Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 12, 2021

Securities Finance: H2 2020 Review

- H2 revenues decline 10% YoY

- Q4 IPO boom boosted US equity returns

- EMEA specials boost H2 revenue past H1 total

- Lack of specials subdues APAC revenues

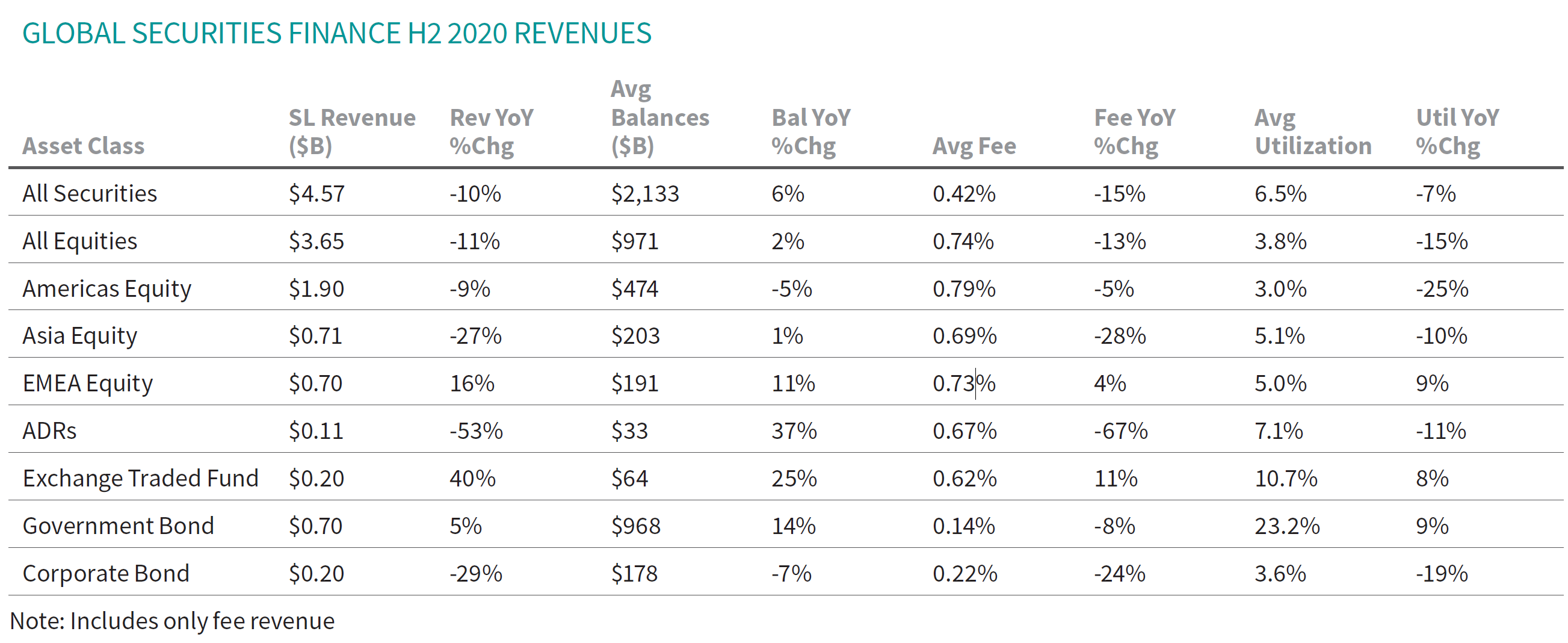

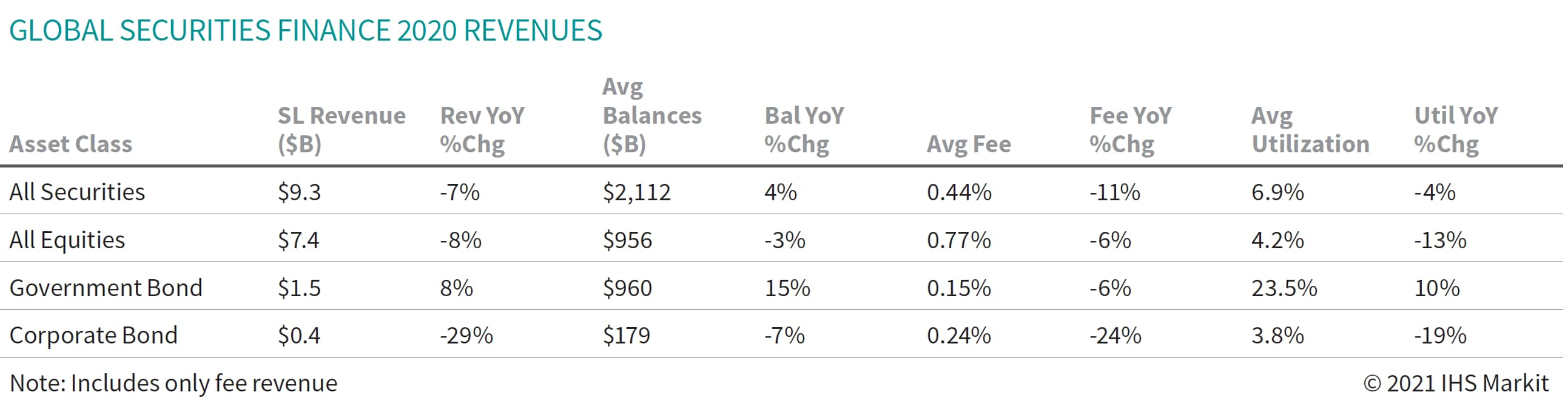

Global securities finance returns totalled $4.57bn over the 2nd half of 2020 (H2), a 10% YoY decline. The utilization of lendable assets declined substantially from the March 2020 peak as market valuations recovered. Increasing demand for US and EMEA equity specials, US Treasuries and global ETFs drove revenue growth for those asset classes. The YoY revenue shortfall was caused by lower average fees, while loan balances grew YoY for most asset classes and regions. Returns varied substantially over the course of H2, with Q3 revenues declining 16% YoY, while Q4 revenues only declined by 3% YoY. Combined with H1 returns of $4.77bn, which reflected a 4.8% YoY decline, FY 2020 global revenues totalled $9.3bn, a 7% YoY decline.

