Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 06, 2023

Securities Finance February Snapshot 2023

- February revenues of $1.054B generated

- Strong revenue increases YoY but revenues decrease slightly MoM

- Fixed income assets continue to outperform

- US equity specials activity heats up further

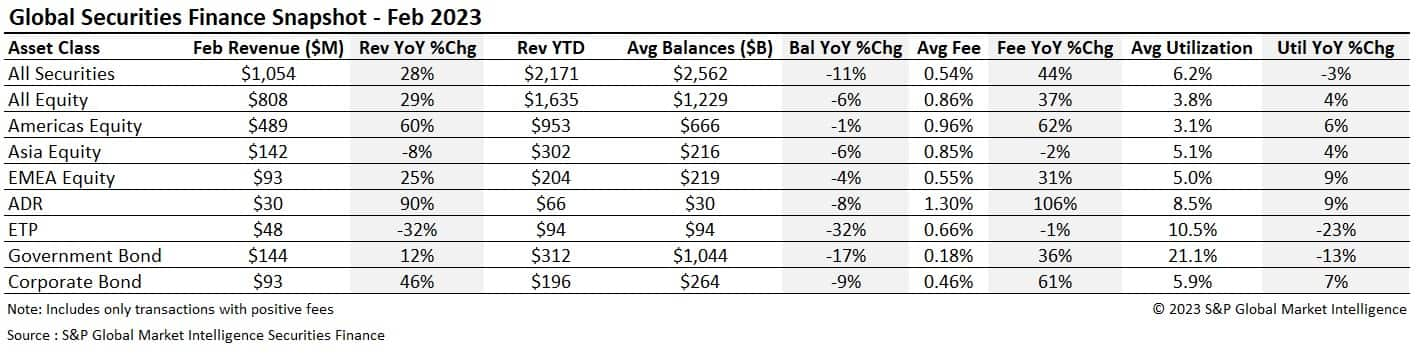

Securities finance revenues of $1.054B were generated throughout February. This was an increase of 28% YoY. This increase in revenues was the result of significantly higher average fees. Over the month average fees were 54bps which was an increase of 44% YoY and 8% MoM. Americas equities, ADR's and corporate bonds saw the largest increases in fees YoY. Americas equities also experienced a significant increase MoM as US equity specials activity increased to 80% of all monthly US equity revenues (74.8% in January).

Equity revenues declined 3% over the month. This decline was a result of a decrease in revenues from EMEA equities (-16% MoM) and Asia equities (-12% MoM). When compared YoY, EMEA equity revenues (+25% YoY) and average fees (+31% YoY) and utilization (+9% YoY) all increased significantly. Asia equities saw declines across most metrics when compared on a YoY and MoM basis.

Both corporate bonds and government bonds increased their revenues YoY but these declined when compared MoM (government bonds -14% and corporate bonds -10%). Average fees remained unchanged MoM across government bonds (18bps) but declined slightly across corporate bonds (-1bps to 46bps). Balances across corporate bonds increased MoM by 2% to an average of $264B.

Americas equities

Equity markets across the Americas region remained volatile over the month. Investors looked to digest and reposition portfolios following the release of economic data pointing towards a slower decline in inflation, a robust labor market and stronger than expected consumer spending. Swings were seen across the Nasdaq and the S&P 500 as some of the gains that were made during January started to unwind as bond yields started to push higher.

