Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 01, 2023

Price pressures alleviated by falling demand, fewer supply delays and inventory reduction policies

Global manufacturing supply chains continued to show signs of healing in January which, combined with falling demand for factory inputs, points to weaker industrial price inflation in coming months. Destocking policies are meanwhile adding to the downturn in pricing power. China's re-opening should further help boost supply in the coming months, though the resulting deflationary impact on prices may be offset by resurgent demand.

Global factory output downturn moderates

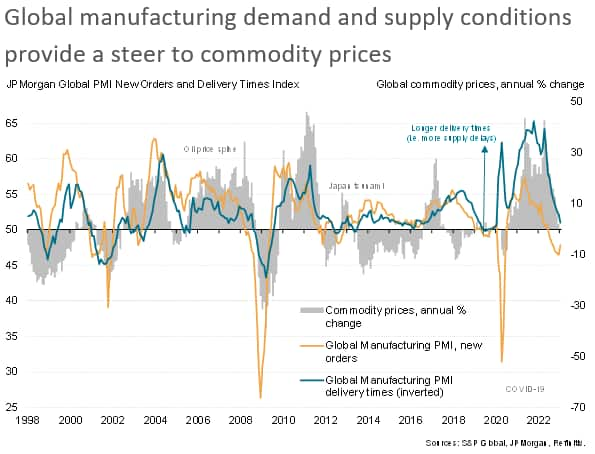

A combination of falling demand and improved supply conditions is indicative of weak global commodity price inflation, with inventory reduction policies adding to the subdued price pressures evident in January.

The latest PMI surveys compiled by S&P Global showed a further calming of the supply chain crisis that disrupted worldwide production and led to soaring prices during the pandemic. The number of reported supply chain delays fell for a ninth successive month in January, resulting in the fewest delays reported since January 2020, just prior to the major impact of COVID-19.

A further improvement in the supply situation is widely anticipated following the recent relaxation of COVID-19 restrictions on the Chinese mainland, which is expected to boost exports from the region. Hence, the upward pressure on factory input prices from supply constraints has all but disappeared on average, globally.

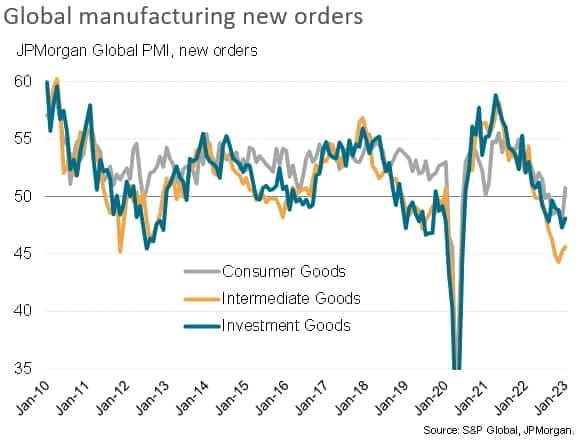

At the same time, demand for goods is falling worldwide, which has likewise exerted downward pressure on prices. The global manufacturing PMI survey showed new orders for goods falling for a seventh straight month in January. Although the rate of decline moderated, it was still among the steepest seen since the global financial crisis.

Digging deeper into the PMI new orders data, by far the steepest drop in demand in recent months has been recorded for intermediate goods, which are products sold to other manufacturers as inputs. This downturn in global demand for inputs underscores the weakness of current pricing power for suppliers of goods into factories.

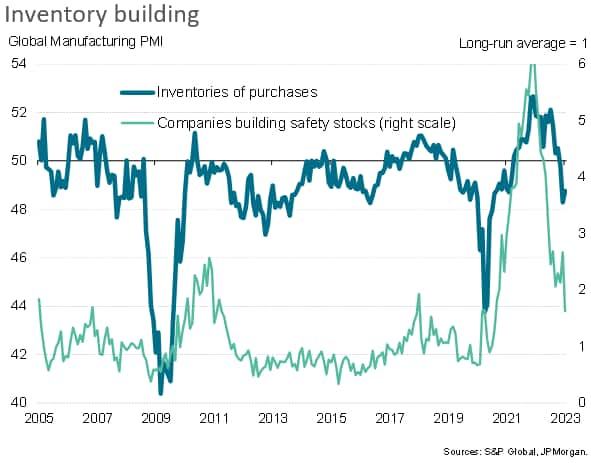

Inventories hold insights into future price developments

The survey data also reveal how inventory holdings are affecting pricing power. Recent months have seen manufacturers around the world trimming their inventories of inputs on average, marking a distinct change from the deliberate inventory building seen during the pandemic. In fact, the number of producers worldwide reporting that they are building safety stocks (mainly due to concerns over supply and prices) has now fallen to its lowest since August 2020 and is moving close to its long-run average.

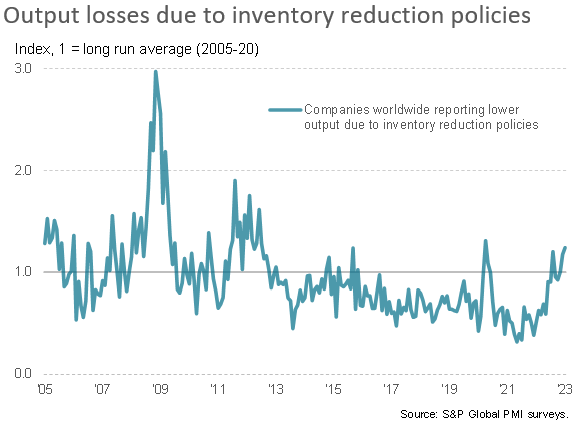

At the same time, and perhaps more tellingly, the number of companies worldwide that are reporting lower production due to the need to reduce their inventory levels has spiked higher, rising in January to the highest seen for a decade barring the initial pandemic crisis in early 2020.

This shift to inventory reduction, and the historically strong downward pressure on output that it is exerting, points to a substantial reduction in pricing power that will continue to keep a lid on industrial prices worldwide in the coming months. Improved supply from China amid the reopening of the mainland economy will meanwhile help further alleviate any supply constraints, adding further downward pressure on prices. The extent to which reviving economic growth in China will stimulate demand for commodities and hence push up prices remains uncertain, but for now the prevailing forces on prices appear to be firmly downward.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprice-pressures-alleviated-by-falling-demand-fewer-supply-delays-and-inventory-reduction-policies-feb-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprice-pressures-alleviated-by-falling-demand-fewer-supply-delays-and-inventory-reduction-policies-feb-2023.html&text=Price+pressures+alleviated+by+falling+demand%2c+fewer+supply+delays+and+inventory+reduction+policies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprice-pressures-alleviated-by-falling-demand-fewer-supply-delays-and-inventory-reduction-policies-feb-2023.html","enabled":true},{"name":"email","url":"?subject=Price pressures alleviated by falling demand, fewer supply delays and inventory reduction policies | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprice-pressures-alleviated-by-falling-demand-fewer-supply-delays-and-inventory-reduction-policies-feb-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Price+pressures+alleviated+by+falling+demand%2c+fewer+supply+delays+and+inventory+reduction+policies+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fprice-pressures-alleviated-by-falling-demand-fewer-supply-delays-and-inventory-reduction-policies-feb-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}