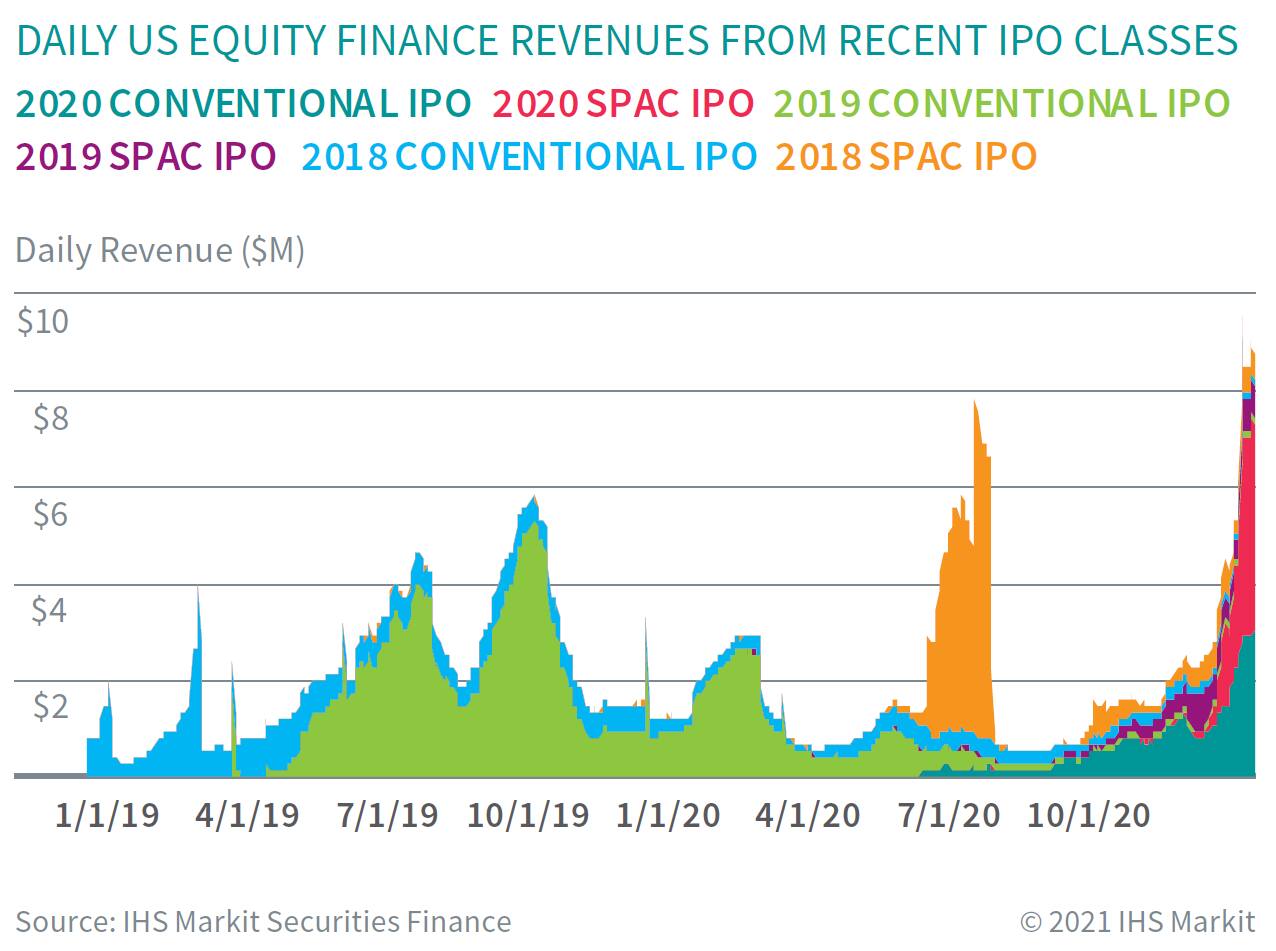

US equity revenues came in at $1.7bn for H2 2020, a 0.3% YoY decline. The YoY shortfall was driven by the slow-down in activity during late summer, with returns thereafter moving shortly higher through Q4. The core demand driver for the late-2020 upswing was around traditional and SPAC IPOs. The 2019 traditional IPO class generated $540m in 2019, with Beyond Meat contributing just over $300m; During 2020 the 2019 IPO class delivered $208m, with the most concentrated contributors being Peloton Interactive Inc and SmileDirectClub Inc, which combined to earn $113m of the total. The 2020 IPO class delivered $146m, with the majority coming in H2. Insurance firm Lemonade Inc was the most revenue generating 2020 traditional IPO, delivering $42m in 2020 return, 29% of the total.