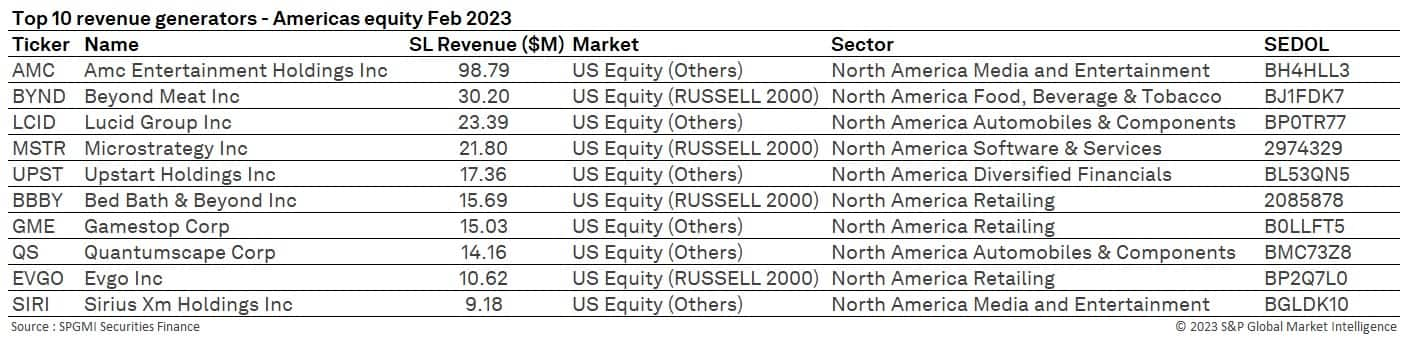

Americas equities are experiencing a very strong start of the year generating over $953M in revenues since January. This is 66% higher than the same period during 2022 ($573.9M). Revenues generated by Americas equities increased by a very impressive 60% YoY and 8% MoM. Both balances and utilization decreased over the month, but average fees increased. This is a direct result of the growth in specials activity that was seen over the month. Average fees increased 62% YoY to 96bps and 16% MoM, increasing from 81bps during January.

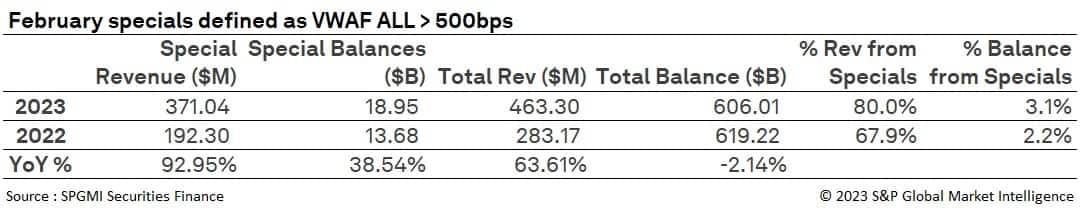

US equity specials revenues increased to $371M which is 93% higher when compared YoY and 14% MoM ($320M during Jan). Specials activity accounted for 3% of all US equity balances and 80% of all revenues derived from US equities. Specials activity remains an important driver of revenues across the Americas equities asset class. This is also reflected in the totals generated across the top ten highest revenue generating stocks. During February, these stocks generated $256M ($98.7M from AMC alone). During January the top ten highest generating stocks produced $209M, an increase of 22%.

US equity specials:

VWAF = Volume Weighted Average Fee

Over the month, demand strengthened for AMC as a result of the upcoming vote that may lead to a 1:1 share offer between AMC and APE shares. Fees for AMC shares reached their peak during the last week of February before starting to decline along with utilization. Recent press reports have stated that the increased cost of borrowing the shares, along with high utilization levels, have started to weigh heavily on the risk profile and the overall profitability that can be generated from this potential opportunity. This may explain why both utilization and fees started to fall towards the end of the period.

Interest in Quantumscape Corp (QS) increased throughout the month. As reported previously, the EV (electric vehicle) sector remains a firm favorite for short sellers as the high barriers to entry in this market are making it difficult for automobile / tech companies to generate profits in the short to medium term. Quantumscape (QS) shares fell 14% on the 15th February after posting another quarterly loss.

Similarly, Evgo Inc (EV), which owns and operates fast charging networks across the USA, also entered the table during February, generating just over $10M. Redundancies across the company to optimize its cost structure reportedly led to a decline in its share price over the month. The company (at the time of writing) has just over 11% of its outstanding shares on loan. Other EV related stocks such as Lucid Group (LCID), and Sirius XM Holdings Inc (SIRI) generated slightly lower revenues than January.

