Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 28, 2021

Post-COVID-19 sub-Saharan African consumer spending

- Savings accumulated during 2020 are likely to fuel consumption in sub-Saharan Africa (SSA) as the economic recovery gains momentum in upcoming quarters. The boost is likely to be sizeable but temporary.

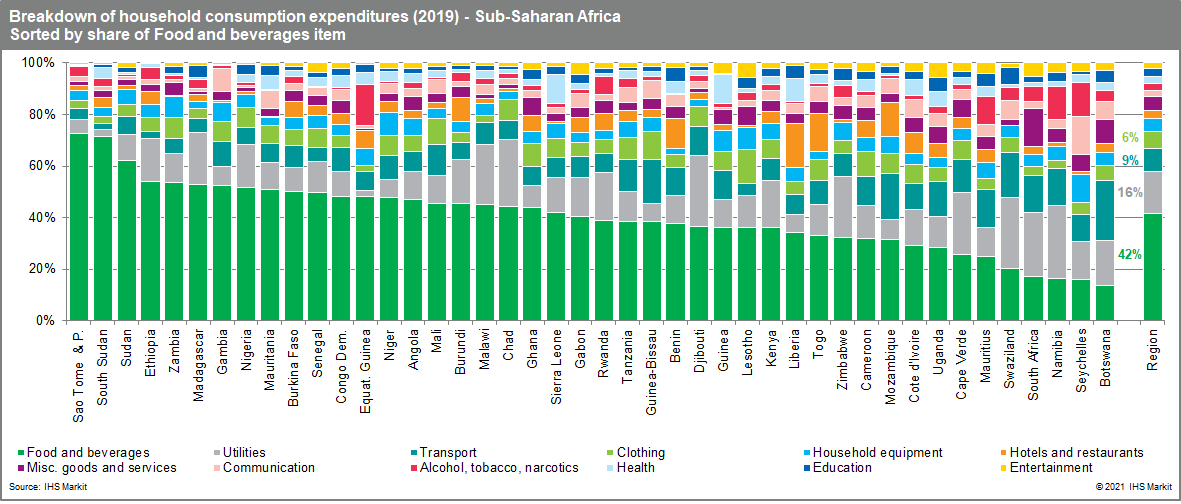

- Over 2021-22, consumers in SSA are expected to assign a larger share of consumption expenditure to food, household equipment, and health services compared with pre-Coronavirus disease 2019 (COVID-19)-crisis consumption.

- Although credit growth was generally resilient during 2020, we project a deceleration in lending in SSA, as government stimulus measures end. SSA banks are likely to tighten credit standards further.

- A COVID-19-pandemic-related decline in school enrolments in the near term is likely to have long-term implications on skills performance and, therefore, employment trends. Addressing human-capital development needs to foster value-added sectors in the economy, in the long run, may become more challenging.

Real GDP in the SSA region is expected to bounce back in 2021, while consumer spending is expected to fuel the recovery, bolstered by pent-up demand, low interest rates, and stronger remittance inflows as the global economic recovery gains momentum. We note that short-term savings accumulated through 2020 are likely to fuel consumption as the recovery gains momentum in upcoming quarters. The boost is likely to be sizeable, judging by the increases in saving rates witnessed globally in 2020 - more than 10 percentage points of disposable income in the most fortunate countries and often more than 5 percentage points.

However, in the aftermath of the COVID-19 pandemic, widening income inequality, higher unemployment, permanent losses in education, and reduced credit growth could reshape SSA consumer-spending patterns in the near to long term. Global poverty as measured by the international poverty line is expected to have risen in 2020 for the first time since 1998. Among the world's economies for which poverty can be measured, 18 of the 20 poorest are in SSA. Although the decline in economic growth last year was more modest in SSA than in advanced economies, according to IHS Markit's forecast data, it is likely to spur a rise in extreme poverty in the region that will be one of the largest increases globally.

IHS Markit research shows that the share of food, household equipment, and healthcare in total household spending is likely to rise in the short term, compared with expenditure patterns before the crisis. This shift will be at the expense of non-essential goods and services, such as communication and hotels and restaurants. Our model simulations also indicate that households are likely to devote less of their income to traditionally important items, such as transportation, the share of which is set to drop in every country by 2022. However, consumer-spending segments hit hard by the crisis, such as accommodation, transport, communication, and entertainment, could experience a marked recovery in the coming years, potentially growing by 10-15% by 2025.

Furthermore, delays to post-COVID-19 economic recoveries will bring delays in employment creation. One of the bigger concerns is that an increase in public spending in response to the pandemic has compromised SSA governments' already weak capacity to finance social spending programs, such as building human capital needed to develop higher-value-added sectors. Countries confronted by fiscal constraints are often forced to choose between existing social protection and healthcare programs.

IHS Markit expects that employment in the informal sector has remained relatively unchanged, with only slight to moderate increases. However, more people than currently projected may have moved into the informal sector to sustain livelihoods. Declining disposable incomes and a slower-than-projected recovery in the tourism, travel, and accommodation sectors may mean reduced demand for the informal sector's goods and services, along with reduced employment in the near term.

Bank deposit growth for most countries in SSA rose as a consequence of the COVID-19 lockdowns that limited customer spending. Meanwhile, increasing uncertainty about the economic outlook elevated households' cautious approach to their finances amid the COVID-19 virus shock. Overall we project a deceleration of loan growth in SSA as governments' COVID-19-related stimulus packages come to an end in many countries. In addition, banks are likely to tighten credit standards further as stresses facing companies and households amid the ongoing pandemic and delayed vaccination rollouts in several countries.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostcovid19-subsaharan-african-consumer-spending.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostcovid19-subsaharan-african-consumer-spending.html&text=Post-COVID-19+sub-Saharan+African+consumer+spending+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostcovid19-subsaharan-african-consumer-spending.html","enabled":true},{"name":"email","url":"?subject=Post-COVID-19 sub-Saharan African consumer spending | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostcovid19-subsaharan-african-consumer-spending.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Post-COVID-19+sub-Saharan+African+consumer+spending+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpostcovid19-subsaharan-african-consumer-spending.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}