Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 02, 2020

Securities Finance: June 2020

- June revenues +17% YoY

- US equity special balances soar

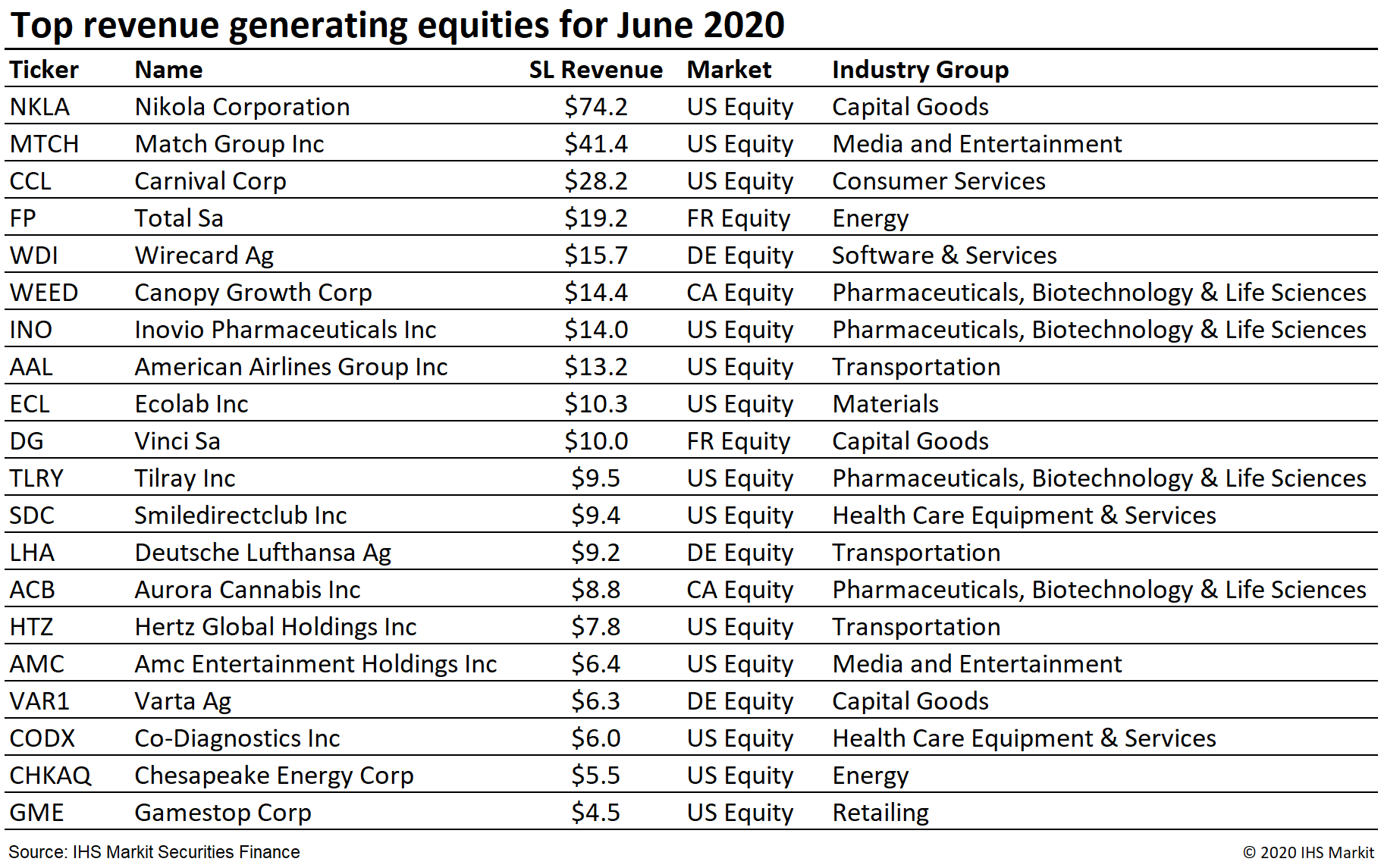

- Nikola Motors most revenue generating security of the month, $74m

- Wirecard delivers 10% of EU equity revenues

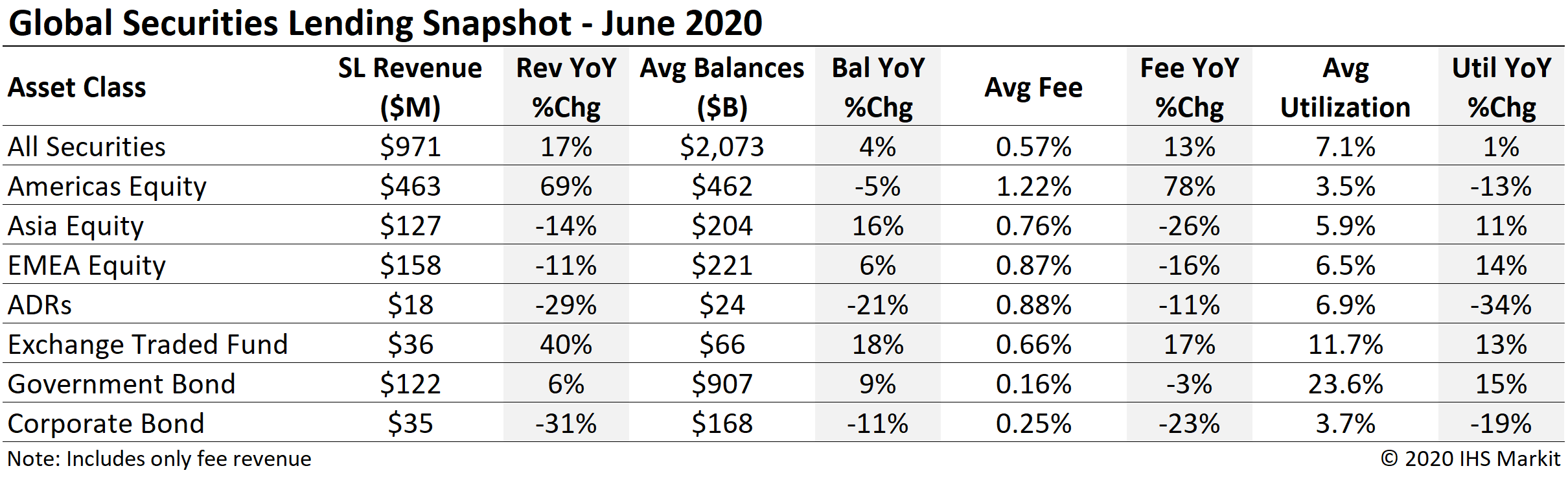

Global securities lending returns increased 17% YoY in June. The upswing was concentrated in US equities, though government bonds and ETFs also delivered YoY growth in revenues; Corporate debt and non-US equity returns fell short of June 2019. Utilization of lendable assets remains elevated YoY overall and for most asset classes, despite declining from the March YTD peak. Uncertainty reigned in June as the path of COVID-19, and responses to it, remained difficult to forecast. In this note we'll examine some drivers for securities finance borrow demand and lending revenue for the month just past and implications as we move into the 2nd half of 2020.

Americas equity revenues came in at $463m for June, pushing the Q2 total to just over $1bn, an increase of 36% YoY. US equity revenues exploded higher in June, led by a handful of specials, however the broad short squeeze in hard-to-borrow shares in first week of the month had the knock-on impact of increasing special balances broadly. June returns were the most for any month of 2020 so far, as a result of balances bouncing while spreads widened.

An emergent driver of US equity revenue is SPAC arbitrage, with Nikola Motors being the current poster child, with the common shares delivering $74m in June revenues on the back of eye-popping fees. The fees can be explained as substantially reflecting the difference in valuation between the common shares and the warrants over the time remaining before the warrants are eligible for redemption. Nikola comes on the back of similar trades in Virgin Galactic and DraftKings earlier this year. Another driver, noted in the May revenue snapshot , is convertible bond issuance driving borrow demand for some US equities, notably including Carnival Corp, which was the third most revenue generating security in June, with $28m. June produced the second significant exchange offer of 2020, the Ecolab Inc spin-off exchange offer for ChampionX shares, however the smaller size of the deal in nominal terms caused the returns to be lower than the McKesson exchange offer for shares of Change Healthcare in March.

