Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 06, 2022

Risk-off sentiment returns

Research Signals - April 2022

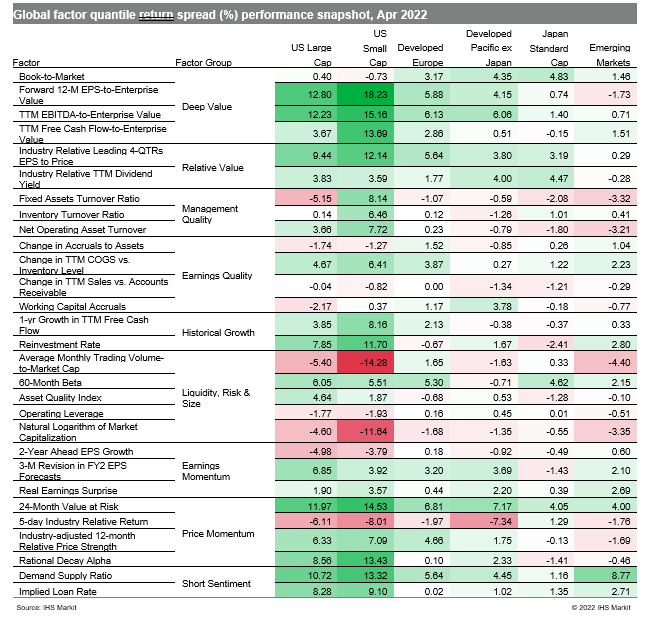

Markets faced economic headwinds as confirmed by some key data releases including the April J.P.Morgan Global Manufacturing PMI which signaled a downturn in worldwide manufacturing production for the first time in 22 months and an initial estimate of a decline in the US Q1 GDP. Geopolitical tensions, escalating inflation pressures and tighter Covid restrictions in China contributed to a sharp snapback in risk-off sentiment across regional equity markets (Table 1).

- US: Investors favored low risk shares and the least shorted names as gauged by 24-Month Value at Risk and Demand Supply Ratio, respectively

- Developed Europe: Both high momentum and risk-off trades were positive last month, as captured respectively by Industry-adjusted 12-month Relative Price Strength and 60-Month Beta

- Developed Pacific: High dividend payers were rewarded in Japan, as identified by Industry Relative TTM Dividend Yield

- Emerging markets: Investors followed similar themes to other regional markets, with positive performance associated with 24-Month Value at Risk and Demand Supply Ratio

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2friskoff-sentiment-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2friskoff-sentiment-returns.html&text=Risk-off+sentiment+returns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2friskoff-sentiment-returns.html","enabled":true},{"name":"email","url":"?subject=Risk-off sentiment returns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2friskoff-sentiment-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Risk-off+sentiment+returns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2friskoff-sentiment-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}