APAC equities

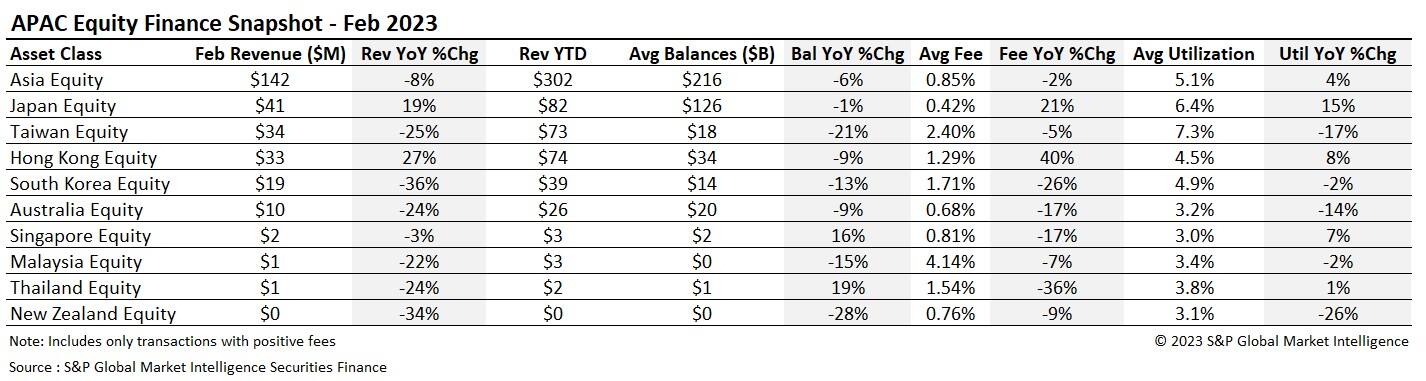

Revenues across APAC equities declined 8% YoY (12% MoM) to $142M. Revenues decreased across all markets except Japan and Hong Kong. Balances and fees also declined YoY but utilization increased by 4% reaching a six-month high at 5.1%. Despite revenues falling when compared with January and February 2022, they're still significantly higher than those seen during February 2021 ($123.7M) and February 2020 ($134.6M).

Revenues declined the greatest in South Korea (-36% YoY) which is likely to be a result of the reduction also seen in average fees (-26% YoY). Revenues over the year are approximately down by 40% compared to 2022. Balances did grow over the month by $517M but they remain significantly under the $16.2B average that was seen during 2022.

Revenues generated by Japanese equities during the month equaled those generated during January. Year to date revenues for Japanese equities are approximately $16M higher during 2023 than at the same point of the year during 2022. Revenues increased 30% YoY during January and 19.5% YoY during February. Utilization also increased 30% MoM and 15% YoY and is now trending above the 2022 average (6.13%). Heading into March, which is typically one of the strongest months for Japanese equity revenues, performance is looking stronger when compared to 2022 and 2021.

Revenues increased in Hong Kong YoY (+27%) over the month. Most of the high earning APAC stocks from February were listed in this market. Average fees and utilization also increased. Balances fell slightly YoY but remained relatively flat on January.

Across the rest of the region revenues declined YoY. Revenues in Australia decreased to $10M over February, down approximately 33% on January. Average fees in the country also fell YoY and MoM by approximately 16%. Revenues in Malaysia and Taiwan were down YoY. The average fee across Taiwan (240bps) fell to the lowest level since May 2021.

