Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 05, 2024

Securities Finance May Snapshot 2024

DOWNLOAD PDF VERSION HERE

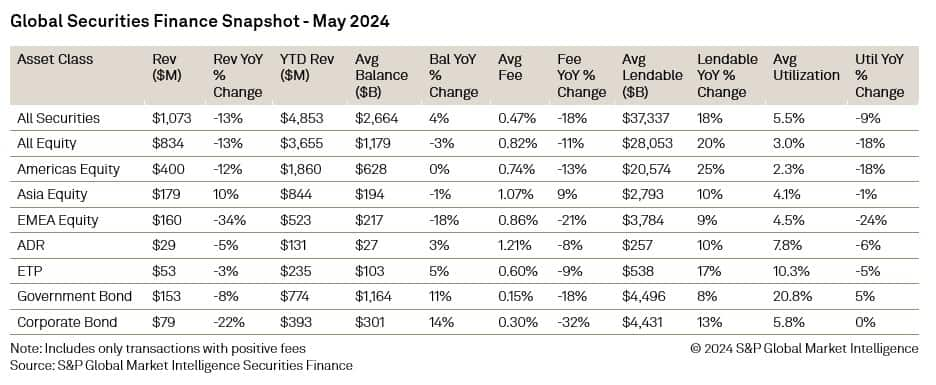

Asia steals the show as revenues increase 10% YoY

- Monthly revenues decline by 13% YoY to $1.073B

- Asia continues to support some very strong markets returns

- Government bond utilization increases 5% YoY

- EMEA equity revenues continue to suffer from large YoY decreases

In the securities lending markets, revenues of $1.073B were generated. This represents a 13% decline YoY. Average balances noted a 4% YoY increase across all securities as lendable surged 18% YoY, surpassing $37.3T.

Across equities, both Americas and EMEA equity revenues experienced YoY declines of 12% and 34% respectively. Asia equities had a great month however generating $179M, representing a 10% increase YoY. Across fixed income markets on loan balances continued to grow YoY with government bond balances increasing by 11% and corporate bond balances growing by 14%.

To find out more click on the link to download the full report above.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2024.html&text=Securities+Finance+May+Snapshot+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2024.html","enabled":true},{"name":"email","url":"?subject=Securities Finance May Snapshot 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+May+Snapshot+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-may-snapshot-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}