Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 24, 2022

Reduced COVID-19 impact supports services growth in Japan and Australia but manufacturing sector under pressure from supply constraints

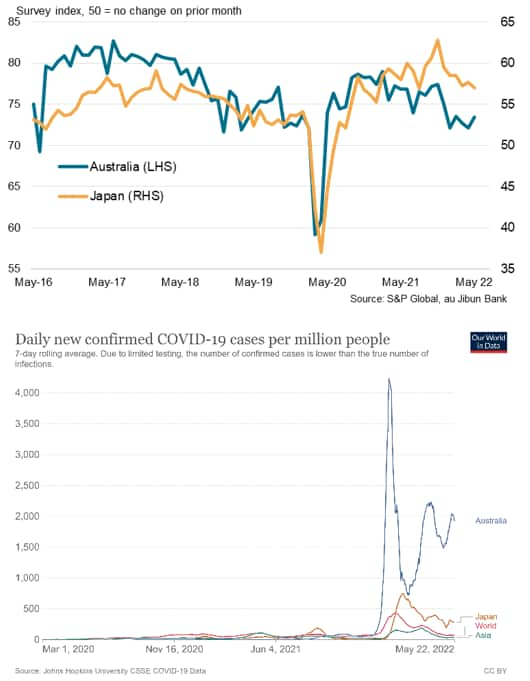

Private sector output continued to expand across Japan and Australia according to May flash PMI data, albeit with rate of growth moving in different directions. While the easing of COVID-19 disruptions in Japan and Australia supported the sustained growth of services business activity, both countries saw manufacturing sector trends deteriorate midway into the second quarter amid heightened supply chain constraints. Issues including the Ukraine war and COVID-19 lockdowns in mainland China continued to be cited as contributors to the supply problems.

Japan and Australia's manufacturing sector performances deteriorate in May

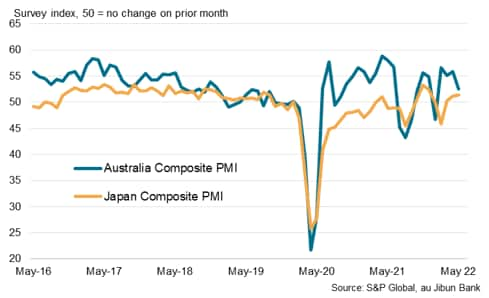

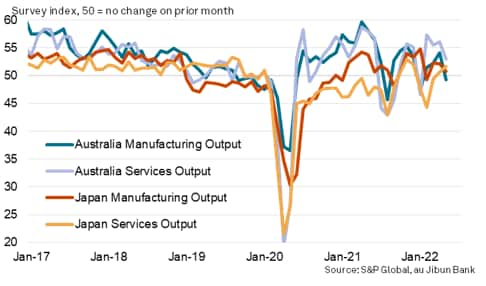

The latest flash PMI data showed Japan's private sector activity expanding for a third straight month and at the fastest pace since December 2021. The au Jibun Bank Flash Japan Composite PMI (compiled by S&P Global) rose to 51.4 from a final reading of 51.1 in April. Services business activity growth accelerated to the fastest in five months, supported by the easing of COVID-19 related restrictions and the diminishing virus impact. Tourism activity notably improved. On the other hand, manufacturing output expanded at the softest pace since February as firms linked the deterioration to heightened supply chain disruptions.

Meanwhile the S&P Global Flash Australia Composite PMI fell to 52.5 in May from a final reading of 55.9 in April. Although still a solid rate of expansion, the rate of growth was the slowest in four months, weighed by a renewed fall in manufacturing production. Over and above the disruptions from the Ukraine war and China's lockdowns, domestic issues including instances of flooding hampered operations for manufacturers in May. Service sector output expansion slowed from April but remained at a rate above the series average to signal strong growth.

S&P Global Flash Composite PMI

Manufacturing and services output

Ukraine war and China lockdowns continue to contribute to supply delays and higher prices in May

The deterioration of manufacturing sector performance had been apparent across both Japan and Australia midway into Q2. Common causes of the persistent supply disruptions including the Ukraine war and COVID-19 related restrictions in China continued to be cited by survey respondents, reflecting the grip that these issues have on manufacturing performance.