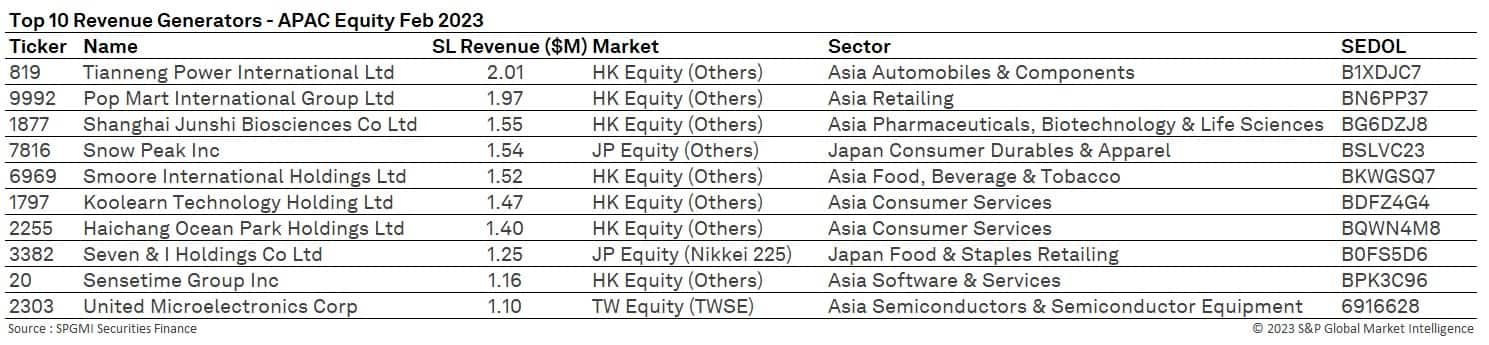

The top ten revenue generating stocks in the APAC region were dominated by Hong Kong listed equities and accounted for just over 10% of the entire revenues generated by APAC equities. Revenues fell across Koolearn Technology Holding Ltd (1797), Shanghao Junshi Biosciences Co Ltd (1877) and Tianneng Power International Ltd (819) over the month.

Seven and I Holdings Co Ltd (3382), a Japanese food retailer, entered the top ten during the month as demand increased towards the end of the month as its record date approached. Sensetime Group Inc (20 HK), which has been a popular borrow for some time, also joined the top ten. The company has been affected by legislation that bans US entities from exporting goods to Chinese technology companies. This has had an impact upon its share price and has led investors to believe that the company may come under financial pressure in the future.

EMEA equities

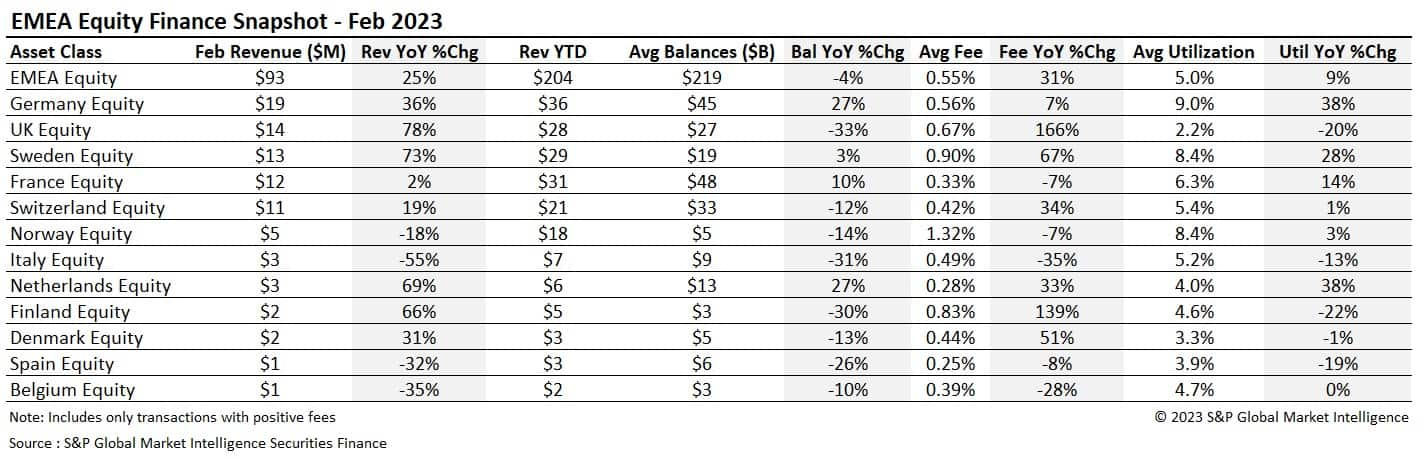

Securities finance revenues across EMEA equities increased by 25% YoY, generating $93M over February. This is the highest February figure seen since 2020. Despite the increase YoY, revenues declined 16% MoM (Jan revenues $111.4M). Revenues across most countries increased when compared YoY, with the greatest increases seen in the UK (+78%), Sweden (+73%), Netherlands (+69%) and Finland (+66%). Average fees also increased across all EMEA equities (to 55bps +31% YoY), with the largest increases seen in the UK (+166%), Finland (+139%) and Sweden (+67%).

