Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 06, 2022

Securities Finance April 2022 Snapshot

$1.058b in April securities finance revenue

- April revenues climbed by 32% YoY

- ETP and Corporate bond borrow fees increase on last month

- Slump in ADR borrow demand continues

- European markets boosted by dividend yields

Global securities finance revenues totaled $1.058b in April, a 32% YoY rise. The YoY increase was primarily the result of equities, with all regions showing YoY growth. Average daily global revenues decreased 2% MoM compared with March. American equities and global ETPs are notable in revenue growth driven by both YoY increase in balances and fees. In this note, we will review the drivers of April revenue.

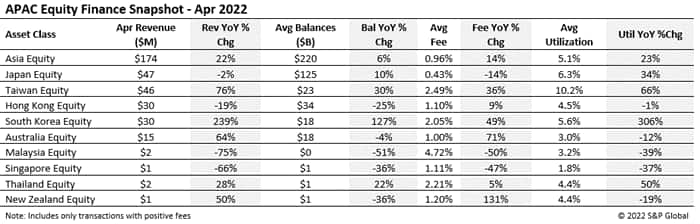

APAC Equity

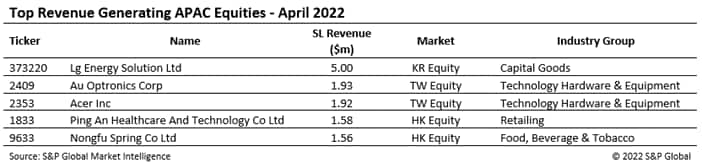

APAC Equity Finance revenues totaled $174m in April, up 22% YoY but down 15% from the YTD high in March. Last month the average value on loan was $275bn but reduced borrow demand in April saw loan balances drop to $220m. Japan was on top in April, generating $47m of equity finance revenue but Taiwan retains 2nd spot delivering $46m, up 76% YoY. South Korea remains buoyant, producing $30m and up 239% YoY, with Hong Kong also generating $30m but down 19% YoY.

The top revenue name is Lg Energy Solution for the second month in a row, delivering $5m in April. Taiwan stocks Au Optronics Corp and Acer Inc generated $1.93m and $1.92m respectively. Cost pressures and lockdown restrictions have driven borrow demand for bottled water maker Nongfu Spring, generating $1.56m in equity finance revenue and entering the APAC top 5.

Americas Equity

Americas Equity Finance revenues totaled $362m in April, +49% YoY and -11% MoM. We saw an increase in both average fees (+23.7% YoY) and average balances (+20% YoY). Despite the YoY increase we saw a downtick MoM with fees (-4%) and balances (-4%) both decreasing.

Canadian Equities revenue remained mostly flat YoY (+2.4%) producing $24.1m for April with continued offsetting drivers observed in a +20% YoY increase in balances but a decrease of -15% YoY in average fees. US Equities generated $335.9m, with a +54% increase YoY and -10% MoM decrease.

Sweetgreen (SG) and Rivian Automotive (RIVN) topped the list for April generating $18.71m (+67% MoM) and $15.46m (+43% MoM) respectively. Sweetgreen and Rivian's ascent to the top of the list was due to an increase in fees of 86% and 54% from March. We saw a significant drop in the top two names from March as Lucid Group (LCID) and Digital World Acquisition Corp (DWAC) declined in revenue by -65% and -63% respectively. Two entrants into the top 10 were Gamestop Corp (GME) and Sirius Xm Holdings Inc (SIRI). Both securities saw major spikes in fees from March with deltas of +98% for GME and +81% for SIRI.

European Equity

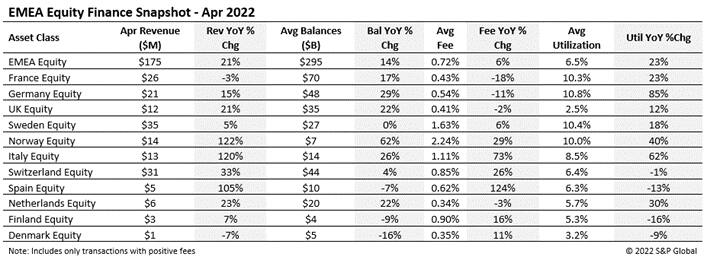

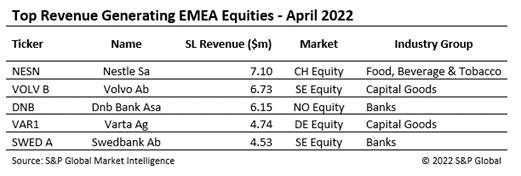

Dividend yields have continued to boost equity finance revenue in Europe, generating $175m in April, up 21% YoY and 43% from March. Renewed demand in the region has increased the utilization of assets to 6.5%. Sweden ($35m), Switzerland ($31m) and France ($26m) saw strong securities finance returns, and utilization exceeded 10% in France, Germany, Sweden and Norway. Italy generated $13m in equity finance revenue with high demand for insurance group Assicurazioni Generali Spa contributing almost 30% of the total in April.

