Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Dec 12, 2022

Recruitment downturn signals cooling wage growth in UK

Signs of a marked cooling in the UK labour market were provided by the latest survey of recruitment agencies, which saw the number of people placed into permanent jobs fall sharply for a second successive month in November. Staff availability problems meanwhile eased alongside slower growth of demand for workers from employers, the latter pointing to weaker job vacancy gains.

Wage growth moderated as a result, dropping close to the pre-pandemic five-year average. Such a steep downturn in wage growth compared to earlier in the year is a welcome sign that the UK is not seeing second-round inflation effects and a wage-price spiral, though clearly the deteriorating labour market is a concern in terms of the broader economic picture. However, it remains too early to assess whether hiring has merely slowed due to short-term factors, notably the botched "mini" budget, or is sending a recession signal.

Permanent staff hiring turns lower

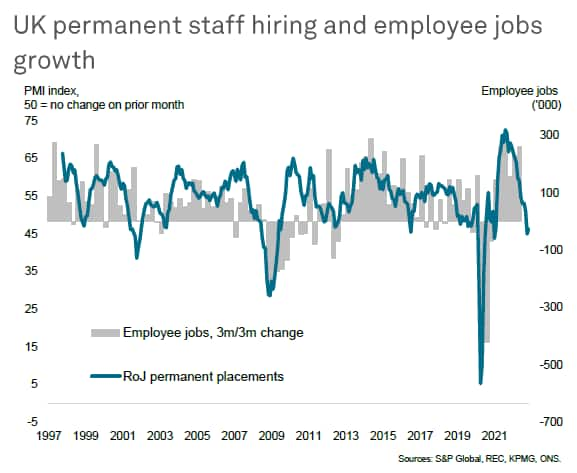

Recruitment agencies in the UK reported a sharp fall in the number of people placed in permanent jobs for a second consecutive month in November. The decline, signalled in the monthly survey of around 400 recruitment consultancies conducted by S&P Global on behalf of KPMG and the REC, pointed to a marked cooling of the UK labour market, contrasting with strong hiring seen earlier in the year.

The survey (which has been running since 1997) showed an unprecedented surge in the hiring of staff throughout much of 2021, after the COVID-19 related lockdowns, which extended into the early months of 2022. However, as 2022 progressed, the pace of hiring steadily cooled to the extent that the fourth quarter so far has seen the steepest cut to permanent job placements since the initial Brexit shock of 2016 and, prior to that, since the global financial crisis in 2009.

This reduction in new job placements is a reliable advance signal of employment starting to fall again in the UK - albeit only modestly - after the robust post-pandemic jobs boom.

Fewer staff shortages, less demand for labour

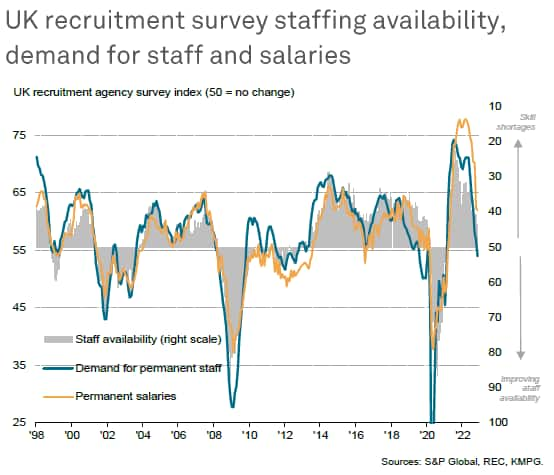

Part of the recent pull-back in the number of people placed in permanent jobs is a function of low staff availability, but there are signs here that the situation is starting to improve. Recruiters reported that the availability of staff deteriorated to the least degree for just over one and a half years in November.

More importantly, the drop in placements reflected slower growth of demand for staff. Recruitment agencies reported that employers' demand for staff grew in November at the slowest rate since February 2021.

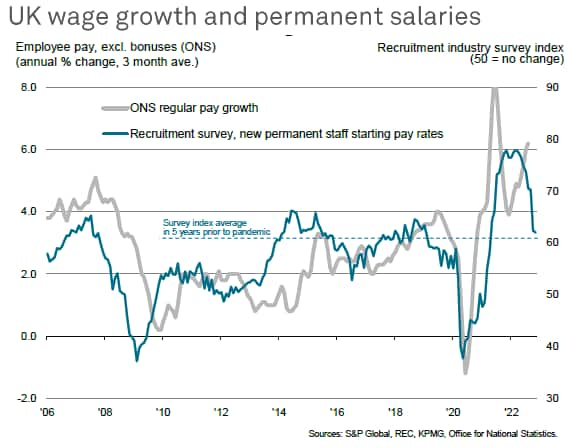

Permanent salary growth cools close to pre-pandemic average

With staff shortages becoming less acute, and demand for staff moderating, wage bargaining power has shown further signs of shifting from employee to employer. The recruitment industry survey saw average salaries awarded to candidates taking up new positions continue to rise in November, but at the slowest rate since April 2021. The rate of salary growth has consequently weakened considerably since the all-time highs seen late last year and in the first half of 2022 such that November's rise was only slightly higher than the average increase in salaries seen in the five years leading up to the pandemic.

Wage growth peak?

The recruitment industry data therefore point to a substantial cooling in the demand for staff in recent months, which has been accompanied by fewer issues in sourcing staff and has in turn led to weaker pay growth. The survey's permanent salaries index provides a useful advance guide to turning point in UK wage growth, and hints at average regular pay rising an annual rate of less than 4%, thereby falling in the months ahead from the current rate of 5.7% as estimated by the Office for National Statistics.

Such wage growth moderation would be welcome news for policymakers at the Bank of England, but it remains to be seen if this labour market soft patch is merely temporary, reflecting the financial market turmoil created by the autumn's "mini" budget, which has since eased, or whether this represents a more definite turning point in the economy. More clarity on the evolving economic situation will be provided by the flash PMI surveys on 16 December, which have also shown a cooling jobs market alongside a growing recession risk.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecruitment-downturn-signals-cooling-wage-growth-in-uk-dec22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecruitment-downturn-signals-cooling-wage-growth-in-uk-dec22.html&text=Recruitment+downturn+signals+cooling+wage+growth+in+UK+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecruitment-downturn-signals-cooling-wage-growth-in-uk-dec22.html","enabled":true},{"name":"email","url":"?subject=Recruitment downturn signals cooling wage growth in UK | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecruitment-downturn-signals-cooling-wage-growth-in-uk-dec22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Recruitment+downturn+signals+cooling+wage+growth+in+UK+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecruitment-downturn-signals-cooling-wage-growth-in-uk-dec22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}