Revenues across UK equities were buoyed by Tui AG (TUI) and Aston Martin Lagonda Global Holdings Plc (AML) which can be seen in the highest revenue generating stocks table below. Both stocks collectively contributed 47% of the top ten revenues. Returns across the UK were flat oin January. Average fees of 67bps are the highest since November 2020. The first months of 2022 offered lower than average revenues for UK equities. This explains why the UK offers some of the largest increases seen through a YoY comparison.

Germany reclaimed its place as the highest revenue generating country during the month as revenues in France fell MoM. Revenues in Germany were the highest since August 2022 and were 36% higher YoY and 16% higher MoM. Average fees in Germany also increased over the month (43bps during January) reaching their highest level (56bps) since July 2022 (60bps). Balances in Germany have increased significantly when compared YoY (+57% January and +27% during February).

Scandinavia continued to offer strong performance over the month. Borrowing in Swedish stocks remained strong with Samhallsbyggnadsbolaget I Norden Ab (SBB B) the highest revenue generating stock within the region. Average fees across Norway remained high at 132bps whilst increasing 139% (to 83bps) in Finland and increasing 51% in Denmark to 44bps. Revenues across Scandinavia accounted for 24% of total revenues for EMEA.

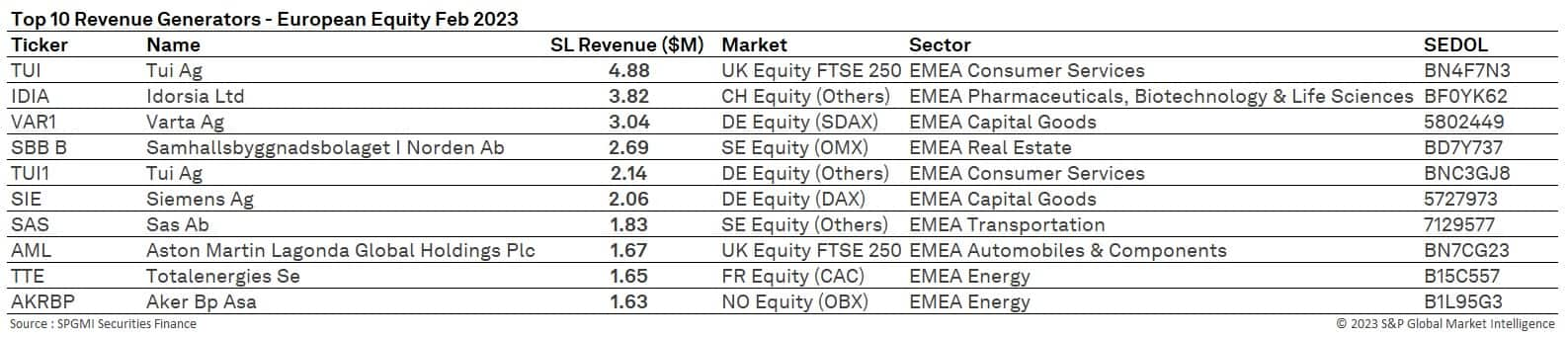

Tui AG was the highest revenue generating stock of the month. It currently has a short loan quantity of 67M shares which equates to circa 34% of all shares outstanding. Revenues increased significantly over the month ($2.6M January) as days to cover topped 100 days for the first time.

Idorsia Ltd (IDIA) remained a popular borrow throughout the month despite revenues declining slightly, when compared with January. The company remains under pressure as uncertainty remains regarding the company's funding requirements for reaching its 2025 profitability targets.

Several German stocks appeared in the table. Revenues and fees increased in Siemens as the company declared its dividend during the month and Varta AG (VAR1) and Tui AG (TUI1) remained popular and well documented short positions amongst market participants.

ADR's

Revenues across ADR's grew significantly (+90%) when compared with February 2022 but declined 16% when compared MoM. Average fees also followed this trend, increasing 106% YoY to 130bps but declining 10% MoM (January fee 144bps). Average balances were slightly higher than the 2022 average ($29B) over the month but utilization fell 9bps to 8.55%.