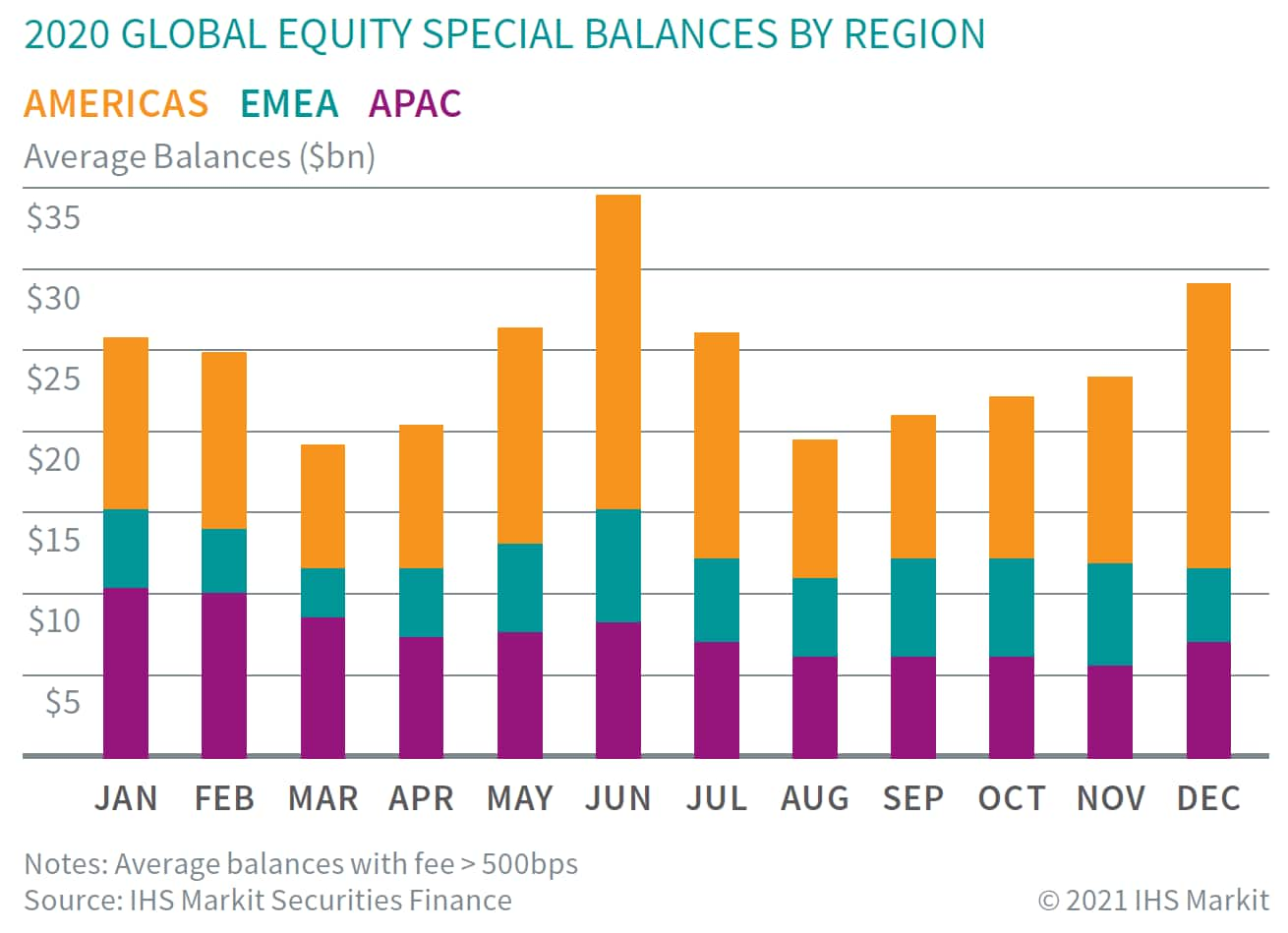

FY 2020 EMEA equity finance revenues fell well short of 2019 returns, with FY 2020 revenues declining 16% YoY; however, the shortfall was entirely concentrated in H1 (-35% YoY), with H2 revenues of $704m reflecting a 16% YoY increase. The upswing was led by hard to borrow shares like Varta Ag, which saw borrow fees trend higher over the latter half of the year, and corporate action related borrow demand from tradable rights and convertible bond issuance. 2020 is the first year on record where EMEA H2 revenues exceeded H1. Average EMEA special balances, those with an average fee greater than 500bps, averaged $5.4bn in H2, a 14% increase compared with H1.

