Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 08, 2022

Securities Finance July Snapshot 2022

- July was the highest revenue generating month of 2022

- The US hard to borrow equity market pushes revenues higher

- Fixed income continues to see strong demand

- Corporate bonds are in for an impressive 2022

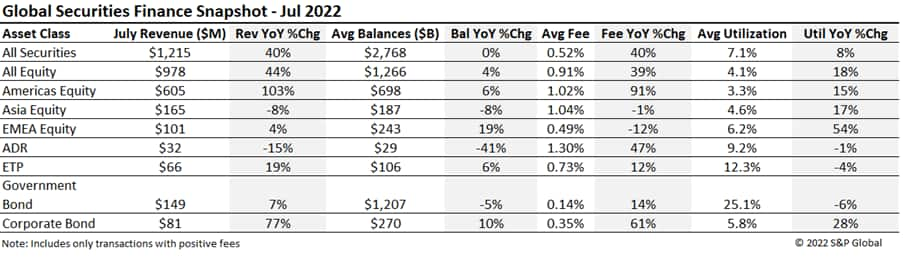

Global securities finance revenues totalled $1.215 bln, making July the highest revenue generating month of 2022. In comparison with June, revenues increased 6%. Demand for equities, especially those in the US, fuelled the 40% increase YoY. Average balances across all securities remained flat YoY with only corporate bonds and EMEA equities seeing any meaningful growth. Average fees increased significantly in Americas Equities and Corporate bonds. Equity revenues increased 44% YoY and 8% MoM making July the highest revenue generating month so far for the individual asset class. EMEA equities experienced a 12% decrease in fees YoY despite an impressive 54% increase in utilization. ETPs, Government and Corporate bonds all saw increases in revenues and average fees YoY. ADRs continued to experience a decline in revenues YoY but there was a reasonable recovery when compared MoM (increase of 40%).

Americas

July was a standout month for Americas equities. Revenues increased by a phenomenal 103% YoY, average balances increased 6% YoY and average fees topped 1% for the first time this year (91% increase YoY and 13% increase MoM). To top it off, average utilization also increased by 15% YoY. Americas equities continues to be the largest revenue contributor to the Equity asset class comprising 62% of all revenues. This region continues to benefit from numerous hard to borrow high fee stocks that continue to drive revenues higher MoM (also reflected by the increase in average fees).

The top ten revenue generating stocks constituted 43% of revenues for all Americas equities over the month (3% higher than in June). Revenues continued to rise in GME (+7%), BYND (+273%) and LCID (+146%) MoM. Short interest, average fees, and days to cover continued to rise in GME following the 4 for 1 stock split. A fall in the share price of BYND towards the end of July saw an increase in demand to borrow stocks. Borrow fees remained elevated in this name during July when compared to the first six months of the year. FFIE and SIRI entered the top ten table this month. Average utilization increased markedly in FFIE throughout July as the electric vehicle sector remained under pressure. SIRI experienced strong directional demand throughout July and average fees rose significantly.

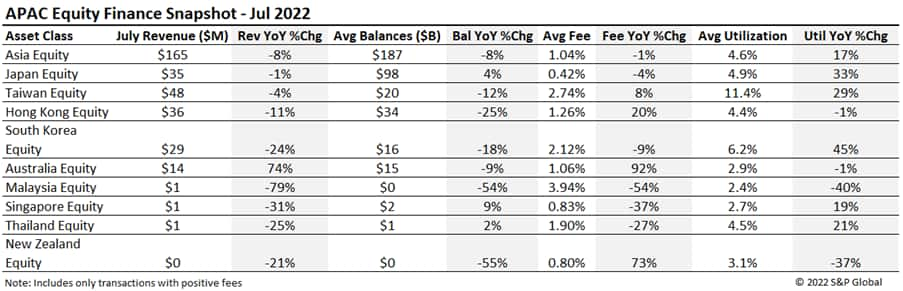

APAC Equity

Revenues in Asian equities were down 8% YoY to $165m. Average balances and average fees also saw a decline. Australia was the standout market in Asia with revenues increasing 74% YoY and 8% MoM. Three stocks in Australia generated over 30% of the market's returns alone (Brainchip Holdings Ltd, Core Lithium Ltd and Lake Resources Nl). Taiwan continued to be the highest revenue generating market in the region, accounting for circa 30% of all Asian equity revenues for the month. Average fees increased 8% YoY to 2.74% which is the highest level seen this year. The value of average on loan balances were down 12% YoY, which is a net positive when compared to the 21% decrease in the value of the TWSE 50 over the same period. South Korea experienced a slight increase in revenues when compared to June (+7%) even though they declined 24% YoY. Average balances were also down YoY along with average fees. Despite this, the highest generated equity within Asia during July was Korean, Lg Energy Solution Ltd (BNSP8W5), which generated over $5.8m USD over the month. Given the recent decision by the FSC to tighten the oversight of short selling activity in the country balances and fees are subject to uncertainty going into the second half of 2022 in this market.