Swiss stock Nestle took top spot in April, generating $7.10m, with demand for German name Varta remaining robust. Nordic securities Volvo, Dnb Bank & Swedbank make up the rest of the top 5 generating $17.42m between them.

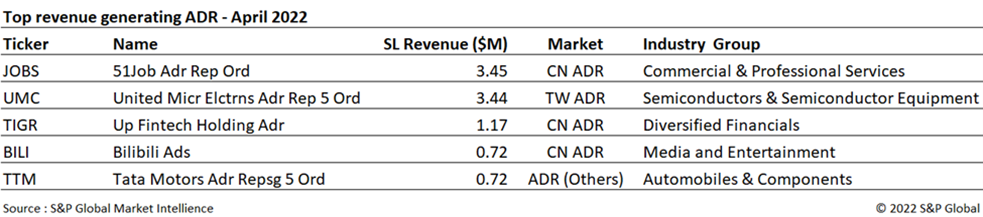

Depository Receipts

Revenues from lending American Depository Receipts (ADRs) in April continued the downswing with a 35% YoY drop totaling $23m, although up 33% from March. ADR securities finance revenues were led by 51Job (JOBS) and United Microelectronics (UMC). JOBS contributed 15% of the ADR revenue with $3.45m this month. Loan balances for ADRs dropped to $29b, the lowest figure since September 2020, and a 5.3% YoY dip in utilization further contributed to the April slump.

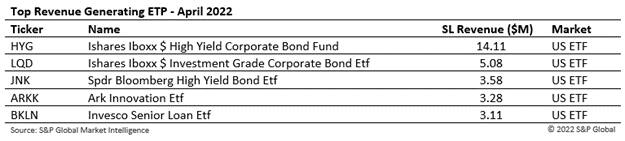

Exchange Traded Products

Global ETPs Revenue remained strong in April totaling $81m, up 48% YoY and only down 4% from the all-time high in March. Although loan balances dropped 10% MoM to $119bn, fees reached a YTD high of 0.84% and lendable assets rebounded from their March dip to $481bn, up 3% MoM. This led to a monthly-average utilization of 11.9%, down 2% YoY.

Americas ETPs remained the strongest revenue generator with Ishares Iboxx $ High Yield Corporate Bond Fund (HYG) generating $14.11m, up 10% MoM. Ishares Iboxx $ Investment Grade Corporate Bond Etf (LQD) was the second highest revenue generator with $5.08, up 19% MoM.

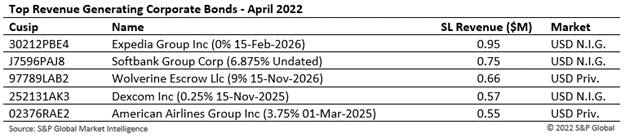

Corporate Bonds

Corporate Bond lending revenues reached a new all-time-high of $75m in April, up 101% YoY. Average balances dipped 1% MoM to $290bn and lendable assets dropped to $4.3tr, a 2% decrease MoM and a 6% decrease YoY. Fees, however, remained robust at 0.31%. As both lendable assets and loan balances moved in lockstep, utilization remained steady at 5.7%, a 46% YoY increase.

Expedia Group Inc 0% note retained its position as the top revenue generator with $0.95m, up 8% MoM. The new entry to the top 5 was the Dexcom Inc 0.25% note with $0.57m monthly revenue due to a sharp increase in fee reaching 2.14%, up 550% MoM.

Government Bonds

Global sovereign debt fee-spread revenues totaled $145m for April, a 12% YoY increase however down 5% MoM. Demand for government bonds increased by 5% YoY which translated to daily average balances of $1.32T in April. Average fees increased 6% YoY.

US government bond lending generated $73.9m, a 3% decrease YoY for positive-fee balances but a 4% MoM uptick. European debt lending generated $53.1m, up 24% YoY, however down 7% MoM driven by a decrease in average balances of 4% compared to March.

Total government bond lending revenue for agency programs including reinvestment returns and negative fee trades decreased 3% YoY mostly driven by a 4% decrease in average balances YoY and reinvestment revenue that decreased 6% YoY that offset a 9% YoY increase in average fees.

Conclusion

A slight bounce in April saw securities finance revenues increase 32% YoY, with similar demand drivers persisting and a less severe decline in ADR revenues. Uncertainty in the fixed income asset class was marked by narrowing UST borrow demand amidst the steep hike in interest rates. The upswing in EMEA revenues was boosted by dividend yields in Sweden and Switzerland. The use of exchange traded products in institutional long portfolios and for short hedges has resulted in record highs for lendable assets and loan balances, with increased borrow demand likely to continue to bolster revenues going forward. Demand for corporate bonds continued last year's trend, with April monthly revenue seeing 101% YoY growth.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-2022-snapshot.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-2022-snapshot.html&text=Securities+Finance+April+2022+Snapshot+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-2022-snapshot.html","enabled":true},{"name":"email","url":"?subject=Securities Finance April 2022 Snapshot | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-2022-snapshot.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+April+2022+Snapshot+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-2022-snapshot.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}