Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 01, 2022

Portfolio risk analytics solutions need to meet the pace of change in buy side risk management

This article was first published in our complimentary ebook: 'Buy Side Risktech 2.0: Solving the challenges of a risk manager'. Access the full eBook here.

The portfolio risk analytics landscape is fundamentally shifting for buy-side firms as risk management professionals face ever-growing challenges. Their world is becoming more complex as they fulfill demanding regulatory requirements while supporting and optimizing front-office teams amid a period of tremendous technological and social change.

Portfolio managers are investing in more exotic, less liquid product types to achieve alpha targets in an increasingly competitive, fee-compressive environment. Meanwhile, the ability to measure risk from an environmental, social, and governance (ESG) perspective is becoming more important, while regulations and client demands continue to grow.

The unprecedented momentum of cloud computing and the evolution of data science has the potential to enable risk managers to grow their capabilities and add even more value. But firms will need the right technology and data to capitalize on market shifts and stay ahead of their peers.

So rapid is the pace of technological innovation that analytics solutions once designed to relieve the burden of risk management were built on what would now be considered outdated technology stacks—often becoming more of a hindrance than a help, given considerable operating overheads.

Portfolio risk analytics computations take too long for buy-side investment firms

At buy side investment firms, traditional risk systems are being pushed beyond their capabilities as demands evolve.