Canadian equity lending revenues increased sequentially from May to June, however returns are still lower than they were in 2019, which has been true since March. Canadian equities had $46.7m in June revenues, a 6.6% YoY decline.

Equity lending in Europe continued to lag in June, with revenues of $157m reflecting an 11% YoY decline. As the Wirecard story descended into scandal in June a reduction of shares in lending programs pushed up on fees and helped to drive the $15.7m in June revenue, 10% of all European equity lending returns. Total European equity lending revenues are down 35% YTD through the end of Q2, however dividend delays complicate the YoY comparison.

Asia equity lending revenues remain subdued compared with prior years. The largest market, Japan equities, delivered $46m in June revenues, broadly in line with April and May; YTD revenues of $303m reflect a 24% YoY decline compared with the first half of 2019. The short sale ban in South Korea has limited lending revenue, with previously borrowed shares such as those of HLB Inc continuing to earn a return, while overall SK equity lending revenues were -44% YoY in June. Hong Kong listed shares were the bright spot for Asia equity lending in Q2, with revenues steadily increasing toward the $31.7m return in June, the most for any month YTD and 32% higher than June 2019. HK equity borrow demand has outpaced the growth in lendable assets, with 6.2% utilization the most for any month YTD.

Global ETF revenues were $35.7m for June, a 40% YoY increase. After the surge in ETF lending revenues in March, relating to high-yield funds, returns in Q2 were consistent; June had the most revenue by a margin of less than $1m. ETFs listed in Europe delivered $6.2m in June, continuing the downtrend from the March peak just above $8m, however still a 40% YoY increase. Asia ETF lending revenues continue to increase, with $3.2m in June revenue the most for any month YTD, the result of increased balances and fees. Global ETF utilization in June extended the trend lower from the March peak, despite robust borrow demand, as a result of lendable value growth outpacing the increase in loan balances.

Fee-based revenue for US government bond lending came in at $74m for June, a 14.5% YoY increase resulting from larger loan balances (fees declined by 2bps YoY in June). For beneficial owners, returns from lending US Treasury securities in 2020 have been substantially bolstered by reinvestment of cash collateral, however reinvestment returns have steadily trended lower since late March. Returns from lending European sovereigns were $36m for June, a 5% YoY decline as the result of both lower balances and fees. Global government bond fee-based revenues are up 11% YoY through the first half of 2020.

Corporate bond lending revenues continue to fall short of 2019 comparison, mostly as the result of declining fees, however balances have also declined YoY. Corporate lending returns came in at $34.9m for May, a 31% decline YoY. Central bank support for global credit has dampened borrow demand, however the market is bifurcated, with credit events also piling up and bonds from some distressed issuers are generating elevated lending returns.

Conclusion:

US equity specials are leading the way into the 2nd half of the year, where the asset class runs into a much more challenging YoY comparison, with the back half of 2019 having been populated with relatively large IPOs and surging demand for Cannabis related shares. A substantial portion of the demand for 7 of June's top 10 most revenue generating securities was driven by arbitrage trades of various types. While that isn't necessarily new, the intensity of borrow demand is increasing, which reflects both the recent success for these strategies as well as the ability of lenders to identify and extract the value of the lendable assets which are borrowed to support these trade structures. Apart from the more arbitrage driven equities, outright short exposure to high-fee equities has been extremely challenging for long-short hedge funds, which was never truer than the first week of June when the most expensive to borrow equities dramatically outperformed broad market indices.

Global securities finance revenues, balances, fees and utilization were all up YoY in June, however apart from US equities the trend is to the downside, with utilization steadily falling since March, reinvestment returns declining and non-US equity special balances remaining depressed. Even in the US, where equity special revenues are accelerating, the explosive share price increases observed for many hard-to-borrow shares may weigh on borrow demand, which could make returns even more dependant on corporate action related loans in the second half of 2020.

We will be hosting a webinar on July 9th to discuss Q2 trends to be followed by the mid-year 2020 report later in July, similar to the full-year 2019 report.

As always, stay tuned for monthly revenue updates from IHS Markit Securities Finance!

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june.html&text=Securities+Finance%3a+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june.html","enabled":true},{"name":"email","url":"?subject=Securities Finance: June 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance%3a+June+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-june.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}