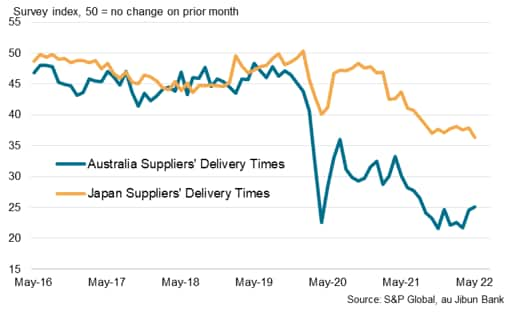

Specifically, suppliers' delivery times lengthened at a faster rate in Japan even as domestic COVID-19 disruptions eased. Manufacturers frequently cited both shortages of inputs and transportation delays linked to the COVID-19 disruptions in China and the Ukraine war contributing to the poorer vendor performance in May.

Australia likewise saw lead times lengthen again in May. Although the rate at which suppliers' delivery times deteriorated eased from April, it continued to outpace the series average, outlining the severity of transportation delays that also contributed to safety stock building inclinations amongst manufacturers. To a large extent, supply issues - including the worsening of weather disruptions in May - had been at the root of the contraction of manufacturing sector output in Australia with new orders remaining in solid growth.

Manufacturing suppliers' delivery times

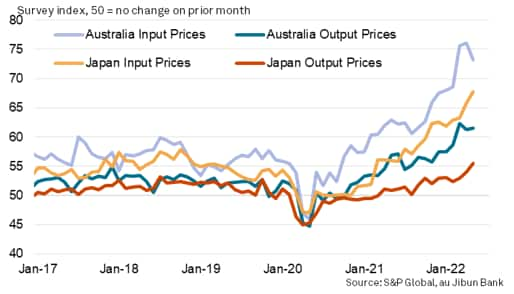

As a result of the supply-demand imbalances, prices continued to climb at rapid rates in both Australia and Japan's private sectors. Overall input costs and output prices rose at the fastest rates on record in Japan. While the rates of price inflation eased in Australia, they remain amongst the fastest on record.

Input and output price indices

Business sentiment remains positive, but firms concerned with rising costs

Overall sentiment about the future in both Japan and Australia meanwhile remained optimistic in May, according to the flash data for these APAC economies, indicating positive expectations for business activity growth in the next 12-months period. That said, relative to prior months, business confidence in Japan dipped to the weakest in six months. Anecdotal evidence pointed to concerns over supply issues and the corresponding rising costs, while some firms remained worried about lingering COVID-19 effects on growth.

Meanwhile in Australia, business confidence improved from April amongst private sector firms but remained at a level below the series average. Concerns similar to their Japanese counterparts had been outlined. Moreover, worries over the impact of rising interest rates, an issue affecting many other APAC economies, had also been detailed by Australia firms. This is an item worth watching with the trend of slowing growth and rising costs apparent in May and could be made more pronounced by the mixture of exogeneous shock to prices and central bank reactions towards rising inflationary pressures.

Future output indices

Sign up to receive updated commentary in your inbox here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freduced-covid19-impact-supports-services-growth-in-japan-and-australia-May22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freduced-covid19-impact-supports-services-growth-in-japan-and-australia-May22.html&text=Reduced+COVID-19+impact+supports+services+growth+in+Japan+and+Australia+but+manufacturing+sector+under+pressure+from+supply+constraints+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freduced-covid19-impact-supports-services-growth-in-japan-and-australia-May22.html","enabled":true},{"name":"email","url":"?subject=Reduced COVID-19 impact supports services growth in Japan and Australia but manufacturing sector under pressure from supply constraints | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freduced-covid19-impact-supports-services-growth-in-japan-and-australia-May22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reduced+COVID-19+impact+supports+services+growth+in+Japan+and+Australia+but+manufacturing+sector+under+pressure+from+supply+constraints+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2freduced-covid19-impact-supports-services-growth-in-japan-and-australia-May22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}