Xpeng (XPEV) continued to drive revenues across this asset class. Fees in this stock have declined over February despite active utilization remaining above 95%. A similar situation took place across Polestar Automotive (PSNY). Benchmark fees declined but active utilization remained relatively high (+65%). The automotive sector remains well represented across the ADR space, accounting for the top three highest revenue generators. Tencent holdings generated $640K during the month. This stock has once again been affected by the selloff in tech stocks over the month and remains challenged by financial difficulties.

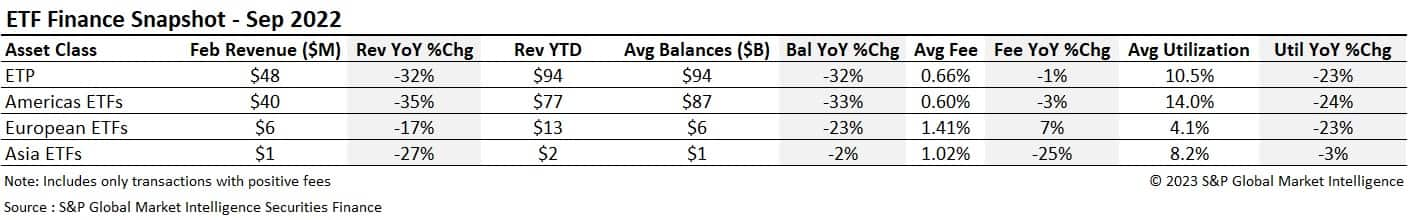

Exchange Traded Product's

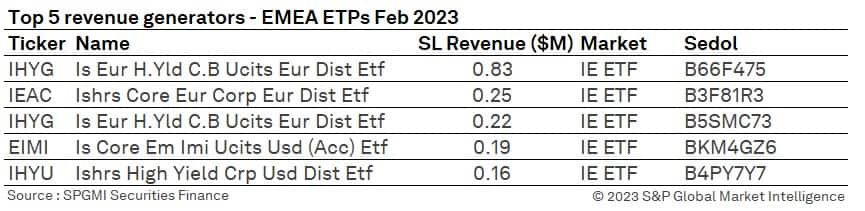

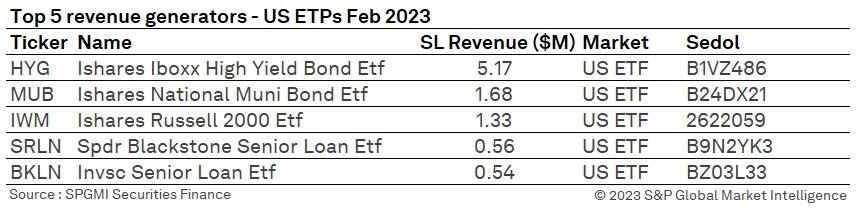

Revenues, balances, and utilization all declined across exchange traded products YoY but increased MoM (Jan revenues $46M, balances $91B and utilization 9.4%). The increase in revenues was generated by Americas ETFs, increasing 7% over the month. Average fees increased across both Americas and European ETFs over the month, but a decline was seen in Asian ETFs.

Over the month, the financial press has been reporting heavily on ETF investor flows. Uncertainty surrounding inflationary trends and the moderate losses seen across some equity markets has pushed greater flows into bond ETFs. Fixed income ETFs dominated the highest revenue tables over the period. The only equity ETF to appear was the iShares Russell 2000 (IWM). Given the possibility of higher terminal rates in the US as a result of strong data released during February, investors looked to short the small / mid cap equities as they remain more sensitive to increases in interest rates in the US economy.

Revenues across the corporate bond ETFs increased significantly throughout the month. Revenues in HYG increased from $1.33M in January to $5.17M during February. Increases were also seen in IHYG in Europe ($0.77M in January) and IEAC ($0.21M in January). iShares National Muni Bond ETF (MUB) generated $1.68M in revenues over the month increasing from $0.92 during January. As Municipal bonds tend to have a low weighted average maturity and offer low interest rates in comparison to Treasury equivalents, the risk of a higher-than-expected terminal rate, puts pressure on the prices of these assets.