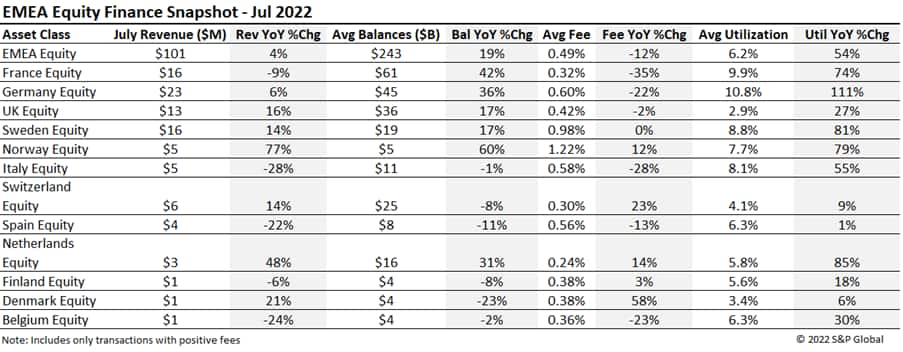

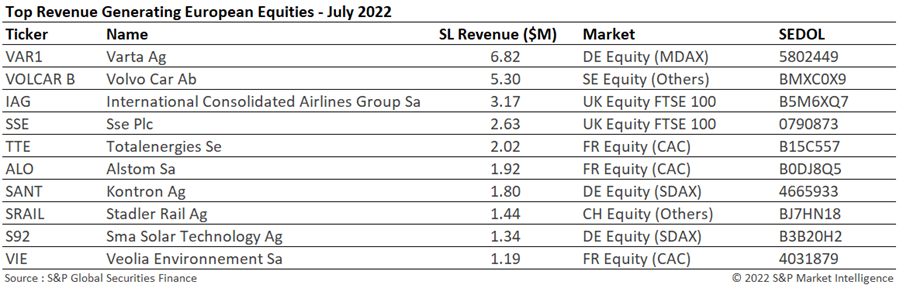

Europe

European equity revenues increased 4% YoY to $101m. Despite revenues declining 26% MoM, average balances declined by a more modest 17%. Average utilization remained elevated, +54% YoY, and Germany overtook France as the highest revenue generating market during July. Varta Ag in Germany continued to be the highest revenue stock in the region generating $6.82m during the month. Revenues in the UK increased 16% YoY and were stable MoM. Scrip dividends (SSE Plc generated $2.63m) and the directional interest in IAG Group ($3.17m, share price has fallen 30% since January) contributed to this increase. As mentioned in the June commentary, interest in Scandinavian continues to be robust. Sweden matched France in terms of revenue generation, up 14% YoY, but down slightly MoM by 6%. Volvo was the second highest generating stock throughout July ($5.3m) as it continues to suffer from declining sales. Interest in the Nordics remains strong with Sweden, Norway, Finland, and Denmark all Seeing YoY increases in revenues, fees, and utilization.

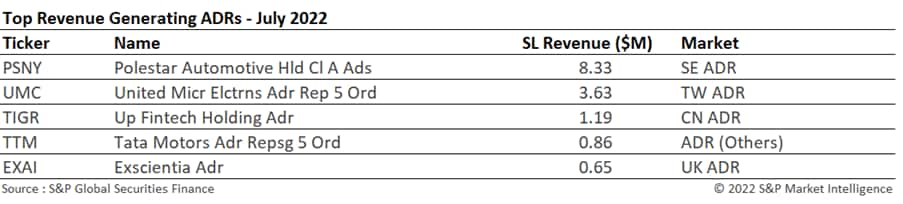

ADR

ADRs continued to see declines across all metrics apart from average fees when compared YoY. Average fees of 1.3% (+47% YoY and +34% MoM) were the highest seen since the beginning of the year. As a result, July was the highest revenue generating month for the asset class. Polestar Automotive, a Swedish Automotive company, was the highest generating ADR during July ($8.33m in revenues). The company's stock price fell sharply during the month as the electric vehicle sector remained under pressure. United Micro Electronic ADR was subsequently knocked down to second place. Concerns around microchip shortages and the impact of the SEC delisting of Chinese / Taiwanese ADRs is continuing to drive demand for the stock. The top two names in this asset class were the main contributors to the increase seen in revenues when compared with June (38% of all ADR revenues).

