Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 03, 2024

Securities Finance Q1 and March Snapshot 2024

DOWNLOAD THE FULL REPORT HERE

March revenues surpass $1B for the first time in 2024

- Monthly revenues reach $1,056M

- Equity revenues continue to experience double digit declines YoY

- Fixed income balances increase YoY

- Lendable value surpasses $37.26T

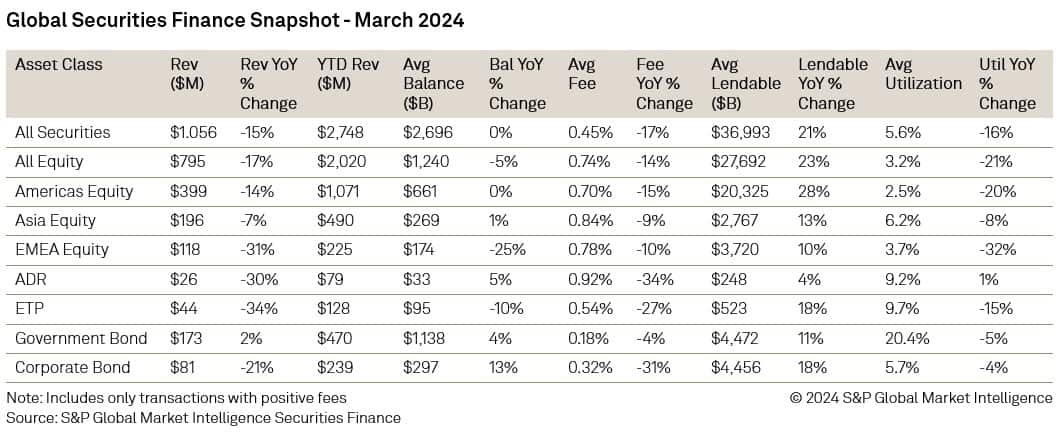

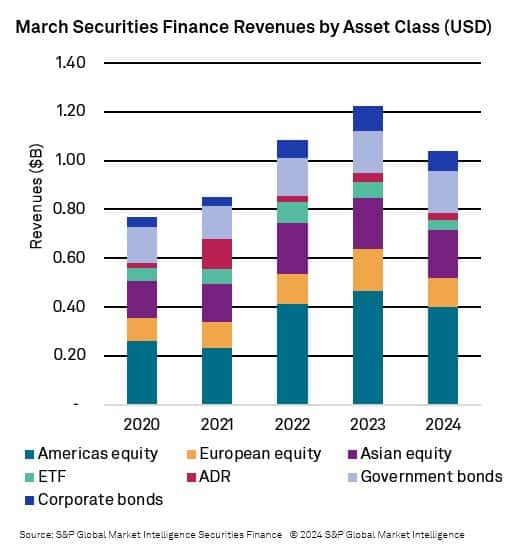

In the securities lending markets, monthly revenues surpassed the $1B mark for the first time this year as market revenues reached $1.056B. All asset classes experienced YoY revenue declines during the month with EMEA equities, Exchange Traded Products and ADR's all down by over 30%. The decline in revenues was due to the 17% YoY decline in average fees. This was a trend that affected all asset classes as fees during Q1 and Q2 of 2023 were close to all time highs. Asian equities and Government bonds experienced the smallest declines of 9% and 4% respectively. All other asset classes suffered double digit decreases. As expected, average lendable balances grew at a rapid pace over the month. Average lendable finished the month at a recent high of $37.3T.

In the equity markets many of the same trends that have been seen in the preceding quarters continued during March. The lack of demand that has affected EMEA equity lending continued. YoY revenues declined less than during the previous months of the quarter (-31%) but performance remained weak. Average fees were strong across France, Belgium and Sweden but remained weak elsewhere with double digit YoY decreases. Utilization remained sub 4% (3.7% a decline of 32% YoY) as valuations pushed lendable higher. Across the Americas, revenues remained robust (just not when compared to 2023). 2023 was a strong year for Americas equities, so a decline in revenues is to be expected. when compared to previous years, revenues remain higher than those seen previously. Across Asia, a strong divergence in performance continued to be seen. With the on-going short selling bans across the region and a continuation of economic uncertainty, as the Chinese economy continues to underperform, weighed upon returns. Taiwan and Malaysia were the bright spots in the region with a 30% and 44% YoY increase in revenues. Average fees declined across all markets apart from Malaysia which experienced an increase of 4% YoY. ETPs and ADRs experienced lackluster performance during the month as revenues and average fees declined YoY. In relation to revenues, ETPs experienced their worst March performance for many years. The shrinking revenues produced by the asset class can be clearly seen in the March revenue graph.