Government Bonds

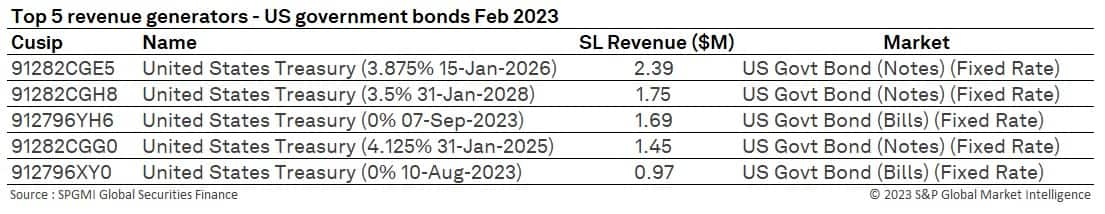

Over the course of February, the yield on the ten-year US Treasury surpassed 4% for the first time since November 2022, as investors sold bonds in anticipation of a longer period of higher interest rates. During the month, one of the largest yield inversions ever seen across the 2's/10s yield curve took place as the 2yr Treasury hit a sixteen year high of 4.929%, which is nearly a full percentage point higher than the US ten-year Treasury bond. Yield curve inversion usually predates a recession by twelve to eighteen months but so far, despite this inversion being present for some time and becoming wider, economic data continues to strengthen and countries around the world continue to dodge the predicted recessions. This is leading many economists to question whether a recession has been avoided or just delayed.

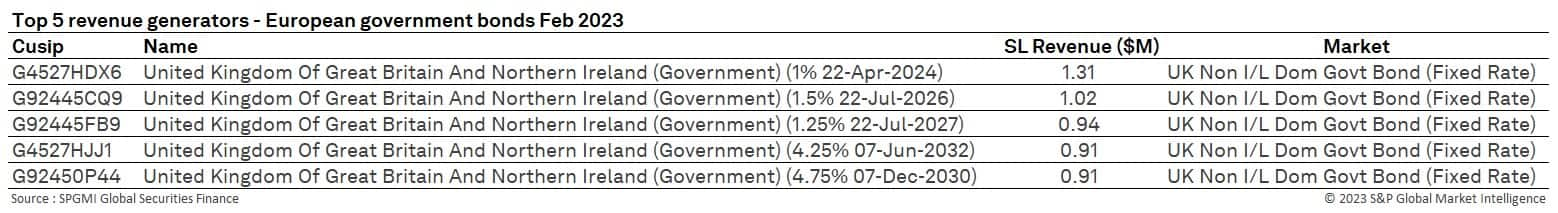

Over the month, revenues generated by government bonds increased 12% YoY but decreased 15% MoM. Average fees remained steady at 18bps which is 3bps higher than the 2022 average. Average utilization decreased both over the year and the month. Revenues for the first two months of 2023 are currently 14% higher than during the first two months of 2022. Utilization (21.1%) is at its lowest however since 2020.

The highest revenue generating government bonds continue to be the very short-dated issues. This is the same across the US and Europe. European government bonds are all UK denominated. Investor short interest has grown across UK Gilts in recent weeks given the rapid increase in interest rates and the stubbornly high levels of inflation. The UK holds a higher proportion of its debt in inflation linked bonds which means that the UK's interest payments are likely to surpass those of countries that have larger debt issuance levels such as France and Italy over the coming years.