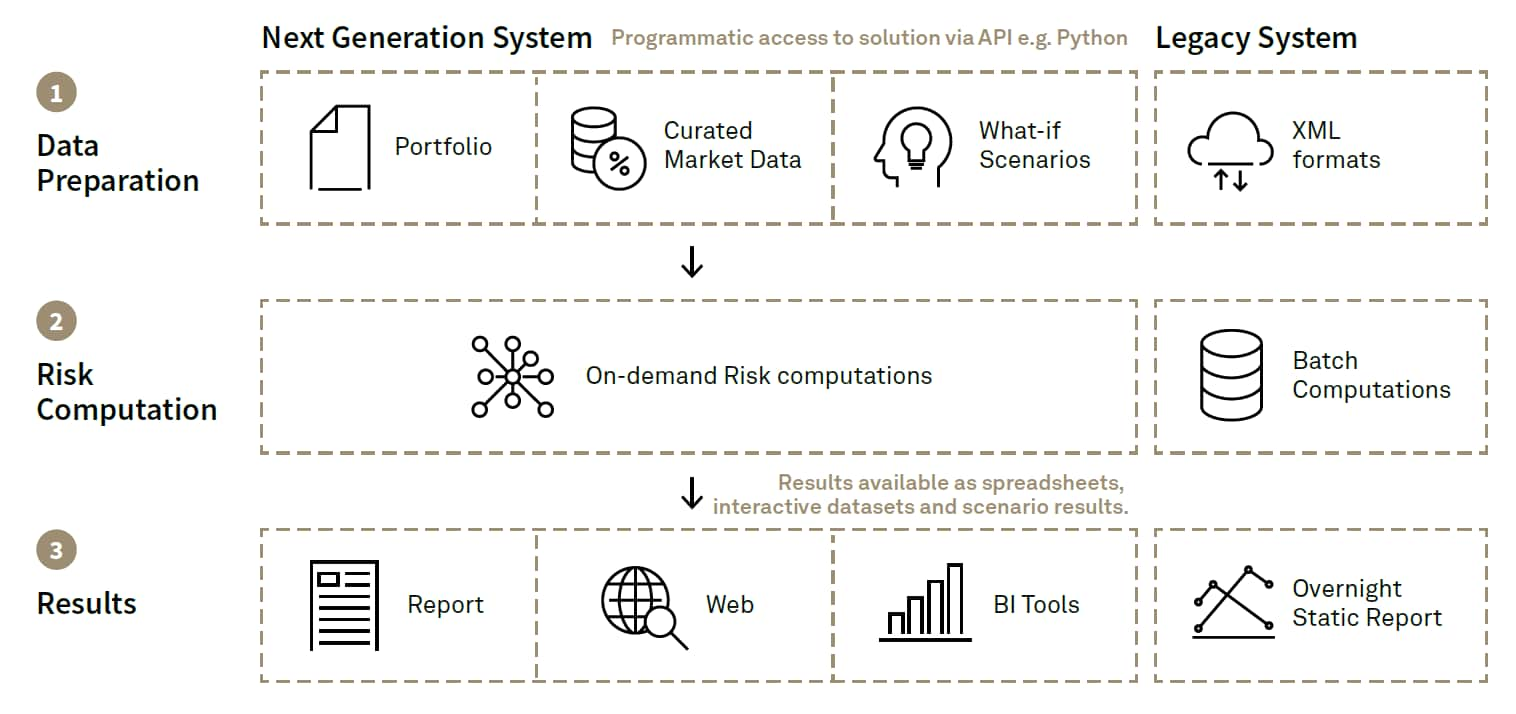

One significant consequence of an outdated technology stack is sub-optimal computational performance. Historically, the only computation results obtained were based on a cumbersome overnight batch process. While this was once adequate for the needs of most risk managers, changing requirements, emerging technologies, and the deeper integration of risk management in the investment process have led to greater demands on systems.

What-if scenarios and bespoke investigations are almost impossible tasks to carry out without significant knowledge of how to manipulate a system to unique requirements. Intra-day reruns are required to cure regulatory breaches and ensure consistent time series data for current and potential clients. These processes take a long time to run and require significant support from IT teams.

Overnight vs on-demand

Most overnight batch processes are based on end-of-day positions and T-2 market data. Typically, overnight batches take hours to run and rely on physical servers, which determine performance by the number of threads a client is allocated.

These long calculation times can restrict risk managers from running multiple scenarios or performing bespoke investigations. This limits the scalability of a risk system, capping the ability to grow the number of uploaded portfolios and, ultimately, making a firm less agile in bringing products to market.

The limitations also impact the ability of the risk manager to assure the quality of the risk data calculated in an overnight batch. When data problems are identified, risk managers are often powerless to quickly rerun a batch and fix the issue.

Unfortunately, reruns are typically needed at the most time-critical moments: during a potential regulatory breach, a client request, a portfolio-manager inquiry. If risk managers can't react to such demands efficiently, they risk reputational damage, regulatory fines, and frustrated portfolio managers.

In a fee-compressive environment, Chief Risk Officers will be continually challenged to seek alternatives to investing in risk systems with diminishing returns.

Driving efficiency and scalability in risk management systems

A next-generation cloud-native risk solution, incorporating greater flexibility to control the output of the system, as well as Risk as a Service (RaaS) gives investment managers and risk teams access to raw computational power, fully configurable outputs, and data that solves their ad-hoc, value-add requirements.

Cloud-based RaaS can also adapt to changing business demands and

volume through the ability to scale up and down in both the size of

portfolios and frequency of computations. RaaS additionally

provides flexibility and cost savings. Moreover, users can move

away from being tied to a terminal for combined risk analytics and

data.

RaaS that is agile and built on a next-gen technology stack can

meet emerging needs as the risk team evolves, supporting new

product launches as well as innovative risk-management

techniques.

You can't be competitive with inflexible tech

Risk systems lacking real-time calculation - or at least using the latest market data - become an immovable obstacle for risk managers in establishing themselves within the investment process.

Inflexible solutions hindering the implementation of new techniques and portfolios can impair a business's competitive edge. Risk managers have to wait for new enhancements to be made available and then wait for internal tech teams to deploy them. This can delay product offerings as well as the implementation of innovative risk-measurement techniques and bespoke client requirements.

The fast-evolving portfolio risk landscape needs a modern tech stack to keep up

Long delays in system updates are increasingly unacceptable. Tech stacks should be flexible enough to support new products, computations, and reports without large development costs. This can be achieved with a modern solution, following agile methods with continuous improvement.

Instead of infrequent and resource-heavy software updates, a modern approach uses development methodologies that continuously roll out improvements to a hosted cloud environment. This agile approach enables new instruments, reports, and methods to be deployed to all clients as they become available.

As we can see, a system with high performance calculations frees up a risk manager to work on the real challenges of managing risk in a portfolio rather than trying to work around daily batch calculations. Fast calculations allow for more time to do error checking, run what-if scenarios and perform intra-day calculations.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-analytics-solutions-buy-side-risk-management.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-analytics-solutions-buy-side-risk-management.html&text=Portfolio+risk+analytics+solutions+need+to+meet+the+pace+of+change+in+buy+side+risk+management+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-analytics-solutions-buy-side-risk-management.html","enabled":true},{"name":"email","url":"?subject=Portfolio risk analytics solutions need to meet the pace of change in buy side risk management | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-analytics-solutions-buy-side-risk-management.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Portfolio+risk+analytics+solutions+need+to+meet+the+pace+of+change+in+buy+side+risk+management+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fportfolio-risk-analytics-solutions-buy-side-risk-management.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}