In the fixed income markets, there was better news on offer as Government bond revenues increased YoY by 2% ($173M). This was despite a decline in average fees. A 4% increase in average balances helped to push revenues higher. US Treasuries were the driver of stronger revenues as a number of specials were present in the market. Revenues and average fees declined across all other regions, falling the most across emerging market bonds. Corporate bond fees continued to decline from the all- time highs seen last year. Revenues fell as a result. A number of private placement bonds became popular during the month generating strong revenues. Balances increased by 13% YoY which helped to offset some of the decline seen in average fees.

Securities lending revenues rebounded during March with strong MoM performance seen in across a number of asset classes. Whilst revenues have declined YoY, 2023 and 2022 generated banner returns for participants so a decline should be expected. Higher valuations have been supportive of stronger revenues across all markets. Heading into Q2 and the seasonal revenue period across European equities, if volatility does re-enter the market in the coming weeks, the second quarter of 2024 could generate some strong returns for lenders.

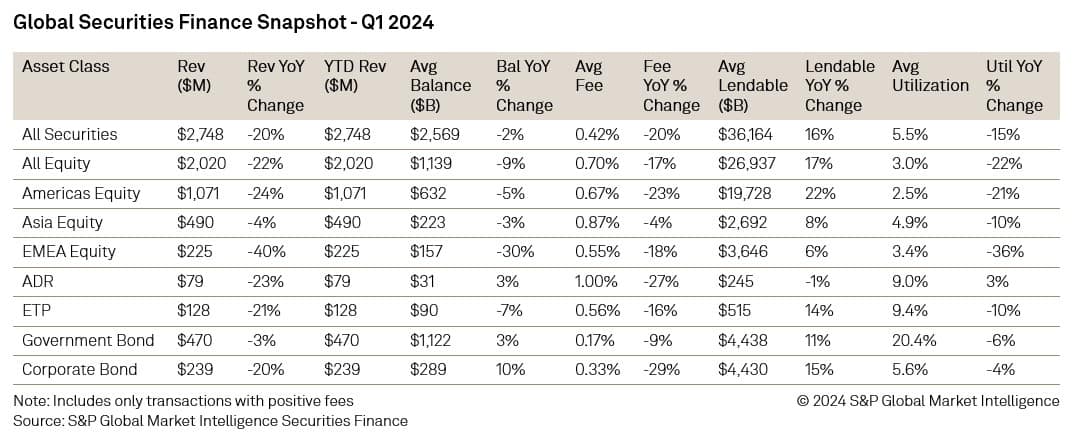

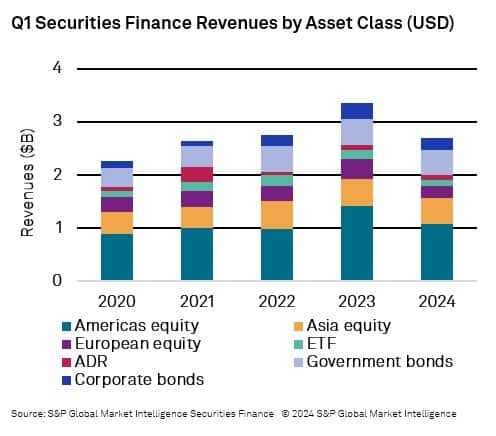

In the securities lending markets, revenues during the first quarter of the year were underwhelming when compared with Q1 2023, with a reduction of 20% YoY. When compared to the period of 2020 -2022 however, 2024 revenues fared well. The decline in quarterly revenues across equities (-22%) was largely responsible for the YoY decline. A substantial decline in equity revenues from EMEA (-40% YoY) and the Americas (-22%) pulled market revenues lower. As seen throughout the quarter, average fees across equities continued to decline (-17% YoY) along with average balances (-9% YoY). EMEA equities suffered from a lack of demand with YoY balances falling by 30%.

In the fixed income markets, quarterly revenues also declined YoY across both corporate (-20%) and government bonds (-3%). This was a direct result of a fall in average fees as speculation in regard to future moves in interest rates started to subside. When compared with the 2020-2022 period, the strength of corporate bond revenues during Q1 2024 can be seen. Despite falling revenues, demand remained strong with average balances increasing by 10% YoY. Across the government bond market, US Treasuries were the driving force behind the revenues during the quarter. Revenues generated from this asset class helped to offset the 29% YoY decline in revenues experienced by EMEA government bonds. Balances remained stable increasing by 3%.

The S&P Global Market Intelligence Securities Finance Forum will once again be taking place in London on the 16th May at One Moorgate Place EC2R 6EA. The forum will consist of an afternoon of discussion and insights from market experts, guided by the Securities Finance team. An official "save the date" will be sent in the coming weeks but we are looking forward to hosting an afternoon of lively discussion and topical debate with our clients, friends, and partners.

If you would like to attend the forum, you can do so by registering HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2024.html&text=Securities+Finance+Q1+and+March+Snapshot+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2024.html","enabled":true},{"name":"email","url":"?subject=Securities Finance Q1 and March Snapshot 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+Q1+and+March+Snapshot+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q1-and-march-snapshot-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}