APAC equity finance H2 2020 revenues of $707m reflect a 27% YoY decline. Average special balances decreased 26% in H2 as compared with H1. The shortfall over the latter half of 2020 was driven both by the short sale ban in South Korea and a lack of high-fee lending opportunities in Japan. Despite a lack of specials, H2 APAC equity on-loan balances increased by 0.7% YoY. Lendable balance growth outpaced the marginal growth in loan balances, leading to a 10% YoY decline in H2 utilization.

Global ETF revenues were $199m for H2, a 40% YoY increase, almost exactly matching the H1 return, though return drivers evolved over the course of the year. Both equity and fixed income exchange traded products saw surging revenues during the Q1 sell-off. Equity revenues maintained a higher plateau relative to the start of 2020, after declining from the March peak, as did fixed income albeit by a much smaller margin.

Fee-based revenue for government bond lending came in at $696m for H2, a 5% YoY increase, resulting primarily from larger loan balances. For beneficial owners, returns from lending US Treasury securities in 2020 were substantially bolstered by reinvestment of cash collateral in H1, the impact of which faded in early H2. Looking purely at fee spread income, UST revenues declined by 15% for H2 compared with H1, while EUR sovereign issue revenues increased by 3% for H2 as compared with H1.

The supply of corporate bond lendable assets has substantially outpaced borrow demand growth, leading to relatively few issues with any friction between supply and demand. Corporate lending revenues of $200m in H2 reflect a 29% YoY decline and the lowest H2 return since 2010.

Conclusion:

The first half of 2020 was characterized by the COVID-related market decline in February and March, which resulted in increased lending returns for some asset classes. Returns for reinvestment portfolios resulted from the Fed rate cut, while increased equity utilization resulted from deleveraging on dealer balance sheets while the surge in Q2 special balances was a result of event driven strategies such as warrant and convertible arbitrage. The return drivers from H1 were still having an impact at the outset of H2, but quickly faded in July, with August reaching a near stand-still for lending activity. From there, capital markets activity in the US took off with conventional and SPAC IPO issuance. With interest rates rising, borrow demand for US Treasury securities increased as well. EMEA specials balances posted substantial YoY gains. APAC equity revenues, still subdued in part by the South Korea short sale ban, posted incremental specials balance growth in Q4. The year ended on a high note, with December generating the second most revenue for any month of 2020.

Looking ahead, the IPO market in the US is likely to generate a lineup of borrow demand events ahead lockup expiries throughout 2021, which will only be bolstered by the surge in SPAC deals. In Europe, the expected reinstatement of dividends in 2021 will likely boost lending returns. In addition, arbitrage trades driven by capital raising, such as rights issues and convertible bonds, may continue to drive EMEA specials balances. In APAC, the conclusion of short sale bans may be a tailwind for 2021, while some markets such as Hong Kong SAR are currently seeing increased borrow demand. At the end of tumultuous year there is cause for optimism heading into 2021!

FY 2020 Snapshot:

Global securities finance revenue $9.3bn for 2020, a 7% YoY decline. The primary growth drivers for equities were increased borrow demand during the Q1 market decline followed by borrow demand tied to capital raising during the recovery. Peak monthly revenue for 2020 was observed in June, when a trio of US equities delivered outstanding lending returns on the back of corporate action related arbitrage opportunities. Lendable assets reached a new all-time in December, nearly $30T, adding to the challenge of increasing utilization going forward, though a similar statement could have been made at lower levels entering 2020 before the surge in utilization during the Q1 decline.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-h2-2020-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-h2-2020-review.html&text=Securities+Finance%3a+H2+2020+Review+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-h2-2020-review.html","enabled":true},{"name":"email","url":"?subject=Securities Finance: H2 2020 Review | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-h2-2020-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance%3a+H2+2020+Review+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-h2-2020-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}