Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 24, 2019

Q1 Securities Finance Quarterly Review

Welcome to the Securities Finance Review for Q1 2019. Two commentary features from the review are excerpted below. The full report is available for download via the link at the bottom of this page. Feedback is welcome and appreciated, please direct to msf-media@ihsmarkit.com

Q1 Revenue Update

- Lending revenues improve 3% compared with Q4 2018

- Government bond balances and revenues decline

- EUR denominated corporate bonds in demand

- Asia remains bright spot for equity lending, particularly Japan & South Korea

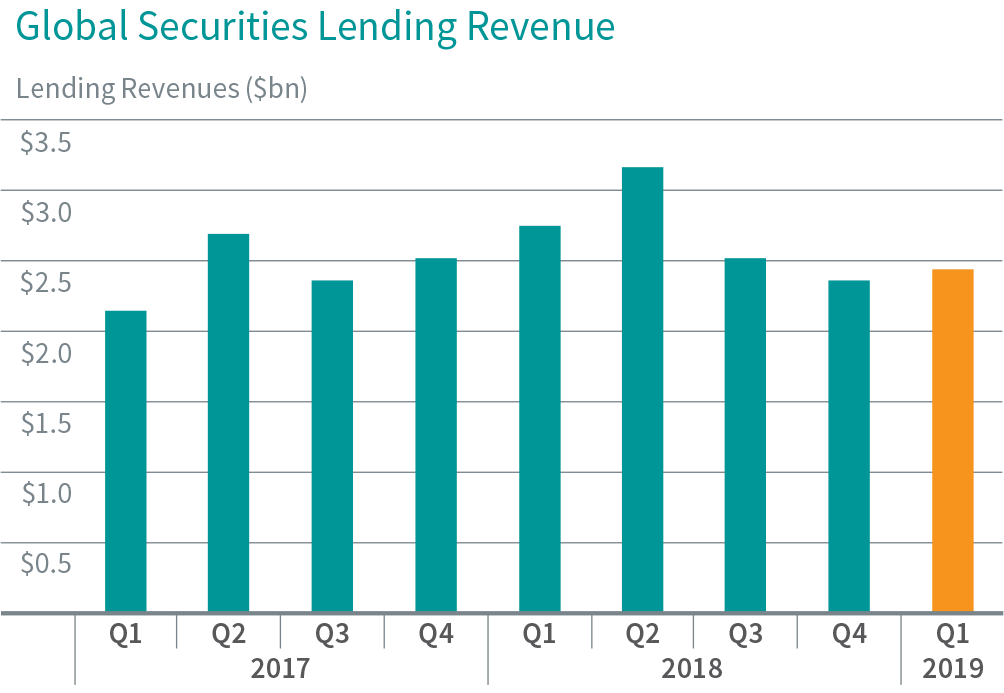

Global securities lending revenues for Q1 2019 came in at $2.4bn; 10 percent lower than Q1 2018, and 3% higher than Q4 2018. Equity lenders have seen a lack of special balances, while there has been some marginal cooling in previously hot market segments, including: government bonds, corporate bonds and ETFs. The revenues are within the range of the preceding four quarters, however the breakdown of returns continues to evolve along with the changing needs of market participants.

2018 delivered the most securities lending revenues since the financial crisis, which looks like a tough act to follow in the early going of 2019. The last two quarters have been notable in that there hasn't been the pickup in borrow demand which often accompanies periods of increased volatility. Most recently, in Q4 2015 - Q1 2016, US equities had the two best post-crisis revenue quarters amid the credit and equity sell-off as investors hedged and added to shorts. There was no such increased demand in Q4, though there is some cause for optimism. Q1 revenues at least mounted some sequential growth relative to Q4 and key revenue drivers remain in place: Asian Emerging Markets, North American Cannabis and global credit.

(Continued in the full report)

Hooray for Exchange Offers!

