Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 18, 2024

Rotation robustness; what the short data shows.

As the stock market rally starts to broaden out, short sellers remain unconvinced of its potential.

As confidence grows for a September rate cut by the Federal Reserve Bank, following the softer than expected inflation data seen earlier this month, investors appear to be repositioning their portfolios as the market rally expands from the narrow leadership of the "magnificent seven". As interest rate cuts lower the cost of capital, small-cap equities are set to benefit, and this is where investors appear to be heading, pushing the Russell 2000 up 10.13% year-to-date.

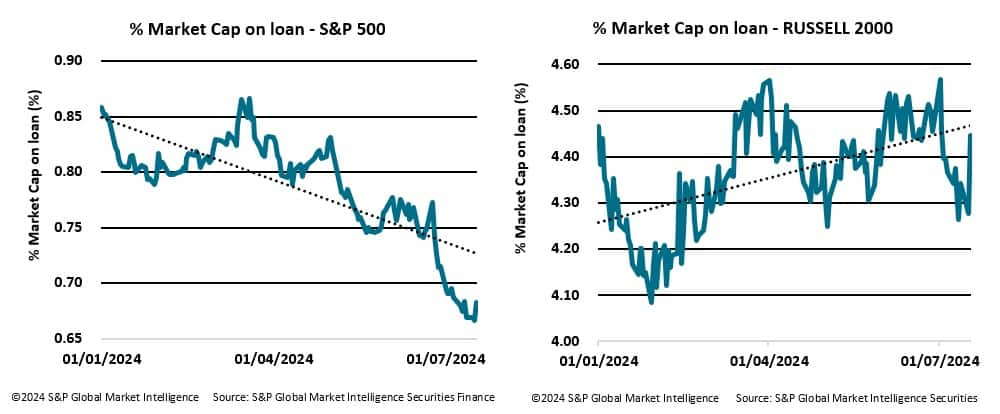

In the securities finance markets, short sellers appear to be unconvinced that the current rotation into small cap stocks is here to stay. The percentage of market capitalization on loan of the S&P500 Index is continuing to fall, signifying positive sentiment in the persistence of the current rally, whilst the opposite can be seen across the Russell 2000. Short Interest across the Russell 2000 index has been rising since July 12th.

With a growing number of risks on the horizon, looking at the short Interest data, it appears that investors may need a little more convincing before unwinding their current short positions across these two indices.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frotation-robustness-what-the-short-data-shows-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frotation-robustness-what-the-short-data-shows-.html&text=Rotation+robustness%3b+what+the+short+data+shows.++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frotation-robustness-what-the-short-data-shows-.html","enabled":true},{"name":"email","url":"?subject=Rotation robustness; what the short data shows. | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frotation-robustness-what-the-short-data-shows-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rotation+robustness%3b+what+the+short+data+shows.++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frotation-robustness-what-the-short-data-shows-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}