Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 02, 2024

Securities Finance Q3 and September Snapshot 2024

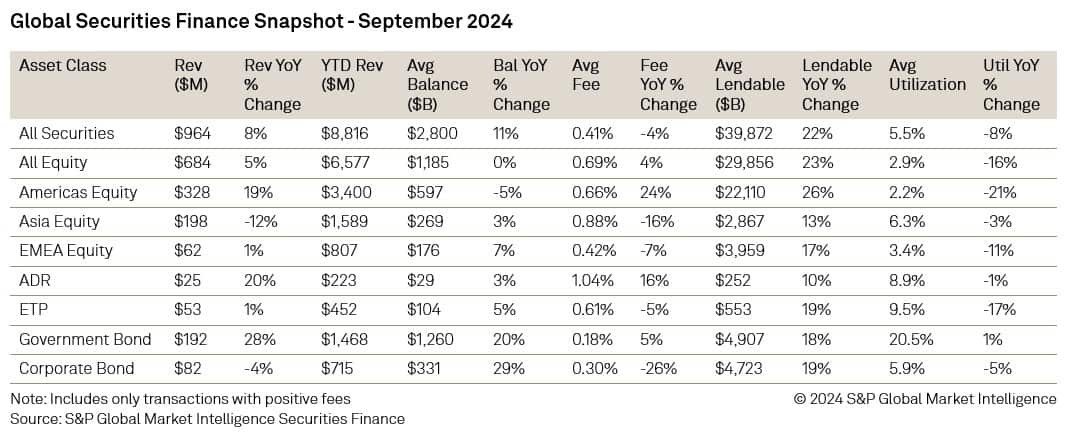

- Monthly revenues reach $964M

- A surge in government bond borrowing pushes YoY revenues higher

- Average fees grow 24% YoY across Americas equities

- EMEA equities record positive YoY growth for the first time in 2024

In the securities lending markets, monthly revenues of $964M were generated during the month. This represents an 8% increase YoY. Balances continued to grow YoY (+11%) as equity markets continued to rise throughout the month, average fees fell by 4% YoY to 0.41%.

Across the equity markets, revenues across Americas equities surged by 19% YoY. Increases were seen across all markets (USA, Brazil, Mexico, ADRs) apart from Canada which experienced a YoY decline of 6% to $33M. Average fees increased by an impressive 24% YoY across the region to 0.66%, with the highest increases seen across both US and Brazilian equities (+27% YoY US and +62% YoY Brazil). These increases in fees were seen against a backdrop of declining balances (-5%), despite an increase in equity indexes over the month, and lower utilization (-21% YoY).

EMEA equity markets posted their first positive growth of the year so far, as revenues grew 1% YoY to $62M. Large increases in YoY average fees were seen across France (+42%), the UK (+28%), and Norway (+21%). Revenues responded in kind growing by 40% YoY in France ($12M), by 56% in the UK ($9M) and by 50% in Norway ($4M). EMEA equity balances increased by 7% YoY with the largest growth seen in Poland (+163% YoY), Greece (+45% YoY) and Italy (+53% YoY).

Across Asia revenues exploded across Taiwan (+30% YoY), Australia (+33% YoY) and Malaysia (+87% YoY), but fell across Hong Kong (-30% YoY), South Korea (-87% YoY) and Thailand (-7% YoY). Japan continued to provide solid numbers with revenues of $83M (+11% YoY) and average fees of 0.54% (+3%). Taiwan continued to show strong signs of growth as the value of on loan positions grew 51% YoY. Taiwan also surpassed Japan during the month as the region's highest revenue generating market.

Fixed income markets performed well over the month with government bond revenues posting one of their best monthly numbers on record. A mammoth $192M was generated by the asset class during the month as average fees increased to 0.18%. The growth in revenues was a direct result of an increase in demand for US treasuries following the Federal Reserve's cut in interest rates. Average fees for Americas government bonds hit an average of 0.20bps during September, the highest seen for some time.

Corporate bond monthly revenues of $82M were the highest seen during 2024 so far despite the 4% decline YoY. Average fees of 30bps were maintained across the asset class but stronger demand for convertible bonds, lifting the average fee to 0.84%, covered up the 1bps decline in fees across conventional bonds.

Heading into October and Q4, securities lending markets appear to be capitalizing on the increased volatility seen across the financial landscape. As geopolitical tensions grow, the US Presidential election campaign picks up pace and new governments start to flex their muscles, the coming months are likely to provide fertile ground for securities lenders.

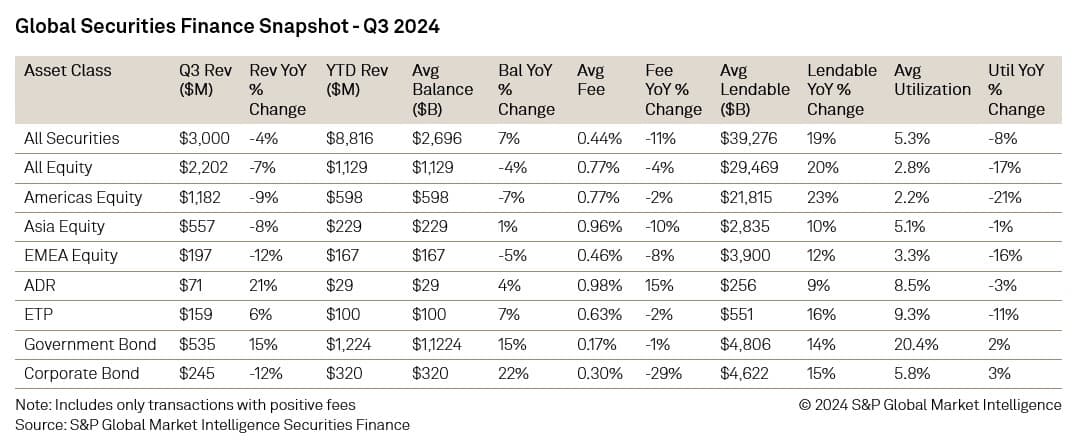

In the securities lending markets, revenues of $3B were generated. This represents a 4% decline when compared with Q3 2023. Despite declines in average fees across the board, the growth in asset valuations played an important role in maintaining revenues. Lendable topped $40T during the quarter for the first time on record and average balances grew by 7% YoY.

Government bonds were the best performing asset class during the quarter, as Q3 revenues grew 15% YoY to $535M. As central banks started to enact their policy pivots, speculation regarding the timing and size of any future rate cuts is likely to continue to translate into increased balances.

Heading into Q4, with the US presidential elections now only a number of weeks away, growing uncertainty and tensions in the Middle East, stimulus measures sending asset valuations higher in China and dovish tones from central bankers, securities lending is well placed to capitalize on these moves in the coming months. Government bond lending is expected to remain robust, and ETFs are expected to see increased demand as thematic strategies increase their attractiveness.

SAVE THE DATE

Our Q3 Securities Finance Review webinar will be taking place on the October 24th 3PM UK / 10AM EST, with guest speaker Paul Wilsonfrom S&P Global Market Intelligence. In addition to the normal quarterly update, Paul will be providing an update on the most recent ISLA Americas conference and discussing the future role of data within the securities finance markets. To register, please click HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q3-and-september-snapshot-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q3-and-september-snapshot-2024.html&text=Securities+Finance+Q3+and+September+Snapshot+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q3-and-september-snapshot-2024.html","enabled":true},{"name":"email","url":"?subject=Securities Finance Q3 and September Snapshot 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q3-and-september-snapshot-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+Q3+and+September+Snapshot+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-q3-and-september-snapshot-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}