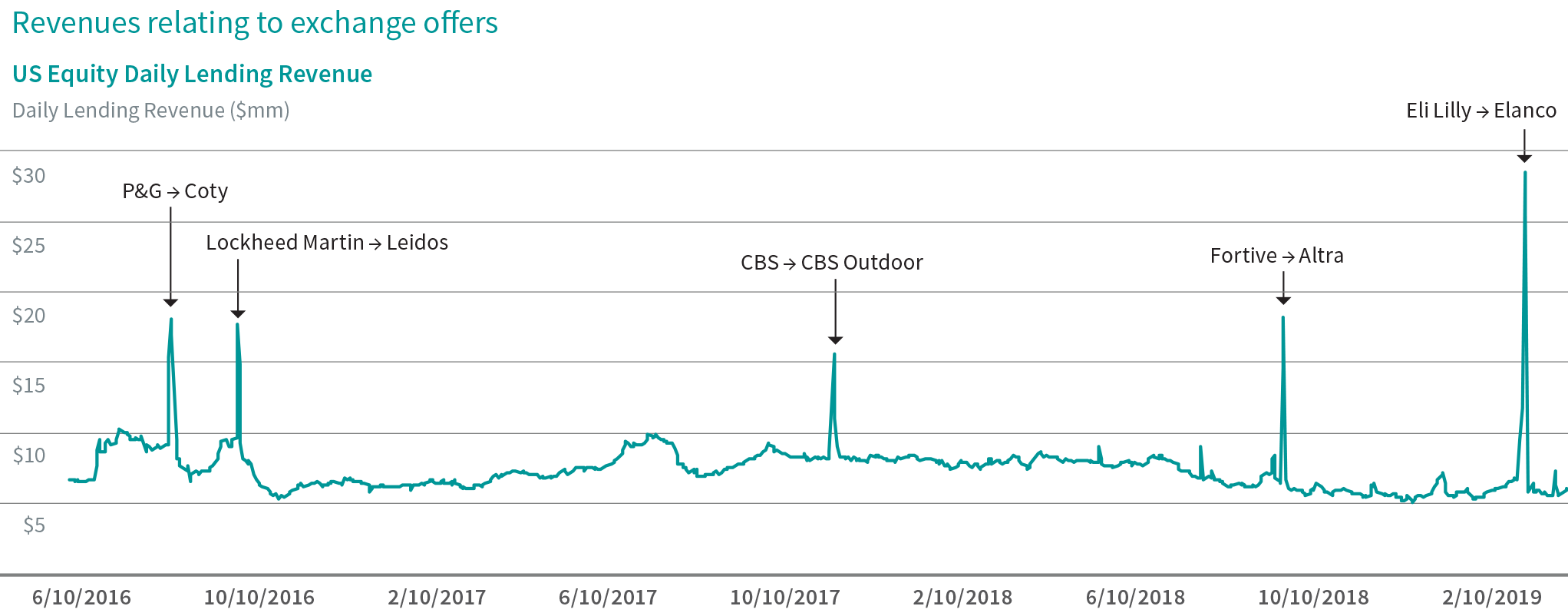

When Eli Lilly announced it would spin off the remainder of its stake in Elanco Animal Health, ears perked up on securities lending desks. Exchange offers reflect the key role that securities lending plays in the plumbing of global financial markets, which we'll discuss in some detail here. This corporate action type is also boon to the securities lending industry itself, driving significant loan balances and fees. One industry veteran recently quipped that an advocacy group ought to be formed to raise awareness of exchange offers in corporate boardrooms.

Elanco Animal Health was spun off from Eli Lilly in September of last year, at which time $1.5bn of ELAN shares were floated. On February 8th, seeking to complete the divestiture, Eli Lilly offered their shareholders an opportunity to tender LLY shares in exchange for ELAN shares, the latter offered at a 7% discount to incentivize participation.

This type of incentive also attracts arbitrageurs who will buy shares with the intention of tendering them. In theory this position could be hedged by shorting ELAN shares, which would lock in the 7% discount. There's a catch. Not all tendered shares will be accepted, so arbs need to estimate the percentage of their tendered shares which will be accepted and hedge those shares with a short position in ELAN. That leaves their position in LLY shares which aren't accepted, so they need to hedge that as well by effecting a short position in LLY shares, or "boxing" their position, which can be done with synthetic products.

The hedging activity on the part of arbitrageurs causes borrow demand for both securities to increase. The real driver of lending revenue comes from the LLY shares; In forgoing the opportunity to tender shares, lenders can charge a premium to lend their holdings. These shares are referred to as "take no action" or TNA shares and are typically auctioned off to borrowers.

The scale is massive. Fully 44% of the outstanding shares of LLY were tendered, reflecting a market value greater than $57bn. The corresponding borrow in LLY shares to hedge that position reached $33bn, while the ELAN borrow balances reached $2.7bn.

(Continued in full report)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-securities-finance-quarterly-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-securities-finance-quarterly-review.html&text=Q1+Securities+Finance+Quarterly+Review+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-securities-finance-quarterly-review.html","enabled":true},{"name":"email","url":"?subject=Q1 Securities Finance Quarterly Review | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-securities-finance-quarterly-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Q1+Securities+Finance+Quarterly+Review+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-securities-finance-quarterly-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}