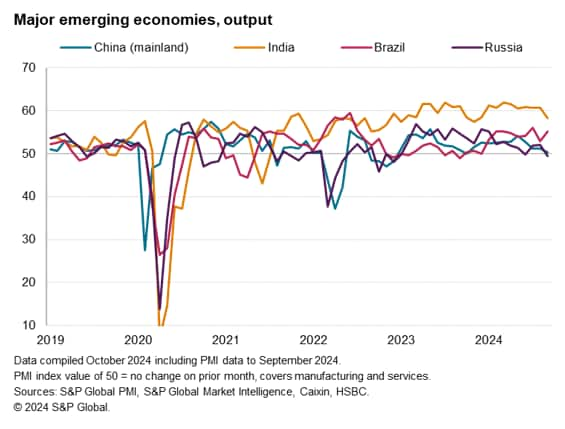

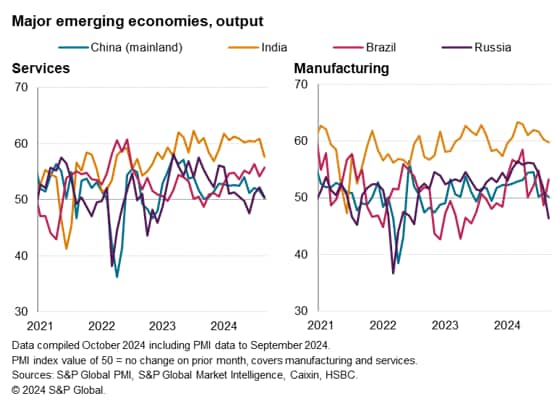

Emerging markets led by India as mainland China and Russia lag

India continued to lead the four BRIC 'emerging' economies by a wide - but diminished - margin, as has been the case since early-2022. Growth weakened to a 10-month low, however, reflecting slower rates of expansion across both manufacturing and services.

The PMI for Brazil revived after dipping in August amid a recovery of manufacturing output and strong services growth, but output fell in Russia for the first time in three months as the steepest fall in manufacturing output for over two years was accompanied by a near-stalled service sector.

Growth meanwhile slowed close to stagnation in mainland China, as the Caixin PMI produced by S&P Global signalled the smallest expansion for 11 months. Growth rates waned to register only marginal expansions of output in both manufacturing and services.

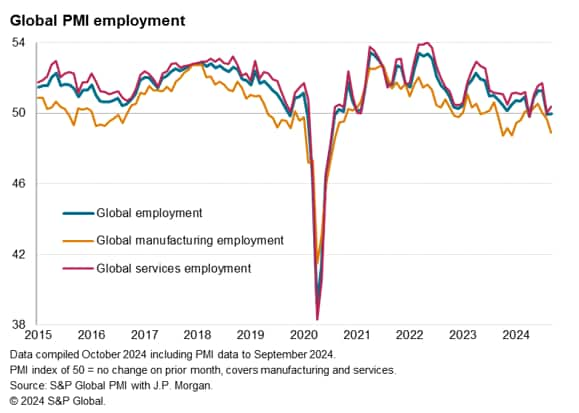

Global employment stagnates

Global employment was unchanged in September which, following a marginal decline in August, signalled the softest back-to-back monthly hiring trend since the pandemic months of mid-2020. Manufacturing jobs fell sharply, and at an increased rate, while only modest service sector payroll additions were reported, the latter running at one of the lowest rates seen this side of the pandemic in recent months.

Hiring was subdued by weakened order book growth, as new orders rose globally across goods and services at the slowest rate since December, but was also hit by heightened caution about the business outlook. Global business expectations for future output fell in September to their lowest since October 2022, dropping sharply in both manufacturing and services.

Companies often cited geopolitical concerns as having clouded the outlook, including uncertainty surrounding the US Presidential Election as well as political changes in Europe and conflicts in the Middle East and Ukraine.

However, some companies also reported that employment was subdued by skill shortages, notably in the services economies of the UK and US.

Broad-based softening of labour markets

Among the major economies, employment fell most sharply in Canada, where job shedding hit the highest since July 2020, though modest job losses were also reported in the US, mainland China and the eurozone. Only marginal gains were meanwhile seen in the UK, Australia and Russia as rates of hiring slowed. Slower job gains were also seen in India, Brazil and Japan to round off a broad-based picture of softening labour market trends amid the intensifying concerns about global economic prospects.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-slowest-global-expansion-since-january-and-optimism-hits-near-twoyear-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-slowest-global-expansion-since-january-and-optimism-hits-near-twoyear-low.html&text=PMI+signals+slowest+global+expansion+since+January+and+optimism+hits+near+two-year+low+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-slowest-global-expansion-since-january-and-optimism-hits-near-twoyear-low.html","enabled":true},{"name":"email","url":"?subject=PMI signals slowest global expansion since January and optimism hits near two-year low | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-slowest-global-expansion-since-january-and-optimism-hits-near-twoyear-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+signals+slowest+global+expansion+since+January+and+optimism+hits+near+two-year+low+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-slowest-global-expansion-since-january-and-optimism-hits-near-twoyear-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}