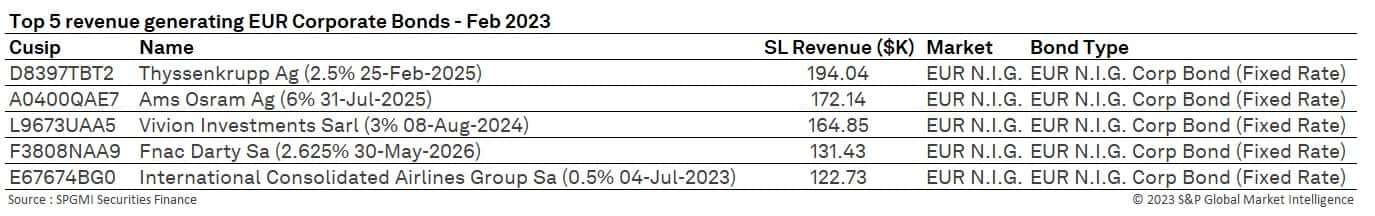

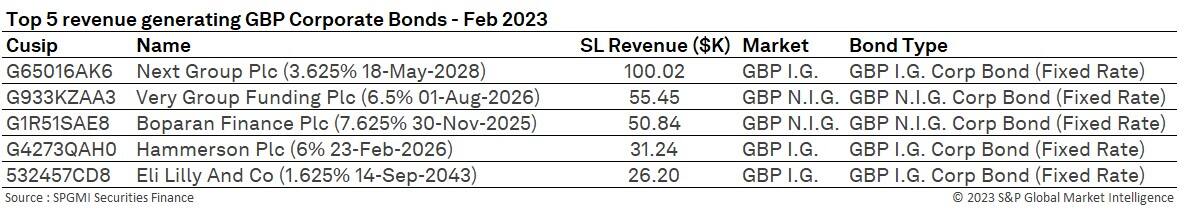

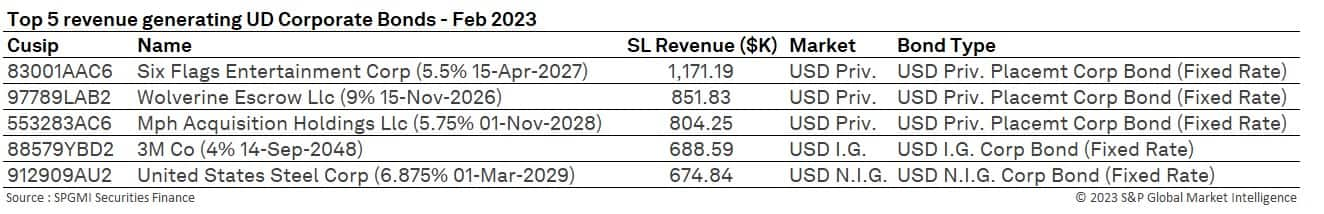

Corporate Bonds

Revenues generated by corporate bonds increased 46% YoY to $93.1M. Despite decreasing when compared to January ($102M), revenues for Q1 2023, after two months, are only $10M less than Q1 2022, and are the equivalent of the first five months of revenues for both 2021 and 2020. Over the month average fees dipped 1bps to 46bps (+60% YoY) from the all-time high seen during January, offsetting a decline of 9% YoY in balances. Utilization increased over the month to 5.86%, which is also likely to be a near record level.

During February, the recent steep rally that took place in credit prices, as traders bet that central banks will stop rate hikes at a lower level than previously expected, concluded as stronger than expected economic data put yields and prices back into reverse. Stronger-than-expected January employment data sparked a reassessment of how much higher the Fed's policy rate might need to go to stifle inflation. Investors also bet that the peak of ECB interest rates would reach 4% for the first time after France and Spain posted higher than expected inflation figures. The ongoing uncertainty surrounding interest rates continues to provide opportunities for borrowers of corporate bonds. A mixture of lower market liquidity and the more volatile asset prices continues to stoke demand for the asset class.

Conclusion

Securities finance activity remained robust throughout the month of February. Strong revenues driven by fixed income assets and US equities ensured that revenues significantly increased YoY. The continued volatility within the financial markets driven by the uncertainty surrounding terminal interest rate levels and the slowdown in inflation continue to provide significant borrowing opportunities for market participants. Whilst inflation remains stubborn and relatively high across major world economies and the uncertainty regarding soft, hard or no landing scenarios remains, the investment landscape is expected to remain challenging. The first quarter of 2023 is likely to be very strong for the securities lending market, although, as was the case in 2022, not all market participants are likely to reap the benefits on offer to the same degree given the specific pockets of demand and revenues that are on offer.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2023.html&text=Securities+Finance+February+Snapshot+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2023.html","enabled":true},{"name":"email","url":"?subject=Securities Finance February Snapshot 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+February+Snapshot+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}