Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 23, 2018

Room remains for additional monetary policy tightening in the Philippines

- The central bank raised its policy interest rate in May for the first time since 2014, citing higher inflationary expectation as inflation breached the upper bound of its target range.

- Consumer price inflation accelerated to a five-year high, marking one of the fastest rates in the region. In addition to cost-push inflationary drivers, demand-pull pressure is rising, indicating a more broad-based upward inflation trajectory.

- Double-digit credit growth has helped to drive one of Asia's fastest-expanding economies, with real GDP growth above 6% in recent years. However, mounting inflation, concerns over economic overheating, and a deteriorating current-account deficit have rendered the local currency one of Asia's worst performers.

- We expect one more rate increase later in 2018 to defend the inflation target, anchor inflationary expectations, and preempt any overheating risks.

First rate hike since 2014

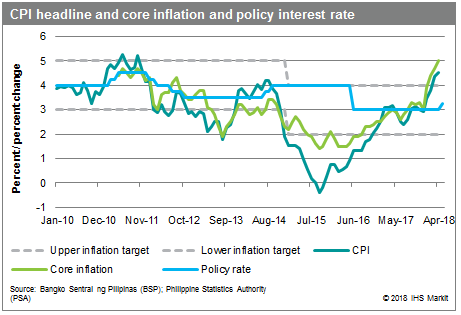

As expected, the Philippine central bank (Bangko Sentral ng

Pilipinas: BSP) raised its key policy interest rate by 25 basis

points to 3.25% during the May meeting, marking the first rate hike

since September 2014 when the policy rate was increased to 4%.

The BSP's move came after consumer price inflation breached the upper end of its inflation target range in early 2018, raising questions about whether the economy is overheating. Indeed, signs of overheating risk in the economy have emerged. Consumer price inflation is running at a five-year high amid a 17% surge in credit growth, rising global oil prices, and the impact of the recent tax reform package on indirect taxes. Real GDP growth is above 6%, while the Philippine peso has remained one of the worst-performing currencies since 2017, as the current-account deficit has widened in the first quarter of 2018.

Mounting inflationary pressure

Consumer prices surged 4.5% year on year (y/y) in April, the

strongest reading since 2013. For the first fourth months,

inflation averaged 4.1%, which along with a 5% surge in core

inflation - excluding certain volatile food and energy items -

topped the BSP's target range of 2-4% for 2018-2019.

Supply-side and external factors have played a large part in lifting CPI inflation. In particular, global oil and commodity prices have rebounded considerably and are expected to increase further. Together with the implementation of tax reform packages and weather-induced volatility on agricultural supply, these factors suggest a further upswing in prices of food and transport, as well as housing, electricity, and other fuels. These items contributed to approximately 75% of inflation in early 2018.

Meanwhile, demand-pull pressure is also rising amid robust consumer spending, rapid credit growth and ample liquidity, falling real interest rates, and an improving labor market (this was indicated by a sharp acceleration in core inflation). With cost-push and demand-pull pressure rising, combined with possible second-round effects from tax reform packages, we expect CPI inflation to exceed the BSP's upper target range in both 2018 and 2019.

Rapid credit growth

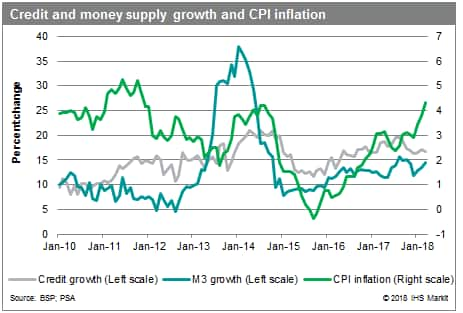

Credit growth has run at a double-digit pace since 2010, fueled by

low interest-rates, vibrant economic activity, rising income and

profits, robust capital and remittance inflows, and the

government's expansionary fiscal policy. Along with the boost in

domestic demand, the economy has consequently expanded at an annual

rate of more than 6% in recent years, marking one of the fastest

growth rates in the region.

It has been argued that the expansion of domestic credit has stemmed from relatively low levels, with credit to the private sector as a percentage of GDP remaining at just 45% in 2016, which was among the lowest compared with Asian peers. However, the rate of expansion averaged more than 16% during 2012-17, the fastest rate in the region. This rapid expansion is unlikely to prove sustainable without raising the risk of overheating in the economy.

Swelling credit growth is fueling inflationary pressure and resulting in even lower real interest rates, which in turn encourage further credit growth and may create a vicious cycle leading to excessive credit and economic overheating.

Among Asia's worst-performing currency

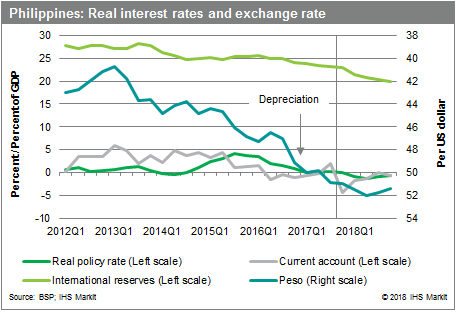

Despite strong economic fundamentals, the Philippine peso has

steadily weakened since 2013. At end-2017, the peso depreciated by

about 12% to PHP49.92/USD1.00, making it one of the worst

performers in the region. US monetary policy normalization,

compounded by easing local interest rates, the current account's

fall into deficit, and President Rodrigo Duterte's controversial

rhetoric and war on drugs have undermined investor confidence and

dragged the peso into a rapid depreciation in 2016-17.

These factors, coupled with mounting concerns over inflation, increasing geopolitical tensions, and further US monetary tightening dragged the peso to a fresh 11-year low of PHP52.35/USD1.00 in late February 2018. It has subsequently remained weak through early May.

Further rate hike is expected

Amid intensifying inflationary pressure, the BSP has revised up its

inflation forecast to 4.6% for 2018 and 3.4% for 2019. While

blaming temporary supply-side factors for the upsurge, the BSP also

acknowledged a more broad-based pressure is developing to overall

price levels.

In addition, despite the BSP's rate hike, the peso weakened further to a fresh 11-year low during the week of 14 May. The peso's weakness indicates still-jittery investor confidence as the economy remains at risk of overheating. It suggests that excessive credit and demand growth could disrupt the stability of prices and the financial market, while a deteriorating current-account balance will intensify downside risks to the peso.

Taking current economic conditions into account - and considering the similar environment in 2014, when the Philippines most recently tightened its monetary policy - we expect one more rate hike by the BSP during later 2018 to defend its inflation target, anchor inflationary expectations, and preempt any overheating risks.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2froom-remains-for-additional-monetary-policy-tightening-in-the-philippines.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2froom-remains-for-additional-monetary-policy-tightening-in-the-philippines.html&text=Room+remains+for+additional+monetary+policy+tightening+in+the+Philippines+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2froom-remains-for-additional-monetary-policy-tightening-in-the-philippines.html","enabled":true},{"name":"email","url":"?subject=Room remains for additional monetary policy tightening in the Philippines | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2froom-remains-for-additional-monetary-policy-tightening-in-the-philippines.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Room+remains+for+additional+monetary+policy+tightening+in+the+Philippines+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2froom-remains-for-additional-monetary-policy-tightening-in-the-philippines.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}