Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2018

Russian interest rates fall following sustained drop in inflation

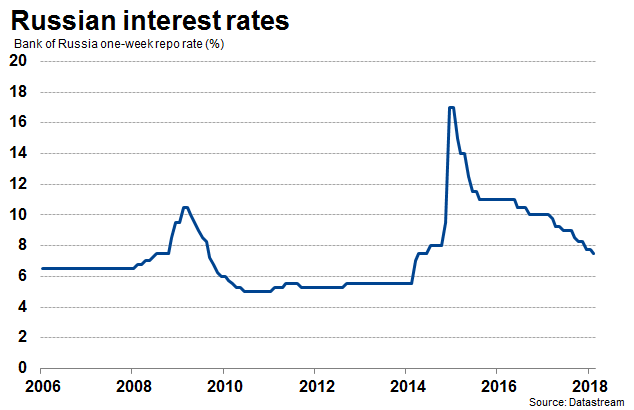

- Central Bank of Russia cuts its key interest rate to 7.5% in February, the lowest since mid-2014

- PMI surveys indicate that inflationary pressures remain subdued

- Official inflation rate drops to 2.2% in January

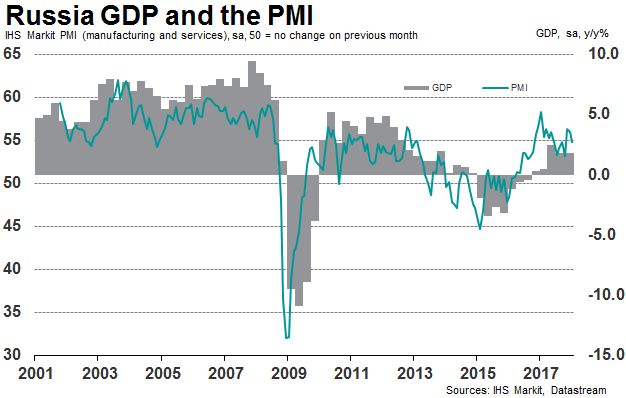

While many economies are seeing central banks become more hawkish, Russia is bucking the trend. The start of 2018 saw another reduction in the interest rate set by the Central Bank of Russia, amid lacklustre inflationary pressures. Following stronger growth since late-2016, momentum in consumer demand has subsequently eased. Struggles to lift demand conditions from their low base have meanwhile coincided with a decline in inflationary pressures, suggesting further policy stimulus is on the cards.

To encourage greater borrowing and spending among Russian consumers, the Central Bank of Russia began cutting its key interest rate from 17% in early-2015. It is widely expected that further cuts will be made to the current rate of 7.5% throughout 2018, with another rate reduction expected in the coming months.

Subdued price pressures persist

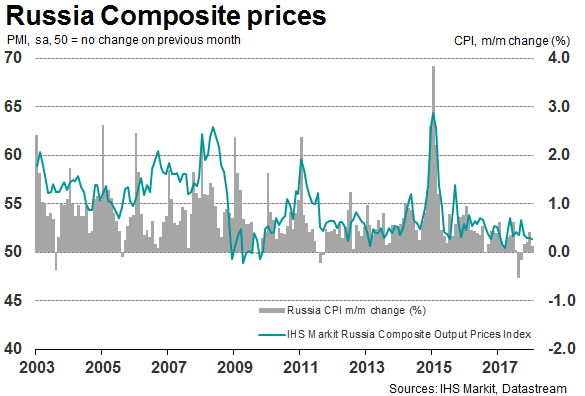

At just 2.2%, the latest consumer price inflation rate has fallen well below the central bank’s target of 4% and represents one of the lowest levels of inflation in the post-Soviet era. Moreover, the deceleration has been fast, with the rate of inflation declining from 16.9% in just under three years.

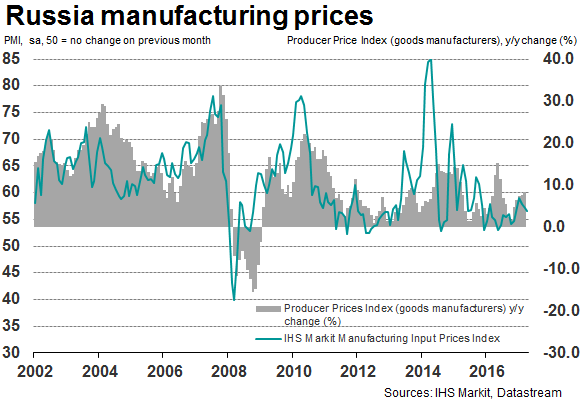

The inflation rate could fall further. January survey data signalled a softer rise in input costs faced by Russian private sector firms. At a seven-month low of 54.6, the IHS Markit Composite Input Prices Index indicated a muted pace of inflation in the context of the series history in January. Service sector costs rose at the joint-weakest rate since August 2010 and manufacturing production costs also grew at a softer pace.

Subdued cost pressures reflected the conclusions of the central bank that highlighted moderate increases in wages and a softer rate of non-food inflation as key contributing factors driving a further cut in interest rates.

Weaker supply-side cost pressures have in turn contributed to slower growth of average prices charged by companies. Firms generally seek to pass on greater cost burdens to their clients through increased output prices; however, a rise in competitive pressures has limited the pricing power of firms, according to anecdotal survey evidence. The latest IHS Markit Composite Output Prices Index indicated only a modest rise in charges, having dipped to a 10-month low, largely driven by a weaker increase in charges set by service providers.

Changing inflation dynamics

January’s official rate of inflation marks the seventh successive month that prices have increased at a pace below the 4% target. Following a poor harvest in 2017, increased food prices drove inflationary pressures. It is expected that these effects will drop out of the figures throughout the first half of 2018 as food production levels have recovered, and inflation will likely remain well below the Bank’s target throughout 2018, according to IHS Markit forecasts. In fact, price rises are not expected to touch the 4% target until 2019.

Although food and oil prices will continue to pose an upside risk to inflation, the Central Bank of Russia also sees external factors and uncertainty regarding global financial markets as sources of upward inflationary risk. Actions within these markets will be significant in determining the upward or downward risks for Russian inflation.

Forthcoming economic data releases:

- March 1st : IHS Markit Russia Manufacturing PMI (February)

- March 5th : IHS Markit Russia Services PMI (February)

- March 6th : Inflation Y-o-Y (February)

- March 23rd : Next interest rate meeting of the Central Bank of Russia

- April 3rd : GDP Preliminary Growth Rate (Q4)

Sian Jones, Economist, Economic Indices IHS Markit

Tel: +44 1491 461017

sian.jones@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-interest-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-interest-rates.html&text=Russian+interest+rates+fall+following+sustained+drop+in+inflation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-interest-rates.html","enabled":true},{"name":"email","url":"?subject=Russian interest rates fall following sustained drop in inflation&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-interest-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+interest+rates+fall+following+sustained+drop+in+inflation http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frussian-interest-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}