Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 08, 2018

Reserve Bank of India surprises with pre-emptive rate hike

- RBI's MPC unanimously voted to raise interest rates

- Pre-emptive move to tame inflationary pressure

- PMI data will provide clues as to growth momentum and timing of future hikes

The Reserve Bank of India raised the policy rate for the first time in nearly four-and-a-half years at the Monetary Policy Committee's June meeting, confounding many analysts that were expecting the central bank to hold off a rate hike until August.

The decision was unanimous among the MPC's six members, but the committee kept its future policy stance as 'neutral', allowing the RBI some flexibility regarding the next policy direction. Future action will depend on how inflation developments play out in coming months. The rate increase came in the wake of similar decisions made by central banks in Indonesia and the Philippines.

Rate hike

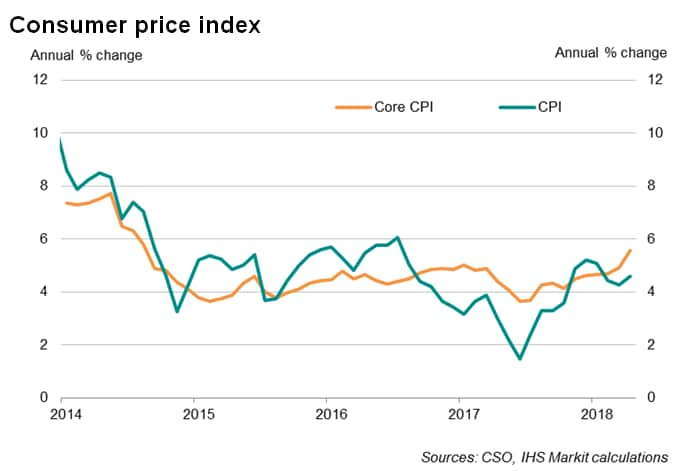

Increasing concerns about rising inflation was seen as the main driver of the RBI's decision to raise its policy rate by 25 basis points to 6.25%. While headline inflation has eased from last December's peak, core inflation was estimated to be hovering near the upper band of the RBI's 2-6% target range.

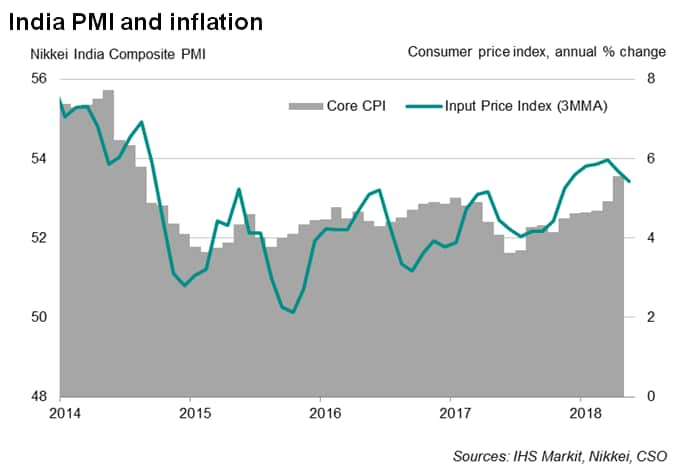

More recently, anecdotal evidence from the May Nikkei PMI surveys indicated that increased raw material prices, particularly fuel costs, have lifted overall input inflation for Indian companies.

The latest rate move can therefore be seen as an attempt to preserve price stability and anchor inflation expectations.

Data dependent

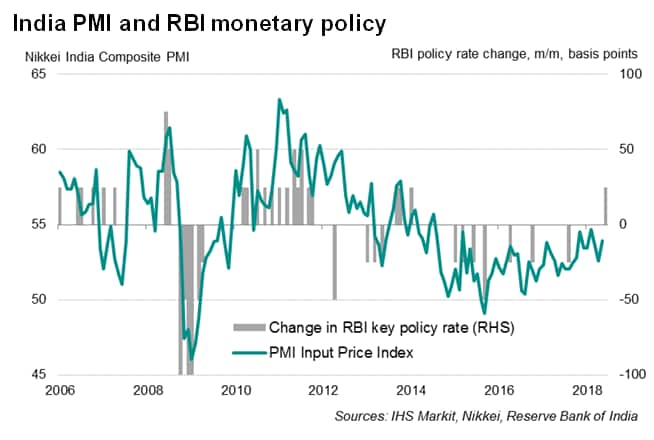

The PMI survey's gauge of input prices can provide some clues as to changes in monetary policy at the central bank. When the input price index reaches a certain level, the increase in price pressures signalled is consistent with the RBI tightening monetary policy.

The fact that input costs had not reach the trigger point for higher interest rates in May supported the view that the policy action was a pre-emptive move. This also explained to some extent the central bank's decision to continue maintaining a 'neutral' stance on the rate cycle, indicating that future increases would rely on how inflation develops in the months ahead.

The data in the next few months will therefore be watched closely for clues as to the next policy move. Unless price pressures, especially oil prices, come off the boil in coming months, the chances of an August rate hike cannot be ruled out. The June PMI surveys, published in early July, will provide strong signals on second quarter GDP growth and inflation trends.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frbi-surprises-with-rate-hike.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frbi-surprises-with-rate-hike.html&text=Reserve+Bank+of+India+surprises+with+pre-emptive+rate+hike+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frbi-surprises-with-rate-hike.html","enabled":true},{"name":"email","url":"?subject=Reserve Bank of India surprises with pre-emptive rate hike | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frbi-surprises-with-rate-hike.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reserve+Bank+of+India+surprises+with+pre-emptive+rate+hike+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frbi-surprises-with-rate-hike.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}