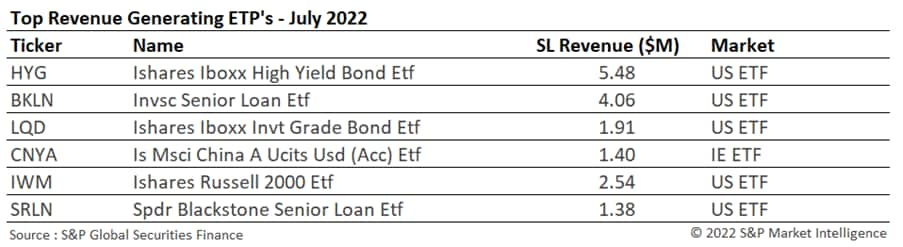

ETP

Exchange traded products saw a decline in revenues in comparison with June (-17%) despite increasing YoY (+19%). Average revenues ($66m) and balances ($106b) were at their lowest levels since the month of January. When reviewing the top five stocks, earnings in the Ishares Iboxx high yield Bond ETF and the Ishares Iboxx Investment grade Bond ETF declined collectively by 40%. Average fees for both assets more than halved over the month as borrowing demand declined.

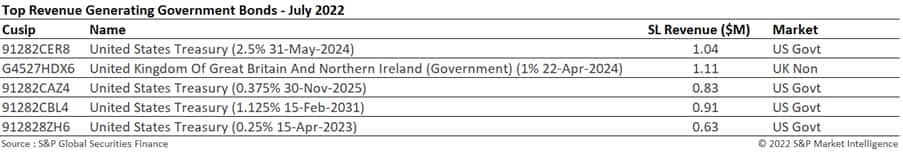

Government Bonds

Revenues generated by Government bonds increased 7% YoY to $149m. Average fees increased but average balances and utilization were down YoY. US treasuries accounted for $73.5m (49%) of the Government bond revenues during July. UK Gilts contributed $14m (9%) which was equal to the revenues generated by French and German Government bonds.

The top five revenue generating Government bonds continued to be dominated by US treasuries. With inflation remaining a key area of focus in fixed income markets, short-dated Government bonds continued to be attractive to borrowers. This was especially the case in the US and the UK as their central banks continued to increase interest rates which led to rising yields and falling prices (short-dated issues are more sensitive to expectation changes in interest rates). As Central banks continue to raise interest rates and with more persistent volatility being seen in equity markets, demand to borrow short-dated Government bonds is expected to grow throughout the year.

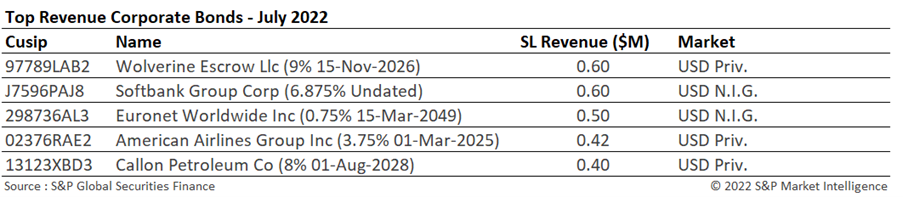

Corporate Bonds

Corporate bonds continued their impressive run generating $81m collectively during July (+77% YoY). July was the highest revenue generating month of the year for this asset class. Corporate bond revenues for 2022 have now equalled those for the whole of 2021 ($513m). Average balances were up YoY by 10%, average fees were up 61% YoY and utilization was up 28% YoY. As company fundamentals are deteriorating due to tighter financial conditions and falling consumer demand, the spreads on High Yield and non-investment grade bonds continue to widen. As a result, the asset prices fall, yields subsequently increase, which in turn drives borrower demand. In addition, the corporate bond sector continues to be affected by the wind down of the CSPPP (Corporate Sector Purchase Program) in Europe as discussed in last month's snapshot. All these factors are indicative of further borrow demand and additional revenue opportunities going into Q3 of 2022.

The top five generating names in this sector accounted for only 2% of all corporate bond revenues during July. This shows how widespread demand is for this asset class.

Conclusion

Securities finance had another impressive month during July generating notable revenues of $1.215bln. Returns were up both MoM and YoY along with average fees. US equities and corporate bonds continued their impressive runs with 103% and 77% increases in YoY revenues respectively. The hard to borrow equities market in the United States remained a key contributor to these revenues during the month. Returns from Asian equities remained steady in relation to June 2021 and Australia and Taiwan continued to shine. Significant increases in average fees YoY in Taiwan, Australia and Hong Kong were key contributors to the revenues generated in this region. European equities continued to show solid revenues with the UK, Scandinavia and The Netherlands experiencing significant increases YoY.

ADRs sustained their general decline in securities financing activity and ETPs had another good month when compared YoY.

In the fixed income markets, there was more good news for lenders during the month of July. Both the government and corporate bond sectors continued to show robust revenues and the economic conditions appear to remain supportive for further impressive returns throughout the remainder of 2022.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2022.html&text=Securities+Finance+July+Snapshot+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2022.html","enabled":true},{"name":"email","url":"?subject=Securities Finance July Snapshot 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+July+Snapshot+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-july-snapshot-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}